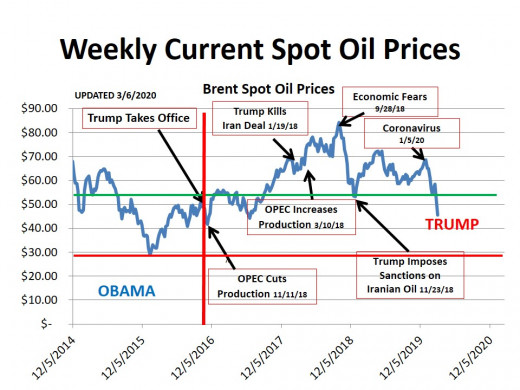

American Oil is Under Assault by Coronavirus AND Saudi Arabia AGAIN (updated - 3-20-2020)

In The News

- Saudi Arabia has won the oil battle - https://www.cnn.com/2020/03/20/perspectives/saudi-arabia-oil-market/index.html

- Russia and OPEC had a major falling out leading to a price war between the two and OPEC flooding the market with oil. Of course American fracking will take a hit as well with many companies cutting back production or going bankrupt under heavy debt. - 3/11/2020

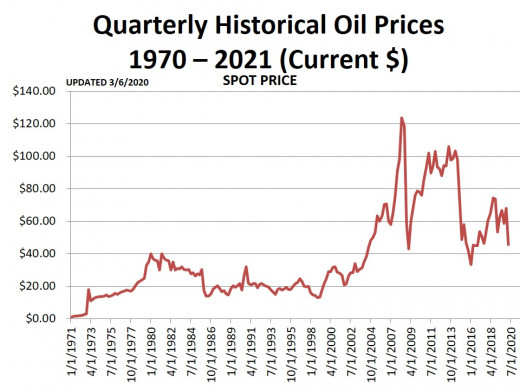

- The coronavirus outbreak has taken a heavy toll on oil prices because of a major drop in Chinese demand (as they deal with trying to combat the virus). Today, the price dropped to $45.53/bbl - 3/6/2020

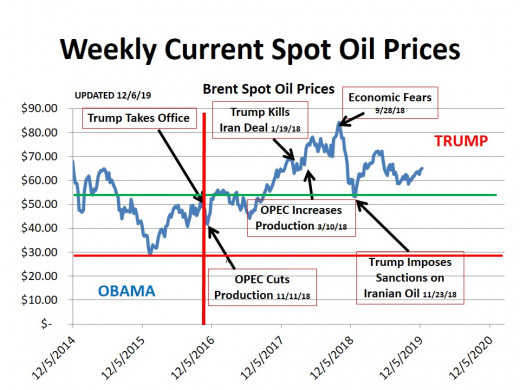

- For the last six months, even though Donald Trump has destabilized the Middle East on a regular basis, oil prices have remained between $60 - $70/bbl - 12/19/2019

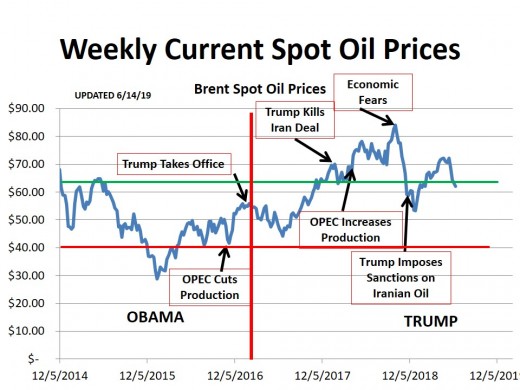

- Apparently Iran has been attacking oil tankers in retaliation to America's economic war on them which is rattling the oil markets - 6/15/19

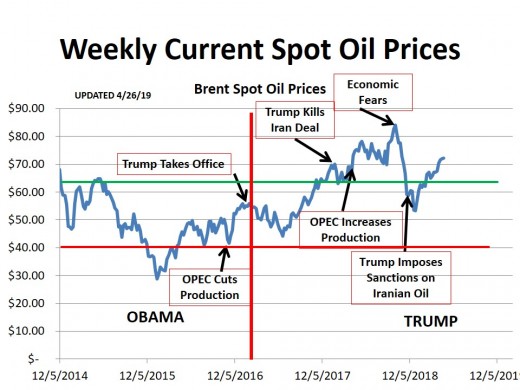

- Oil prices have started their upward climb again as Trump forces countries not to by Iranian oil - 4/26/19

- Oil prices crash through $60.00/bbl on fears of economic slow down - 11/23/18

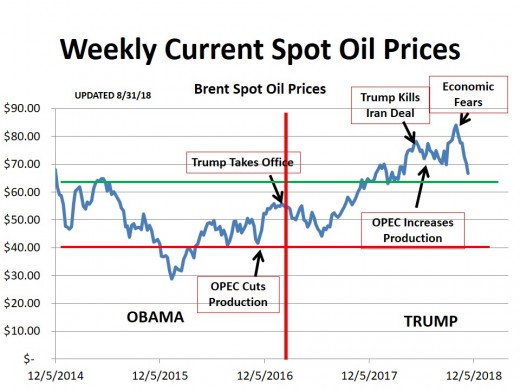

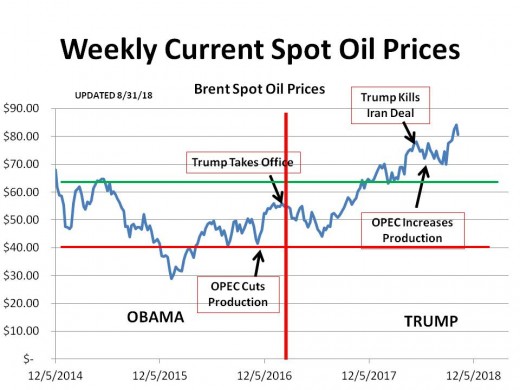

- Oil prices break through $80.00/bbl ceiling and still climbing under Trump - 9/28/18

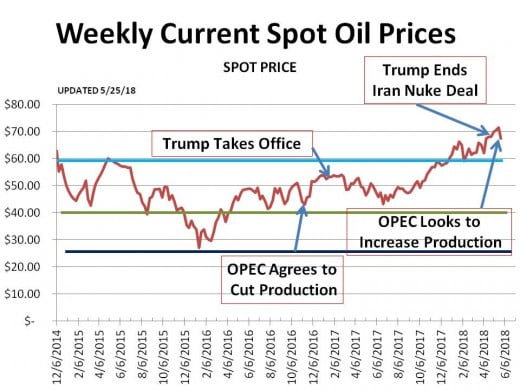

- Saudi Arabia and Russian in talks to increase production to relieve supply crunch - http://money.cnn.com/2018/05/28/investing/oil-prices-down-saudi-arabia-opec/index.html

