A Review of Tengizchevroil Corporation's Strategic Approach

The context of the organization and the operation being analyzed

Tengizchevroil, which is an affiliate of Chevron Corporation, is a world leader in integrated energy corporations. The entity has currently an approximate of 58,000, and conducts energy related business in explorations, production and transportation of crude oil, as well as natural gas, distribution of fuels and other energy related products, refining, manufacturing, marketing, power generation, manufacturing and marketing of petrochemical products, initiating and commercializing energy resources including bio-fuels (Tengizchevroil, 2014).

Tengizchevroil is also involved in innovative processes and uses reliable facilities to produce crude oil, liquefied petroleum gas, and dry gas. The company is also involved in the production of high quality sulfur. This entity inherited a gas and oil separation plant when it started operating Tengiz oil wells in 1993. Further, the company introduced the first generation of the Tengiz plants, which are commonly referred as KTL (Tengizchevroil, 2014).

Tengizchevroil has expanded its facilities to ensure that its operations are able to meet the increasing demand of crude oil products both locally and in the international market. The company currently has five gas and oil processing plants to assist in widening capacity and hence meeting the demand for its products. Due to increased demand for its products, Tengizchevroil has expanded its production capacity by putting in place a 2nd generation expansion system. The expansion scheme is made up of Second Generation Plant (SGP) and Sour Gas Injection (SGI). Investment in capacity has doubled the capacity of Tengizchevroil, and hence, it is able to meet the demand for its products. The company’s expansion has led to widening capacity to 600,000 barrels of crude oil and 750 million standard cubic feet of gas (Tengizchevroil, 2014).

The company spends an estimated $2 billion in Kazakhstani for the expansion so that other companies are also engaged in the expansion to ensure that demand for crude oil products is met. The expansion of the company’s facility has made its Second Generation plant to be the largest in the world. Through the expansion of its facilities, Tengizchevroil has managed to produce above 25 million tons of crude oil per year. Among its happy customers are Parker Drilling, Schlumberger, Parson’s Fluor Daniel, ArnaOil and many others (Tengizchevroil, 2014).

TCOs Capacity to Meet Demand

The operation being analyzed is the capability of TCO to meet the rising demand of oil products through increasing its capacity. The company is facing new capacity challenges and it is expected that it will engage in further expansion projects to meet the demand and enhance its production capacity. For instance, currently, TCOs capacity in storing its open-air sulfur stock is insufficient. The company therefore, needs to develop a capacity capable of storing all the sulfur stock that is not sold. This incapacity has mandated the firm to reduce its sulfur stock significantly in order to cope with the available space and avoid wastage.

Concerning production of crude oil, TengizChevrOil currently produces 300,000 bpd, accounting for 20% of the total oil production in the country. This means that the company cannot meet the demand for oil products on its own. However, expansion plans to increase the production capacity are currently in place. The expansion will see the consortium increase its crude oil production by 400,000 bpd during the first year and 540,000 bpd during the second year. Part of the expansion initiatives by this company are establishment of new facilities and technologies as part of the expansion program.

The first phase of Tengizchevroil’s expansion with a focus of 90000 barrels per day will see the current capacity increased to 400000 per day. Other projects included in this project include Sour Gas Injection (SG1) as well as the front end of the second-generation plant. SGI will assist in reinjection of the sour gas produced into a reservoir at a higher pressure to increase production. In Tengizchevroil, SGP is currently approximately at a third of its full capacity and is employed to separate natural gas for injection. At the same time, it is also used to stabilize and sweeten crude oil. Once it becomes operational, SGP is also anticipated to process sour gas into various gas products and basic sulfur.

The three components of operations that the company can manage well to meet demand through increased capacity can well be represented by the transformative model. This model has the following components- inputs, transformation processes, and outputs. This are represented with the following diagram.

Figure 1.1 transformative model

In order to meet demand, the company’s production capacity should be able to have profitable transformation of inputs into outputs and ensure timely delivery to meet customer needs. Further, the company needs to analyze the critical features of its operations in order to ensure that its capacity is able to meet demand.

Literature on capacity management

Capacity in most cases relates to the capability of a particular object, whether a work center, machine or operator in producing an output over a specified period. Many organizations underrate the measurement of capacity, with assumptions that their facilities harbor adequate facilities that may not always be the case. Software programs such as warehouse management systems and enterprise resource planning systems are increasingly being used in calculating throughput based by use of techniques that depend on capacity (Fujitsu, 2013, 1).

Organizations use different approaches to measure capacity including out, input or both in measuring capacity. A recycling company for instance calculates its capacity based on the quantity of material cleared from the inbound trailers at their factory. On the other hand, a textile organization calculates capacity based on the quantity of yarn produced, in other words, the output. The two main measures of capacity used by organizations include rated and theoretical. Theoretical capacity relates to the maximum output capacity that disallows any form of downtime. On the other hand, rated capacity relates to the output capacity that is used for the purpose of calculation based on long-term evaluation of the actual capacity (Armistead, and Clark, 2008, 11).

