The Dollar & the Euro & the Yuan

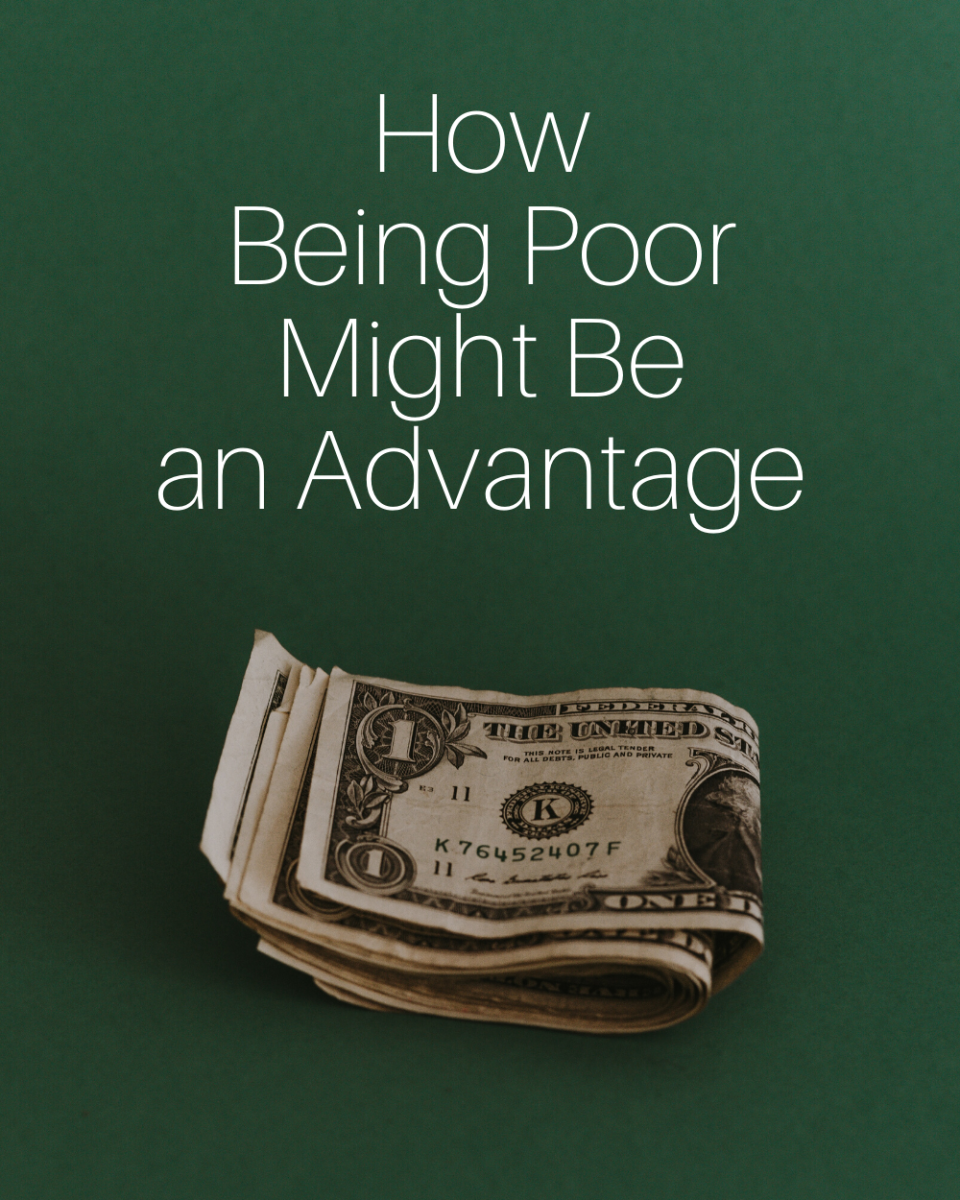

As most of us know, currency is important everywhere in the world. Every nation has a type of currency that is used by its authorities. Nations use currency as “a medium of exchange, unit of account, or store of value. Despite the fact that the Deutsche mark and the Japanese yen internationally gained ground in the course of the last two decades the US dollar was ahead by a wide margin and the US acted as the only economy that had to a considerable degree to cope with both the beneficial and the disadvantageous effects emanating from the issuance of an international currency. (Beckmann, Born, & Kösters).” Debates have been shown that the dollar has many advantages and disadvantages as the euro and the yuan do. In addition to that, they played a big role in international finance and trade. Will the euro or the Yuan eventually supplement the dollar?

