Why Small Businesses Choose to Grow through Acquisition

One pathway to rapid growth for small businesses is acquisition. Acquisition offers a variety of opportunities. You can expand your customer base, add to your product or service offerings increasing the breath or depth of your market share, acquire equipment at a discount, add to your resource skill set, and / or gain more control of your supply chain. Sometimes there is a single motivator though most often a combination of benefits is required before an acquisition has real benefit.

Why Grow?

Most small companies start with a limited number of products or services. Many soon learn that to grow they need to add to the list. Service companies find they need to offer additional services because the most valuable contracts tend to go to “full service” vendors. Product companies realize they can add complimentary products to make their customers happy and increase sells. Sometimes companies that sell a product find that they can grow their bottom line by offering services to implement, install, and maintain those same products. Vice versa, service companies may discover that selling one or more of the products they service will add to their profit margin.

What are the Challenges?

The challenge becomes how to create, build, add resources, and acquire skills quickly enough to make the expansion profitable but not so fast as to create chaos. Larger companies grow by expansion all the time. They watch for companies in their market who are gathering momentum and gaining market share and then make an offer at just the right tipping point.

Growing by acquisition is easier for large companies who already have an infrastructure that supports rapid growth. Large or small the transition of two companies into one has to be handled carefully to be successful. The combination of two cultures, two sets of business processes, two management styles into one new cohesive unit requires careful preparation and appropriate change management.

For small companies the planning and transition process has to be managed even more carefully. When two small businesses come together it can become quickly apparent that neither has the infrastructure to adequately operate the new larger entity. Change management considerations are even more important when a business suddenly needs new processes and new management to move information efficiently, make decisions, and deliver on time.

Market Share

Whatever reason a business owner looks to make an acquisition the added benefit can be a new list of customers. A loyal customer base is a valuable asset. Of course making sure the customer base is loyal is the key. The purchase of a troubled company can come with unhappy customers who aren’t willing to trust the new owner and make the transition. Additionally the purchase of a company that has already been sold several times can leave customers change weary and disloyal.

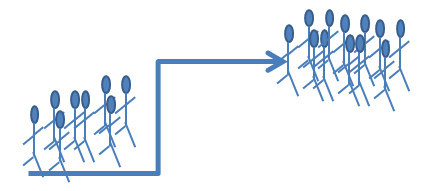

Still with careful up front Investigation and proper transition planning businesses can retain as much as 80% of acquired customers. Those customers and the ones that follow can pave the way to pay for the newly acquired company with increased revenues. Your new stronger customer base can also help to brand your company and give you name recognition you have not had before. Cell phone companies like Sprint and T-Mobile have grown successfully over many acquisitions.

Scale Up

Scaling up to meet growing demands can be tricky especially in a tight labor market. Finding labor with the necessary skills, on boarding, and training can be time consuming and expensive.. Businesses can rapidly add resources in locations where those resources are most needed as well. In the right circumstances growing your resources through acquisition can be the answer to meeting a host of opportunities. Consulting companies often add to their ranks by buying other companies that provide the same services to customers with whom they have strong relationships.

Discount Equipment

Adding necessary equipment can be the most expensive aspect of rapid growth for small businesses. For struggling businesses the equipment they own may be the most valuable asset on the books. Purchasing using equipment can sometimes be high risk. Used equipment often comes with no warranty and no sales relationship. Even if the equipment is new enough to have a warranty the transition of ownership will often times void the warranty agreement. However, when you purchase a company the contracts that are in place will most often be transferable. Of course an attorney needs to validate that this holds true in any acquisition because the wording on the contract can make all the difference. Still small businesses that want to grow can often purchase equipment through the purchase of a company at a significant savings. Oftentimes there is the added benefit of acquiring resources who know the equipment and have the skills to operate and maintain it. Including those resources with the purchase reduces the upfront costs of training.

Supply Chain

Sometimes the answer to your supply chain problems is to own more of the chain. If you cannot get the materials you need to produce your product because the resources are limited then owning the resources is one way to solve the problem. For example, I knew a small oil and gas company whose exploration was slowed down because they needed large quantities of sand. They didn’t need the sand all of the time, however, when they did need it; they needed it in large quantities right away. While their supplier appreciated their large orders the company needed a stable supply of customer orders and so the sand supplier gave priority to regular steady customers over customers with intermittent large orders. Other sand suppliers in the area operated the same way. The oil and gas producer often had to wait on sand causing costly delays. Purchasing a sand supplier solved the problem.

The oil and gas company didn’t really want to be in the sand business, but the business was profitable, came with a skilled labor force, had a consistent customer base, and required little headquarter oversight. As the new parent owner of the sand company, the oil and gas company was able to shift the supply priorities to meet their needs first. The key was to purchase a viable business, with a loyal customer base, with the resources to continue to operate profitably with little oversight.