Why you should invest your money in Africa

Wherever there are challanges opportunities exist.

As an African and European descent; my ultimate dream obviously is to see the condition of Africans in Africa improve. I always dream that one day the countries of this land would unite. And together they’ll bring once again enlightenment to the world like the Black Egyptians in Africa once did. Africa, the land of all people, the second largest continent with nine hundred million people is composed of 54 different countries. As an American, can you imagine United States of America being split into 52 separate countries? How unpractical would it be for us to trade? Conflict among states would have become an issue; war would have become inevitable just like we have seen with different nations in Africa. A united nation of Africa is the only solution. As long as Africa is divided between different countries she will always be a prostitute for empires to pimp.

Africa is the richest continent in natural resources, and yet most of her people are amongst the poorest in the world. How that came to be is an issue that most economist would prefer not to elaborate about. Those that do either lied about it or they simply won't tell or don’t know the truth. There is only a handful of economist who would tell you the truth about why Africans are poor, but they're not famous. Anyhow those who knows the truth would rather avoid talking about the issue.

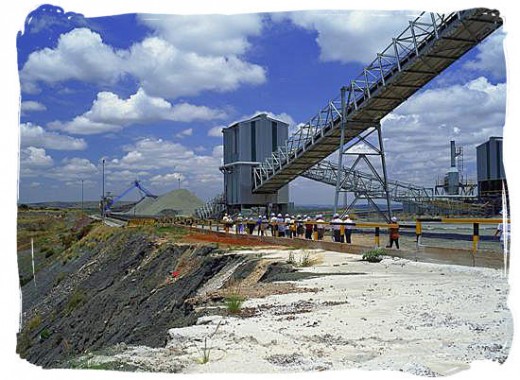

However, some investors have been looking to build new factories in some countries of Africa. Some investors wishes to invest in local enterprises in a few of the African nations. Countries like China sees opportunities in Africa; and for that reason they look to build factories in Africa. Which is a good way to help Africa but not the only way. The method that’s not helpful to African nations is when these countries are offered help in the form of charity. That money never got to be distributed or invested within the economy of the country to which it was intended. The best way to help Africa, is to invest in its infrastructure by building roads, schools and factories.

We live in a time where the world economy is connected and accessible via the World Wide Web. Once our economy becomes fully connected it will become laughable for us to even think of ourselves as separate government. We have already see how the recession can affect the world economy; what will happen next is a joint venture between some of the biggest corporations in the world. This is why some companies are now exploiting the opportunities that are currently available in Africa. The one world government we wish to secure will not happen by face value; the people of every country will still desire their sovereignty. It is part of their culture and you cannot globalize culture, it is impossible. The one world government you might get will be one that is secured by global corporate ties who will work underground to guide and manage public conflicts, public dissatisfaction, corporate interest.

These corporations understand that if they want to continue growing they must expand their operation to the world poorest population by formulating products that the poor market can afford. The ability to increase sales by expanding an organization’s activities or operations to a different region is the outcome of a growth strategy.This strategy can be strategized to understand how to market products to population where the income level of the individuals are substantially less than most average countries. This strategy will have to incorporate an intense integrated low-cost differentiation strategy so that it become effective. What I'm conveying to you here is that corporations that choose to invest in those poor areas in Africa must produce at a price that is advantageous to them so that they make a profit.

I presume, since the income of the population in some countries in Africa are that low, corporations might as well consider building their factories there. The purpose of doing that is to raise the income of the very population they wish to sell their product to. They should do so by providing the Africans with jobs while subsequently developing a market for prosperity and growth to take flight. It is very much like the paradox killing two birds with one stone. You increase the median income of the population you also increase their buying power. And being that you have the competitive advantage there's no competitors around to feed of the market you have created for yourself. In essence you are creating a loop system by which some of the money you invest in human labor can come back to you.

