Debt Crisis: Germany & European Countries in Debt

Introduction

To anyone who has paid any attention to any form of news, the European debt crisis is not anything recent and is still an ongoing problem that has yet to be completely resolved. The creation of the euro for the single currency for the European Union countries was designed for the purpose of unity and a symbol of economic strength. This common currency was also created for the prevention of military conflict among the nations involved. This unity however does not equal complete agreement between European countries, and it is most obvious due to the European debt crisis situation. How exactly did the economic crisis come to be? An economist by the name of Paul De Grauwe argues that in order to see the sovereign debt of the peripheral countries, one must look in the context of the financial and credit crisis of 2007-2009 (Young & Semmler 2012).

The fiscal deficit was rising in all EU countries, and he promotes ideas concerning how bailout systems for banks and businesses combined with critical tax revenue losses from a multitude of causes. The first obvious Euro crisis state was Greece which was showing financial stress not only from its own doing but from the institutional mechanisms surrounding the Euro. Italy and Spain also show signs of financial issues in GDP because they had private debts, especially household debt (Dodd, 2010). The European Union flaws appeared blatantly during these economic hard times, and the very fabric of the EU is being unraveled. This financial crisis shows the lack of political union that should keep solidarity among Member States, and also shows the absence of stability devices to give support to countries that could face currency flow issues.

Another issue that helped the crisis develop is the perspective that this financial ordeal developed from inappropriate ethical behavior from the failing Member States. Therefore, Germany has been promoting austerity plans for failing European countries to follow rather than promoting the acceptance of measure that could help repel harmful speculation towards countries with a lack of financial liquidity (Soares, 2012). The Germans figured austerity was the only way because if failing countries were bailed out, then it would only be encouraging these bad financial morals.

Can There Only Be One Winner?

Europe created this unity to provide a win-win economic system. With a common currency, everybody works together to provide wealth and stability for each other. During the crisis, the win-win scenario started to appear like a zero-sum game where if one nation gains, then some other loses (Rachman, 2011). With this encroaching feeling of zero-sum, as well as contrasting economic power, European countries are becoming more nationalistic. Countries with much economic power, namely Germany, have been the center of criticism. It has been observed that the European Monetary Union (EMU) has shown a form of hierarchical relationship among EU Member States. The Eurozone also includes smaller and weaker countries in order to allow for the creation of an internal market. In this way Germany has been given financial and industrial capital with competitive advantages in the European and global market all due to the euro (Cheick Wague). More than this, the euro as a reserve currency has been a stronger alternative than the older Deutschmark which reveals part of the motive of Germany’s switch to the Euro.

During the time spent trying to figure out how to solve the crisis were the German demands for a further increase of fiscal discipline for Eurozone countries, along with the strength of control mechanisms by European institutions, and the adoption of sanctions to the States that breached fiscal policy rules. A fiscal treaty was presented by Germany to try to force Member States to balance their budgets and spend more intelligently. This treaty shows the authority that Germany has during these economic hard-times; Germany is able to influence other countries policies to suit its own self-interests. This influence is also seen in the early 1990’s at the Maastricht Treaty negotiations which created the Economic and Monetary Union; Germany was successful in establishing its preferences concerning the future structure of the Euro (Social Growth Pact, 2012). No bailout clause for bankrupt, indebted countries was mentioned (Soares, 2012). In spite of the preeminence of the European Council as an equal collection of European leaders, the Euro crisis revealed an interesting reality, namely, the existence of a true European political directorate. The summits were preceded by the Merkel and Nicolas Sarkozy where they agreed to various economic strategies to present to the Union. Due to the length of the debt crisis, the fact that France was tending to be subordinate to German positions was becoming more obvious.

Example of Anticipated German Actions

The way in which Germany chooses to act towards other countries can be anticipated by the way Berlin was bailed out in 2011. The state of Berlin was running a debt of 66 percent GDP. The southern German states agreed to bail Berlin out in exchange for a deal with which all new borrowing by the states would stop in 2020 and borrowing would not exceed .35 percent of GDP annually. Germany has taken a similar stance as the above example with the rest of the struggling European countries. Perhaps Germany should be responsible for the other European countries’ economies, but not because Germany has the power. Some experts believe that the reason why Germany’s economy is so strong is due to its strategic advantages over the weak-economic countries. In 2009, Germany's exchange relations with the fifteen other members of the Eurozone accounted for roughly half of its overall current account surplus (Rosenthal, 2012).

