MuRatopian Intersection Economics

A New, Just World Economic Order.

January 01st 2016- Most developing nations, and beyond, are now gripped, by the most immediate and most menacing economic crisis in modern history. There are three, crucial qualities of economic issues to be considered:

First, we must end the current commitment to an accelerating, debt money system hyperinflation.

Second, we must end an already deep and still-deepening collapse of world economy.

And third, we must end the presently immediate threat of one factor free market economics. That is responsible for the increasing poverty and inequalities and an immediate threat to destroy civilization worldwide.

These three categories of present threats to humanity are to be traced to the effects of the presently continuing, and presently accelerating, hyperinflationary policy of the superpower nations. These present trends in North America and Europe have created a presently hopelessly accelerating, hyperinflationary system. And this leads to a consideration of three conditions.

There are first, therefore, three conditions which the new economy must introduce immediately, if true economic revolution is to be launched.

The first of the three essential preconditions for a new economic revolution that are relevant , is the combined systems of both public money system and the two factor market economics[1] ,new structural laws of supply and demand , the creativity Machine paradigm which now form the MuRatopian Intersection Economics , that is modeled to become a successful economic system to be launched globally .

The implementation of the MuRatopian Intersection Economics, will suffice to halt the hyperinflation which is now leading all nations of the world. This will prevent them from leading into a hyperinflationary collapse, and an increasingly probable certainty of economic warfare.

Second: Establishing an equitable new international monetary order for world economy depends upon the actual creation of a set of systems based on the principle of MuRatopian Intersection Economics, among cooperative nations. This means that the future economy must be one rightly deemed debt free economies which is uttered under the authority provided by the binary financing system of the respective sovereign nations. The presently accelerating rate of conventional economics-centered hyperinflation must be terminated with the appropriate full force of appropriate measures of Global Monetary and Binary Market Reforms.

Under such reform , the composition of government funding of sovereign national economies , will be composed of a combination of public money system and binary financing model of credit extension to the poor and middle class people , and by , the respective nation-states as such . Think this through as follows : There exists presently a widespread practice which locates wealth , mistakenly in money as such, or in terms of similarly fictitious assets , rather than the democratic capital acquisition to those most in need and public money system communities.

Whereas, any actual task of establishing an equitable world economy will demand that presently hyperinflationary practices among nations, must be superseded by national public money systems, of national binary financing and new structural laws of demands and supply, from both within and among those cooperating nations.

Third: it must be recognized, that it is the increase of democratic capital acquisition wealth[2] to poor and middle class people which must be practicable by the respective nations extension of systems of public money system. This must be a system of debt free economies, which is duly warranted as an investment in the creation of the future, productive poor nations, rather than merely nominalist forms of monetarist wealth, per capita and per square kilometer.

The future wealth of nations and of the enterprises must warrant the extension of binary financing, within and among cooperating nations. That MuRatopian Intersection economic policy shall serve for both the public and private investment, in the creation of that which will exist only through the means of the productive future of each nation and humanity in general.

[1] Binary Economics was first advanced by corporate finance attorney, investment banker, and

philosopher, Louis Kelso. See, L.O. Kelso and M.J. Adler, The Capitalist Manifesto (1958); L.O. Kelso

and M.J. Adler, The New Capitalists; (1961) L.O. Kelso and P. Hetter, Two-Factor Theory: The

Economics of Reality (1967); L.O. Kelso and P.H. Kelso, Democracy and Economic Power: Extending

the ESOP Revolution through Binary Economics (1986, 1991).

[2] For writings on binary economics by Robert Ashford see “Milton Friedman’s Capitalism and

Freedom: A Binary Economic Critique,” forthcoming, XLIV, No. 2 Journal of Economic Issues,

533 (June 2010); “Broadening the Right to Acquire Capita with the Earnings of Capital: The

Missing Link to Sustainable Economic Recovery and Growth,” 39 Forum for Socio-Economics.

