venture capitalists and business angels why they like small businesses

WHY AM I LUCKY AS A SMALL BUSINESS OWNER?

Small business owners and potential small business owners are lucky because the windows of funds/ finances are opening up for them on a daily basis – provided they (small business owners) meet up with the stringent requirements of the venture capitalists and business angels.

Google is among the notable companies that have earmarked billions of dollars to finance small businesses in their startup stage. They have particular interest in biotech and high-tech startup businesses. Good business ideas that are nicely packaged and presented no longer have to worry much about financing. You can join Google’s program called Gadget Venture if you are an entrepreneur who specializes in building online tools using Google technology. Or head on to Silicon Valley where you will find many VCs waiting to path with their money in return for some equity share in your business.

Venture capitalists and business angels help provide fund/ finance to small businesses at the stage where it is extremely difficult for them to raise fund/ finance.

WHAT/ WHO IS A VENTURE CAPITALIST?

Venture capitalist in most country is a limited partnership formed by wealthy investors. They operate more like a co-operative society where each member signs to make an initial investment/ contribution then followed by a series of additional investment to the tune of maximum allowed contribution by a single partner (this is often enshrined in the partnership agreement). A general partner known as the venture capitalist is usually appointed and saddled with the responsibility of making investment and investment decision. Carried-interest is the phrase used to describe the additional incentives that the general partner gets together with an annual management fee.

The pool of fund/finance provided by these partners is known as venture capital (VC). These funds are used to finance existing and relatively new small businesses that are struggling to raise fund/ finance.

