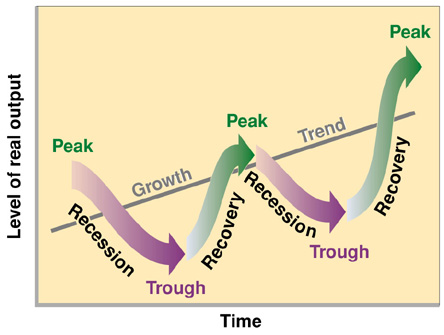

Business Cylces: Induced Purely By Inflation

It’s been proven, business cycle booms are inflationary induced—and they are induced to the point of being major catalyst for the inevitable recessions that follow. Mainstream economics postulates that the business cycle is the inevitable result of some flaw in free market enterprise system itself. Furthermore, it thinks the government’s role is to mitigate economic recessions. It’s a pure economic fallacy to believe that government can remedy a sick economy. The Fed tried to remedy the dot.com bust and caused an even bigger bust in the sub-prime real estate debacle: two consecutive booms and busts have never occurred in the history of our economic engine’s history.

To most economist who employ rational logic, business cycles are inevitable and they are mainly caused by one thing: inflationary-induced monetary polices by the Federal Reserve. When the Fed intervenes into a monetary system, it begins the onerous task on misallocating economic resources; this misallocation of economic resources can only lead to erratic business fluctuations. Just look at central banks—through its fiduciary media—and what it has created in excessive bank credit. This over reaching bank credit induces inflationary bubbles, which then lead to aberrant economic conditions. If you don’t buy this logic, one very important sign post to research are interest rates. You don’t need a PhD in economics from MIT to understand the inner-workings of a business cycle, fact is, government— through monetary policy—has completely altered the economic landscape in this country, and by manipulating interest rates they have been able to create erratic fluctuations in the overall market place.

What are interest rates? Interest rate is the price for the use of money (McCornell). Expressed as a percentage, it’s the rate at which interest is paid by a borrower for the use of his/her monies. Because interest rates are tied to borrowed money, in essence, it becomes the price of all borrowed money within a market based economy. For an individual or business, obtaining monies have a price to it. For example, if I’m a businessman and I want to increase my capital I’ll accomplish this by borrowing monies. Moreover, I can’t just walk inside of a bank and say, “hey give me some money, I’m a nice person.” The banker might say, “hey you might be a nice person but before I give you the bank’s money, I want you to give it back to me, with a little extra for my risk.” The entire banking concept is based around this idea—which is why interest rates play such a significant role in the free market enterprise system. Interest rates are objective measures tied to the entire banking process and the attractive appeal about interest rates to the Federal Reserves is that they can be used to manipulate the supply of money; thus, the general flow of the economy.

The importance of interest rates in a capitalist society can’t be overstated—and if used irresponsibly, interest rates have been cause for major abnormal economic conditions. In reference to interest rates and inflation, this theory is even more ten fold: there’s an inverse relationship between interest rates and aggregate investment. Broadly speaking, fluctuations in interest rates are the forces behind aggregate investment—to be exact, if interest rates increase across the board, then investment decreases, thereby causing a fall in national income.

Again, through monetary policy, government institutions like the central bank, can loan monies to commercial banks to manipulate their interest rates. Why would the government want to do this? Your guess is as good as mine, but I assume that has a lot to do with the fact that they just can. If I’m a bad guy and I can get away with murder; then why shouldn’t I kill? In addition, by altering interest rates, central banks are able to affect the interest rates faced by everyone who wants to borrow money for economic investment; hence, control the general flow of the economy. This said, it’s a complete power trip by the Federal Reserve System to be able to affect such a large mass of people simply by manipulating a one digit number. How does the Fed accomplish all this? Three words: open market operations.