89 (2010); “Capital Democratization,” 37 The Journal of Socio-Economics, 1624 (2008) (co-authored

with Demetri Kantarelis); Binary Economics: The New Paradigm. Lanham, MD: University Press of

America. (1999) (Co-Authored with Rodney Shakespeare); "A New Market Paradigm for Sustainable

Growth: Financing Broader Capital Ownership with Louis Kelso's Binary Economics." 14 Praxis, The

Fletcher Journal of Development Studies 25 (1998); "Louis Kelso's Binary Economy." 25 Journal of

Socio-Economics 1(1996) (1998).“The Binary Economics of Louis Kelso: A Democratic Private

Property System for Growth and Justice,” Chapter 6 in Curing World Poverty: The New Role of

Property, (1994), John H. Miller, C.S.C., S.T.D., editor; “The Binary Economics of Louis Kelso:

The Promise of Unversal Capitalism.” 22 Rutgers Law Journal 3 (1990).

Drop the Debt 2009, (July 2009). Video compares financial crisis bailouts with third world debt.

Odious Third World Debt Has Remained For Decades; Banks And Military Get Money Easily

Crippling third world debt has been hampering development of the developing countries for decades. These debts are small in comparison to the bailout the US alone was prepared to give its banks, but enormous for the poor countries that bear those burdens, having affected many millions of lives for many, many years.

Many of these debts were incurred not just by irresponsible government borrowers (such as corrupt third world dictators, many of whom had come to power with Western backing and support), but irresponsible lending (also a moral hazard) from Western banks and institutions they heavily influenced, such as the IMF and World Bank.

Despite enormous protest and public pressure for odious debt relief or write-off, hardly any has occurred, and when it does grand promises of debt relief for poor countries often turn out to be exaggerated. One recently described “historic breakthrough” debt relief was announced as a $40 billion debt write-off but turned out to be closer to $17 billion in real terms. To achieve even this amount required much campaigning and pressuring of the mainstream media to cover these issues.

By contrast, the $700 billion US bail out as well as bailouts by other rich country governments were very quick to put in place. The money then seemed easy to find. Talk of increasing health or education budgets in rich countries typically meets resistance. Massive military spending, or now, financial sector bail out, however, can be done extremely quickly.

And, a common view in many countries seems to be how financial sector leaders “get away” with it. For example, a hungry person stealing bread is likely to get thrown into jail. A financial sector leader, or an ideologue pushing for policies that are going to lead to corruption or weaknesses like this, face almost no such consequence for their action other than resigning from their jobs and perhaps public humiliation for a while.

The Story of Your Enslavement

The Financial Crisis And Wealthy Countries

Many blame the greed of Wall Street for causing the problem in the first place because it is in the US that the most influential banks, institutions and ideologues that pushed for the policies that caused the problems are found.

The crisis became so severe that after the failure and buyouts of major institutions, the Bush Administration offered a $700 billion bailout plan for the US financial system.

This bailout package was controversial because it was unpopular with the public, seen as a bailout for the culprits while the ordinary person would be left to pay for their folly. The US House of Representatives initial rejected the package as a result, sending shock waves around the world.

It took a second attempt to pass the plan, but with add-ons to the bill to get the additional congressmen and women to accept the plan.

In Europe, starting with Britain, a number of nations decided to nationalize, or part-nationalize, some failing banks to try and restore confidence. The US resisted this approach at first, as it goes against the rigid free market view the US has taken for a few decades now.

Eventually, the US capitulated and the Bush Administration announced that the US government would buy shares in troubled banks.

This illustrates how serious this problem is for such an ardent follower of free market ideology to do this (although free market theories were not originally intended to be applied to finance, which could be part of a deeper root cause of the problem).

Perhaps fearing an ideological backlash, Bush was quick to say that buying stakes in banks “is not intended to take over the free market, but to preserve it.” Professor Ha-Joon Chang of Cambridge University suggests that historically America has been more pragmatic about free markets than their recent ideological rhetoric suggests, a charge by many in developing countries that rich countries are often quite protectionist themselves but demand free markets from others at all times.