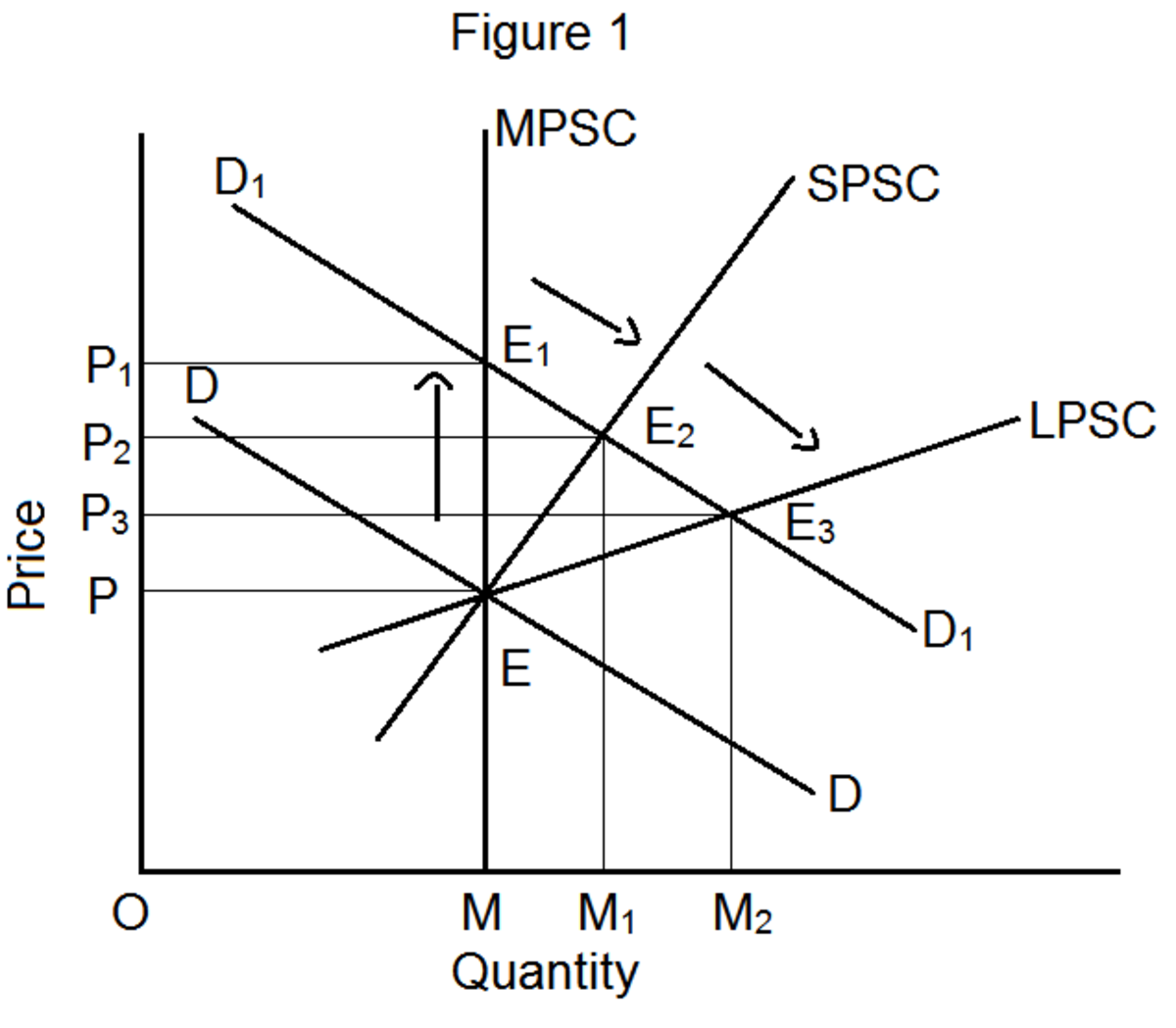

Key strategies in Capacity Management

In accordance to Armistead, and Clark (2008), there are three key strategies in capacity management used by entities when considering increased demand. These include lag capacity, lead capacity and match capacity strategies. Lead capacity is used to add capacity prior to occurrence of the actual demand. This strategy of capacity management is common among companies since it allows a firm to rump or leverage production when the demand slows down. Any problem that occurs during the rump up process is addressed accordingly to ensure that the company is ready when the demand normalizes. Many companies prefer this approach because it has low risks. Since companies are more geared towards customer satisfaction, businesses are more concerned in meeting customer demand, ensuring timely delivery of products or services, a factor that calls for increased capacity. In addition, lead capacity also gives companies a competitive edge of similar ones in the market. However, this strategy also harbors some risks. For instance, if the anticipated demand does not occur, then the company could realize unwanted stock or inventory. Moreover, the expenditure incurred for the ramping up capacity would go to waste. This is the type of capacity management process typified by TCO.