What are some disadvantages of the dollar? “When the dollar is strong, it makes American products more expensive for foreign buyers. Thus, the exportation of U.S. products to foreign buyers typically declines as the dollar value increases. Foreign buyers cannot buy as much or get as much value in exchange for their own currencies. One interesting disadvantage of a strong dollar is that it can negatively affect profit reports from companies that operate globally. Visitors to the U.S. find their vacation is much more expensive,” according to Neil Kokemuller in the article titled The Advantages & Disadvantages of a Strong Dollar. In addition to that, Glenda Taylor, Demand Media, shows that a weak dollar negatively affects consumer spending. It causes gas prices to become more expensive and causes businesses troubles. Employees would expect their employers to pay them more so that they can afford those costs.

What are some advantages of the dollar? Neil Kokemuller goes on to show in the article titled The Advantages & Disadvantages of a Strong Dollar that “a main advantage of a strong dollar is global perception. A strong currency is usually reflective of a strong economy. Thus, when the dollar is strong, the perception is that the U.S. economy is strong. A strong dollar lowers import prices, thus helping U.S. companies that buy supplies and products from other countries and bring them into the U.S. The dollar typically buys more foreign products when it is stronger. When the dollar is strong, business travelers and vacationers can buy more local currencies when traveling abroad.” Kathy Lien shows in the article titled The Pros and Cons of a Weak Dollar that when the dollar is weak, more people visit the country; as a result, that increases export and causes the economy to growth, and the company makes profits.

What are some advantages and disadvantages of the euro? According to the article titled The Euro: Advantages and Disadvantages of A Single Currency in currencysolutions.co.uk, “There are many advantages of the euro, and the most well-known are the following: obliteration of the existing exchange rate fluctuations between a number of currencies and reduction of transaction costs (no other currency is necessary when conducting business or travelling in the Eurozone). The single European currency also stimulates trade activities and free movement of capital or goods and people, but these effects should be subject to a profound academic research.” In addition to the advantages, the author shows many disadvantages that the U.S. Federal Reserve Releases Data shows. Among the disadvantages, he shows that the euro adoption by the countries in the Eurozone causes more people to be unemployed; businesses face a lot of trouble with their loans and others. “In addition to the data released by the European Central Bank, Forex traders around the globe take decisions whether to buy or not to buy euro depending on data about the national economies of the countries participating in the Eurozone. Hence, negative signals reported by the French or German economy could result in depreciation of the euro exchange rate as a whole despite that the economies of all other Eurozone member states are running smoothly”( The Euro: Advantages and Disadvantages of A Single Currency in currencysolutions.co.uk).

Will the euro eventually supplant the dollar? “In the near term, the bank said the euro remains the biggest challenger to the dollar. The single currency of a host of European countries is ‘poised to expand’ its status as a currency of choice, though the appetite for the euro will depend in large part on whether officials can successfully navigate the sovereign debt and banking crises the region currently faces,” according to Merco Press in the article titled US dollar status as world’s single reserve currency will end by 2025, The United States dollar status as the world’s single reserve currency will end by 2025, according to a new report by the World Bank. Hans Timmer, director of development prospects at the bank, said during a conference call with reporter according to that same article , “’I think it is still quite possible that this will only be a very gradual process ... it's very likely that the dollar will still be very dominant’” (Merco Press).

