Economic Profit and Accounting Cost

The profit is the difference between the value of output and other costs which is called the “residual”:Profit = Value of output minus ( wages + rent + interest) minus raw materials costs and other purchases.

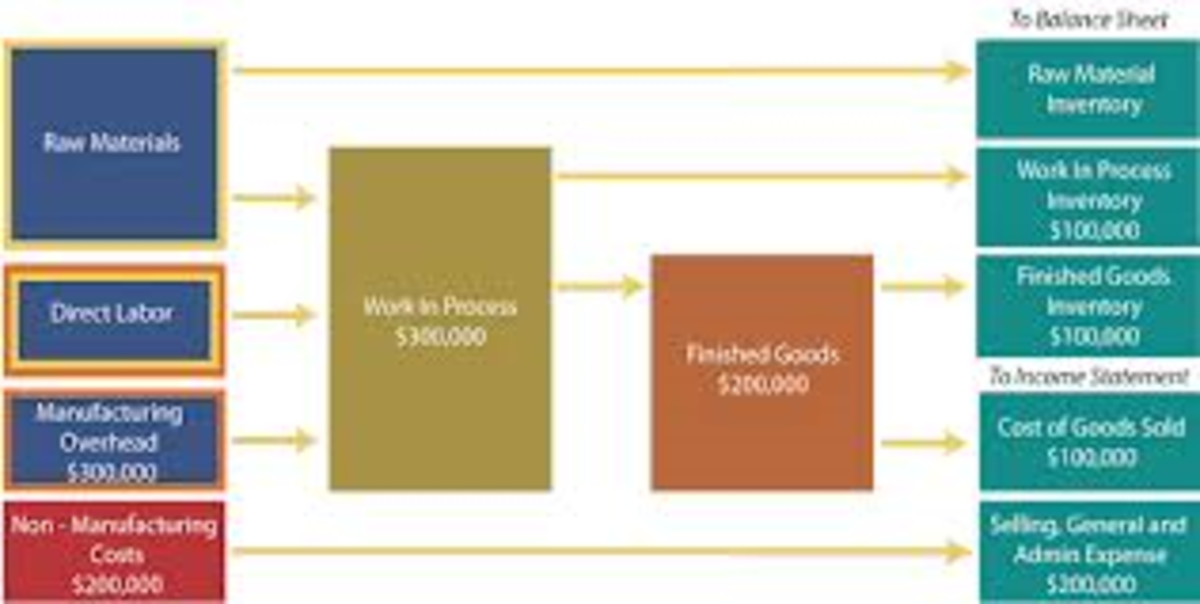

The existence of business firm assumes to follow the primary objective on the interest of the businessmen to maximize profit. This is generally computed by the purchase of inputs ( such as raw materials) and transform them into finished products which now being sold in the market (as the output).

The general assumption in computing the economic profit is financially analyzed by the difference between total revenue and total cost. Hence the simple equation may follow in this way:

