Full Impact of Rising Energy Prices on Companies: A Case Study of Tullow Corporation

Introduction

The ever rising oil prices is a hotly debated topic which societies , organizations, oil companies and even individuals have to contend with. There is no doubt that the ever rising prices of oil have resulted into many social and economic problems not only to the society and businesses but also to the oil producing firms. In essence, high prices in oil products results into reductions of outputs, increases competition for businesses that depend on oil products, and lead to decreased nominal wages and unemployment. This therefore makes it necessary to conduct a precise evaluation with regard to the extent by which a country, business, individuals or oil companies are affected by the rising oil prices. This will assist in the determination of measures that could be effectively implemented by the companies, government or individuals to curb or reduce such effects.

Crude oil constitutes 73% of the gasoline price. The extra cost of the final oil product is dependent on the cost of refining and distribution, government taxes and organizational profits. In most cases, if such costs remain constant, the market price of gasoline may be a reflection of the general oil price fluctuations (Source: EIA, 2013). Usually, changes in oil prices may take up to two or more months to adjust themselves in the distribution and gas plumb. Oil prices are a bit volatile in comparison to gas prices. Just like other goods and services, the prices of oil are influenced by demand and supply. If demand is higher, prices will also be increased. However, if prices becomes too high, it means that the buyers will be limited, thus hindering the company’s economy.

The last decade has seen oil prices increasing tremendously. This price has risen from $11 for every barrel realized in 1999 to $45 for every barrel presently. The World Economic Outlook, (2013) also projects an increase on this commodity’s price.

Taking a case of Tullow Oil Corporation, this paper aims to assess the impact of the rising prices on the economy of the oil company. The first part is a general overview of such impact to the oil industry; the second part is an overview of Tullow Corporation, followed by the impact of rising oil prices on the company. The last part is the summary and conclusion of the evaluation.