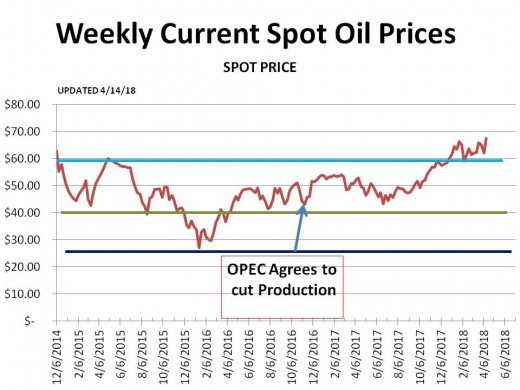

- Oil prices break through $60.00/bbl ceiling and it looks like they aren't coming down anytime soon - 4/14/18

- 2018 starts with Record High oil prices since 2015

- Oil Up 20% since June 2017 http://money.cnn.com/2017/09/26/investing/oil-prices-crude/index.html?iid=hp-toplead-intl

- OPEC struggling to maintain production cuts; could mean falling oil prices again http://www.cnn.com/videos/politics/2017/08/10/trump-thanks-putin-diplomats-sot.cnn

- In a complicated set of events, Russia could end up controlling Citgo ... Congress is upset. http://money.cnn.com/2017/04/10/news/economy/russia-us-oil-company-citgo/index.html

- American shale oil production growing now that prices have stableized above $50/BBL http://money.cnn.com/2017/02/17/news/companies/donald-trump-jobs-watch/index.html

- OPEC surprises world by maintaining production cut leading to steady $53 oil http://money.cnn.com/2017/02/10/investing/oil-opec-production-cut-iea/index.html

- On News OPEC FINALLY agreed to cuts in production, the price of oil surges ... will it last? http://money.cnn.com/2016/12/02/investing/oil-prices-spike-opec-meeting/index.html

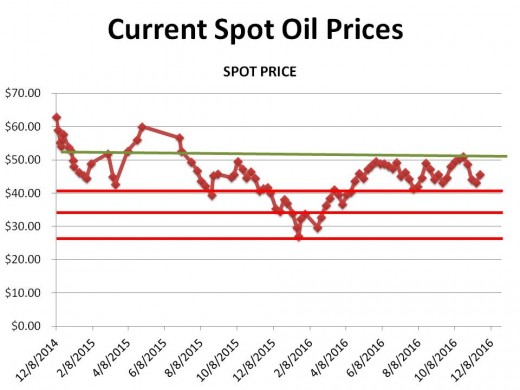

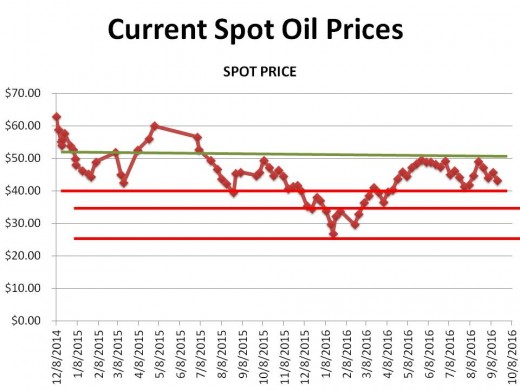

- Oil Prices Stuck between $40 and $50 per barrel. See chart below (11/19/16)

- OPEC again appears unable to curb its greed and not freeze oil production - http://money.cnn.com/2016/09/27/investing/iraq-opec-oil-production-meeting/index.html?iid=hp-toplead-dom

- Low Oil Prices and Sanctions are Killing Russian economy; they are now into 18 months of recession with no end in sight - http://money.cnn.com/2016/09/16/news/economy/russia-cash-reserves-depleted/index.html?iid=hp-stack-dom

- Russia and Saudi Arabia move to stabalize oil prices - http://money.cnn.com/2016/09/05/investing/saudi-arabia-russia-oil-market/index.html?iid=hp-toplead-dom

- If Oil Prices Increase some, America could be energy independent by 2020 - http://money.cnn.com/2016/08/09/investing/us-energy-independence-oil-opec/index.html?iid=hp-stack-dom

- Unfortunately, with low oil prices helping 300,000,000 Americans, they are hurting 200,000 more: http://money.cnn.com/2016/08/04/investing/200000-oil-jobs-lost/index.html?iid=hp-stack-dom

- And now (3 days later) below $40/bbl; will it stop? http://money.cnn.com/2016/08/01/investing/oil-falls-below-40/index.html?iid=hp-toplead-dom

- Oil Keeps Falling, Now $41 per barrel - See Chart 1

- Saudi Arabia was wrong (so far). After Brexit, Instead of $60, Oil Plummets to $45 per barrel.

- Will Higher Oil Prices Increase Jobs in America?: http://money.cnn.com/2016/06/09/investing/oil-companies-pumping-more-50-dollars/index.html?iid=hp-stack-dom

- Saudi Arabia predicts $60/bbl: http://money.cnn.com/2016/06/02/investing/opec-meeting-oil-prices-60-saudi-arabia/index.html?iid=hp-stack-dom

- Oil breaks $50/bbl ! This is a big price test on whether the days of cheap, cheap oil is over. http://money.cnn.com/2016/05/26/investing/oil-crude-prices-50/index.html?iid=hp-stack-dom

- American Oil production finally falling, what will OPEC do? http://money.cnn.com/2016/04/14/investing/oil-doha-meeting-opec/index.html?iid=hp-toplead-intl

- Even though prices are rising (gas is over $2/gal in my area) OPEC countries are forced to start taxing its citizens (sales tax) and companies. http://money.cnn.com/2016/03/17/news/economy/oil-crash-middle-east-budgets/index.html?iid=hp-toplead-dom

- For 3 Weeks Running Now, Oil Prices Rise. http://money.cnn.com/2016/02/29/investing/oil-prices-surge-opec/index.html?iid=EL

- Crashing Oil Prices = More US Oil Production?? What gives? http://money.cnn.com/2016/01/26/investing/us-oil-boom-not-dead/index.html?iid=hp-toplead-dom

- Russia continues to suffer, Ruble Plummets - http://money.cnn.com/2016/01/20/investing/russia-ruble-record-low/index.html

- Banks are joining industries impacted by low oil prices - http://money.cnn.com/2016/01/18/investing/oil-crash-wall-street-banks-jpmorgan/index.html?iid=hp-toplead-dom

- $10 Oil???? http://money.cnn.com/2016/01/13/investing/oil-prices-10-dollars-standard-chartered/index.html?iid=surge-toplead-dom

- OPEC is finally feeling the pressure - http://money.cnn.com/2016/01/12/news/economy/oil-opec-emergency-meeting/index.html?iid=hp-toplead-dom

