Business Cycles, Inflation And The Supply Of Money

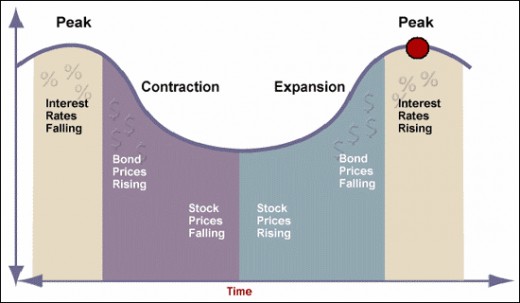

What goes up, must go down and what goes around, must go back around; herein lies the essence of a business cycle. To the shock of many, periods of too much economic growth or too little growth are hidden within theories of fluctuating markets. This said, the term business cycle refers to recurrent ups and downs in the level of economic activity extending over several years (Stanely Brue). These “ups and downs” create fluctuations in both production and economic activity over a period of long-term growth. Also, these fluctuations typically involve shifts over time between short-term periods of relatively rapid economic growth (expansion or boom) or long-term periods of economic decline (contraction or recession.) A typical properous economic engine really only has two goals: 1) The idea that everyone should have a job; and 2) The idea that prices should be stable enough to allow continual growth. Goal two is the one that get most engines in trouble—to be precise, when government tampers with the supply of money, both an inflationary boom and precipitous decline in output & employment could, and usually is, the direct result.

In fact, the Austrian School believes when credit creation by monetary authorities exceeds a society’s structural saving rate, financial intermediaries end up lending money at interest rates that are below the rate where supply and demand clear in the market for loanable funds. [Austrian Business Cycle Theory And the Global Financial Crisis: Confessions of a Mainstream economist.] The flooding of monies by “big gov” may seem like an inundation of economic jubilation, but time has shown that this inundation of monies isn’t anything more than typical capital distortion and misallocation. This misallocation, in the long-run, affects an economic engine because it misguides the entrepreneurial process.

This misallocation of capital can only be the cause of “big gov’s” monetary polices. Namely, the real forces behind the business cycle, isn’t the free market process, but, indeed government itself. Whenever the government infuses too much credit, you’ll get what’s called a business boom, and as soon as this “false boom” reaches its peak, you’ll get a bust. In a market based economy, there’s nothing illogical about both good times and bad times. If you follow the U.S. economic engine’s history, you should notice these same “good times and bad times.” The illogical part of the business cycle, especially in a kamikaze economy, begets the question of, how to stir an economic engine away from bad times? But, can this really happen? In an economy where government has got its “big hands” on everything, this becomes a very hard task: a business contraction in a sluggish economy is a tough trough to get out of. Historically, booms has always been followed intermittently by major innovations within the marketplace— i.e., such as, railroads, the automobile, fiber optics, dot.com, sub-prime etc.

In the two latter cases of both the dot.com and subprime, it could be argued that the innovation didn’t justify its creations. Very early on, it was very apparent what was taking place: you had this major economical frenzy going on where the Fed intentionally kept interest rates low, spurred cheap money and credit, thereby created an illusion of full employment and aggregate output. This cheap money/credit created a boom in the business cycle that was brought on by government induced inflation. The economic business cycle is like any other cyclical concept, whereas in economics there could exist causes for inducement. Monetary policies were created to fight off recessions but history has continuously shown that these same policies are maybe the one thing causing the problem.

Have you ever seen the movie The Fugitive played by Harrison Ford? This surgeon guy escapes from the hands of the law; hence, the film’s title The Fugitive. Nonetheless, believing that he has been wrongly convicted of a crime he didn’t commit: the murder of his wife. He then proceeds to elude being captured by chief US Marshal’s character, played by Tommy Lee Jones. Anyways, in this film, you have this well-off doctor guy that has been wrongly convicted of a crime and is out on the streets trying to free his name. He then goes on to seek help in clearing up his name from one of his medical school colleagues, but mysteriously uncover that it was, indeed, his medical friend who actually had him set up. Ironically, the same thing occurs with monetary policy. Namely, the American people—in the hopes of economic prosperity—confer its confidence in the hands of the Federal Reserve in the hopes of steering clear of economic bad times. But just like Ford’s surgeon friend, the American people, soon find out that it maybe government that’s causing all the bad times. Again, it seems the Fed doesn’t care about the harm it does to the social well being of our modern economical society. They’re people just like us, but the only difference is they have a lot of power and we don’t.