Alternatives to Across the Board Tuition Hikes

While the cost of tuition has continued to rise well above the cost of inflation at institutions of higher learning across the country, it may be inevitable that a tuition increase is necessary, but a straight percentage-based increase may not offer the desired results. There are alternatives to such tuition hikes that would be a benefit to both the school and the student body. Many viable solutions exist, but some are, obviously, more radical than others. The solutions discussed below are geared to provide a working alternative to the same approach to tuition increases.

The most palatable of solutions regarding tuition are, generally, the easiest ones to sell to the public. These are usually the most conservative in nature and the ones that affect the fewest number of people. The two approaches that follow have worked well in government and business and can just as easily be applied to the tuition revenue problem.

Tiered Structure Method

Universities and colleges

already use the methodology behind the tiered approach. It just needs

to be extended to affect more undergraduate programs. Consider that

nearly all majors are treated equally under the current tuition

structure. With the exception of a few minor course fees, an

engineering or accounting student pays the same tuition as a student of

philosophy or psychology. Is this fair and equitable?

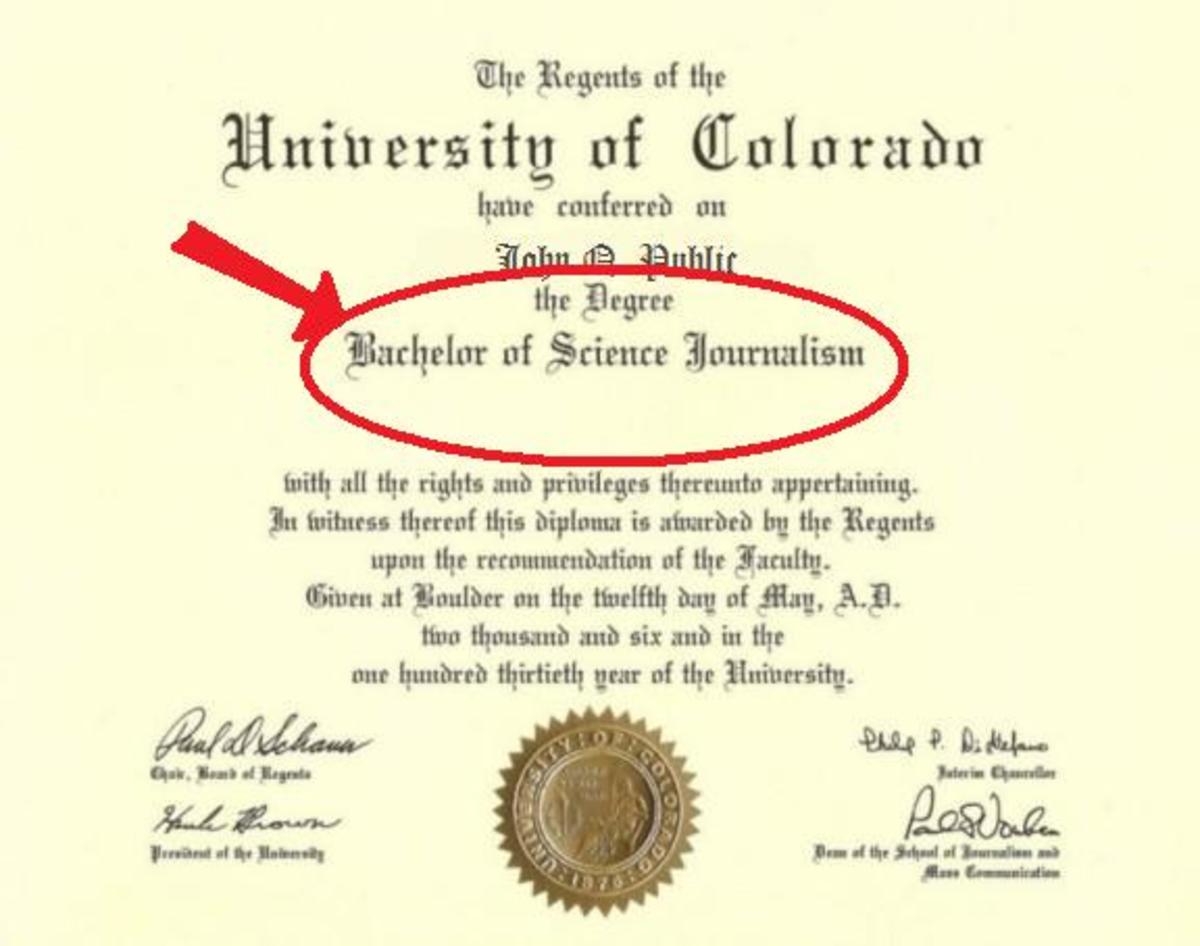

It is

readily accepted that a law student, medical student, dental student or

pharmacy student will pay a higher tuition for their education. Tuition

for these students is justifiably high since the level of expertise

provided by the teaching staff comes at a much higher cost than faculty

in other departments. However, when compared to the average starting

salary for anyone in these fields, the tuition seems very manageable.

