Coronavirus Pandemic Economic Impacts

As the Pandemic Evolves

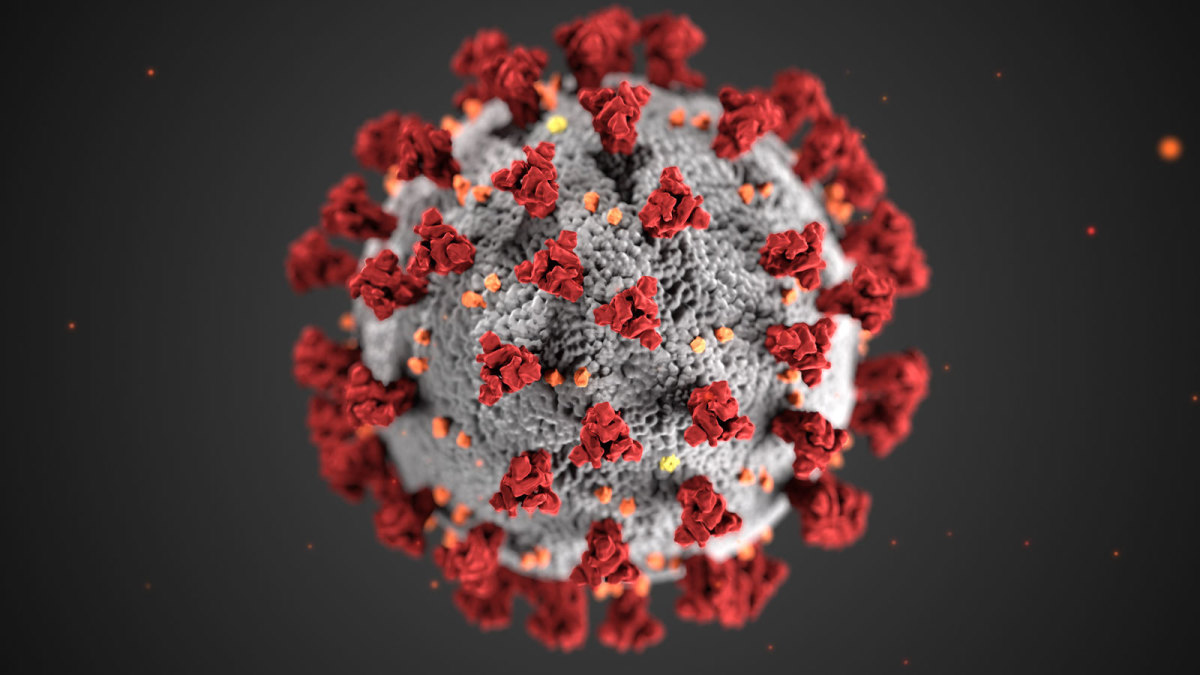

Like a bubble that has burst, the Wuhan coronavirus (COVID-19) has become a pandemic encompassing much of the world. Even the well protected USA has now become a breeding ground as community spread occurs like elsewhere. In Europe, it is expected that up to 50% of the population will get it and Trump has stopped travel to and from China and Europe. Israel has taken more draconian measures with mandatory isolation of those arriving to the country for two weeks. Despite all the efforts to contain or mitigate this virus, human efforts have failed due to a series of mistakes.

Coronavirus Economics

While we can project the human toll somewhat, the panic shown in the world's stock markets have created another problem: economic upheaval and collapse. Anyone that has looked at their IRA or investment funds in just the last two weeks will see a free fall and loss in the thousands of dollars. Just in the last week, the stock market in the US has halted trading due to dramatic sell offs in investments. Personally, I have lost nearly $15K in my retirement accounts.

What to Do

As panic grips the major trading markets with uncertainty around the world, will there be another depression as the virus impacts manufacturing, shipping goods, company losses, etc.? Maybe, but what are the investors doing with the sell off of their investments?

- Are they simply taking their money out and into their savings until the smoke clears? I mean, it's better than just losing it in market numbers as it is real cash.

- Are they buying gold and silver, always good in dire events?

- Are they reinvesting in low yield stocks, CD's, or bonds that are usually not impacted by economic crisis?

- Are they buying cheap stocks at their low rates now because they are confident the stocks will regain their value later?

- At what point should an investor simply bail out 100% of the market before losing it all? When losses reach 25 or 50% of value?

Millions are being impacted in other ways as K-12 and colleges shutdown to prevent the spread. Already, any public event much larger than a few hundred have been stopped. The NBA has curtailed it basketball season, while other sporting events play in front of no fans due to fear of the virus contagion. All these prudent things have a dramatic economic impact unforeseen. If they last long enough, real losses will not be sustained and many places will shutdown and increasing unemployment. The ripple effect of this virus is seeping through the economic fiber of all countries. Look at China, Italy. As airlines stop flying and cruise lines halt, the travel industry will crumble with loss. Already in the Philippines, domestic airline flights have been halted.

The confusion and panic caused by the virus, even if it is nil or mild in your geographic area, is huge emotionally and economically. Should this continue for several more months, let alone, the rest of the year, more economic shocks could cause a recession that is bad or another great depression.