- Not only Saudi Arabia having problems, so are four other oil producing countries - http://money.cnn.com/2015/12/30/investing/oil-prices-countries-suffering/index.html?iid=hp-stack-dom

- Saudi Arabia is feeling the pinch but will take Budget Cuts before Production Cuts - http://money.cnn.com/2015/12/28/investing/saudi-arabia-budget-oil-opec/index.html?iid=surge-toplead-dom

- Oil had a GREAT month (from consumer perspective) - http://money.cnn.com/2015/12/28/investing/oil-prices/index.html?iid=hp-toplead-dom

- The American Oil industry keeps contracting, more jobs lost - http://money.cnn.com/2015/12/11/investing/oil-spending-cuts-chevron-conocophillips/index.html?iid=hp-stack-dom

- OPEC at war with itself and the rest of the world's oil producers by maintain production levels - more US job loss in Texas and North Dakota expected - http://money.cnn.com/2015/12/04/investing/opec-saudi-arabia-war-oil-prices/index.html?iid=hp-stack-dom

- More pressure on Oil Prices ... Renewable Energy http://money.cnn.com/2015/11/24/news/economy/renewable-energy-iea-cop21/index.html?iid=hp-stack-dom

- Is Saudi Arabia in for troubled times? http://money.cnn.com/2015/11/23/investing/saudi-arabia-opec-revolt-oil-prices/index.html?iid=surge-stack-dom

- FYI - What it costs to produce a barrel of Oil? http://money.cnn.com/2015/11/24/news/oil-prices-production-costs/index.html?iid=hp-stack-dom

- American Oil Companies are feeling the pinch in low oil prices http://money.cnn.com/2015/11/06/investing/oil-companies-debt-gundlach/index.html?iid=surge-stack-dom

- Big money problems for OPEC if oil stays below $50/bbl http://money.cnn.com/2015/10/25/investing/oil-prices-saudi-arabia-cash-opec-middle-east/index.html

- If Oil stays above $40/bbl, my bet is the Saudi's are wrong. http://money.cnn.com/2015/09/11/news/oil-opec-iea/index.html?iid=hp-toplead-dom

- Consumers are Winning for a change! http://money.cnn.com/2015/08/21/investing/crude-oil-prices-below-40/index.html?iid=surge-stack-dom

- Russia (Putin) still suffering, yea! http://money.cnn.com/2015/08/17/investing/russia-ruble-currency-slide/index.html?iid=hp-stack-dom

- Who Can Last Longer, OPEC or US Oil Companies?http://money.cnn.com/2015/08/12/investing/oil-price-war-us-losing/index.html?iid=hp-stack-dom

- How Low Will It Go?: http://money.cnn.com/2015/08/10/news/economy/gas-prices-fall/index.html

- Crocodile Tears: http://money.cnn.com/2015/07/31/investing/exxon-mobil-chevron-profits-tank/index.html?iid=hp-stack-dom

- Another 2,500 jobs cut: http://money.cnn.com/2015/07/30/investing/shell-oil-job-cuts/index.html?iid=surge-stack-dom

- Oil Prices Take a Dive: http://money.cnn.com/2015/07/10/news/iea-oil-report/index.html?iid=hp-toplead-dom

It's A Crazy World

ARE YOU CONFUSED? I AM. Low oil prices, which translate to low gas prices, are supposed to be a GOOD thing, aren't they? Welllll, it depends on where you sit.

- Worldwide consumers are the biggest gainers followed by their economy

- - Low prices mean more money in the consumer's pocket

- - More money in the consumer's pocket means more spending

- - Spending is the major component of most nations GDP; and more spending means a Higher GDP

- -- All Is Good ... EXCEPT

- Worldwide oil producers and the people they employ are the biggest losers

- - Less revenues lead to oil company budget cuts, lay-offs, and bankruptcies

- - Lay-offs, bankruptcies, and lower revenues mean less tax revenue for the gov't (raising budget deficits)

- - Lay-offs, bankruptcies, and lower revenues mean less spending by the oil sector and a Lower GDP

- - Less tax revenue sometimes means budget cuts which, in turn means, Lower GDP for those countries (like Saudi Arabia and Russia, but not America)

- If More consumer spending exceeds Less oil sector spending plus less gov't budget cuts, then economy expands and More Jobs

- If More consumer spending is Less than Lower oil sector spending plus less gov't budget cuts, then economy contracts and Less Jobs

As I said, it depends on where you sit.

What A Love Triangle This Is!

WHAT WAS IT THAT OLIVER HARDY SAID TO STAN LAUREL? "This is another fine mess you got us into!" Well the world has apparently done just that is a new round of brinksmanship over the price of oil. But this time it has the potential to make the 1970s and early '80s look like the good ol' days.

The title to this piece suggests we are only talking about the Organization of Petroleum Exporting Countries (OPEC), who pump oil straight out of the ground, and the combination of U.S./Canadian shale oil producers who use special drilling techniques to extract oil locked up shale rock. But we are not, far from it. Because of other conflicts going on around the world, this fight between oil producers could very well end up determining the outcomes as far apart as Ukraine's struggles with Russia and ISIL's success on the battlefield, let alone the stability of at least six nations.