While the US move was eventually welcomed by many, others echo Stiglitz’s concern above. For example, former Assistant Secretary of the Treasury Department in the Reagan administration and a former associate editor of the Wall Street Journal, Paul Craig Roberts also argues that the bailout should have been to help people with failing mortgages, not banks: “The problem, according to the government, is the defaulting mortgages, so the money should be directed at refinancing the mortgages and paying off the foreclosed ones. And that would restore the value of the mortgage-backed securities that are threatening the financial institutions [and] the crisis would be over. So there’s no connection between the government’s explanation of the crisis and its solution to the crisis.”

(Interestingly, and perhaps the sign of the times, while Europe and US consider more socialist-like policies, such as some form of nationalization, China seems to be contemplating more capitalist ideas, such as some notion of land reform, to stimulate and develop its internal market. This, China hopes, could be one way to try and help insulate the country from some of the impacts of the global financial crisis.)

Despite the large $700 billion US plan, banks have still been reluctant to lend. This led to the US Fed announcing another $800 billion stimulus package at the end of November. About $600bn is marked to buy up mortgage-backed securities while $200bn will be aimed at unfreezing the consumer credit market. This also reflects how the crisis has spread from the financial markets to the “real economy” and consumer spending.

By February 2009, according to Bloomberg, the total US bailout is $9.7 trillion. Enough to pay off more than 90 percent of America’s home mortgages (although this bailout barely helps homeowners).

And for many months concern has been growing about where the US bailout money is actually going. It seems that there has been a bit of tension between the US Treasury and Congress. Interviewing Special Inspector General Barofsky, Inter Press Service notes, “The Treasury has called [auditing spending of bailout money] ‘meaningless’, Barofsky said.”

It's All About Growing, Spending & Taxing

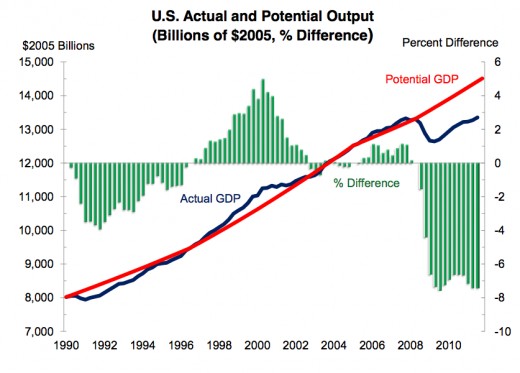

"The economy suffered a severe shock during the recession, with the result that economic activity, represented by the blue line, contracted sharply. Since then, GDP has recovered at a steady pace and now stands above its pre-recession level. However, GDP growth has merely kept pace with its trend (or potential) rate, the red line, which is a function of population growth, changes in labor supply, and productivity growth. As a result, the gap between what our economy is producing and what it could produce if it were operating at the level implied by the trend has not closed much. The green bars show this unused capacity to have equaled 7.4% - or more than $1 trillion - of potential output in Q3 2011. This unused capacity represents workers who cannot find jobs, idle machinery, and foregone opportunities for growth; in this challenging economy, this chart underscores why we must continue to focus attention on investments in the economic recovery and long-run growth." -- Treasury Assistant Secretary for Economic Policy Dr. Jan Eberly

Tracking the Course of U.S. Debt

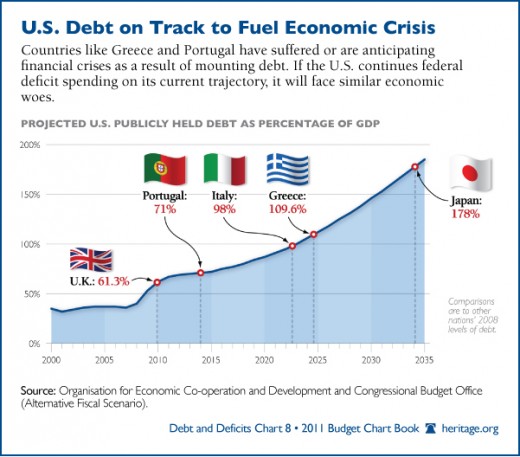

"Greece, Italy, Spain and other countries are suffering from a financial and economic crisis - fueled by unmanageable debt and monetary policy failure - that will surely affect the U.S. economy. As this graph shows, debt held by the public in the U.S. totals about 70 percent of the economy. For the U.S. to avoid going down the same path as Europe, Washington must curb federal spending." -- Emily Goff, Research Assistant, Thomas A. Roe Institute for Economic Policy Studies, Heritage Foundation