Two decades ago, the question was how much Germany, the continent’s economic powerhouse, would do to save the European currency. The measurements created by Germany for the EU nations to balance government spending were too strong for the weaker nations. Perhaps Germany needs to focus on its own internal economic problems before it can start to be concerned about assisting others. Even though many people say how strong the German economy is, some people say that it is unsustainable. This unsustainability is due mostly to the lack of domestic investment. Germany is declining in education and is failing to prepare for the changing demographics; Germany knows this and knows what it will take to provide such domestic aid. The costs of such domestic investment would run into the hundreds of billions of euros, and due to the current crisis, the German government is constitutionally barred from increasing the public debt to pay for such programs. Chancellor Merkel’s administration discusses the investment plans in general terms but they have no idea who will pay for them.

Solutions?

One possibility may be to increase immigration into Germany. The birth rate in Germany is significantly lower than other European countries which equal a lack of workforce, and also a lack of taxpayers. There are problems with this though. The immigrants would have to be taught German as a second language which might make those students less likely to succeed. Then the issue of multiculturalism emerges which Germany has had a hard time dealing with in the past. Another option that Merkel has been working on is trying to increase the child-care system in order to bring work force. Between 2006 and 2011, Germany created 230,000 new places for preschool students, and local governments now face the challenge of creating a further 260,000 places by 2013 (Tooze, 2012). The clean-energy goals investments that Germany has been seeking could help it to establish sustainability which could help stabilize the European economy. Investing in the energy programs, like all the other programs, will cost the German people billions. If Merkel’s energy plans (Energiewende) take place, it will cause the costs of electricity to rise 50 percent for the Germans, and they are already paying three times as much as Americans do.

The issue facing German leaders concerns the amount of domestic investment towards businesses. Germany’s private sector has a fantastic business environment, but they most often choose to direct funds to outside countries to develop other markets. The German government does not have much control over what businesses spend their money on, so while businesses continue to make a profit, the salaries of German workers fall. A 2009 survey conducted by the GFK Group found that only 24.9 percent of Germans considered their society to be “fair” – this was before the crisis (Tooze, 2012). This decline in the average worker pay in Germany only helps lead to the thought that Germany should help itself first before helping other countries. This kind of thought could be a problem for the failing Member States who need Germany’s assistance. If German taxpayers decide that it is not in their best interest to bailout other countries, then those nations are going to have to look elsewhere for assistance. Another opinion poll conducted in Germany in June, 2012 found that 51 percent thought the country would be better off abandoning the euro currency (Hack, 2012). Although margins of error exist in surveys, it is hard not to see future issues Germany will face when dealing with its taxpayers.

Looking from the Outside

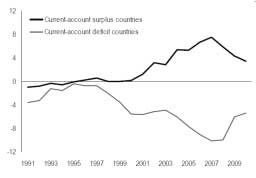

In order to see the true nature of the European debt crisis, one must not only look outward from Germany’s perspective but also inward from the perspective of other Member States. In March 2010, the French Finance Minister Christine Legarde spoke out against the asymmetries in the Eurozone; that they are from German wage moderation. This wage moderation has driven down export costs for Germany compared to its competitors (Young & Semmler 2012). According to critics such as this, Germany continuously obtains surpluses that are financed by the peripheral countries. Thus, in general, Germany is seen by such thinkers as the main beneficiary of the Eurozone. Many Keynesian economists and even some European leaders have wondered what Germany’s role in the financial crisis really is. Since the Eurozone is a confederation of independent countries, one state’s account surpluses has to be balanced by the deficit run by another state (Young & Semmler, 2012). Struggling countries such as Italy, Spain, and Greece have growing sentiments of an uprising Germany similar to that of World War II; in turn, German taxpayers are extremely nervous about bailing out failing nations. How the European countries end up in the coming years is directly affected upon how Germans distribute their assistance. It is apparent that the amount of surplus in succeeding nations reflects the amount of deficit in indebted countries (See graph 1). The graph shows the balance of surplus and deficit among Eurozone countries, but it also shows the zero-sum game as explained earlier.

