Dave Ramsey's Total Money Makeover: Debt Free Living

Dave Ramsey's Method to Debt Free Living has Worked for Millions!

Dave Ramsey is a financial expert. He became serious about debt free living after having to file bankruptcy years ago. He is now debt free and shares how he was able to do it by following these 7 steps to living debt free. My son and his wife took the Dave Ramsey classes and became debt free in as little as 3 years. They followed his advice to the T and it worked. But it didn't come easy.

It took more than just following the 7 steps listed below. It took hard work. They had to cut corners. They had to stick to their budget. They paid off credit cards, cut them up and threw them away. They paid off 2 new car payments, set up their emergency fund, and now they are saving money for their first house and giving to charities of their choice.

Follow These 7 Baby Steps to Become Debt Free

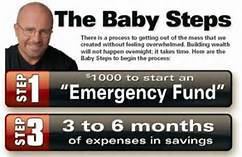

- Save $1,000.00 and try not to touch it! This is your emergency fund.

- Use the debt snowball method to help pay off your debt. Start by paying off your smallest debt first. There's a reason for this rather than starting with the highest interest rate debt and it's called enjoying success. Your hard work is paying off. When your smallest debt is paid take that payment and add it to the payment you're already paying on the next smallest debt. Pay this one off and start on the next.

- Work on setting up a fully funded emergency fund by saving enough money to pay 3 to 6 months expenses. Reaching this goal is an important step to avoid disaster in case of a job loss.

- Put 15% of your income into a retirement fund. For younger folks, becoming debt free before saving for retirement is a suggestion. It is certainly not set in stone as each person's finances are different.

- Begin budgeting for your children's college tuition.

- Pay off your mortgage early or begin saving money for your first house. This is where my son and his wife are in the Dave Ramsey debt free living strategy and they've only been married 3 years.

- Build wealth and give generously. Investing in Dave Ramsey's course to learn about investing is something you may want to do. Attending his classes is even better. That group effort really works. Giving generously may sound like a tough goal to reach. You may be surprised how easy it is though when you are debt free.

Budgeting Tools to Help

After setting up your $1,000.00 emergency fund set up a budget. Begin setting money aside from each paycheck for Christmas, auto repairs, travel and vacation expenses, dental and medical visits and any other expenses that you know will come up during the year. Rather than using a credit card for these expenses, budget for them.

Budgets and other forms can be found in the back of Dave Ramsey's book Total Money Makeover and online. You can download the budgeting form from his website above.

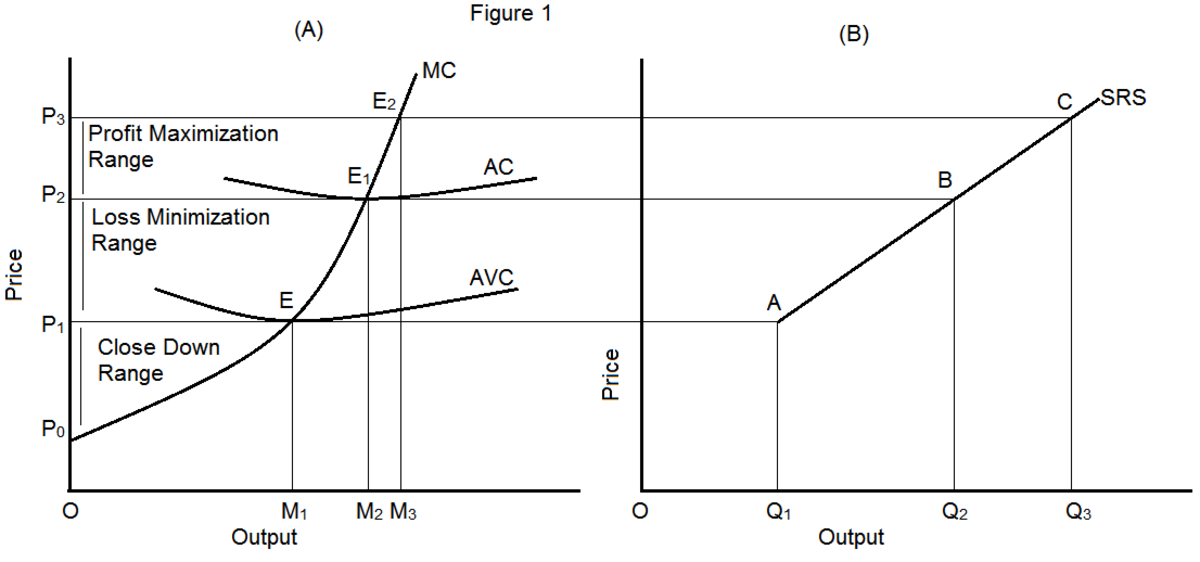

Dave Uses The Following as a Road Map to Financial Freedom