Mandatory Spending Out of Control

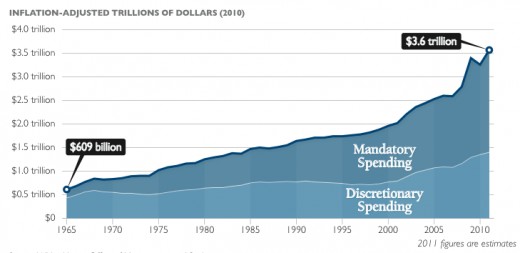

"Since the adoption of President Johnson's Great Society programs, spending on entitlement programs has grown more than five times faster than annually appropriated discretionary spending. The entitlements run on autopilot, with rare congressional oversight. This unsustainable rate of spending threatens to overwhelm the budget and smother the economy." -- Patrick Louis Knudsen, Grover M. Hermann Senior Fellow in Federal Budgetary Affairs, Thomas A. Roe Institute for Economic Policy Studies

Average Tax Levels Won't Keep Up With Spending

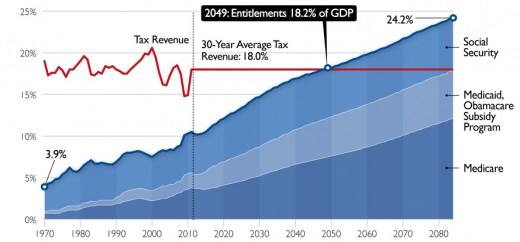

"As this graph shows, under average historical levels of revenue, Medicare, Medicaid, and Social Security will consume all tax revenues by 2049. We must reform these entitlement programs now to make them fiscally sustainable and to ensure that seniors are protected from poverty, without burying younger generations under insurmountable levels of debt." -- Romina Boccia, Research Coordinator, Thomas A. Roe Institute for Economic Policy Studies

... Oh, It's a Taxing Problem Alright

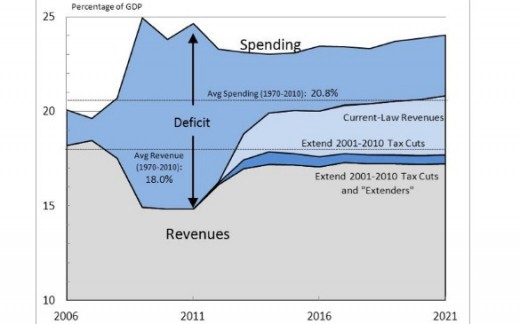

"The federal budget deficit this year will approach 10 percent of GDP, an unsustainable level that will soon push our national debt past 100 percent of GDP. The deficit will shrink rapidly over the next few years, to a manageable 3 percent of GDP, but only if Congress allows the 2001-2010 tax cuts to expire in 2013 as scheduled. If Congress instead extends the tax cuts--and the traditional "extenders"--deficits will not drop below 7 percent of GDP and our debt will soar." -- Roberton Williams, Tax Policy Center

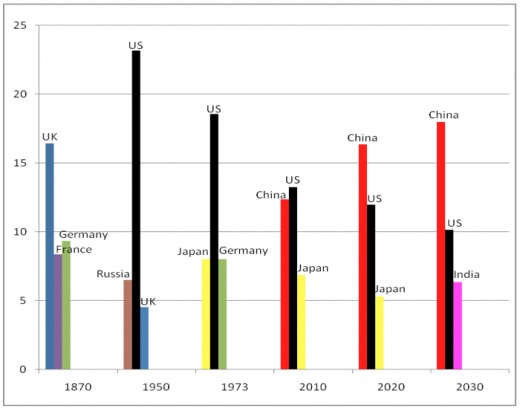

The World's Strongest Economies: 1870-2030

Notes: This index is weighted average of the share of a country in world GDP, trade, and in world net exports of capital. The index ranges from 0 to 100 percent (for creditors) but could assume negative values for net debtors. The weights for this figure are 0.6 for GDP (split equally between GDP measured at market and purchasing power parity exchange rates, respectively; 0.35 for trade; and 0.05 for net exports of capital.