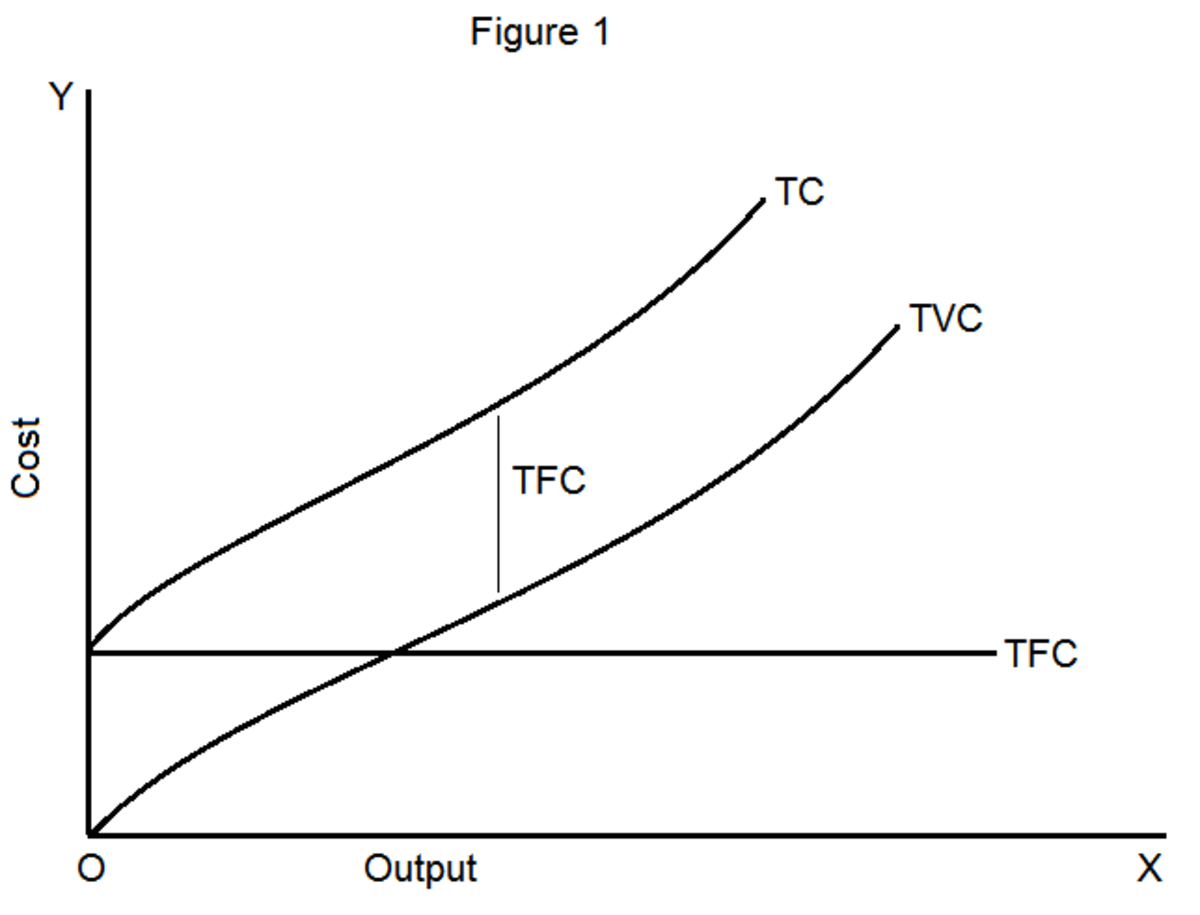

PROFIT= Total Revenue (TR)- Total Cost (TC)