Will the Yuan eventually supplant the dollar? “As SHANGHAII shows, it's practically a given that China will overtake the U.S. as the world's largest economy, probably within the next two decades.,” according to Shen Hong in the article titled Can the Yuan Replace the Dollar In the Wall street journal. “The Yuan, however, may never kick the dollar off its pedestal.” In addition to that , Mike "Mish" Shedlock argue in Globale Economic Analysis in SPDR in the artile titled Is the Yuan About to Replace the Dollar as the World's Reserve Currency that the Yuan will never supplant the dollar by supporting a working paper by Arvind Subramanian and Martin Kessler at the Peterson Institute of International Economics and by supporting the article titled The Financial Times , China’s currency rises in the US backyard by and Martin Kessler at the Peterson Institute of International Economics also. Mike "Mish" Shedlock shows that “China’s bond markets are not big enough or deep enough for the Yuan to displace the US dollar.”

Source: Data From The US dollar, the euro, and the yen: An evaluation of their present and future status as international currencies, Beckmann, Rainer, Born, J¨

1980

| 1992

| CIb) 1992

| |

|---|---|---|---|

EMS-5a)

| 31

| 33

| -

|

Deutsche mark

| 14

| 15

| 1.4

|

US dollar

| 56

| 48

| 3.6

|

Japanese yen

| 2

| 5

| 0.6

|

Source: Data From The US dollar, the euro, and the yen: An evaluation of their present and future status as international currencies, Beckmann, Rainer, Born, J¨

Share of world GDP in %

| Share of world exports in %

| |

|---|---|---|

EU -11

| 15.5

| 19.5b)

|

USA

| 20.8

| 15

|

Japan

| 7.5

| 8.5

|

What are some disadvantages of the yuan? “The survey showed 52 percent of companies admitting to having a limited understanding of the internationalization of the yuan, while 38 percent said they didn't perceive a clear benefit. Around a third of respondents said their counter-parties are unwilling to use yuan and another one-third said they haven't fully considered the option,” according to Nyshka Chandran in CSBC news in the article titled Yuan as global currency? Many firms don't see benefits. In addition to that, America manufacturing shows in the article titled China and Currency Manipulation that the yuan causes the US a lot of deficits.

What are some advantages of the yuan. Giles Chance in China Daily in the article titled The Steady Advance of the Yuan, “It seems appropriate that the yuan should play a major world role, alongside the dollar and the euro. The benefits for China are obvious: cheaper borrowing on world markets, the profits gained from the issuance worldwide of a widely used valuable paper currency and a reduced foreign exchange risk both for Chinese companies and for the management of China's dollar reserves.” In addition to that, Giles Chance shows that the yuan has been an appropriate tool that causes financial stability in many places in the world.

In conclusion, many researchers argue that the euro or the yuan will never supplant the dollars. I agree with them. The dollar has many advantages and disadvantages. For example, sometimes, when the dollar is strong as it has been proving above, it is disadvantageous to the tourists. They have to pay more money for their vacation. Also, it has advantages. When it is strong, US Company makes a lot of profit. Similarly, the Yuan and the Euro also have many advantages and disadvantages.

Works cited

Neil Kokemuller in the article titled The Advantages & Disadvantages of a Strong Dollar in smallbusiness.chron, “N.D” November 16, 2013.

The Euro: Advantages and Disadvantages of A Single Currency in currencysolutions.co.uk, “N.D” November16, 2013.

The US dollar, the euro, and the yen: An evaluation of their present and future status as international currencies, Beckmann, Rainer, Born, J¨urgen and K¨osters, Wim, 2001. November 16, 2013.

Philip Jessup in transnationallawblog, “The Lure of China and Economic Activism in transnational law blog ,April 07, 2010, November 17, 2013.

Neil Kokemuller in The Advantages & Disadvantages of a Strong Dollar, ”N.D” November 16, 2013.

Axel_Merk, Why I Sell the U.S. Dollar: From Dollar Strength to Dollar Weakness Currencies / US Dollar Nov 12, 2013 - 02:41 PM GMT in the market oracle, November 17, 2013.

Kathy Lien shows in The Pros And Cons of A Weak Dollar, August 4, 2010. November 16, 2013.