The Three Methods To Matching Principle

Matching principle is basically associating the revenue of a time frame with the cost that were required to make the revenue. This can be done in a few ways and the way the assets and cost are matched will depend on what expense is incurred. The three methods for matching costs with revenue are direct, indirect and expiring simultaneously.

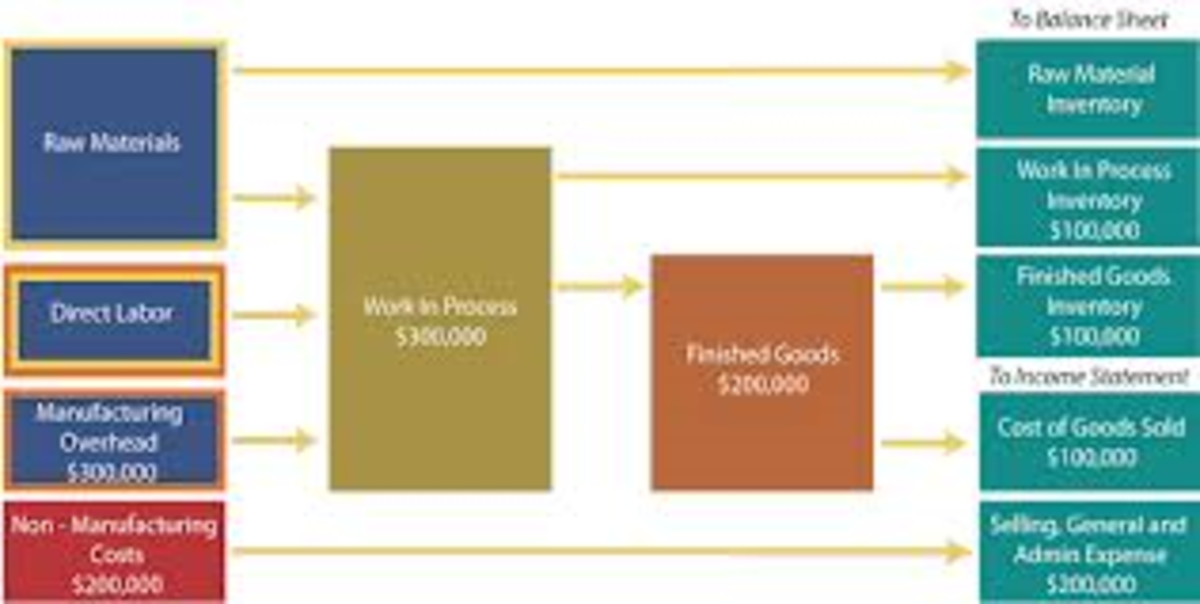

In the direct approach, the cost can be linked directly to the revenue. An example of this would be the cost of goods sold or matching a commission percentage directly with the sales that created it. In this method, the cost must be transparent and easy to associate.

The indirect approach is used for less traceable costs that are a long term asset. Long term assets like buildings or vehicles are beneficial over a longer period of time and their cost should be equally distributed . This method usually involves depreciating the asset over the expected period of use.

The last method is for costs that cannot be traced to any specific revenue and has no future benefits, so in this way they expire with the acquisitions. An example of costs that would be treated this way are income taxes and utilities. These cost only benefit the period they are incurred in, so the cost should be subtracted fully in its useful period