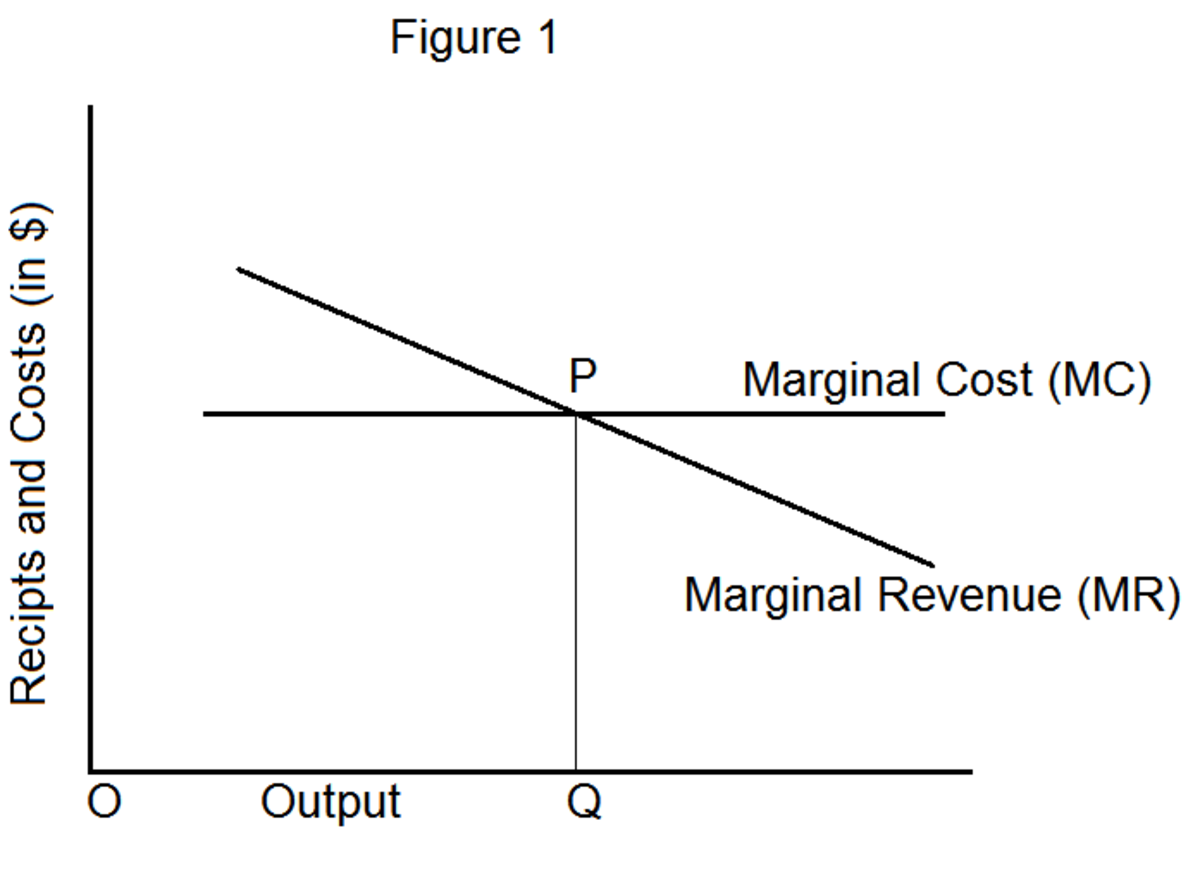

Impact of the Rising Oil Prices on Companies

When the price of oil rises, this followed by the rise in food prices. This is because oil is used in one way or another to grow and transport food. The scramble for bio fuels also results into the price of land rising. The cost of transporting all types of commodities or services also rises because oil is employed in many transportation methods. Apparently, the cost of raw materials and chemical goods also increases. This means that companies have to dig deeper into their pockets in paying for more transportation costs for raw materials, and when sourcing for more oil fields as the cost of land will subsequently rise.

The increased oil fields also raises the prices of fossil fuels. Further, the expense of natural gas and oil extraction will also subsequently rise. In fact, a report by Nathon, (2008), articulates that the production costs for world oil is increasing at a rate of 9% per annum. This increase will also necessitate an increasing the worker’s salary. This means that the general production costs may precede the sale price, thus jeopardizing the economical growth of a company. A company, which is unable to make profits, is headed to nowhere and is at risk of collapsing.

Again, it is apparent that when oil prices are increased, consumers limit how they spend their cash and prioritize on their basics including food. These decreased spending may lead to some company stocks which may not be considered basics piling up because of the limited purchase from customers. Low sales will apparently reduce the revenue of a company.

The subsequent high cost of production and manufacturing apparently results in inflation. The increasing oil prices means that the oil producer will be forced to set high prices, to generate some profit. This is irrespective of people’s income are not rising. This as we noted above will make consumers to purchase products at low quantities while large quantities of stock will remain piled up. The large quantity of stock that remain unsold will necessitate that the companies sell at a lesser amount and therefore, resulting into loss. Consequently, many of the business companies will be economically affected. This is the reason why oil investment and investors are skeptical regarding the opportunities in this industry (Minassian et al, 2008, 4). The resultant losses for companies, wrong reactions towards policies and low confidence among consumers will put the company’s economical situation to be at risk.

Another aspect to be noted is that currencies are also a factor in changing the balance of trade. Increased fuel prices will subsequently lead to the value of the dollar. Most oil companies and exporters tend to invest their earnings in assets that are controlled by the US dollar. Transactions in trade therefore demand for rise of the dollar. A dollar that is strong will increase the economy of a company. According to Evans et al, (2013), oil prices are constantly rising. However, stocks in oil companies are almost remaining the same if not piling up. In fact, the stock value plus the funds that are invested in them are not by far reflecting the gains of the rising oil prices.

Tullow Oil: Company Overview

Tullow Oil Corporation is one of the leading oil and gas producers in the world. Presently, the company has shown more than 150 interests for explorations and has acquired operation licenses in more than 26 nations. These are managed in three units, Asia and South America, Europe and East Africa, North and West Africa. The company is quoted in the stock exchanges of Ghana, London and Ireland and is also included in the FTSE 100 (Clerides, Zachariadis, 2008, 223).

Tullow has also shown exploration interest in Africa where it has began production in nations such as Congo, Equatorial Guinea, Mauritania, Code d’ Ivory, Ghana and Kenya. It has also two big development and appraisal programs in Uganda and Ghana. Other exploration interests in Africa include countries such as Madagascar, Ethiopia, Senagal, Sierra Leone, Mozambique, Senegal, Mauritania and Namibia where developments are already in place.

