Home Insurance Claims

Your home is your castle...

But what will you do if something unforeseen occurs to it?

It's a question none of us ever want to be in the position to have to ask, or answer. But life has this way of going awry from the best laid plans of mice and men, and you should be sure to have as much information as possible if - and Heaven forbid! - it happens to you and your family.

Are you renting? Do you have housemates? Are you and owner-occupier? Do you have a rental property? Do you have a summer home and a winter home? Do you run a business from home?

These are just some of the questions that can affect the type of Home Insurance Policy you will need to take out on your property, and which company you take your business to.

Not all insurance policies are the same, and not every insurance policy has the extra bells and whistles that you, the Insured Owner, requires. Reading that PDS before you take out the insurance policy might seem like a time consuming enterprise, but believe me, better now BEFORE something happens, than later to find out you're not covered and dollars out of pocket.

Please be aware this lens is specific to Australian insurance companies.

Image courtesy of xedos4 / FreeDigitalPhotos.net

This Hub is an ongoing WIP!

As time goes by, I'm always learning new things about the claims process, new ways of doing things, and how different companies work. So this hub will be an ongoing work-in-progress (WIP). If I haven't covered a component that you want to know about, please take a moment and leave me a comment; I'll do my best to find out!

When Things Hit the Proverbial Fan...

When large weather events occur, many people are put into a pretty difficult situation. And every insurance company knows that this is make-or-break time for them; the "moment of truth". Please believe me when I say we start prepping as soon as possible BEFORE an event hits, and make every human effort to help everyone ASAP. It's a supply and demand issue; there's only so many staff to supply the customer demand.

Please be patient. We want to help, it will just take time.

There's different types of Home Insurance Policies?!

Well, yes, actually, there are. And each insurance company has a different name for the type of policy they offer.

For the sake of simplicity, I'll be sticking to the main, generic labels for policies:

Home Building

Your insured property. This covers the actual building that is your home, and also some other fixed, permanent structures at your property. This can include your fence, a retaining wall, your driveway, your pool, your oven (if it's not one that moves house when you do), your dishwasher (same goes).

*Important!*

You MUST read your particular policy PDS carefully, as not all companies constitute the same things as part of your building. Don't be caught short.

Home Contents

This covers the possessions that you own and keep within your insured property. So, your furniture, electronics, books, clothing, cookware, some spas, etc. The list for possible contents items is quite large and impossible to list completely.

A good way to determine whether or not something constitutes a contents item or part of your building, is to picture picking your house up, turning it upside down, and shaking it! Generally speaking, all the items that would fall out would be contents, and the ones that stay put building.

*Important!*

This is NOT a hard-and-fast rule, so please don't get upset with me if something you thought was building is actually a contents item, or vice versa. This lens is intented to give you a better idea of how the claims process should run, and should not be taken as an expert opinion on insurance law.

Fire and Theft Contents

This policy only covers you for if your possessions sustain damage due to fire or are stolen. It isn't very popular as, let's be honest, these are two of the least likely events to occur. Some companies do offer it, however, and if you're thinking of taking out this type of policy, please remember IT DOESN'T COVER YOU FOR EVERYTHING!

Portable/Personal Valuables Cover

This type of policy is useful for those times when you're wiping your hands vigourously and one of the stones in your engagement ring jumps out and makes a mad dash for the drain in the sink, or your glasses fall off your night stand and get smashed or stood on. Or when you leave your wallet on the mens room bench and forget about it. Things like that. It is for the accidental loss and breakage of some items you generally take and carry with you away from the home.

*Important!*

Portable/Personal Valuables Cover is generally for a strictly adhered to list of contents items, such as jewelry, personal music systems (iPods and MP3 players), handbags and wallets, glasses/specticles, and a few others. IT IS NOT A BLANKET COVER FOR ITEMS LOST OR DAMAGED WHILEST AWAY FROM HOME!! You must read your PDS carefully; items like mobile phones and laptop computers are often NOT COVERED under this type of policy.

That said, it is worth the peace of mind to know that the repair or replacement of that stone from your ring or your prescription glasses is only going to cost you your Policy Excess, and not a small fortune.

