Methods for Measuring National Income

Introduction

National income accounting is the process of counting of money value of the entire economic activities of a country during a particular period of time. National income accounting is an important concept in Macro Economics. In this modern era it has more important. Anyway national income accounting is a very difficult task of Economists. Because it is not a narrow concept but a wider concept and so it takes time.

Anyway Economists explained and developed some methods to find out the value of the output of an economy. They explained these methods very systematically. Mainly they explained three major methods to find out the value of an economy’s output or the value of national income. They are as like below.

I – Income method

II – Expenditure method and

III – Product or value added method

Each method are described as below separately

I – Income Method

Income method of measuring national income refers to adding of all the kind of income earned for factors of production in an economy for their contribution to the national output, in terms of rent, interest, profits, wages and salaries etc. Since these incomes are earned by all for their economic activities, means they rewarded for their production of output either for goods or for services. The major items counted as incomes are listed below.

Wages and salaries

It is the reward for labor or human capital for their contribution to the national output.

Rent

It is the reward for factors of production like land, labor, factory etc.

Interest and dividend

It is the reward for individuals or investors for their savings and investment on capital, investment on securities etc.

Undistributed corporate profits

Actually it is the profits or return on capital retained for business. Such profits are not distributed. It is also included in Gross National Product (GNP)

Taxes

It is the income of governments from individuals and others as a part of their economic activities. Government earns taxes either directly or indirectly.

Depreciation

Even depreciation is an expenses, it also included in Gross National Product (GNP)

Net Factor Income from Abroad

It is the value of foreign trade. That is export and import. It can be calculated by deducting the value of imports from exports (mathematically, exports – imports). If Net Factor income is positive, it will added to national income otherwise deducted from national income.

Exclusions from income

Some incomes are not taken into account while calculating national income. They are listed below.

Income from selling of secondhand goods

The income earned from selling of secondhand goods is not included in national income. The reason is that, such goods are not produced in the current year, but it is produced in earlier. So such incomes are not counted.

Transfer payments

Transfer payments are those which are not given for any current economic activities. For example: pensions and scholarships. These are not given for any ongoing productive economic activities.

Further, Illegal incomes, windfall gains, income from the sale of bonds and shares etc. are also excluded from national income.

II – Expenditure Method

Another method of measurement of national income is the ‘expenditure method’. In this method, we can find national income by adding up all the kinds of expenditure in the form of consumer spending expenditure and investment expenditure. Here we can count all the expenditures incurred in an economy during a year on different goods and services. To reduce the complexity of the method, economists explaining it by dividing the source of expenditures from four major sectors of the economy. They are

1) Consumers' spending expenditure (C)

2) Private Investment expenditure (I)

3) Government spending expenditure (G)

4) Foreign sector or exports and imports (X)

Each of these items is explained as below.

1- Consumer spending expenditure (C)

In an economy we can see the spending of money on different goods and services by the individual consumers or the household sector. We get the total spending on the consumer goods and services by adding the expenditures of household sector. This can be denoted by the letter ‘C’.

2- Private Investment expenditure (I)

It refers to the new generated investment expenditure in an economy by the private sector during the period. And the expenditures on the replacement of old capital is also added. It is denoted by the letter ‘I’.

3- Government spending expenditure

In an economy government is spending for its employees, other officers for the smooth functioning of the country’s activity. Moreover, sometimes government spends on some investment. Such expenditures are incurred by the government sector should be added to the national income in this expenditure method. One exception is that transfer payments from government sector are not included in national income because, such expenditures never create any contributions to the national output during the current time.

4- Foreign sector or net export

It refers to the value of exports over imports. The net results of foreign trade also affect national income.

In fact, we can arrive at national income by adding expenditures of each sector.

So national income will be= C+I+G+X

Which method of national income accounting is more efficient?

III – Product Method or Value Added Method

National income can be calculated by the method of value or product method by following four steps. Before discussing this, first learn some other related things which are mentioned below.

What is value added?

Simply value added means the value or price added or generated during the production process of a commodity.

For example: A farmer produces wheat and sold at $ 1000 to a Bread making company. After they converted in to bread and sold at $ 1500 to retailers. The retailers sold it to the ultimate consumers at $ 1750. Here the value added is

Value added by farmer = $ 1000

Value added by bread makers = $ 500

Value added by the retailer = $ 250

So total value added is = $ 1750

Here we can see that the value added is equal to the value of output.