In Europe, the company focuses itself on gas production in United Kingdom’s South North Sea, Nertherlands where there are developments in gas production and exploration. Other countries of operation include Norwich and Greenland, Tullow has prospects in South America, where there are exploration prospects in countries as Guyana, Suriname, French Guiana and Uruguay.

The company’s headquarter is placed at London but has regional offices in South Africa, Ghana, Ireland and Kenya. The company harbors more than 1800 workers and more than half of these are working in Africa operations. The company endeavors to conduct its operations adherence to the highest ethical standards. The company’s vision is stated as to be ‘the leader in production and exploration prospects with consistent and clear strategy for growth”. Tullow’s corporate aim is to establish a business that has a “competitive position which is unrivalled”. The management endeavors to do this through selective developments, a diversified but balanced portfolio as well as material production. The subsequent part of the part is an evaluation of how Tullow has been affected economically by the rise of oil prices.

Oil Price Rises and Its Effect on Tullow’s Economy

Tullow’s general revenue in 2012 was only 2% rise from the previous year. Over the last five years, the Stellar Price for Tullow has not shown a significant economical growth despite the continuing oil price surge. This has prompted that company to change its business strategy on several occasions, moves that have accelerated investment returns. During the year 2009 Tullow’s production were flat at 58,100 bopd. Further, the company realized a substantial rise in profits. Part of the reason is the surging oil price.

As a move to further strengthen its economy and its push for explorations, Tullow’s notable strategy has been on divesting some of its assets that appear less lucrative to achieve this objective. For instance, in December 2013, the management of the company announced that it was interested at selling its gas assets that are found in North Sea. Further, other interests, which Tullow has put up for sale, include Pakistan and Bangladesh. In addition, the company has planned to increase the cash flow from new explorations such as from Kenya, Uganda and Ghana. Other exploration projects include Mozambique, Mauritania, Ethiopia, Cote d’Ivoire, and Guina. These moves were purposed to make the operation and explorations sufficiently funded in explorations strategy and generally its economic development.

Among the challenges, which Tullow has experienced, is because it is constantly growing and expanding. This leads to increased operation costs and other issues. A number of times have shown the company experiencing delays and a substantial amount of tax bill in some of its operating. Other issues range from political issues and difficulties in some countries. For instance, the government of Uganda is tightly pushing the company alongside others to build oil refineries in the nations. The Market environment for Tullow oil in 2012 was largely framed by the worldwide political and economic and demand uncertainty.

Similar to other countries, other operating and marketing risks have also limited the economic prospects of the company. The company’s market valuation and earnings are tightly attached to the gas and price of the oil. Other factors include the high cost of explorations in some areas such as in deep waters where millions money could be used for such explorations. Bad lack can also not be left behind as another factor, which has hindered the company’s progress over the past years. It becomes painful and a loss to the company after using extensive resources in exploration of oil resources.

The world economic downturn experienced for some years back was also challenging to Tullow the same way as many other companies. The company however came to design effective management mechanisms with regard to operations, investments, and resource and capital allocations. This has enabled it to thrive well and realize a significant opportunities in that are value enhancing. The company has taken advantage from the rising oil prices for realizing positive prospects.

However, in 2013, the company began to realize significant results on its revenue. In essence, the company’s pretax profit amounted to $1.1 a 4% increase from the previous year. The company realized an exploration success rate of 83% during 2013. The basic earnings per share for Tullow were 6.1%. It is anticipated that economic growth.Although the growth rate for Tullow has been low over the years, the company has begun to improve over the recent past. For instance, the market capitalization for the company in 2012 was £4.5bn. Presently, it has a market capitalization of £12.55bn.

Volatile Equity Market

The company’s equity trading in 2012 decreased tremendously. This was more particular in during the second half of the fiscal year as the company is waited for clear market opportunities. The FTSE100, which Tullow is also part of was also unstable as it was also affected by the economic events around the world. By the end of this year 2012, it was 5.8% when compared to the previous year. The FTSE gas and oil sector also performed dismally during the year. This sector was ranked 35th of the 38 sectors, indicating that it was the second last. The dismall performance was due to the limited advances in exploration during the year owing to low performance. A gain the deferral of investments by the company’s investors resulted into a near inertia in the company’s economic growth. The company’s share price during 2012 was indicated as £12.61, a drop of 10% from the previous year. The exploration potential in East Africa is deemed to achieve success for the company.