Landlord/Investor Building and Contents

For the investment property owner. Covers you for the building and furnishings to your rental property.

*Important!*

Again, what one company considers part of the building, another may consider part of the contents. Read your PDS, and don't be scared to ask questions. Better to be educated up front than later when it comes to claim time.

Strata Title Contents/Landlord

A strata titled property is one that is part of, for example, a block of units or a housing estate. Generally speaking, someone who lives in a strata titled property will have a Body Corporate to who is responsible for the communial parts of the building structure.

The Body Corporate will have their own insurance policy on these parts of the building. As a private individual, if you own and occupy a strata titled property, you would likely have a Strata Title Contents policy for your unit/house. If you rent your strata property, you would have a Landlord version of the same policy.

*Important!*

Most Personal Insurance (PI) policies will only cover parts of your strata titled property that the Body Corporate's insurance does NOT. Be prepared to provide supporting evidence when claiming that the flooring/ceiling/window/air conditioning is your responsibility, and not your Body Corporate's.

Pet Cover

This can take many different forms, and while some companies have it built in to an existing policy (usually home contents) it IS possible to purchase a pet insurance policy without having any other type.

*Important!*

As with anything, be sure to read the PDS when deciding on which policy to take out. Having worked for a number of different companies over time I can assure you that not all policies are created equal. Also tends to apply to dogs and cats only; if you have an exotic, it's even more crucial to do your reading before parting with your hard earned funds.

There are probably a few other kinds of policy that I have missed mentioning here, and again I will say, most insurance companies have their own names for these types of policy. Shop around to be sure you are getting the best bang for your buck.

It's better to take the time now, than find out you aren't sufficiently covered should disaster strike.

Image courtesy of Maggie Smith / FreeDigitalPhotos.net

Some basic Insurance terminology

It's not as confusing as it seems!

Here's just a small bit of the terminology you may encounter during your dealings with insurance.

Policy

This is what you have paid your Premium to be covered for. When we talk about Product Disclosure Statements (PDS) this is the information about what your policy covers. Your individual Policy Statement or Insurance Schedule is generally sent to you at renewal time, and will have the details for what kind of cover you have, how much you are paying, and any additional benefits you have purchased.

When you take out a Policy you will be given a Policy Number. Always a good bit of information to keep handy.

Premium

This is what you pay annually or monthly (depending on the option you chose) to have an Insurance Policy.

Claim

This is what you make when you have an incident occur to your property; an Insurance Claim. When you have lodged the Claim you will be given a Claim or Reference Number - VERY IMPORTANT piece of information! This is what you will need to have when you call the company for updates on the progress of the repairs or replacement or your property.

Excess

This is what you pay at Claim time as your share or contribution to the claim costs.

Generally speaking, you will ALWAYS have an Excess of some description to pay when you lodge a home insurance claim. Some companies give you a variety of options to lower the dollar value of your Excess, and sometimes also your Premium. The lower price for one will likely mean the other is higher, so if your Premium is low, your Excess maybe higher to compensate.

It is vitally important you discuss your Excess options with your insurance company when starting your policy with them. What your best friend has on their policy, even if it's with the same company as you, does not mean your policy will have the same value Excess or Premium.

Rating/No Claim Bonus Effect

Some insurance companies offer a type of loyalty scheme, which rewards their customers for long term policy ownership with them, and also low claims. This is sometimes called a Rating, or No Claim Bonus.

Again, each company has a different scheme and a different name it can go by. Ask the question when obtaining a quote or renewing your policy.

Insured Event

The incident, accident or event which occurred causing damage which can be covered under your insurance policy.

Not everything that can happen in the home of to your possessions is considered an "insured event". Please refer to your insurance company's PDS for what you are covered for.

Make Safe

This is usually used to refer to emergency action or repairs taken to ensure the people living in the home are safe, and to help minimise the amount of damage to property.

There's undoubtedly a few I've missed, so if there's a phrase you'd like included, please let me know and I will attempt to address it here for you.