"This chart from Arvind Subramanian's new book, 'Eclipse: Living in the Shadow of China's Economic Dominance,' is interesting in three respects. First, it tracks broadly the economic dominance of the previous two superpowers, the United States and Great Britain. Second, it suggests today that China has come close to matching the United States in terms of dominance. Third, it suggests that under conservative assumption about economic growth for China and the United States, by 2030 the world may well see a G-1, with China as the economic hegemon." -- Steven R. Weisman, editorial director, Peterson Institute for International Economics

There Will Be No Economic Recovery. Prepare Yourself Accordingly.

Securitization And The Subprime Crisis

The subprime crisis came about in large part because of financial instruments such as securitization where banks would pool their various loans into sellable assets, thus off-loading risky loans onto others. (For banks, millions can be made in money-earning loans, but they are tied up for decades. So they were turned into securities. The security buyer gets regular payments from all those mortgages; the banker off loads the risk. Securitization was seen as perhaps the greatest financial innovation in the 20th century.)

As BBC’s former economic editor and presenter, Evan Davies noted in a documentary called The City Uncovered with Evan Davis: Banks and How to Break Them (January 14, 2008), rating agencies were paid to rate these products (risking a conflict of interest) and invariably got good ratings, encouraging people to take them up.

Starting in Wall Street, others followed quickly. With soaring profits, all wanted in, even if it went beyond their area of expertise. For example,

- Banks borrowed even more money to lend out so they could create more securitization. Some banks didn’t need to rely on savers as much then, as long as they could borrow from other banks and sell those loans on as securities; bad loans would be the problem of whoever bought the securities.

- Some investment banks like Lehman Brothers got into mortgages, buying them in order to securitize them and then sell them on.

- Some banks loaned even more to have an excuse to securitize those loans.

- Running out of who to loan to, banks turned to the poor; the subprime, the riskier loans. Rising house prices led lenders to think it wasn’t too risky; bad loans meant repossessing high-valued property. Subprime and “self-certified” loans (sometimes dubbed “liar’s loans”) became popular, especially in the US.

- Some banks evens started to buy securities from others.

- Collateralized Debt Obligations, or CDOs, (even more complex forms of securitization) spread the risk but were very complicated and often hid the bad loans. While things were good, no-one wanted bad news.

High street banks got into a form of investment banking, buying, selling and trading risk. Investment banks, not content with buying, selling and trading risk, got into home loans, mortgages, etc without the right controls and management.

Many banks were taking on huge risks increasing their exposure to problems. Perhaps it was ironic, as Evan Davies observed, that a financial instrument to reduce risk and help lend more—securities—would backfire so much.

When people did eventually start to see problems, confidence fell quickly. Lending slowed, in some cases ceased for a while and even now, there is a crisis of confidence. Some investment banks were sitting on the riskiest loans that other investors did not want. Assets were plummeting in value so lenders wanted to take their money back. But some investment banks had little in deposits; no secure retail funding, so some collapsed quickly and dramatically.

The problem was so large, banks even with large capital reserves ran out, so they had to turn to governments for bail out. New capital was injected into banks to, in effect, allowthem to lose more money without going bust. That still wasn’t enough and confidence was not restored. (Some think it may take years for confidence to return.)

Shrinking banks suck money out of the economy as they try to build their capital and are nervous about loaning. Meanwhile businesses and individuals that rely on credit find it harder to get. A spiral of problems result.

As Evan Davies described it, banks had somehow taken what seemed to be a magic bullet of securitization and fired it on themselves.

