Why Sears Employee Feedback Predicted Its Downfall

Introduction

Sears used to be known as the store where America shopped. As a company over 120 years old, it is one of the oldest retail chains in the United States. Its performance for the past five years has been horrible, a sloped line angling down toward oblivion. While Sears’ poor performance has been in the headlines for the past year or two, warning signs were readily available to those who knew where to look.

Internal Warfare Instead of Focusing on External Competition

Sears employees are on the front lines of the business’ operations and the face of the firm to the public. Sears employee feedback on corporate rating websites like Glassdoor and others was an early warning sign of its decline well before word hit news sites like Forbes and Business Insider.

Lampert broke the company up into separate units competing with each other, instead of focusing on the bottom line or competing against true competitors like Dillards, Macy’s and Kohl’s. Executives of these 30 separate units started undermining each other, to the detriment of the whole. Middle managers complained about the Atlas Shrugged nature of it all long before the company’s bottom line began to crash. Employees griped about the cutthroat competition and internal strife this caused well before the Ayn Rand inspired management model caused profits to plummet.

Spending Money on the Wrong Things

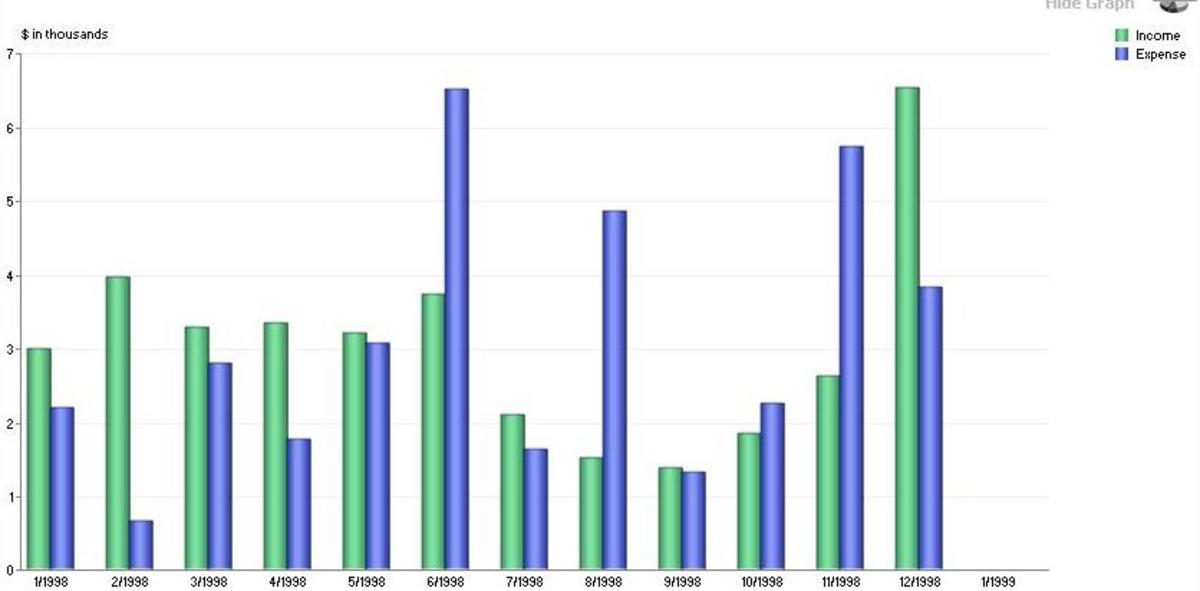

Sears employee feedback on a number of social networks revealed the discontent over pay-cuts long before they protested in 2013. Employee discontent was in part a reaction to six billion spent on stock buybacks to prop up stock prices while pay was cut.

The company failed to make repairs at existing stores, resulting in broken tiles and burned out light bulbs dissuading customers from shopping there. Employee feedback sites described the deteriorating condition of stores well before pictures of it reached Business Insider feature articles. In fact, employees posted pictures of messy racks, empty shelves, photo departments blocked off and dim secondary retail niches hidden from view. The company preferred to buy back stock and pay higher dividends over investing in the company.

Buying K-mart instead of improving existing stores is its own categorical error.

Failing to Keep Focus

Sears tried to respond to the threat of Walmart’s more upscale brands and expansion by buying K-Mart. An upscale retailer buying a low-cost retailer resulted in efforts to upgrade K-mart’s product lines while Sears’ stores suffered inventory shortages, deterioration from lack of maintenance and poor appearance due to harried and understaffed work groups.

Sears employee feedback on the K-mart merger was ignored by management but clearly indicated that things were not going well. In the end, it degraded the premium Sears stores while failing to improve K-Mart’s venues or sales. This destroyed the Sears brand because people went their for upscale offerings and found it below expectations.

Sears would have done better to build new stores outside of the malls, located in the suburbs, instead of trying to rehabilitate a low cost leader and neglect its profitable premium line. In an era of segmented markets and highly targeted marketing, owning a premium store and dollar-store rival is schizophrenic and doomed to failure.

Sears probably would have done fine if it dropped soft goods like clothing and focused on hard goods like appliances that were still money makers for the company. After all, Sears owned many solid and reliable brands like Kenmore appliances, Craftsman tools and Diehard batteries. If it capitalized on these products in its stores instead of trying to sell Martha Stewart products at a dressed up K-mart while letting its Sears mall locations fall apart, Sears wouldn’t be at risk of bankruptcy today.

The company's failing was thus not buying a budget store chain but trying to upgrade the budget chain and letting the premium stores suffer, ending up with two middling companies that failed to meet the expectations of their target demographics.