Image courtesy of David Castillo Dominici / FreeDigitalPhotos.net

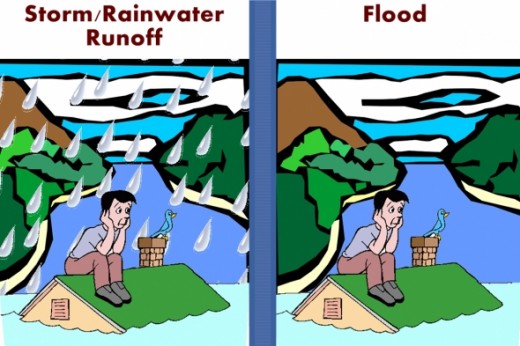

Flood Vs Storm/Rainwater Runoff

A lot of people get confused about the difference between storm or rainwater runoff, and flood, so here's a very basic definition.

If it rained where you are, and as a direct result of the that rain the stormwater drains and local waterways overflowed, that's rainwater runoff.

If the rain from up river caused said river to burst its banks in your location, not the rain that you had in your area, that's flood.

This isn't hard and fast, but I hope it gives you a better indication of what you're looking at.

Did you know that some Australian insurance companies are signatories to the Insurance Council of Australia General Insurance Code of Practice? This is sometimes shortened to the ICA GICOP, and is an important tool in the delivery of insurance services.

The Incident

What to do when that nasty insured event occurs

First things first - are you and your family safe? Do you have access to water, toilet facitilties, cooking facilities?

If the answer is NO, then you need to find somewhere to stay, at least overnight, and quite possibly until repairs are finished, depending on the individual circumstances of your claim (there is no blanket answer).

If the situation is safe, call that phone number, or even logon to their website, and lodge that claim as soon as is practical. The sooner the claim has been lodged with your insurance company, the sooner they are able to start getting you back into the situation you were in prior to the loss occuring.

There are any number of Insured Events or Incidents under different insurance policies with different companies, and not everyone covers the same types of damage and loss. Here are some of the most common ones:

* Theft

* Storm and Rainwater

* Fire

* Flood

* Lightning

* Animals and birds - the actions of animals and birds

* Earthquake

* Explosion

* Impact

* Burst pipes, leaks and overflows

* Malicious Damage, Acts and Vandalism

* Accidental Breakage of fixed glass

*Important!*

The above list is not exhaustive, and is the most basic titles for the events. Please refer to your PDS for what your company covers.

Some things to get in order for the operator

If your claim is the result of someone else's actions, that is: vehicle impact; vandalism; theft- you should contact the police and lodge a report with them. They should then provide you with Police Report Number (PRN) which your insurance company will need in the event that they maybe able to seek recovery from the culprit if they are caught and charged (when it's been a criminal act). When it's a motor vehicle, a PRN is still a good idea, but so long as you get the details of the driver (name, address, phone number, license number, insurance company, number plate) it's not essential to the recoveries process.

*Important!*

Recovery is not always possible, and in the event of vandalism or theft, only when someone has been charged for the offence. I've never personally been in the Recoveries department of any insurance company, so I am unable to offer any further information on this. I will see if one of my co-workers who has might be persuaded to write a piece for us, if enough people are interested.

There are any number of questions that the lodgement operator may be required to ask you in relation to the circumstances surrounding the event that's taken place; please be patient and honest with them. The more information we have straight up, the more quickly we'll be able to process your claim.

And it does take time. Rome wasn't built in a day, remember.

Image courtesy of think4photop / FreeDigitalPhotos.net

The Claim

There's quite a bit of information required for a successful claims experience.

You have insurance in the hope that you never, ever have to use it. So when you do, sometimes it's because some pretty traumatic events have come to pass. Sometimes it's not quite as earth shattering. Here's some handy tips for whenthat moment of truth arrives.

The Assessment Stage

Determining the full extent of the damage, what's covered, and how to cover it.

Every claim, no matter the size, is subject to being assessed, and it won't be the same type or level of assessment for each. Some losses are very easy to substantiate (here's a photo showing a tree has hit my clothesline, for example), some are very much more complex (my ceiling fell in and I don't know why).

I've mentioned before that each company I've worked for does things a bit differently, and assessing claims is no different! Some companies have internal assessors whom they sendout to assess the damage, compile a Scope Of Work (SOW) and an estimate, and from there a team back in the office takes over managing the claim process. Other use external companies called loss adjusters to assess the damage before it is handed over to the office staff, whereas others again have the loss adjusters manage pretty much the whole process, with the insuance company keeping a broader eye on things from that next step back.