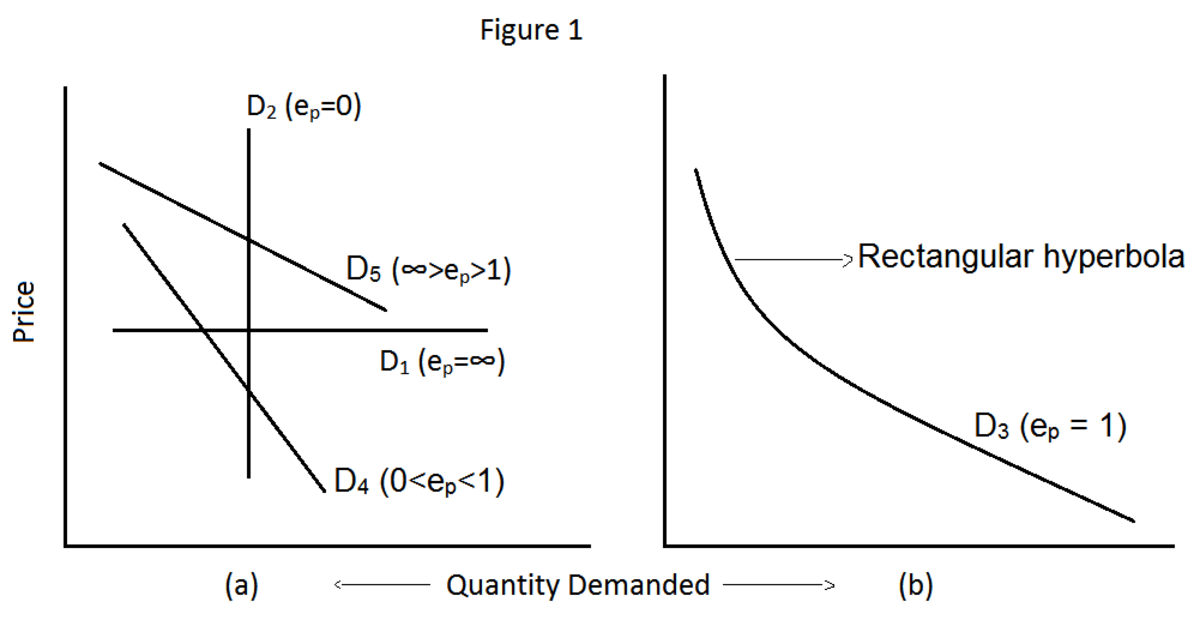

At the bottom of all this, of course, is ... ta da! Supply and Demand. Since the 1970s, OPEC found itself in the international driver's seat when they found they were sitting on the world's supply of extractable oil. They set the production levels to drive the price levels they thought were needed for both domestic and foreign policy reasons. Demand was not an issue as it was always increasing, either because of American growth, and as that drew down, the emergence of Asia, especially China. It was a long-term case of "if we produce it, you will buy it ... thank you".

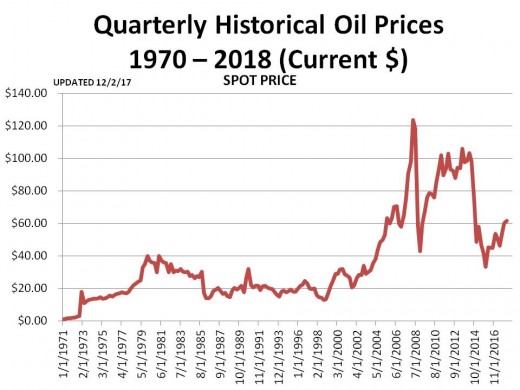

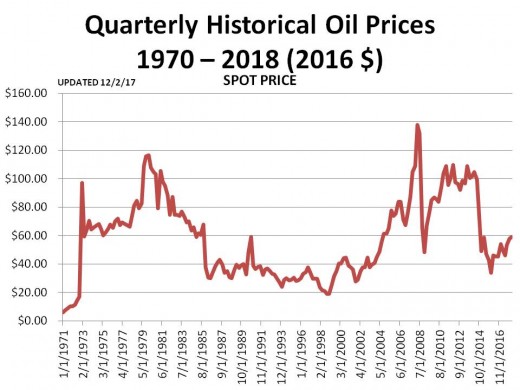

OPEC had no competition because, up until a few years ago, there was no economical way of extracting oil that was trapped in shale and sand formations. It didn't become economical to do so on a large scale until after 2006 (except for a brief period between 1977 and 1981) when oil prices rose above $70/bbl ... and stayed there.

While start-up costs would have made the break-even cost even higher than they are now, those have largely been expended. Consequently, to economically produce oil from shale or sand the price of oil must stay above $50 to $140/bbl, depending on which oil field you are talking about. For two the main producers for the U.S., the Bakken and Eagle Ford formations, break-even is $75 and $65/bbl, respectively; today oil is selling for a little more than $65/bbl on the spot market. And there lies the problem.

