Why Today's Companies Are Automating Their Accounts Payable

According to Forbes, companies across all sectors are finding that the benefits of automation have increased security, productivity, continuity control, and profitability.

One of the most affected by the automation of business is accounts payable.

In this article, we wish to discuss five reasons every business should switch to accounts payable automation.

Automation Of Accounts Payable Offers Security

One of the most prevalent crimes committed against a company is accounting fraud.

In an article posted by lexology.com in 2014, according to PWC’s 2014 Global Crime Survey, accounting fraud went from 16 percent in 2011 to 23 percent in 2014 - nearly a one-third increase.

The PWC admits that this increase has to do in part with “more regulation, stricter enforcement, and increasing investigations.”

This means that some of the increase in accounting fraud cases involve companies and law enforcement taking better measures to detect such activities.

The report goes on to point out that companies are employing or enhancing internal controls, implementing more rigorous risk management and compliance programs.

What’s more, 54 percent of U.S. companies that responded to the study admitted to losing between $100,000 to fraud.

Another 8 percent reported losing as much as $5 million or more to fraudulent activities by employees.

But it wasn’t just monetary loss that affected these companies. There were a number of “indirect” impacts on them as well.

- Eleven percent suffered adverse effects on relations with regulators

- Thirteen percent suffered a negative impact on their brand’s reputation

- Ten percent of their business relations were hurt

- Eleven percent reported it decreased employee morale

Some Schemes To Keep An Eye Out For

There are a few schemes that crooked employees and accountants use to get over on a company.

Some of these are easy to catch. For savvy perpetrators, some schemes can go unchecked for years.

Personal Purchase

This is where an employee orders a personal item(s) on behalf of the company’s name and account.

With more and more companies giving out company credit cards (procurement cards), this has become more prevalent than the previous method of creating fake invoices.

Check Tampering

This form of fraud can take on a few forms:

-

Employee steals blank checks from the company and inserts his/her name or the name of an accomplice.

-

An employee may intercept an outgoing company check and forge the endorsement and deposit into their own bank account or into an accomplice account.

-

One of the most difficult forms of this kind of fraud is when the fraudster actually takes bank account numbers and routing numbers, then totally reproduce the checks on check stock purchased from an office supply store.

Fraudulent Expense Reimbursement

This is a common form of employee fraud.

It involves employees filing inflated or false expense reports requesting reimbursement for personal meals, hotel rooms, travel expenses, and other “work-related” quasi-business goods and services.

Fake Vendor Scheme

This sort of scheme can drain a company to the point of bankruptcy.

An employee who is savvy enough creates a bogus vendor and bills your company for goods and services that don’t exist.

These sort of schemes can also include inflated market prices on the invoices for goods and services delivered (also referred to as a pass-through scheme).

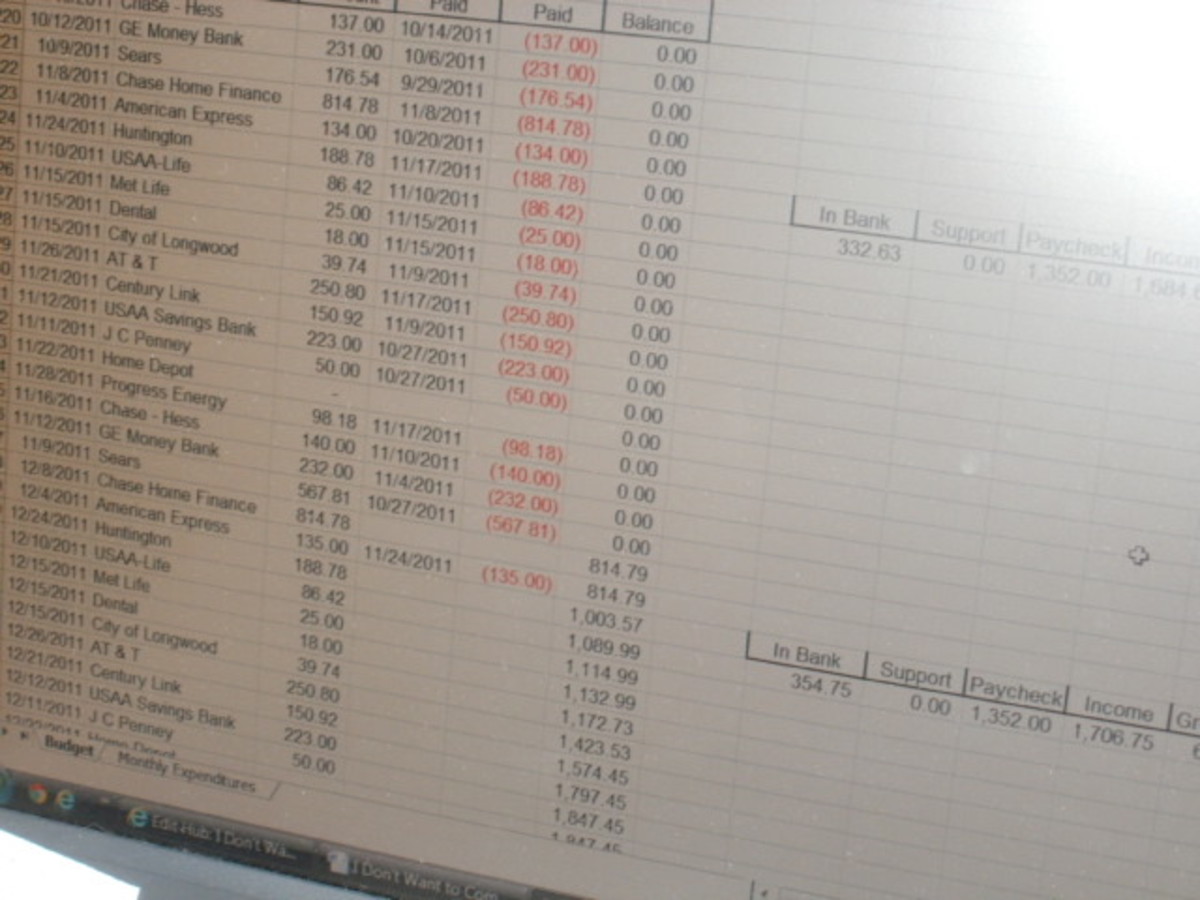

Not All Accounts Payable Mistakes Are Malevolent

Majority of errors in the accounts payable department are purely done by mistake.

Accounting is already a tough job for even the seasoned accountant.

Some common mistakes done in accounts payable are:

- Making copies of invoices. This can cause your company to pay an invoice twice.Employing one person to handle accounts payable. Most companies want to save money, and the first method is cutting employees.

-

Failing to close a purchase order. Once you receive the goods or services, your company cuts the check, then the accounting department must close the purchase order right away. If not, this can lead to your company paying twice for something.

- Late payments. Forgetting to pay your bills because invoices get misplaced or filed in the wrong manner can cause your credit standing to suffer. The most important thing your business should do is to pay bills on time.

-

Failure in communication. Communication can fail at any point in your business. Whether it is internal or between your accounting department and other companies, gaps in communication happen. Communication is the key to any business, so it is important to get it right the first time.

The consequences for bad accounting can be steep - it can even cause you to lose your business.

Heavy fines and legal action could be brought against you simply because of the actions of others within your company.

Companies are finding that AP automation software is the key to securing their company from fraudulent and/or clerical mistakes.

Not only that but accounts payable automation can protect them from possible legal fines or liability due to these unforeseeable issues.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2019 Sarah Draper