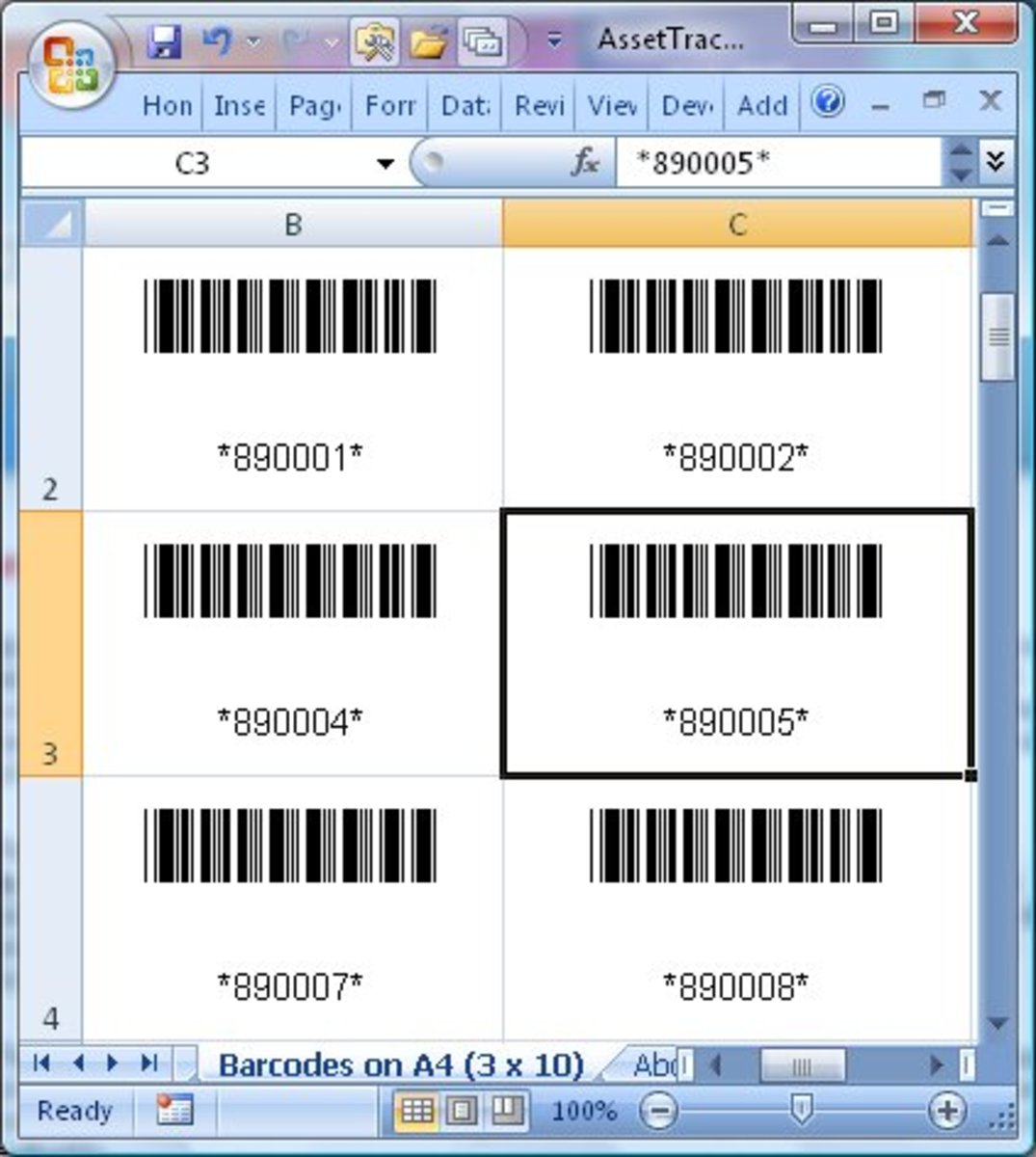

Stages of VC financing

There are six stages that an entrepreneur or small business owner can opt to be financed by VCs and they are:

Seed money financing stage: This is the initial money needed to be invested in a venture to prove that the concept behind- product or services- is real and can actually get off the ground. Though, the entrepreneur or business angel can provide this, VCs occasionally do finance this stage of investment. The amount required at this point is relatively low so, may not really need VCs to finance.

Startup financing stage: this is the stage where further finance is needed to carryout additional or more in-depth research. R&D (research and development) and formulation of initial marketing and production plans characterizes this stage. In some instances, a prototype will be developed. Though, this is a risky stage for VCs to come in, but, most of them are happy coming in at this stage as they will be rewarded with higher return if they succeed.

First-round financing stage: this is the financing stage where finance is typically needed to initiate the actual production and marketing of the products and services of a small business.

Second-round financing stage: here, the financing of working capital is the major problem faced by entrepreneurs and small business owner. VCs are happy to come in at this point as it will have to face a reduced risk though with a reduced reward (risk-return-trade-off).

Third-round financing stage: the aim of seeking finance at this point is to achieve increased sales so as to breakeven, assuming the business has not done so yet.

Bridge-financing stage: this represents the ultimate aim of every entrepreneur and in some cases VCs, bridge finance is necessary when a business wants to go public. Going public means selling of shares to the general public. This is usually done through an IPO (initial public offer).

Note however that these financing stages vary from industry to industry, not all industries will be fine to inject capital into at all the stages.

WHO ARE BUSINESS ANGELS?

Business angels are wealthy individuals that finance startup businesses. It is the responsibility of Business angels to carryout due diligence on small businesses before furnishing them with finances and fund and thereafter monitor them. The difference between a business angel and venture capitalist is that; while a business angel is an individual, venture capitalist is the representative of wealthy individuals. Most seed money and startups are initially provided by business angels before involving venture capitalists when they find themselves in tight corners. Business angels usually have close ties with VCs.

WHY DO VENTURE CAPITALISTS AND BUSINESS ANGELS LOVE SMALL BUSINESSES?

The love that business angels and venture capitalists have for small can be explained by these two points:

Syndication

Venture capitalists in particular love investing in small businesses because this allows them to spread risk and reduce the probability of making mistakes. The pool of monies contributed by partners is diversified into many small businesses that operate in different sectors of the economy.

Chance to eventually buy the business at a cheap rate

The second reason why VCs and business angels love investing in small businesses is to have the chance of eventually buying the business at a cheaper rate. Google for instance invest in startups with hope of buying them later wouldn’t want your business to be bought by Google? I will of course! Hehehe

Venture capitalists were and will continue to be an option for small businesses to raise finance- especially now that big companies are finding it fanciful.