Why Study Actuarial Science - Actuarial Subjects - Career in Actuarial Science - and Actuaries Jobs

What is an Actuary?

What is an Actuary? An actuary is a person who is an expert in the science of mathematics, probability, statistics, economics, and finance. An actuary is the person who work out how much a business company should charge its clients for making promise to pay them a certain amount in future if certain conditions happen. A good example is insurance companies which will ask you to pay now a certain amount of money with a promise they will pay you a certain amount of money should you get a serious accident in the future.

Compound Interests

The Mathematics in actuarial science starts with the basic of working with compound interests. Compound interest comes in place when you invest a certain principal of money at a certain interest rate and you want the interest to be reinvested every year back into your original principal. An example: if you invest $50,000 at a compound interest rate of 10% per year, your money will have earned $5,000 in the first year. Add that interest to the original principal and your new principal for the second year will become $55,000 which will earn an interest of $5,500. At the beginning of the third year, your principal will be $60,500 which will go on to earn you an interest of $6,050 at the end of that year. If you want to find how much money you will have earned at the end of twenty years, then there is a formula for calculating compound interest.

Formula for Calculating Compound Interest

This is the formula: FP = OP( 1 + i )ªۙ

Where FP is the final principal including interest earned

OP is the original principal

“i” is the interest rate

“a” is the number of years your money is invested.

$50,000 into $336,375.00 in 20 Years

If you input the $50,000 original principal invested at an interest rate of 10% for 20 years in the compound interest formula above, you will get a final principal of $336,375.00. You can now see what insurance companies do with your money so that they can afford to pay good salaries to actuarial scientists.

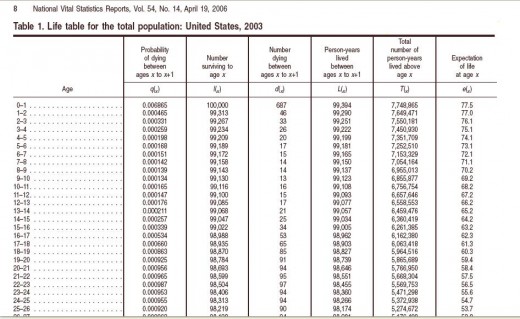

Risks Variables in the Equation

That compound interest formula can become very complex when you start adding other variables in the equation. For example: an insurance company will want to know the risks they stand if they pay their clients full amounts in the event of a client dying before the full period of investment has matured. People will always die but those who are older have higher probability of dying than those who are young. Thus an actuary has a job to do in determining how much money the insurance company should charge different clients for making promise to pay them certain amounts of money in future if certain conditions happen.

Retrospective Reinsurance

It is that variable element of predicting the unknown future that makes a course in actuarial science very rich in mathematics. However, it’s not always that an actuary has to forecast future events but his work may just be determining the cost of financial liabilities that have already occurred. These financial liabilities are called retrospective reinsurance. Often, an actuary will find him/herself working on what has happened to develop new re-pricing of the products and services the company already has.

Pension Fund Management

Having looked at the example above with the associated 101 variables, you will agree that an actuary can be regarded as a highly trained statistician whose job is mainly in evaluating risks in companies in the field of insurance, banking, and any other institutions that has a need to design and mitigate risks. An actuary scientist also is in great demand in pension fund management where their main job there is in predicting future payouts as well as determining current contributions.

Career in Actuarial Science

If you would want to start a career in actuarial science, you will need to pass well in mathematics so that you can join a university where you will do a bachelors degree in actuarial science. Whilst at the university, you will study the following subjects that will lead you in acquiring a degree in actuarial science:

Actuarial Subjects at University

1. Actuarial Mathematics

2. Actuarial Mathematics - Life

3. Actuarial Methods in Finance

4. Actuarial Theory of Pension Funds

5. Analysis of Variance

6. Applied statistics

7. Computational Methods and

8. Data Analysis

9. Economics

10. Elements of Accounting and Finance

11. Elements of Linear Algebra

12. Financial Actuarial Investigations

13. Information systems

14. Law in society

15. Life Contingencies

16. Mathematical Methods

17. Mathematics of Demography and Graduation

18. Methods in Calculus

19. Ordinary Differential Equations

20. Partial differential equations

21. Principles of Financial Management

22. Probability Modeling

23. Probability, Distribution Theory and Inference

24. Programming Methodology

25. Psychology

26. Regression analysis

27. Risk Mathematics

28. Sociology

29. Statistical Theory

30. Stochastic Processes

31. Survival Methods

32. Time Series analysis and Forecasting

Salaries for Actuaries

A day will come when you will pass you university examinations and graduate in Bachelor of Science in actuarial science. You will then proceed and look for a job. Chances are as high as 65% that the job you will get will be in an insurance company. On average, a newly employed graduate from university in actuary science may earn about $50,000 to $60,000 per year. There are certifications needed once you start working which lead to series of exams – as many as nine different exams.

Whenever you pass an exam, your salary is adjusted accordingly by your employer. If you are an actuary in life insurance, retirement plans and investments, you will have to deal with the Society of Actuaries (SOA), and those in insurance dealing with property, casualty and liability, you will have to be certified by the Casualty Actuarial Society (CAS. To reach the highest level of certification may be a lengthy process that may take a minimum of six years but upon reaching there, then you will be a top decision maker in your organization and in most cases your final decision is what the company has to follow. At this stage you should expect to earn in the range of $120,000 to 150,000 per year.

The Future for Actuaries’ Jobs

As things stand now, career in actuarial science is very promising throughout the world. The salaries for actuaries are among the highest of all professions. On the other hand, the demand is currently very high. Like any other market, whenever the demand is high, the price is high, but at the same time, the supply is currently adjusting itself to take on the demand and sooner the equilibrium will be established. The demand for actuaries will not last forever especially with the development of superior computer’s softwares. You just need to look at the historical demands for accountants, doctors, computer scientists, nurses and extrapolate to what we have today and then get a factor and apply that factor to predict what the future careers of actuary scientists may look like.

Buy Yourself a Book on Actuarial Science at Amazon

If you would be interested in studying actuarial science, then there are good books on actuarial science at the trusted Amazon store. By comparing prices at the listing shown below, you should be able to get yourself a book to lead on actuarial science