Coronavirus is Drying Up Demand So Prices Fall

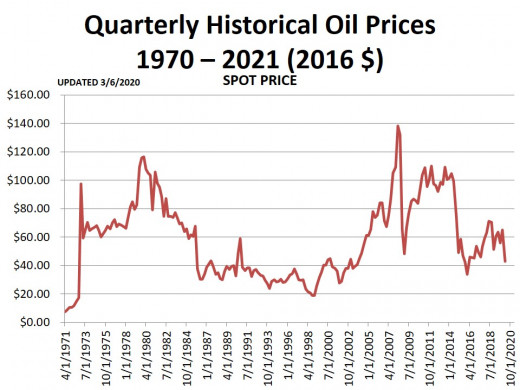

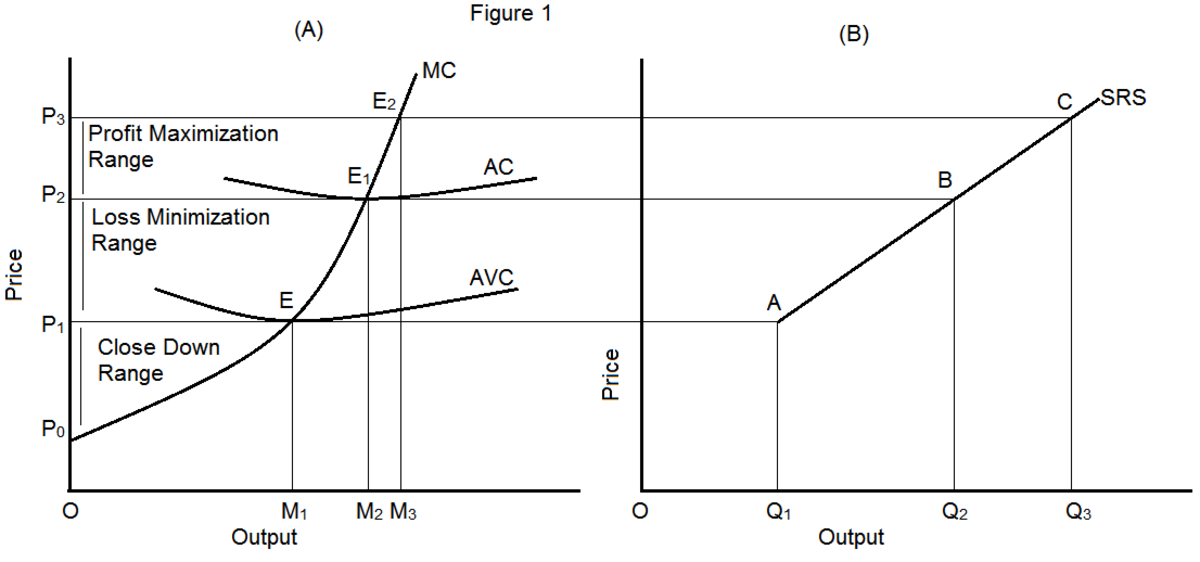

Click thumbnail to view full-size

Quarterly and Real Dollars

Click thumbnail to view full-size

Is Oil Set For a Break-Out? Very Well Could Be

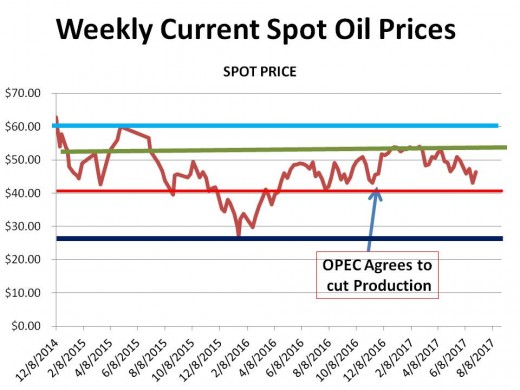

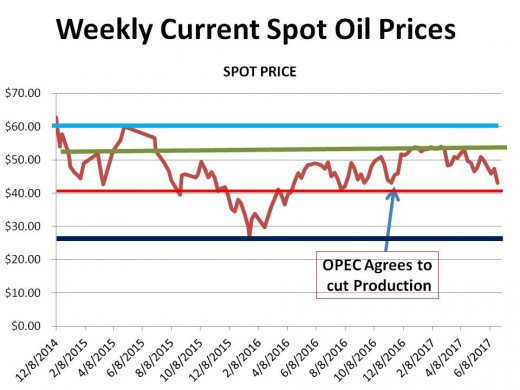

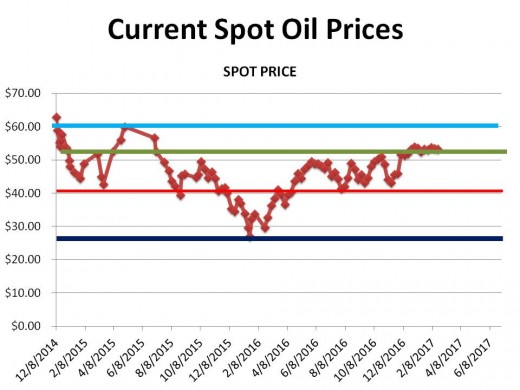

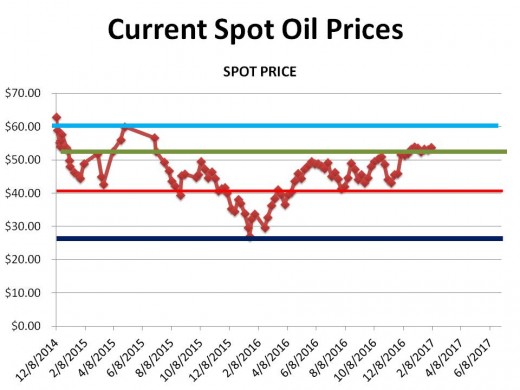

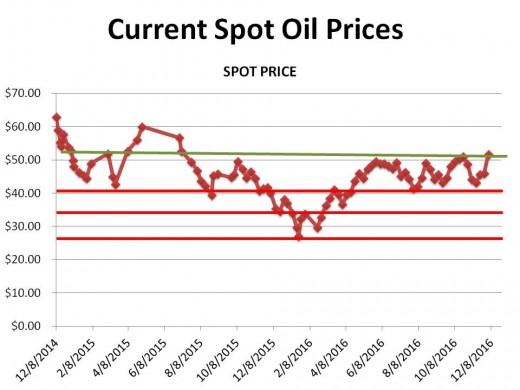

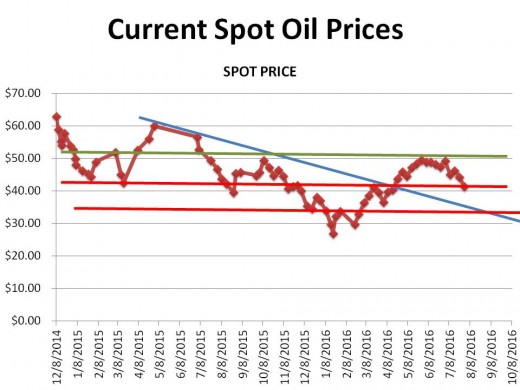

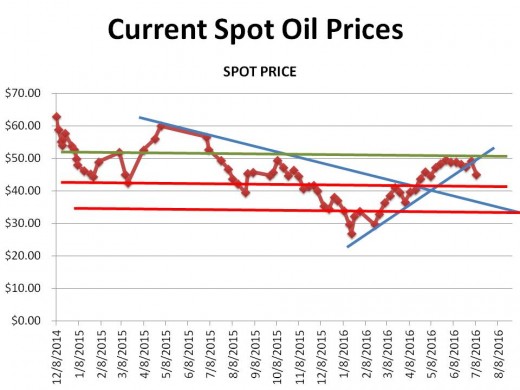

THE BLUE AND GREEN LINES ADDED TO THE CHART are part of what is called "technical analysis" in the stock market and are used to look for patterns that can be related to market movements in the future. In this case, when the price (of oil in this case) goes above or below one of those trend lines near where they meet, if frequently means large movements in price to the next "floor" ($30) or "ceiling" ($50). Oil is currently approaching one of those decision points.

This isn't to say the price of oil will rise of fall to those levels, but history shows that with this pattern, it frequently "breaks out" in that fashion. It is entirely possible, on the other hand, that prices could just bump along at $39 for a while; it is just that there is a smaller chance of that happening.

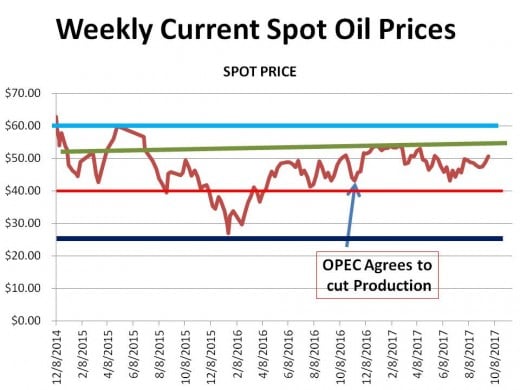

4/22/16 - The above was written two weeks ago. Last week, the price of oil approached the top line. This week it "broke through" the "ceiling". When this happens, given the current "formation" (the pattern the two lines make), it implies there is a greater than average chance that the price of oil could reach $50, the next ceiling (the green line. Time will tell.

5/28/16 - The price of oil is knocking at the door of the $50 ceiling. The probabilities say it will hit it and start back down toward the rising blue line (you will probably need to look back at earlier charts in the series). If it doesn't and instead breaks through the ceiling then two things happen; 1) the $50 ceiling becomes a $50 floor and 2) $60/bbl appears to be the next ceiling. (I need to look at older data to be sure.)

6/18/16 - Oil broke through the ceiling briefly during the week by closing at a little over $51/bbl. I then quickly retreated and at one point dropped to $47 and change. At its current price of $48.26, it rests just above the floor of about $47/bbl.