Double counting

Double counting refers to the counting of the value of the commodity more than ones. In the above example when we count the value added by the farmer, bread producers and retailers altogether we can get 4250 (1000 + 1500 + 1750). Here we got an unrealistic value of output because we counted it by multiple times. It can be avoided by taking the value of final output or counting the value added in each steps of production. Now, we can follow the steps below, to measure national income by value added method.

Step 1: Classifying the production activities of an economy in to three sectors like primary sector, secondary sector and Tertiary sector.

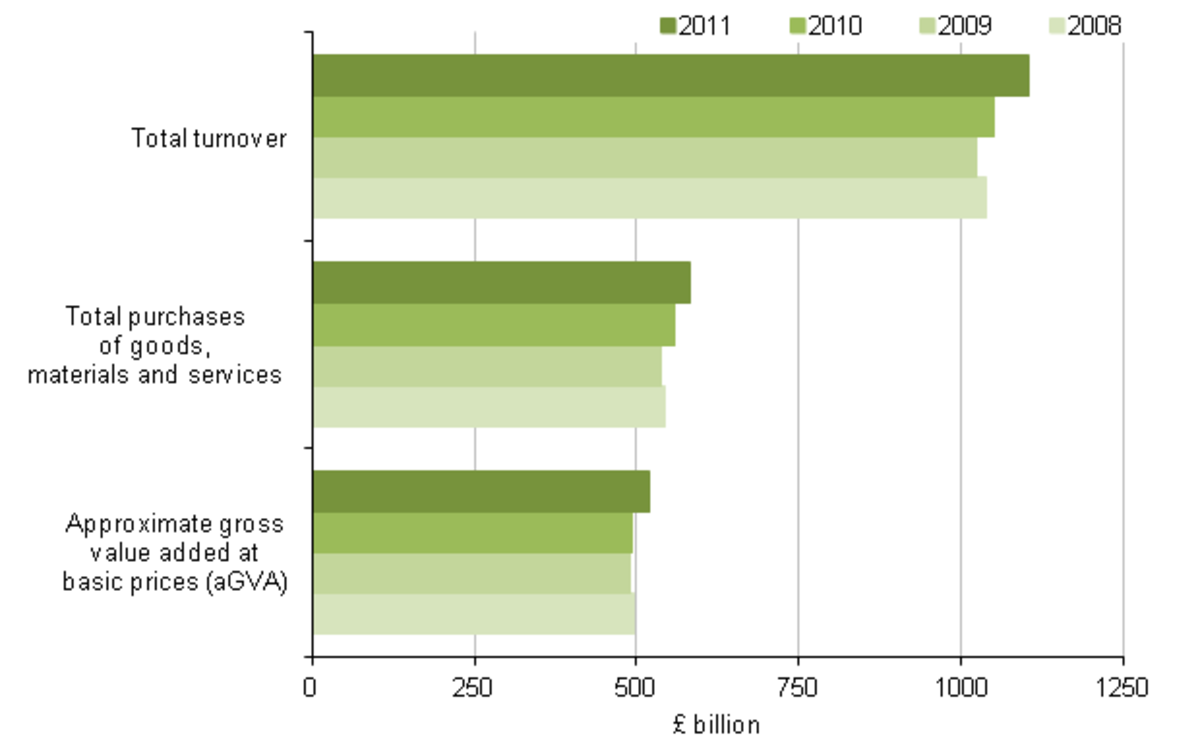

Step 2: Estimating the value added of goods and services produced in an economy for that period or multiplying the quantity of output with the market prices. Then we get Gross Value added of Gross Domestic Product (GDP).

Step 3: To find out net value added or Net Domestic Product (NDP), deduct depreciation from Gross Value added.

Step 4: Add Net Factor Income From Abroad. Factor income may in the forms of wage, rent, profit, interest etc. To get Net Factor Income from Abroad apply the formula.

Net Factor Income from Abroad = factor income received from abroad – factor income paid to abroad

Precautions to be considered under value added method

Including items: production for self consumption, imputed rent for self occupied houses etc

Excluding items: value of secondhand goods, services of housewives, works done as hobby, value of intermediate goods, transfer payments, illegal incomes etc.

Conclusion

National income measurement is one of the wide concepts in Macro Economics. National income accounting means finding of the value of an economy’s output in monetary terms. To measure national income economists developed three major methods like income method, expenditure method and value added method as described above.