The opposite of lead capacity is the lag capacity strategy. The lag capacity strategy enables a company to ramp up its capacity only when the demand has actually happened. Despite many firms deploying this approach, it does not always guarantee success. The strategy ensures that a company does not invest when the demand is low. Further, any significant expenditure on capital is delayed, thus allowing a company to create a stable relationship with their investors and their bank. Further, the company will continue reaping profits in relation to companies that made investment by increasing capacity prior to demand rise. Among the drawbacks of this strategy is that a company will have a period where a specific product becomes unavailable until the capacity is increased (Armistead, and Clark, 2008, 34).

Match capacity approach is also another capacity management strategy where an entity endeavors to increase its capacity on gradual basis to match with the increase in sales volume Armistead, and Clark, 2008, 45). Though this technique attempts to leverage the under and over capacity of the lead and lag strategies, many companies using this strategy may find themselves at odds in terms of under capacity and over capacity at different moments.

TCO tries to balance short-term capacity with uneven demand by engaging in both demand management and capacity management. Capacity management is used to adjust capacity to better respond to the variations in the demand (Heizer, and Render, 2006). In addition, TCO undertakes capacity management to deal with fluctuations in demand.

Armistead, and Clark, (2008) explains that matching demand and supply in products and service has a direct impact on the ability of the delivery systems in achieving productivity targets and quality services. The authors continue to articulate that the problems of overcapacity or excess capacity have no simple solutions, even in cases that may appear simple. Managers are advised to employ both long and short-term considerations in tackling the issues and a clear distinction between excess and overcapacity must be established. This is because the two have divergent policy choices.

In achieving an enduring capacity reduction, many companies prefer to make policy changes geared at creating market incentives in reducing capacities. However, crafting of new policy changes need to be careful before the actual adoption in order to ensure that company objectives and goals are met. This translates that companies have to undertake more research to determine the impact of which the proposed policy changes were bound to bring to the company’s production and storage capacity (Berry, et al, 2010).

Demand for TengizChevrOil’s Products

TengizChevrOil has many retail outlets in U.S and many parts of the world where it supplies its products directly through jobbers and dealers. Further, the company has more than 8500 motor vehicle retail outlets of which the company owns 1500. Moreover, the company has also more than 600 marine ships and aircrafts that act as its retail outlets. The company’s market for its gasoline products is concentrated in southwest, south and western states. A market report by Lundberg (2014) indicates that TengizChevrOil is among the top marketers of gasoline products in approximately 15 nations around the world. It is also the top marketer of aviation gasoline and jet fuel in U.S (Heizer, and Render, 2006).

. In essence, the company enjoys the benefit of a growing demand for oil products and its convenient products around the world. For instance, in 2000 sale of non-fuel products in outlets operated by the company increased by 16% in comparison to 1999. The following table 1.1 presents the sales volumes of refined products by TengizChevrOil in U.S, Canada and other parts of the world between 1998-2000.

Sales Volumes of Refined Products

(Thousands of Barrels Per Day)

2000 1999 1998

--------- --------- --------

U. S

Gasolines 684 668 652

Jet Fuel 258 233 248

Kerosene and Gas Oils 232 236 199

Residual Fuel Oil 47 63 55

Other oil Products 109 100 89

--------- --------- --------

Total sales in United States 1,400 1,302 1,243

--------- --------- --------

International

Canada 60 60 59

Other International 30 35 130

--------- --------- --------

Total international sale 90 95 189

--------- --------- --------

Source: Edgar Online Inco (2014)

n/b

The high volume of sales during this period is an indication of high demand for the company’s products.

The expansion program initiated by TengizChevrOil was a result of the increased demand for TengizChevrOil products. However, the expansion saw an increase of the company’s production capacity rise to 540,000 barrels per day from 310,000, hence bringing the much-required oil in the market (Chevron, 2014).

Kazakhstan, which is the home country for TengizChevrOil, consumes a proximately 2.3 btu of energy by 2013. Coal accounts for the largest energy share which the country consumed at 65%. This was followed by oil (19%) and natural gas, (14%). Figure 1.1 indicates Kazakhstans oil and gas consumption from 2004- 2014

From the statistics presented in figure 1.1, iv is clear that Kazakhstan is one of the largest market base for TengizChevrOil products.