7/9/16 - After bouncing back and forth between the upward trending floor and the ceiling, if finally came to the point where the price had to make a decision. In this case, it busted through the Floor in a big way. I added two new lines, the red ones, to indicate the next two theoretical floors that oil might fall to in the near-term. The first resistance point is at about $41 while the next, if the first one is pierced, is at around $33/bbl. One possible reason for the current decline is Brexit and the implications of Great Britain (if it remains so) and Europe going into recession and reducing demand. Minus further world events, the most probable (meaning more than 50% chance) outcome is oil prices fluctuating between $41 and $51/bbl for a while.

7/29/16 - Oil prices keep declining and have now punctured the first line of resistance since failing to break through the $50 barrier. It is here where oil might bounce back next week. If it doesn't, and continues' lower, then the next bottom might be where it meets the downward sloping blue line at about $36/bbl; and then slide to around $34/bbl before taking a breather while deciding what to do next.

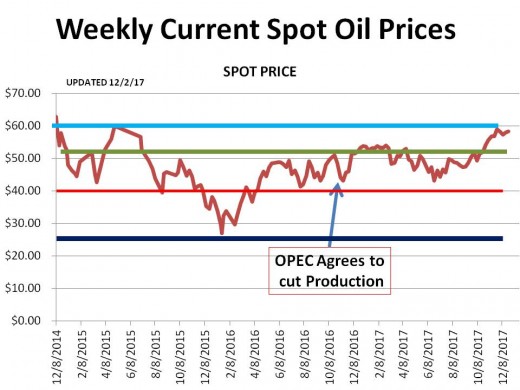

12/8/16 - Oil prices did bounce off the blue line and began establishing a pattern of ups and down between $40 and $52. In technical terms, this is called a "channel". Unless fundamentals don't change, then the price of oil will remain between these two values.

10/8/17 - Oil prices remained in its channel for a very long time, including an event in Oct 2017 that should have knocked it out of its lethargy. That event was when OPEC cut oil production in an attempt to push prices up. The problem is ... it didn't work.

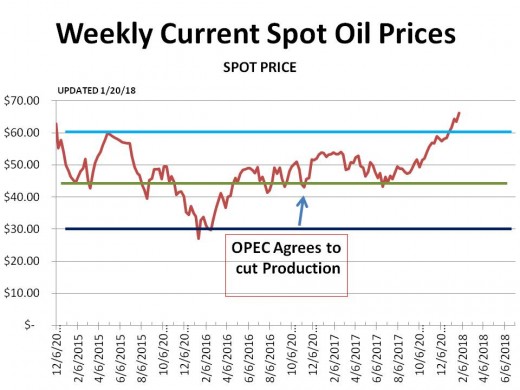

1/27/18 - Prices roared past the "ceiling" price of $60 in Dec 2017. The rising prices have not stopped. What we need to look for in the months ahead is when the price retreats (and it probably will), will it go below $60. If it doesn't, then chances are high that a new dynamic has taken place because the $60 ceiling has now become a $60 "floor"; meaning higher prices are probably locked in.

4/14/18 - The breakout past the $60.00 ceiling is not well established with several failed attempts to fall below $60.00/bbl. Consequently, the "ceiling" has now become a "floor" meaning prices should remain above $60.00 for a sustained period of time. The current news coming out of Syria where the Allies bombed Syrian chemical plants seems to keep prices high for many months to come.

Historical Oil Prices

Click thumbnail to view full-size

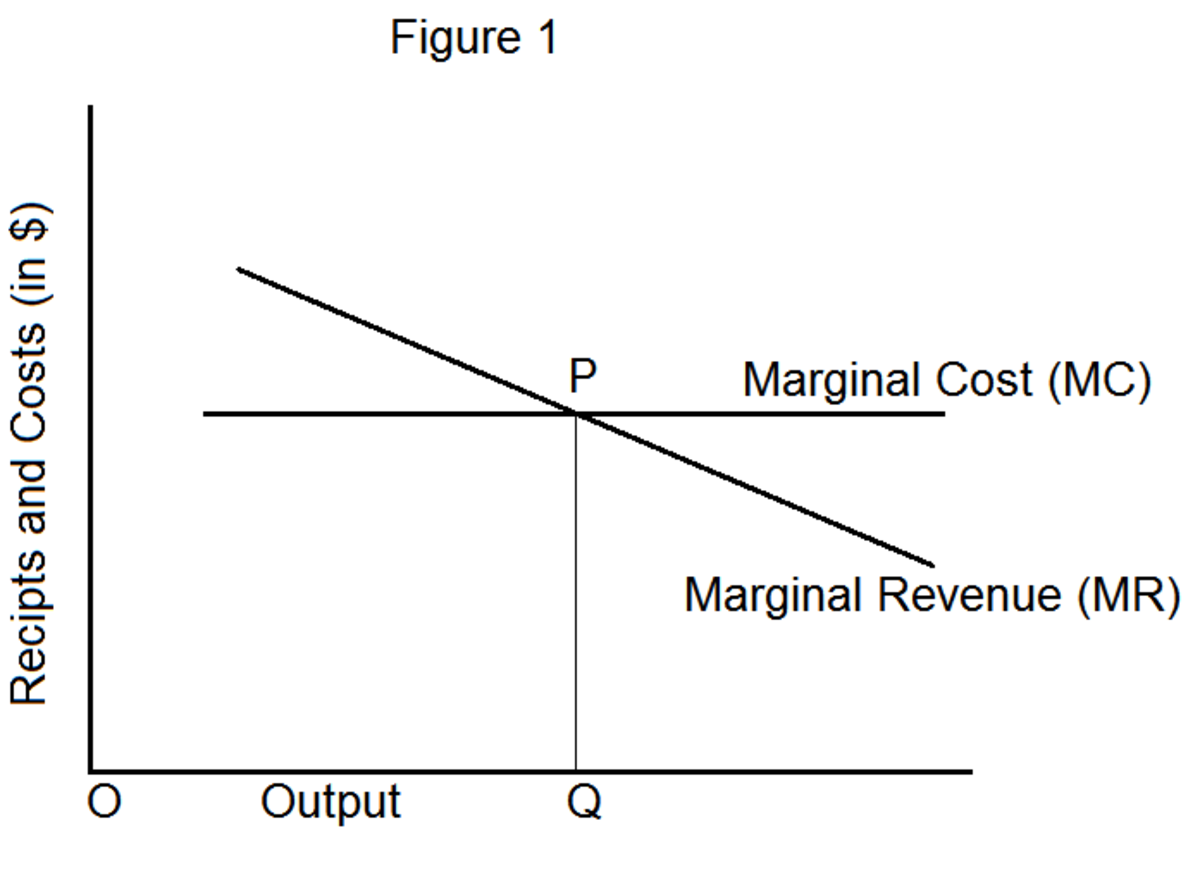

THE MAIN BATTLE LINE IS BEING DRAWN AROUND SUPPLY. Saudi Arabia has good reason to reduce production in order to drive prices up; yet it is refusing to do so in order to put pressure on the West's oil production operations. A recent article by Bloomberg suggests that worldwide demand for oil is up 4% but other reports say that China's economy is slowing down and having a significant downward pressure on demand as is Europe's continued economic doldrums. Looking at the International Energy Agency's (IEA) forecast, demand looks flat at 0.9%/year.