Having so many people involved in one claim can be a pain point to say the least. Don't be afraid to take down names, dates, and company details for the people who you speak to, or turn up at your house If it helps. It can also be a great tool should sny difficulties arise later on in proceedings. Above all else, never be afraid to contact your insurance company and ask questions. The only silly question is the one you didn't ask.

Providing Proof of Loss/Damage and Proof of Ownership

This is one of the key factors in any home insurance claim, building or contents. It is vitally important that you be able to provide something to substantiate the loss/damage sustained to your property. Please, please don't hassle us when we ask for it! It's required because unfortuantely there are some incredibly dishonest people out there, and we live in an age where a person's word just isn't sufficient anymore.

Proof or Evidence of Loss is needed in claims where you still have the item, but you need to prove that an Insured Event has occured to it. There are a great variety of Insured Events, and while at first glance they seem the same from one company to another, the specifics can be very different, so make sure you read your PDS.

Proof of loss/damage can be a repairer's report from a qualified technician or practitioner in the field of the item in question (e.g. an electrician; builder; plumber; computer tech). The report will generally need to include the following information:

* cause of damage

* extent of the damage

* when the damage occured (an estimated time frame for how old it is e.g. water damage to a ceiling)

* whether it is able AND/OR economical to be repaired

* the price of repair if able

* the make/model/specification information of the item

The above isn't exhaustive, but you'll find covering all of the above should see your report acceptable for a claim acceptance decision straight up, thus avoiding further delays.

Proof or Evidence of Ownership comes into play when the item in question isn't there anymore - generally because it has been lost or stolen. This is something many people struggle with the concept of, so I will try to explain it simply and easily for you.

Proof of ownership can constitute, but is not limitted to, the following:

* original purchase receipts, or copiers thereof

* photos of the items (includes people wearing or using them)

* instruction manuals

* warranty cards

* the box/packaging the item came in

* jewellers vaulations

Some companies have a minimum proof of ownership requirement for items depending on the value of them. Please read your PDS to avoid unnecessary delays in processing your claim!!

On occassions where damage has occured but keeping the items until an assessor can arrive is a potential health risk, take photos and document as much as you can, then and only then can you begin to dispose of damaged items!!

Rome wasn't built in a day

and neither will it be possible to have your claim completed in such a time frame. Again, the more information you provide up front, the quicker your claim will progress and be completed.

While every policy holder is a valued customer, some claims are more urgent than others. So yes, even though your claim for your missing earring has been around since, say, early November, if in late November-early December someone else has lost everything... I'm sure you catch my drift.

Repair, Rebuild, Replace

Getting you back to the position you were before the event.

Repair and rebuild will be options generally applied to building damage. Repair can on occassion apply to contents items too, and replace is usually soley in that contents domain. Each option has its own criteria for being applied, and it's not the aim of this hub to go into details of those criteria.

Suffice it to say, most times your home will be repairable; if the damage is extensive enough it may need to be rebuilt; sometimesyour contents items might be repairable; other times they will need replacing. Making an informed decision as to which will apply for what claim is part of why the assessment stage is so crucial.

Some of the PDS's I've read have gone into a bit more detail about when these options will apply. If you're wondering for your own situation, look for a section titled something like "how we settle your claim" or "options to settle your claim".

The Privacy Act of Australia

Due to the Privacy Act, most insurance staff - whether you call them OR they call you - will be obliged to ask 3 questions to confirm you are who you say you are before discussing any claim details with you.

This isn't about inconveniencing you. This is about protecting your identity and personal details.

Questions could be (but are not limited to): the full names of the policy holders; the postal address; your date of birth; how often you pay your policy.

The Finishing Touches

If you have questions pertaining to how an home insurance claim works, please drop them here, and I will endeavour to answer them for you.

If you have questions pertaining to your particular insurance policy, I can try to answer them, but I don't know all of the policies and their individual clauses and conditions. Your best point of contact for your own, personal insurance policy will always be your insurance company.

Other than that, fire away!