Tullow’s market volatility in 2008, saw a significant reduction of most of its oil products such as brent crude, which had fallen from US$140/bbl in July to US$36/bbl in December the same year. This led to detoriation of the company’s economic prospects for quite some time. In addition, the constant fluctuation of the world’s major currencies also hindered the economic aspects of the company at that time. For instance, the US/Sterling moved from £/US$2.03 in February of 2008 to £/US$1.40, which is the present rate. A gain the rate of interest has significantly reduced as a matter of stimulating demands.In general, the market volatility of Tullow has impacted the revenue generated by Tullow.

Impact of Oil Price Surge

According to O’Mahony (2005), the increase of the gas and oil price globally has had a direct positive impact in terms of profits and turnover at Tullow. The first half of the (2013) financial year for instance saw sales rising to €298m from €112.9m. The revenue before tax increased to €135m from €25.7m from second half of the previous year.

Other factors that have boosted its economic aspect is the acquisition of energy Africa. Which had a positive impact on the general economic status of the company. The incorporation of production from other newly developed sites such as in Africa and the North sea also boosted the general performance of the firm, despite similar organizations dwindling in performance. Such deals made Tullow to produce a substantial amount of oil and gas in Britain. O’Mahony further articulates that people or rather clients have been accustomed on the increasing oil and gas prices and the company anticipates that this price will continue rising without jeopardizing the company’s sales. O’Mahony continues to say that people have apparently forgotten about cheap oil or gas.

According to Corbett, (2012) similar economic progress is also expected in its new exploration sites in places such as Kenya, Ghana, D’voire, French Guiana, Uganda and Siera Leone. As from 2013, the company’s shareholder value has significantly risen. It also anticipates that this growth will continue to be experienced over the coming years. Although the company’s production as relatively remained small at 78, 200 barrels a day, the organization’s output is constantly growing. According to market analysts, Tullow is placed in the group of Vanguard companies, which also include the Kosmos Energy and Anadarko Petroleum.

The company’s new operation and marketing strategy has greatly boosted its economic prospects. The company has a strategy of going into frontier basins, which once they become successive, generate a substantial amount of revenue. For instance, 70% of the wells explored by Tullow generate oil. This is partly the reason why the company has continued to remain strong despite the global downturn (Reed, S, 2012, 1).

Tullow is becoming more interested in East African fields due to the fact that this field is less developed and s a potential for more gas and oil reserves. Another advantage for sub Saharan African oil fields is that they are near Asia and China which is a good market for oil and its related products. In these fields alone, the company obtained more than 5 billion oil barrels in 2012 and this year’s prospects are more promising than the previous year.

Conclusion

There is no doubt that the ever rising prices of oil have resulted into many social and economic problems not only to the society and businesses but also to the oil producing firms. In essence, a high price in oil products results into reductions of outputs, increases competition for businesses that depend on oil products, and leads to decreased nominal wages and unemployment. This therefore makes it necessary to conduct a precise evaluation with regard to the extent by which a country, business, individuals or oil companies are affected by the rising oil prices.

Just like many other firms, Tullow is a company with its own challenges too. Among the challenges, which Tullow has experienced, is because are attributed to its rapid growth and expansion programs. This leads to increased operation costs and other issues. A number of times have shown the company experiencing delays and a substantial amount of tax bill in some of its operating. Other issues range from political issues and difficulties in some countries. For instance, the government of Uganda is tightly pushing the company alongside others to build oil refineries in the nations. The Market environment for Tullow oil in 2012 was largely framed by the worldwide political and economic and demand uncertainty.

The negative Economic impact on rising of oil and gas prices on organizations and the general society cannot be overstated. Although the rising of oil prices has had negative implications on many business firms, Tullow oil and gas corporation has been able to come strong all along. By employing effective business strategies, there is no doubt that the company’s management system and as well as organizational structure are efficient enough. The company’s new operation and marketing strategy has greatly boosted its economic prospects. The company has a strategy of going into frontier basins, which once they become successive, generate a substantial amount of revenue.

Owing to the good performance experienced in the present perspective, it now seems that Tullow is quite happy for rising oil and gas prices. This may point to the reason why the company is aggressive on exploration prospects in Africa, North Sea and other places. For this company to continue performing exceptionally, it would be important for the gas and oil prices to continue, “being strong”. This will also make shareholders to benefit from reasonable dividends from their investments. Better oil and gas prices would predict better performance in future