The Unique Quality of Mankind

The essential fact, which must be added to form a new economic foundation among nations, is that mankind can no longer isolate itself to life on Earth alone. Furthermore, the known history of the environmental process of all manifest imaginations, viable ones, of living species, has thus always depended upon the relative increase of the characteristic environmental-sustainability sciences of the existing categories of surviving species. The fact is, that humanity is the only living species known to us, as depending for its power to exist, through the willful development of progressively higher environmental science states of the existence of leading creatures.

The relative facts are, that for mankind, the successful future of any living species, depends absolutely on perpetual and accelerating increases in the environmental-sustainability sciences, per capita, as this is expressed by the progress of the human species, to higher levels of environmental-sustainability sciences. Mankind is the only known species whose existence is defined by the controlled use of nature. Mankind’s prospect of a continued existence depends hereafter on progressing beyond the limits of mere sense-perception to increasing power to command mankind’s growing, willful role, within regions beyond Earth and Mars, to other planets in the Solar System and beyond.

Prepare for the New World Economic Order

What we have to do, also, with all global nations, and similar circles, is to prepare: what can be put on the table, in the moment of the maximum crisis? Which is the MuRatopian Intersection Economics idea, a combination of public money system, which is an addition to the Kelsonian binary financing model, namely, to have, as part of this package, a rational agreement about the raw materials distribution of mankind for the future economy, so that there is no war over raw materials, as part of the picture.

And each government should be induced and encouraged, to make feasibility studies about this soon-to-come eventuality. Very soon, one can see, the dollar collapse will continue, all the bubbles will start to bust, and there will come a moment of utmost crisis, but also of utmost chance.

Now, obviously, we want to combine that with the idea of the new MuRatopian market economy.

A MuRatopian Economy Idea

If you want to have a just new world economic order, it’s not technocratic question; it’s not a question about a new financial system, a new economic system: it’s a question of a passionate idea, of the international community of people. That you have not to be able to stomach it, one more day, that the world is in the wretched condition! And you have to have a vision of how the world could like, once we make it human. Ever green gardens in places where there are deserts right now. People living decent human lives. Africa being totally, infrastructurally developed. Thousands of new cities we want to build. Beautiful cities. And a love of people for mankind.

We will not get out of this crisis, if we don’t return to classical culture; each country, each culture, must revive their high culture. China has a beautiful classical tradition. There are beautiful things in other cultures, which are right now endangered by the culture of globalization and so forth. So, we have to make an effort to revive the Classical Culture.

Notes and Sources

(1) US Congressional Briefing 2011, July 26, 2011 by Prof. Kaoru Yamaguchi: TRANSCRIPT (This is a transcript of my US congressional briefing on the workings of the public money system)

* (1-Page Briefing Note for Media) (One page briefing note distributed to the Media)

(2) HR 2990 (NEED Act, National Emergency Employment Defense Act)

Congressman Dennis Kuchinich's Bill based on the American Monetary Act,

which is submitted to the US House Committee on Financial Services on Setp. 21, 2011.

(3) Workings of A Public Money System of Open Macroeconomies;

(Paper, Slides and YouTube) at the 7th Annual AMI Monetary Reform Conf.

University Center, Downtown Chicago, Sept. 30, 2011.

(4) A Program for Monetary Reform by Irving Fisher, etc., July 1939.

(Reformatted by the Kettle Pond Institute)

(This document is an extended version of the original "The Chicago Plan for Banking Reform" by Henry Simons, etc., March 16, 1933).

(5) On the Monetary and Financial Stability under A Public Money System;

( Paper, Slides and YouTube ) at the 8th Annual AMI Monetary Reform Conference, University Center, Downtown Chicago, Sept. 20 - 23, 2012.

(6) Public vs Debt Money Systems - the American Monetary Act in a Nutshell;

(Paper, Slides and YouTube) at the 9th Annual AMI Monetary Reform Conference,

University Center, Downtown Chicago, Sept. 19 - 22, 2013.

(7) From Debt Money to Public Money System - Modeling A Transition Process Simplified;

(Paper, Slides) at the 10th Annual AMI Monetary Reform Conference, University Center,

Downtown Chicago, Oct. 2 -5, 2014.

MuRatopian Intersection Economics

Controversial Questions