Germany has already given out money to struggling nations within the Eurozone, but what Germany should do in the short-term and long-term based on all the information presented is the question many people are wondering. Clearly we can see that Germany has economic and social issues within its own borders similar to any other country, but if we assume a zero-sum currency problem then there is very little hope that Germany can effectively solve any of this by its own. As a single currency with many independent countries, the balancing of all these countries’ GDPs happens due to the internal market of Europe. Germany and the rest of the Eurozone countries need to work towards making the Euro a stronger currency so that all Eurozone countries benefit. Germany should work towards establishing a plan that could increase the economies of the peripheral countries, particularly ones that it often trades to. This way Germany is investing in those countries in order to be able to sell more exports to them later on. The one factor that becomes an issue is time. How long are Europeans willing to wait before the economies get better? Certainly mechanisms such as bailouts are a quick fix to some contemporary problems, but in the long-run the EU needs to establish a plan to change functions of the EU that allowed for this crisis to occur.

Balance is the key component to finding the solution for both Germany and the Eurozone; the balance within domestic economies and the international economy that is the Eurozone. Countries cannon expect to compete in the international market if they cannot sustain domestic economic issues. Without an effective national economic plan, there is no foundation for said nation to build upon on the international economic stage. The only way to not have an effective domestic plan and survive in the international realm is to take out more and more debt. Countries in general need to consistently find mutual benefiting agreements with other countries.

Conclusion

Based on rising tension with the German people, bailing out failing countries can only last so long. As mentioned earlier, many Germans feel that a move away from the euro currency would be an intelligent move. Essentially, the initial move of Germany into the European Union was a smart investment on Germany’s part, but now that it is being pressured to pay for other countries mistakes the investment is looking like a losing one. Germany needs and will decide on how to act on the financial crisis for the future based on its own self-interests. If other countries want Germany’s assistance, then they need to consider the costs of doing so.

Once Germany figures out how to fund its own domestic programs, in order to maintain its own economy, then it can focus on helping countries such as Greece. This sort of process may sound like mercantilism but the German people have complained about declining worker pay while businesses thrive; thus, Germany needs to find some common ground within those two groups.

Based on all of the above arguments, we can conclude that Germany must set its priorities straight before it acts in favor of the Eurozone countries. First, domestic issues must be addresses which may mean looking towards international issues for solutions, domestic issues such as work force, energy, and corporations. After Germany does that, the decision it makes towards other countries has a large part to do with what those other countries behave with themselves concerning their internal economies. Each individual failing Member State in the EU must learn how to gradually promote growth within their country. That probably means spending less and taxing more, but also focusing on the interest rates of borrowing money within the country, and also focusing on the way the country handles trade. Germany is large piece in an even larger puzzle. When there is not a common denominator for the failing of particular countries, one cannot simply have one solution. The most general solution for those that are struggling is to reform their government and stop careless economic practices.

Bibliography

Social and Growth Pact. (2012). European Social Policy.

Dodd, N. (2010). Money, Law, Sovereignty: Where does this crisis leave the state? ECPR-SGIR. Stockholm.

Hack, C. (2012). Euro Crisis: Should the U.S. help ease Europe's economic woes? CQ Researcher, 843-863.

Rachman, G. (2011). Europe's Zero-Sum Dilemma. The National Interests, 43-48.

Rosenthal, J. (2012). Germany and the euro crisis: is the powerhouse really so pure? World Affairs, 53.

Soares, A. G. (2012). The Euro Crisis. What Went Wrong with the Single European Currency? Beijing Law Review, 81-91.

Tooze, A. (2012). Germany's unsustainable growth: austerity now, stagnation later. Foreign Affairs, 23.

Wague, C. (2012). European Monetary Union and the Optimal Currency Area Theory: The Competitiveness Gap Within the Eurozone. International Journal of Business Strategy, 63-74.