Supply, on the other hand, has been growing at roughly 2%/year, according to the IEA. And, therein lies the problem (well for some anyway, I and my car don't look at it that way), increasing supply with constant demand means decreasing prices; which reflects today.

Given this reality, OPEC has taken on Western oil in a game of survival. OPEC knows the cost to produce oil from shale or sand as well as produce energy from solar and wind is much more than it is for them to extract it from pools under the earth. They also know that:

2/18/2017: OPEC finally gave up on their war with American oil and cut production in Dec 2016. This led to a quick rise in price from a little over $40/bbl to $53/bbl. The impact on American oil production because OPEC increased production to drive down oil prices and force the American shale market didn't work quite like they expected.

While it is true many American shale oil companies were forced into bankruptcy, it primarily because they ran their businesses much like conservatives blame the federal government, that is inefficiently.1 Those companies did fail. But the ones that remained were already strong and they were forced to become leaner and meaner in order to stay alive. Today, they are expanding at a rapid rate.

1. What many people do not know, including me until I took classes on how the government came into being, is that government was Purposefully made inefficient by the founders. They preferred inefficiency over not having effective checks and balances between the three branches of government and the two Houses of the Legislature.

To Produce a Barrel of Oil From These Sources, It Costs ...

Break-even Price per BBL

| ||

|---|---|---|

Eagle Ford (Low)

| $50 - $53

| |

Green River, WY

| $54

| |

Eagle Ford (Med)

| $65

| |

Bakken Antelope

| $67

| |

Permian Basin

| $59 - $97

| Depending on where in the basin

|

Bakken

| $74

| |

Eagle Ford (High)

| $76

| |

Oil from Canadian Sand

| $90

| Think Keystone Pipeline

|

Tonkawa

| $98

| |

PRICE OF OIL 12/5/2014

| $66.26

|

TABLE 1 (as of 12/6/2014)

The implications should be extremely clear, regardless of the face western oil producers put on it. They, and federal government energy policy, are facing a very serious challenge from OPEC. BUT, it is not a one-sided fight as you can see from the chart below.

Breakeven $/bbl Before Country Runs a Deficit

Breakeven $/bbl of Oil (2015$)

| ||

|---|---|---|

Libya (OPEC)

| $184

| |

Venezuela (OPEC)

| $151

| |

Yemen

| $145

| |

Algeria (OPEC)

| $131

| |

Iran

| $131

| |

Bahrain

| $127

| |

Russia

| $107

| Just went into recession

|

Saudi Arabia (OPEC)

| $103

| |

Oman

| $103

| |

Iraq (OPEC)

| $101

| |

UAE (OPEC)

| $77

| |

Quatar (OPEC)

| $60

| |

Kuwait (OPEC)

| $54

| |

PRICE as of 12/5/2014

| $66.09

|

TABLE 2

Having Your Eggs in One Basket

BECAUSE OIL PRODUCTION AND EXPORT makes up such a large portion of each country's economy (Russia by choice, I presume), their national budgets are based on oil brining in a certain amount of revenue. The prices above reflect some assumption they have made regarding production quantities, consequently, to a point, the breakeven price can go down if production increases because total revenue remains the same. There are two problems with that which I will mention; 1) the price of their oil cannot fall below their fixed cost to produce and 2) the more oil they pump into the world supply, the lower the price of oil gets.

This is Yang to OPEC's Ying - driving oil prices down. It becomes a test of wills, first with U.S. and Canadian oil interests and the OPEC governments and, potentially later, with the American and Canadian governments taking up the side of domestic oilmen. The question all are facing is "Who can hold out the longest?

And that is answered mostly by who can come up with the most capital reserves and possibly if the West can come up with technological advances quick enough to lower the breakeven price before they go bankrupt. My bet is OPEC simply because they don't have shareholders to worry about and they have lot's of cash in the bank, as it were.

Is This "Oil War" a Game-Changer?

IT COULD BE! WHY? BECAUSE IT WOULD SEEM that a bar has been set where the price of oil may have a ceiling. The rough average breakeven point for U.S. share production is around $72/bbl right now. If the price goes above that, more and more shale-oil producers will come back on line and begin increasing supply again; the higher prices get, the more oil is put into the system.

On the other hand, OPEC nations seem to be in for a rude awakening because their budgets are based on a price of oil that makes competition from the West quite viable. That would mean, it seems, that all of these countries are going to be forced onto an austerity program to get their own budgets in line with the competitive price of oil, not the speculative price which it has been at for the last 7 years. In some cases like Venezuela, Algeria, and Iran, that is going to be a substantial cut. But even Saudi Arabia is going to have to downsize now that an equilibrium price range may be developing, say between $80 and $95/bbl.

Below that, and Western oil production is no longer feasible, but OPEC has its monopoly back. Above that, the OPEC nations can live high-on-the-hog but will face competition from the West. In all scenarios, however, it does seem like the Middle East is in for even more turmoil, like the world needs it, until the OPEC nations adjust to the new reality.

Fracking for Oil

And If Secretary Kerry Didn't Have Enough On His Plate

DIGGING A LITTLE DEEPER INTO TABLE 2, highlights a potential series of headaches for US foreign policy, let alone the foreign policy of other nations whose own affairs are intertwined with those of the Middle East and who have a need for stability in that area of the world. There are seven counties in the Middle East, two in North Africa, Venezuela, and Russia whose economies require the price of oil to maintain above its current level.

In looking at Table 1, we can see that for nations who need oil to sell at more than $110/bbl, it has been almost three years since that level has been achieved. That means six of the eleven nations in jeopardy have been running deficits since 2011. For the rest, it has been only since July 2014 that they have begun feeling the same pain. But, boy, what pain. Because prices since 2011 maintained in the $100 range, that meant the shortfall was around 10 - 15%, with always the hope prices would be driven back up. But since July 2014, prices have plummeted and are now running between 35% and 41% below previous levels.

It remains to be seen 1) how long these low prices can be maintained, 2) how much lower will they go, 3) how the affected governments are going to react, and 4) how the people of the involved nations are going to react. But it can't be good and I suspect the Secretary of State, or his counterparts, may have a whole new set of problems to address. One nation, however, has a special problem and is already impacting the world scene ... Russia.