Countries with high demand for TengizChevrOil products according to U.S Energy Information Administration (2014) include Iran, which acquires oil products through the port of Neka, which is then sent to refineries of Tabriz and Tehran. However, the amount of oil products traded between the two countries have continued to decline over the years for undisclosed reasons. For instance, in 2012 reports by USEIA indicated that the quantify of oil products traded between the two countries were a paltry 25,000bbl/d. The report also indicate that in 2012, Italy took the largest share of TengizChevrOil products with the volume of traded products approximately at 355,000 bbl/d). Other countries that recorded increased demand for TengizChevrOil products include China, France, Netherlands and Australia. Further, analysts have projected a market expansion of TengizChevrOil products because of the companies’ aggressive online strategies. However, this growth in oil export will consequently necessitate an expansion in the export capacity.

Although TengizChevrOil was able to satisfy domestic demand of natural gas, the increased demand for this commodity in 2008 and 2010 was too overwhelming for the company’s production system. This left the country with no other option, but to import the product so as to satisfy the increased demand. This is why TengizChevrOil initiated expansion strategies in order to meet, not only its growing domestic demand, but also on international perspectives. Another reason why the company was not able to meet its domestic demand in natural gas was that there was poor infrastructure linking the production centers to demand centers. The domestic pipeline system was in also poor state and there was no proper connection in Kazakhstan's gas reserves of the east, west and south (IES, 2014, 4).

In regard to TCO’s sulfur products, the sale volume of the commodity increased in a faster rate compared to production. The sales volumes exceeded production for the first time in 2006. Until recently, this commodity is still the highest selling in volumes. Among the reasons attributed to this increased sales is the many uses of sulfur. In particular, the commodity is used as a key element in making paper, textiles, rubber, paints, plastics and cosmetics. Among other industries where sulfur is also used as a raw material include food industries, pharmaceuticals, glass, mining, cement, asphalt, and shell. The product is also heavily relied upon in the manufacture of soil conditioners, fertilizers among other products (Chevron Corporation, 2014)

Dava and Wood Mackenzie Consultants reports that TCO’s oil production is expected to reach its peak of three million barrels each day between 2020 – 2025. The peak will then decline up to 2 million barrels each day in 2030. This improved production is expected to help in meeting increased local and global demands for oil and gas products (Chevron Corporation, 2014).

TCO’ strategies in Capacity Management

As a means of meeting the global demand of her products, TCO has initiated some strategies to increase its production and distribution capacities. In essence, the company has heavily invested in expansion and improvement of its production plants and stores in most areas of its operation. For instance, the firm has developed the first generation of Tengiz plants (a Russian name for complex technology lines), which are the largest processing train in the globe today. The new generation of Tengiz plants constitute five gas and oil processing trains which are more effective, efficient and environmentally friendly. In addition, routine flaring at these plants were eliminated by the company (Tengizchevroil, 2014).

The commissioning of latest expansion projects by Tengizchevroil has resulted into a rise for the company’s production capacity. Among these projects, include facilities for sour gas injection and second-generation plants. In essence, these expansion programs have successfully doubled the production capacity of Tengiz. They are projected help in ensuring the company meets its goals of increased production, as well as in being ready for unexpected high demand. The completion of the third quarter of its expansion programs in 2008 resulted into the companies’ daily capacity rise to 75,000 metric tons or (600,000 barrels) of crude oil. In addition, the company has currently a capacity of producing 22 million cubic meters which can also be translated to 750 million standard cubic feet of gas (Chevron Corporation, 2014).

Further, the facilities in second-generation plants have full capabilities of stabilizing and sweetening crude oil. They are also able to process and separate natural gas into elementary sulfur and gas products. Not only have these facilities helped in increasing production, but also in maximizing energy and increasing environmental protection by use of new technology(Tengizchevroi, 2014, 1). Prior to initiation of these projects, the company managed to produce a maximum of 3 million tons per year. However, SGP and SGI projects have led to increment of this production to more than 25 millions tones per year.

Critical Discussion

From this review, it is clear that the high demand and sales for TCO’s products have boosted the company’s profitability. This is despite the fact that production of crude oil has sigficanvly decreased over the past years. The favorable earnings by TCO is a reflection of a favorable market condition for TCO’s products, especially crude oil and gas products. However, as reiterated by the companies CEO John Watson, these benefits could have been more were it not for decreased production volume that were caused by the company’s incapacity to produce more.

In order to meet its domestic sales, TCO has to improve the country’s pipe work and infrastructure, especially those responsible for transporting its products. An effective petroleum network will ensure an enhanced supply of TCOs oil and gas products. Further, the completion of a gas processing plant worth $5.5 billion as well as the gas injection system is bound to increase the company’s capacity in crude oil and gas production.

Further, the expansion of TCOs capacity translates that the company’s distribution channels across the world have to be leveraged in order to counter increased production and marketing. Moreover, the company needs to figure out additional transport routes to its local and world market.