The future reward far outweighs the cost.

This same concept

needs to be applied to the undergraduate system. Future reward should

be factored into current tuition. The average starting salary for

accountants, electrical engineers, and computer science professionals

well exceed the average starting salary for a liberal arts major.

Accounting, finance, economic, chemical engineering, computer science,

mechanical engineering and electrical engineering graduates can easily

enter the job market with a starting salary of $45,000 - $60,000. This

is a substantial pay premium given to business and engineering

disciplines. Now, it is only a matter of changing the public perception

of the tuition associated with these disciplines—tying future reward to

current tuition. This will then more than justify an increase in the

business and engineering areas while allowing the majority of academic

programs to remain unaffected or, indeed, discounted slightly.

A

simplistic model of how such restructuring could happen is easy to

understand. Given an enrollment of 20,000 students paying an average of

$3000 a semester for tuition will generate revenue of 60 million

dollars. Now, suppose the same 20,000 students are split into two

groups: 14,000 regular and 6,000 business/engineering students. The

14,000 students continue to pay $3000, but the 6000 business/engineering

majors pay an increased tuition of $3500. This will generate revenue

of 63 million dollars, representing a 5% increase over current tuition

while only affecting 30% of the student body. Likewise, the tuition

could be raised another $100 for the 6000 business/engineering students

and lowered $100 for the other 14,000 students. This provides a break

in tuition for 70% of the student body, but still generates the same 5%

tuition increase for the university.

The increase will

initially cause some dissent amongst the students in those fields so

affected, but the arguments are easy to deflect. Their tuition will

increase $1000 to $1200 dollars a year, but the starting salary for jobs

in their chosen majors will generate between $10,000 to $30,000 a year

higher than the non-affected majors will. Even if they graduate in five

years with an extra burden of $1000 to $1200 a year tuition increase,

this only amounts to $5000 to $6000 during the course of their academic

career. This amount is easily offset by just the first year of higher

wages they will earn. The public perception of business and engineering

majors will increase because of the newly appreciated value that they

bring to the marketplace and the idea will eventually be embraced by the

community in the same way that tuition for medical, law, dental and

pharmacy programs are substantially higher.

Further Reading:

Diminished Returns Method

Another very conservative

method is to invest more time and money into population/cost studies at

the university. Just as a business must find it's optimal price point

for a good (that is, seeking the price that will sell the number of

units to generate the most revenue). Revisiting the numbers in our

hypothetical situation shows those 20,000 students at $3000 tuition a

semester generates 60 million dollars. Will raising the tuition

across-the-board actually help? What if a tuition hike to $3500 a

semester drops the enrollment to 17,200 students? This generates

approximately the same 60 million in revenue. This example allows for a

drop in enrollment equal to the percentage of increase in tuition.

Reality may prove the enrollment to decrease even more. Likewise, a

tuition cut may generate more students, but when the factors of more

resources to teach more students are factored in, there is only a small

change in revenue.

Studies comparing tuition increases and

enrollment changes at other national universities would prove to be

invaluable in establishing the proper rate of tuition that would

generate the most revenue. There is a point where the price of tuition

forms a perfect equilibrium with enrollment to generate the most

revenue. Whether or not this optimal approach will lead to the desired

increase in tuition would be unknown. What is known is that an

arbitrary increase or decrease in tuition without properly understanding

how enrollment will be affected could be financially devastating. It

is up to the trusted leadership of each college or university to decide

the proper balance of risk versus reward, but to also be prepared to

initiate the kind of visionary leadership that their respective

institutions so desperately need in these financial times.

Solving

this problem will not be immediate, nor will it be easy. The rise in

tuition is clearly needed as reflected by both economic indicators and

budget cuts universities are facing, but if students cannot afford to

learn than these increases are futile. Any tuition increases must be

approached carefully.