An Opinion on the Cause of Inflation

Some Thoughts About the Gobal Economy

When I was much younger I attended a conference on Spiritual Economics which made a big impression on me. I left it with two clear conclusions which were that there are so many variables in the world economy that even the most brilliant of economists cannot predict what will happen or how to control it; and that the system of lending money with charging interest is generally bad for the global economy.

I took a college course on Macroeconomics, and it is still surprising to me how little the general populace is informed on economic theories or even information about the banking system. There is a distinct difference in the jargon used between economics and finance, and simple concepts are obscured with complicated language. For example, I was listening to a lecture and the speaker kept mentioning "quantitative easing" which puzzled me and when I looked up the definition it meant "printing money." Many unfamiliar terms are thrown into a lecture on economics and finance such as "derivatives" and "securities."

It makes the subject more esoteric and mysterious. As long as the general public does not know much about economic principles they can be manipulated by the political left and right: the left promises that they will introduce lots of free programs as in countries like Finland or Denmark, such as universal health care, free college tuition, and other social programs; while the right promises to reduce big government spending, and save money for the American taxpayer. What the taxpayer does not know much about is the Federal Reserve banking system and the Central Banks attached to it.

What you need to know about the Federal Reserve is that it is not federal and it has no reserves! The Federal Reserve is a privately owned corporation owned by a group of wealthy banking families. In 1913 it took over the printing of American money, and it sells the money to the American Government. It created the IRS and takes your tax payer money to pay for your American currency. So your tax payments are not paying for the Government Budget, but only the American Debt. However, very recently, as of April 2020, the President has taken some steps during this time of emergency to move the Federal Reserve printing presses into the United States Treasury Department. This is a huge game changer. At this point I personally have no idea what this means for the future. It remains to be seen.

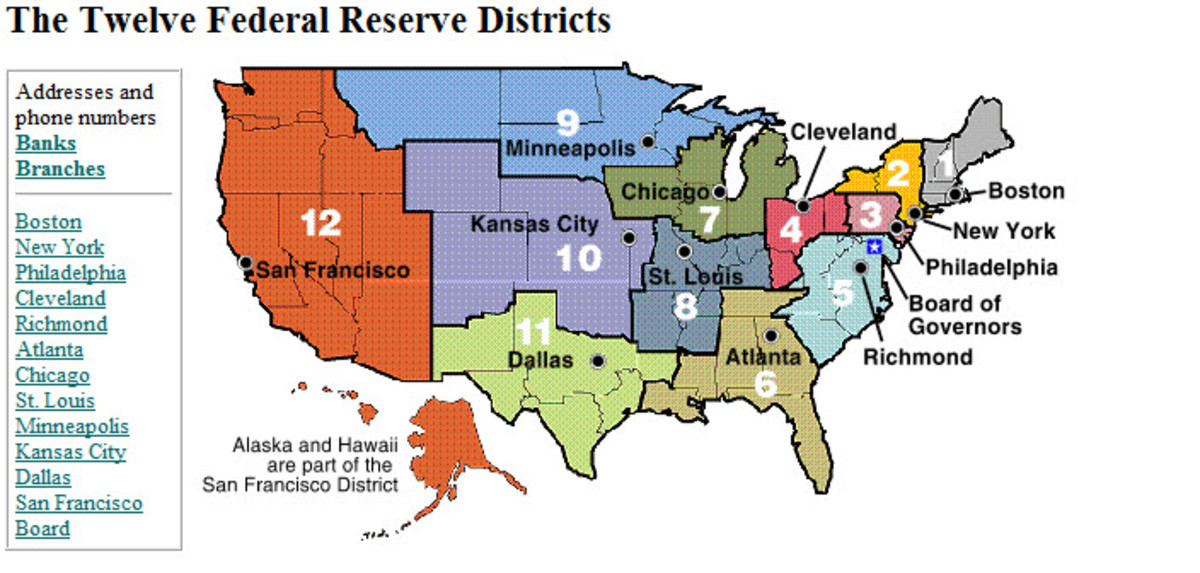

So one of the functions of the Federal Reserve bank is to give currency to the central banks of most of the countries of the world with the exception of about three, and to also determine what the interest rates will be on loans.

Most of the banks in this system use Fractional Reserve banking which means that they take 90% of the depositer's money and use it to essentially buy assets and sell them back to the loan applicant. Banks are buying houses, cars, businesses, and just about everything and selling them back to the applicant with a long term payment plan. So on the one hand you might think that a payment plan is reasonable and the only way to pay for a big ticket item, but in effect the bank is selling it back to you at one, two or three times the original price by charging interest instead of a small fee. Also, the money does not actually belong to the bank. The bank is taking your money to buy these houses, cars and other items. Then, the bank is getting regular payments for these purchases in the form of loan repayments.

However, earlier this year the Federal Reserve was forced to print trillions of dollars out of thin air to give to the central banks to prevent them from crashing. What does this mean? Well, for one thing, and my opinion only, it means that this fraudulent system of making money from other people's money does not work, and it especially does not work if borrowers cannot repay their loans for some reason, or if depositors want to access all of their deposit. Well, here is another thing that big financial institutions do: they invest the money that does not really belong to them in derivatives and they sell securities. Again, if there is a general calamity such as millions of people losing their jobs, this hits the banks that depend on loan repayments, hard. So even before there was a coronavirus, it seems that banks were failing, and that is an indicator that workers were losing their jobs. Well, job loss can be related to downsizing, automation, companies leaving the country, or lack of business and loss of income. It becomes a domino effect. As workers lose their jobs, and small businesses close, and neither can repay their loans, the banks do not have the money for their depositers. If businesses are closing due to loss of revenues this may be an indicator that too many people are unemployed, or underemployed, and their wages are not sufficient for them to have disposable income to pay for more than their basic needs.