To fully understand Africa, one must have had some comprehension of the opportunities that are currently open to investors. To consider these opportunities, one must have had some understanding of Africans in Africa. Some people have said that Africa is a dark country, it has an AIDS epidemic, high poverty rate, etc. These are things that some people say about Africa. Unfortunately, those who are ignorant of Africa will not benefit from the opportunities that are currently available in it. George Campbell, the geographer once said “The only thing that is dark of Africa is our ignorance of it.” I now understand his reasoning since most people seems to think of Africa as a country. In order for one to say that there are no opportunities in Africa one must be willing to say that there is no opportunity in gambling. It is true that there are challenges in Africa, but wherever there are challenges opportunities exist. Investors can lose or make money in Africa just like any stock investment. The bottom line is that investing in Africa is a low risk investment depending on how one looks at it. If you are looking for short term investment than investing in Africa risky business. If you are looking for long term investment in Africa than Africa is the place you wish to be. Why? Because many countries in Africa are still virgin. Meaning that these countries are underdeveloped. Thus, every major road that is built in Africa is an opportunity for developers to expand their resources and capabilities to secure a chance for a long term growth.

In order for investors to invest in Africa they must understand that corporations follow the law of a ruling government, but they are not controlled by them. They're there to protect the interest of the corporations and to protect the platform in which business is conducted. If people can begin to understand that they would come to realize that the world is not truly being governed by countries, but instead by corporations. It is only then potential investors can understand why investing in Africa is a good investment. Until then some investors will continue to neglect the opportunity to develop markets in the countries of Africa.

A threat can also be described as when a company fails to take advantage on a currently available opportunity. A company that fails to act on an opportunity because they have miscalculated the future outcome of their investment has left the door open for their competitors to initiate a threat. This is why any company who has invested in the opportunities that Africa has to offer will have established a customer base that will not be comparable to new arrival competitors. Since it is not possible for companies to invest in all the opportunities that Africa has to offer; every opportunity they miss or leave pending they’re leaving themselves exposed to a potential threat.

On Wednesday, October 24, 2007 Goldman Sachs released a report that predicted that the year 2020, Nigeria will be among the top ten world economies. The report also indicated that CNBC has Launched CNBC Africa, a 24 hrs news network. My first respond to this was why would they do that? They have implemented a growth strategy by moving part of their business to a different region. Then I realized why - they have done it because they have access to information that projects certain economic outcome that most of us regular folks just don't have. I believe the incentive for initiating this news network in Africa reveals that they are expecting investment to fallow. If you take a look at the report, you’ll notice that inflation has decreased from double digits to single digits in countries like Zambia, Egypt and Nigeria. Looking at this report, one can also noticed that there are other opportunities that are available for many companies in America to initiate an investment.

Tanzania needs investors to help established standards for organic produce, that's a possibility for access to opportunity. If new roads are needed to be developed, that should count as opportunity, energy needs that's opportunity. 10% of Nigeria’s population has bank account, that’s opportunity, if there's an increasing for automobiles this would equal opportunity. These opportunities that are currently available in many countries of Africa is for investors all over the world to initiate an investment for future prospects in Africa. It is up to you the executive to decide whether you see opportunity or challenges.

What this report demonstrate is that a threat must not necessarily occur in the present tense; sometime the most severe threat lies in the unpredicted future. Therefore, this is why it is extremely important for companies to follow trends like return on investment, gross domestic product, public needs and population expansion. This way, companies will be able to envision where the next economic boom will take place, so that they can take appropriate measures to exploit every opportunity they get.

Although companies should pay attention to these future threats, the present threats are just as significant if not taken seriously. However, the current threat to some companies is their inability to quickly deploy their dynamic capabilities which are helpful for introducing new products to be sold in the market. This inability will then open new doors for new entrepreneurs to initiate a threat.

The ability for other entrepreneurs to enter the industry is always a threat to any company, regardless of its size. The last threat I will mention is the major stakeholders who are the stockholders, their ability to redraw from their investment is a huge threat that all organization faces. Now, if you sorely think in terms of threat you’ll never notice an opportunity. As a company, it is always important to manage risk by weighing opportunities with weaknesses & threat. It is the only time you’ll know whether or not an opportunity is advantageous.

Honeywell, Lafayette. “Procter & Gamble looks to poor markets for growth.”[Mongabay] Available http://news.mongabay.com/2007/0715-wsj.html, July 15, 2007

Kambo, Frederick. “Addicted to the hustle.” [Goldman Sachs] Availablehttp://freddkambo.blogspot.com/2007/10/invest-in-africa-get-rich-repeat.html, Oct 24, 2007