Barter Exchange System

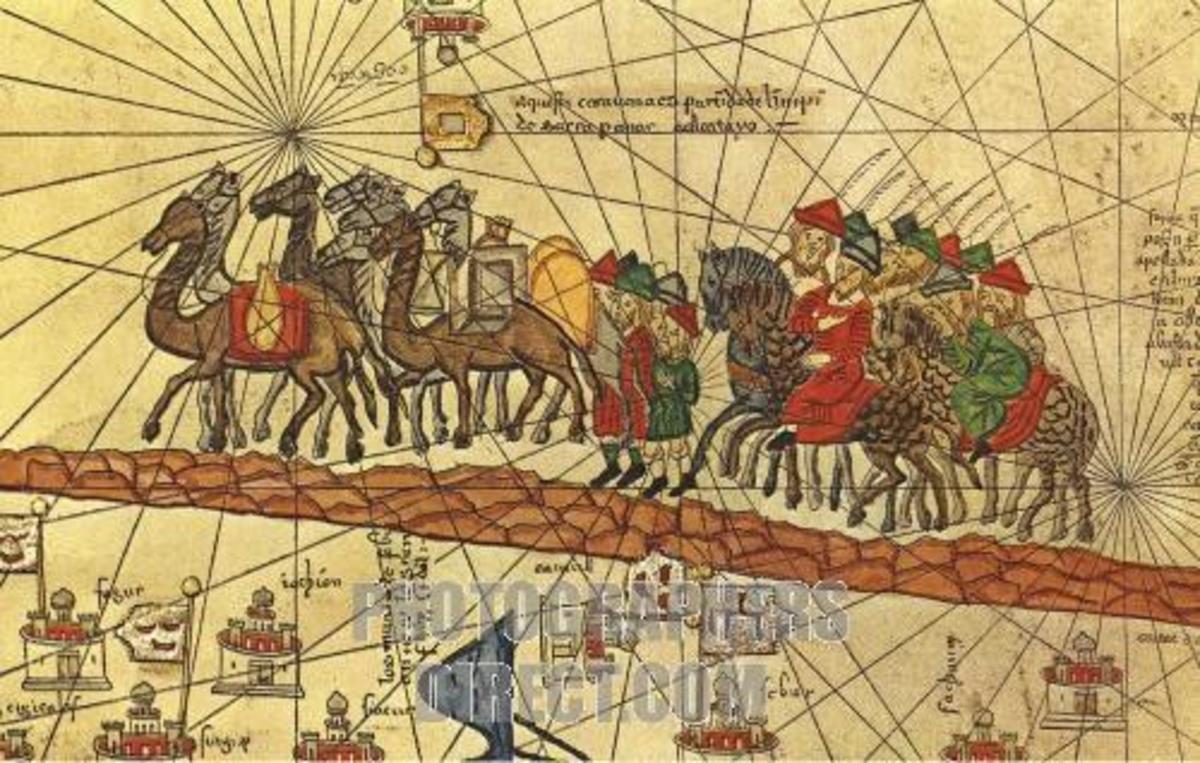

Prior to the introduction of money as it is known today, trade was carried out by barter, i.e. exchange of goods for goods. Due to the wasteful nature of barter, the amount of trade that could be carried out by this method of exchange was limited. The utility gained from trade would be outweighed by the utility lost in the process of making the trade.

The difficulties involved in barter exchange:

The first main drawback of barter is the absence of a common unit in terms of which can be measured the values of goods and services. The value of a good or service means the amount of other goods and services with which it can be exchanged for in the market. The lack of a common unit meant that no proper accounting system was possible. The value of each good and service would have to be expressed not just as one quantity but in as many quantities as there are kinds and qualities of other goods and services in the market. If there were 1000 goods and services in the market, then the value of each would have to be expressed in terms of 999 others.

Secondly, under barter there was the lack of'double coincidence of wants'. It would be a rare occasion when the owner of some goods or services could find someone else who both wanted the former's good or service more than anything else and possessed that good or service that our trader wanted more than anything else. Consider a situation where a person desires to exchange his cow for a bullock cart. His problem is that he has to find a provider of a bullock cart - either new or pre-existing - that matches the required specifications, who wants exactly the kind of cow that the person is offering. This type of chance, discovery of a bullock cart provider would be a rare occurrence. The person would most likely have to make some intermediate transactions - cow for horse, horse for boat, boat for sheep and finally sheep for the desired bullock cart; or he would have to accept something less desirable than the bullock cart.

Thirdly, the barter system lacks any satisfactory unit to engage in contracts involving future payments. Contracts requiring future payments are commonplace in any exchange economy - we enter into agreements regarding wages, salaries, interests, rents etc. and other prices extending over a period of time. In a barter economy future payments would have to be stated in terms of specific goods or services. This leads to the following problems:

- There could be disagreement regarding the quality of the goods or services to be repaid.

- There could be disagreement regarding which specific commodity would be used for repayment.

- The risk exists that the commodity to be repaid could increase or decrease markedly in value over the duration of the contract, thus benefiting the creditor or the debtor respectively.

Fourthly, the barter system does not provide for any method of storing generalised purchasing power. People can store purchasing power for future use by holding stocks of certain commodities to be exchanged for other commodities later. This holding of stocks of certain commodities is subject to certain problems such as costly storage, deterioration or appreciation in the value of the stored commodity, or difficulty in quickly disposing of the commodity without loss if the owner wants to buy something else.

Due to the above four disadvantages of the barter system, the exchange process tends to be highly inefficient. It was to overcome these difficulties that money, as we understand it today, was invented by society. This was necessitated by the increasing scale of industrialisation and commercialisation, which warranted the monetisation of transactions.

See:

- What is Domestic Trade?

Domestic trade is the exchange of goods, services, or both within the confines of a national territory. They are always aimed at a single market. It always deal with only one set of competitive, economic, and market issues. - What is International Trade?

What is International Trade. Scope of International Trade, Advantages of International Trade and Disadvantages of International Trade.

Also See:

- Functions of Money

Money performs four specific functions, each of which overcomes the difficulties of barter. The functions of money are to serve as: Unit of value, Medium of exchange, Standard of deferred payments and ...

© 2009 Dilip Chandra