The Use of Accounting Information to Conduct a Cost/Benefit Analysis

Basic assumptions in cost/benefit analysis

Accounting is the language of business. As such, it can provide useful communication for a variety of purposes. One common use of accounting data is to determine the revenues, costs, and profits in a business. Accounting also helps a company assess its total worth, placing dollar amounts on assets, liabilities, and equity retained by the business. A cost/benefit analysis allows companies to make a preemptive plan for deciding how to achieve better financial results through investment optimization. Cost/benefit analyses use a proactive approach with accounting information, whereas traditional financial statement reporting – as described above – is a reactive approach to past transactions.

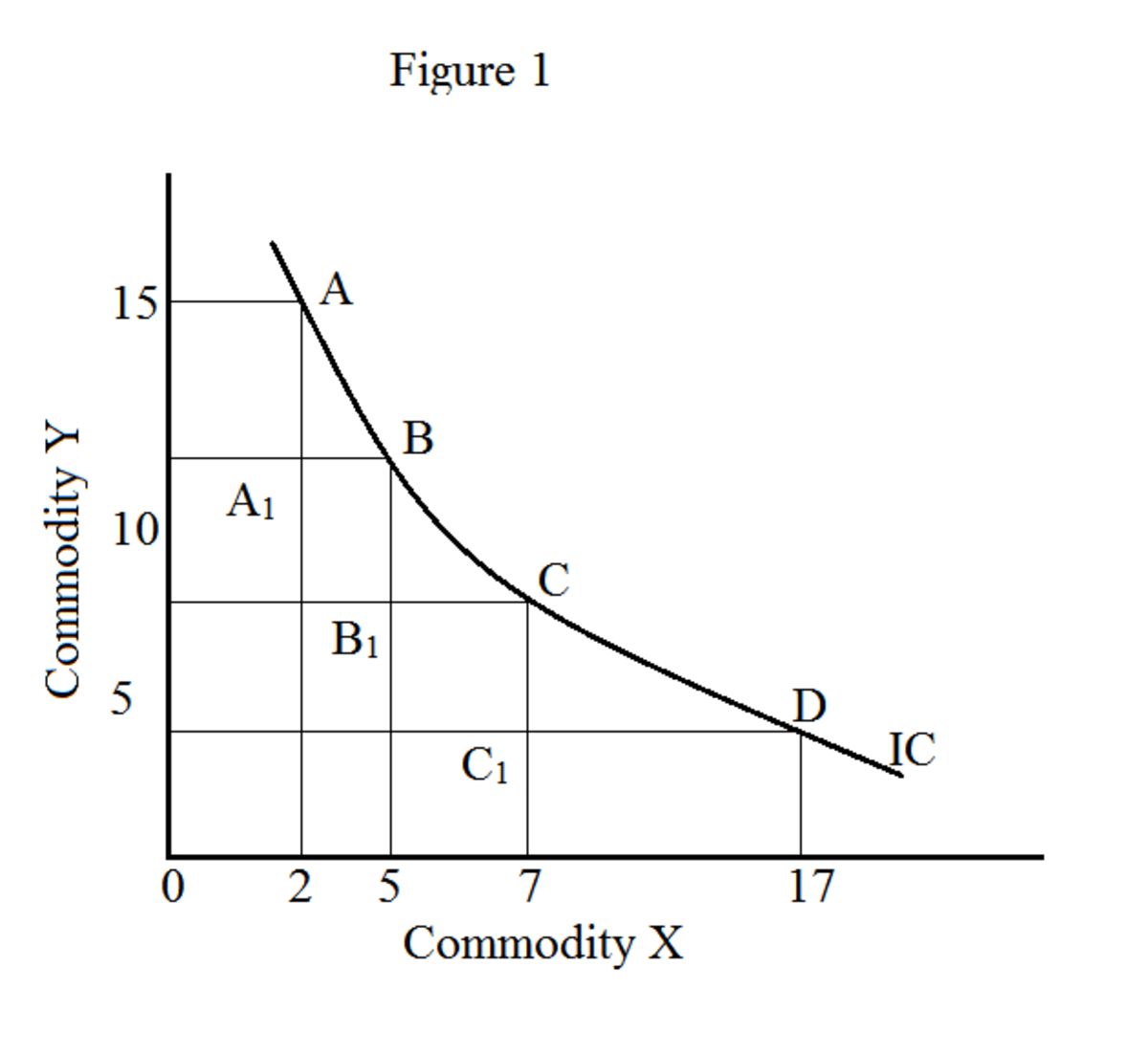

Cost/benefit analyses simply reviews the costs associated with an investment against projected revenues. Though it sounds simple, there are at least two assumptions that fall under this analysis. First, sunk costs are generally not considered in cost/benefit analysis. A sunk cost is money spent on previous items that are not currently recoverable. For example, a vehicle listed as an asset on a company’s balance sheet is a sunk cost. Money paid for this asset cannot be recovered through new investments, at least under standard accounting practices. This is where management accounting comes into play; it often provides details on costs and revenues for current and future cost/benefit analyses.

Another assumption is the comparability between two or more potential projects. This leads to an opportunity cost situation. An opportunity cost represents an option given up in favor of a different one. For example, a company can either save money and earn interest through bank accounts or spend it on new revenue-generating projects. It cannot do both. That is why companies often engage in cost/benefit analyses.

The use of responsibility accounting in cost/benefit analysis

Responsibility accounting and responsibility centers can be tremendously helpful in a cost/benefit analyses that uses accounting information. Responsibility centers place specific cost, revenue, and investment activities under specific managerial oversight. This often allows for an easier cost/benefit analysis for specific units within a larger organization. In this setup, a cost center will most likely not need a cost/benefit analysis in terms of future revenues against invested dollars. Revenue and investment centers typically use cost/benefit analysis to determine how to best earn future revenue.

Two basic methods are commonly used to assess costs versus benefits. The first method is the payback period. The revenue center manager will add up all costs associated with a given activity. Additionally, an annual cash inflow figure is necessary to determine the yearly benefits – whether a fiscal or calendar time period – from the new opportunity. Dividing the cost of the project by the annual cash inflow will determine how long the revenue center must wait to break even on the project. After this period is over, the project will result in pure profit for future years, unless new costs are necessary to maintain the project.

The second cost/benefit analysis method is the return on investment calculation. This method is a bit more complex, though it still uses accounting information provided through a company’s accounting information system. The basic formula here is to compute the gain from the investment and the cost for the investment. (As you can see, investment centers will most likely use this formula) Then, a manager will subtract the investment’s cost from the gains on investment and divide this figure by the total investment cost. The result is a percentage that indicates how much return on spent dollars the unit can expect on the investment.

Without accounting information these formulas are useless. Further division of accounting data – outside of formal financial accounting statements – is also helpful for cost/benefit analysis. Additionally, companies that maintain accurate historical accounting records will often produce better results when looking financially rewarding business opportunities.