Point Change in Gdp If Oil Goes to ...

COUNTRY

| $50/bbl

| $40/bbl

|

|---|---|---|

SAUDIA ARABIA

| -2.9 %

| -3.5%

|

RUSSIA

| -2.6%

| -3.3%

|

NORWAY

| -0.9%

| -1.2%

|

FRANCE

| +0.4%

| +0.5%

|

U.S.

| +0.6%

| +0.8%

|

CHINA

| +0.7%

| +0.9%

|

PHILIPPINES

| +1.4%

| +1.8%

|

Source: Oxford Economics

Unintended, but Fortunate Consequences

THIS IS WHERE THE "CONNECTED" WORLD comes into play. Oil prices are not only fundamental in the war between oil producers, OPEC, Russia, and Venezuela vs the U.S. and Canada; its tentacles reach into the foreign policy of nations not in the Oil War; specifically, Russia, Ukraine, the EU, and the U.S.

As everybody knows, Vladimir Putin, President of the Russian Federation, has been waging a lukewarm war on the Ukraine and a cold war on the EU and U.S. (we just refuse to recognize that reality). One of the consequences of his invasions into Ukraine is a series of sanctions imposed by the EU and US which put significant downward pressure on the Russian once booming economy. The idea being is to put a wedge between the Russian people's complacency and decision to give up liberty in return for economic security AND the stranglehold Putin and his oligarchs have on the levers of power. I am guessing the hope is that 1) the sons, daughters, and grandchildren of the People through off the Soviet yoke will do so again when Putin stops delivering on his promise of economic good times and 2) the People will tie this state-of-affairs to Putins aggression rather than the West's interference.

It was clear the sanctions, while putting a big hurt on the Russian economy, wasn't enough to persuade Putin to change course; Russia had plenty of sovereign reserves to keep things going, probably without subject the people to a recession. Because, however, Russia chose to largely base its budget on the price of oil it left itself wide open to external forces causing great harm.

In this case, it is the crash in oil prices. With a budget based on oil being $107/bbl or higher, the fact that currently oil is selling for 38% less, the short-term writing is on the wall ... and it has happened. As of 12/3/14, the preponderance of the economic indicators show Russia has slipped over the edge and is facing, according to a Business Insider article, a long, deep recession. And that has major foreign policy implications for Putin.

It could be good for the West, or bad; depending on how Putin decides to handle the crisis brought on by the sanctions and the drop in oil prices. Historically, nations in Russia's predicament often create an external enemy for the populus to focus on while things go to hell inside their own borders. Of course he has a ready-made one of his own creation, his incursion into the Ukraine and the West's response to it. As the Russian economy collapses, Putin may decide to saber rattle even more against the West or, possibly, actually invade the Ukraine, something he is fully capable of.

Alternatively, the People, and the crooks (oligarchs) he made rich may turn on Putin as they see their life savings and/or ill-gotten gains evaporate. Personally, I think this is the more likely course the world may take, primarily because the other action will bring on even worse sanctions by the West which may mean a depression could be in Putin's future. It Putin turns inward, then pressure is off of Ukraine which should allow them to consolidate their nation.

Putin's problem, of course, is the sanctions probably won't go away until he gives back the Crimea as well. Somehow, I don't think Putin could bring himself to do that which may leave his tenure in office somewhat problematic.

All because the price of oil dropped back to normal levels.

The Irony of Lower Oil Prices

IRONIC AS IT MAY SOUND, IF THE PRICE OF OIL FALLS too far, that might not be a good thing for the economy. Here is why.

- One of the reasons unemployment has fallen as much as it has is because of the booming oil shale business. If the price falls too far, first new drilling will stop (which is already happening) and production may slow down (although the price will have to fall down to less than $40/bbl for that to become cost prohibitive). The loss of a lot of jobs means loss of overall demand which slows overall growth.

- An amazing number of products (plastics) and services (air travel) are dependent on the price of oil. If the price drops a lot, then the cost of manufacturing or providing a service falls which should mean a fall in prices in a competitive market. If the fall in prices, which one would think is a very good thing, is systemic, then that leads to 'deflation'; which "can" be as bad or worse than inflation. As prices fall, so does revenue for the same demand, and therefore so does net profit as well as net profit margin. That, in turn, GDP goes down (assuming this is happening to a lot of companies) ... not good at all.

- Balancing this is the more the price of oil, and the goods and services depending on it fall, the more funds are available for consumers to spend; which drives up demand and increases growth.

The bottom line is this then:

- IF demand from lower prices increase enough, then that offsets the lower profit margin experienced by suppliers then the net profit will increase ... and all is good.

- IF increased demand falls short, then it is recession time; just like Russia is experiencing now, but probably not anywhere as bad.

So, How Many Balls Are In the Air

LET ME COUNT THE WAYS; BECAUSE THE PRICE OF OIL IS PLUMMETING:

- One set of nations has declared war on its competition in the West, with the goal of driving them out of business

- The same set of nations, and others, are going to have to reevaluate how they want their countries to succeed because, regardless of the outcome of the "oil war" in my opinion, they will never again be able to afford the standard of living they are currently budgeted for.

- The course of the new Cold and Lukewarm war which Vladimir Putin has chosen to declare on the West and Ukraine may be forever altered because his actions can easily be linked to the crashing Russian economy (meaning things might be much better without the West's sanctions.)

- Middle East stability, as fragile as it is, may crack even further straining relations between the Arab and Western world.

- Not discussed is the role lower oil prices might have on the nuclear talks between the West and Iran. Iran is under crushing economic pressure right now, which is why they are at the negotiating table right now; but with another 35% decrease in oil prices, what will be left of their economy but cinder-ash if they don't see the light.

- Venezuelan society, already at the breaking point, may be thrown into revolution as the current oppressive government cannot deliver on its promises to the masses. They put themselves about as far out on the limb as you can go by basing so much of their economy on oil revenues.

- Not addressed, but the lower oil prices, if they continue at this level or lower, may turn struggling European economies into a robust ones. (America's economy is already growing nicely, its just too bad only a few Americans benefit from it.)

Only time will tell on how all of this is going to play out and I certainly don't have any predictions (other than the West will lose the "Oil War"). One thing is certain however ... it's going to be a free-for-all.

What Do You Think??

Will OPEC be able to hang in there and drive US and Canadian oil producers out of business?

Do you think the plummeting oil prices will get Vladimir Putin to back off on his aggression to the West?

Demographic Survey

Do you find yourself agreeing, either a little of a lot, with ...

Demographic Survey # 2

Are You

© 2014 Scott Belford