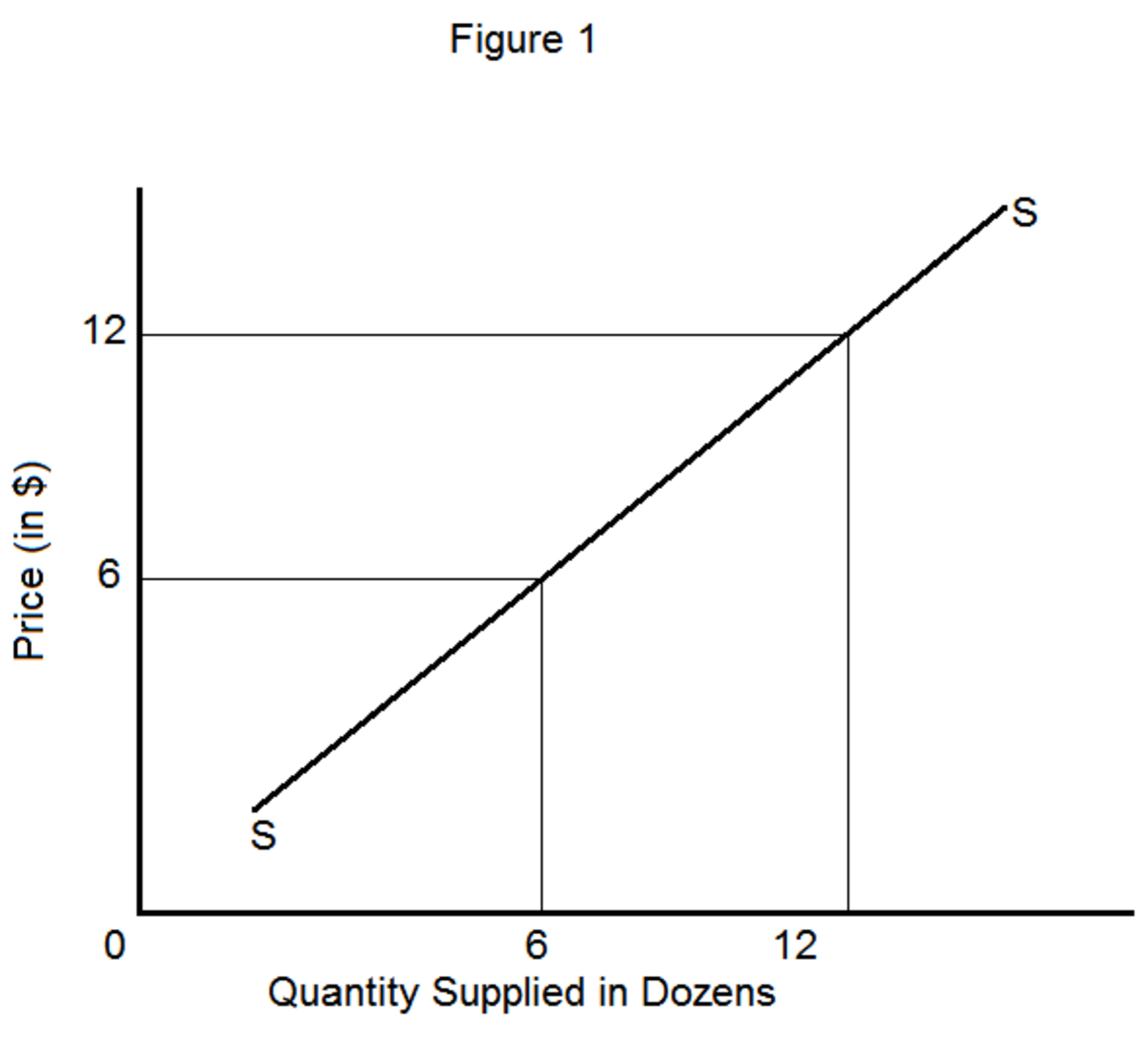

TOTAL REVENUE- This is generated by the quantity sold at a given market price

TOTAL COST-It is the sum of all opportunity cost related to the production process.

OPPORTUNITY COSTS= Explicit Cost +Implicit Costs

1. Explicit Costs of Production. These are the payments directly paid by the producer which includes the wages and salaries, receipts of purchases on the costs of raw materials including the tax paid by the firms.

2. Implicit Costs of Production. These are financial capital invested by the owner of the business including the value of time to operate and manage the enterprise.

The Concept of Economic Cost and Accounting Cost

- Economic Cost. This is the monetary value of all production inputs use in the operation of business. This also presents the accurate used of value resources in the implicit costs of production such as implicit wage, rent and interest of owners’ equity. The owner devotes time in running the business rather than having leisure time. The owner’s input services must have corresponding value in wage including the use of their resources such as rent and interest invested by the owner. This is usually called implicit costs as the cost of non purchased inputs and must be translated into cash value.

- Accounting Cost. This measures the explicit cost of production through the purchase of input services such as wages and salaries, interest and principal payment of business loans, depreciation of capital and other production costs.

Illustration of Accounting Cost and Economic Cost (‘000)

Item Accounting Cost Economic Cost

Wages and Salaries P 20,000 P 20,000

Interest of Loan P 5,000 P 5,000

Depreciation P 10,000 P 10,000

Miscellaneous P 10,000 P 10,000

Implicit Wage of Owner 0 P 15,000

Implicit Rent 0 P 10,000

Implicit Interest of

Owner’s Equity 0 P 5,000

TOTAL COST P 45,000 P 75,000

This is a simple comparative illustration economic and accounting cost. You can notice that the wages and salaries; interest of loans ; depreciation; and miscellaneous have the same financial variables. However, the glaring difference in the financial computation is the implicit costs which is the value of resources by the owner. It includes the wage ,rent, interest and equity of the owner.