So here's the thing: for an economy to be healthy it needs a good-sized population with disposable income who are using it to purchase goods and services within the economy. Of course it does not help the economy if they are purchasing imported goods, or black market goods. If their disposable income is being siphoned off into loan repayments at exorbitant interest rates, they are not supporting businesses and their workers. Well, the other issue is that if workers who are repaying mortgages and car loans have very little money to spend they are more likely to be forced to buy imported goods from China and Mexico that are cheaper than American goods. While it might seem good to American consumers to have access to cheap foreign goods, it ultimately hurts the country, the workers, the businesses, and the national economy.

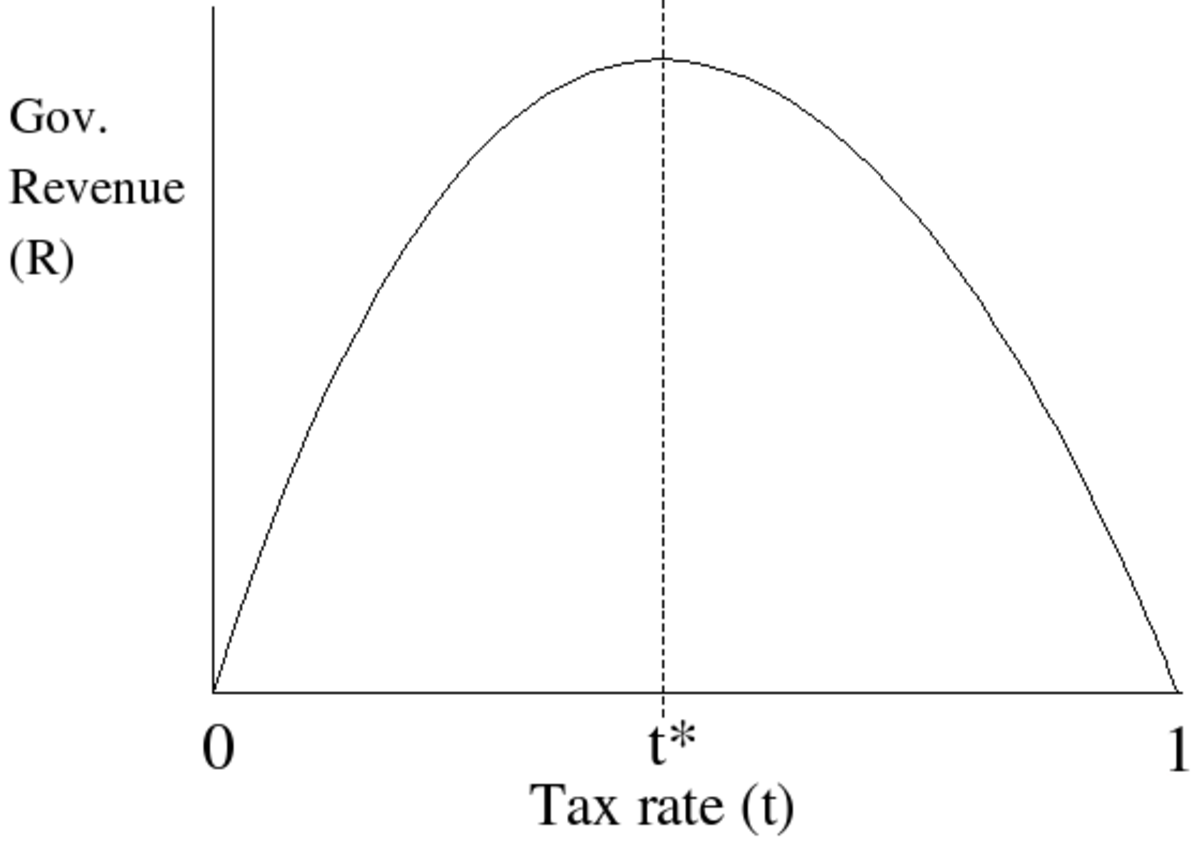

When I was a teenager in high school, there was an elderly lady who was our history teacher, and I can recall her getting very heated about the causes of inflation. She maintained that it was the union movement, and workers striking for higher pay, that put up prices on goods, and created a cycle of rising inflation. She made it sound as if these people who slaved away in unrewarding and dangerous jobs were being greedy by expecting a living wage. Of course, inflation is cyclic, and the cause could be pointed to at any point in the cycle, but I would say that the culprit is interest rates on loans. I feel that the entire system of charging interest rather than a fee is the cause of inflation. Say that a person wants to buy a house: the bank buys it for the current price in time of say $200,000 and over the course of thirty years gets repaid $440,000. But you say, the interest was only a small number like a 4% APR. Well, I am not going to do the math accurately but my point is that the interest figure is deceptive: 4% of $200,000 is $8000, which over 30 years is $240,000. So you see this business of charging interest is exorbitant and the reason that the Roman Catholic Church of hundreds of years ago would not allow Catholics to lend money and called it a sin.

Anyway, many people are expecting as global change in the world economic system, which they are referring to as a Global Currency Reset, and it might require the cancelation of all debt: personal, business, corporate and national, and the Federal Reserve banking families who have magically made money out of thin air and charged the world for it might just have to cancel all of their loans and write off the debts because it has been a Ponzi scam from 1913. Not only that, but the Federal Reserve Board owes the world for the money that it has scammed from them. If there is an end to Fractional Reserve banking then there will very likely be an end to inflation. We shall just have to see how it all turns out.