- HubPages»

- Education and Science»

- History & Archaeology»

- History of the Americas

How Should Roosevelt and Obama have Responded to Their Crises?

Ideology, Party, or Pragmatism

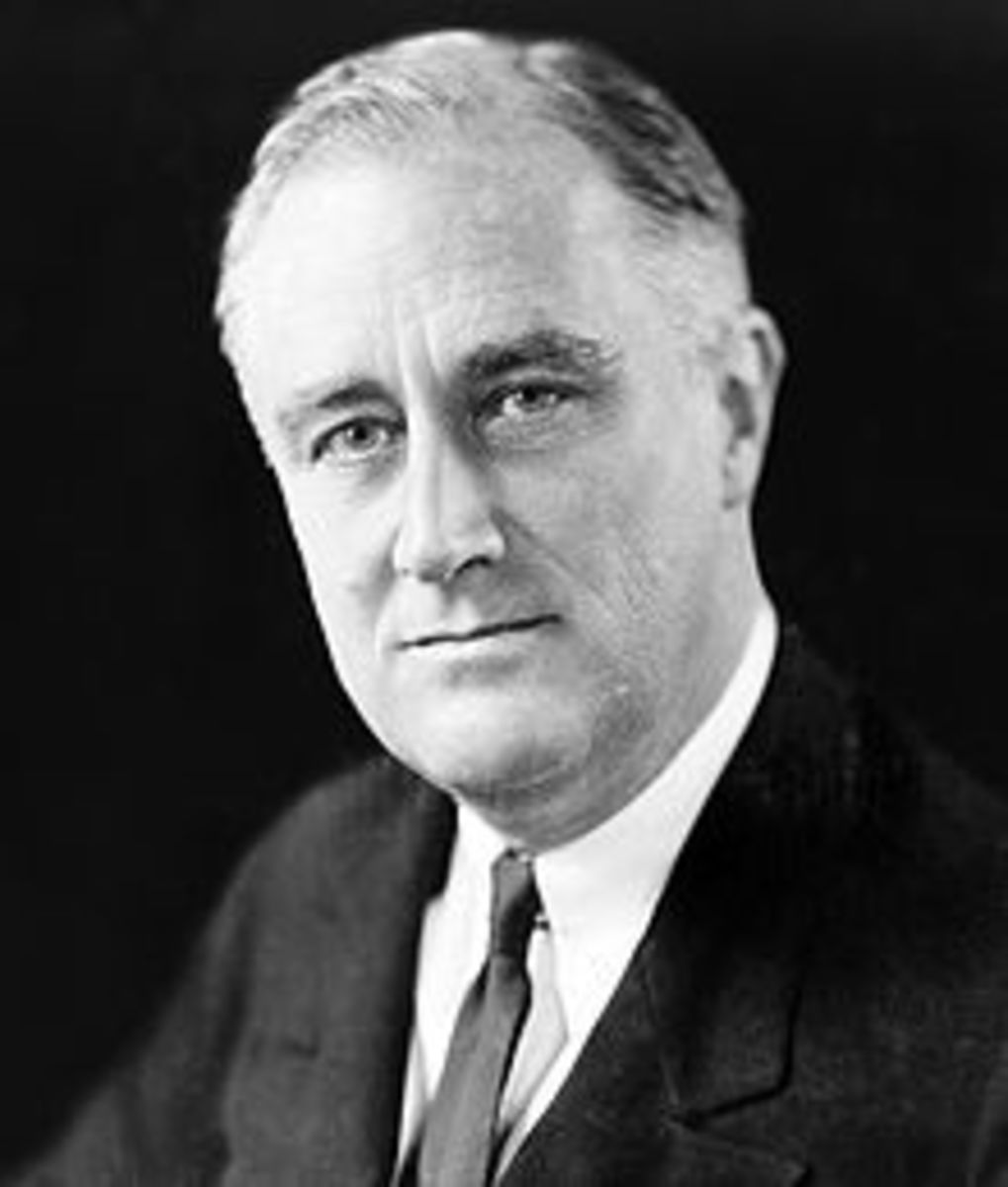

Franklin Roosevelt’s “the only thing we have to fear is fear itself” is one of the classic lines in the history of American political rhetoric. As a piece of advice, it is very difficult to follow. We are not supposed to fear anything but fear, but in the act of fearing fear, we are going against the advice. But that’s OK. Given that he was speaking at the height of the Great Depression, I think we all know what Roosevelt was talking about.

Economics, particularly during periods of boom and bust, is partly a matter of psychology. If people think that prices of stocks (or houses) are going to go up, then they will tend to buy quickly, driving prices further up. But by the same token, once people become convinced that prices are going to drop, they will tend to dump their stocks before things get even worse, driving prices down further. During the 1920s, people often borrowed heavily to buy stocks, so when prices eventually peaked and started to drop, this panic selling was even worse than normal. Many who sold at a loss were unable to pay back their loans, getting some banks into financial trouble. What killed so many banks, however, were not just the unpaid loans and their own personal investment losses in the market. Instead, it was fear. Once people heard that some banks had failed, they were scared that their banks might be next. This fear of more bank failures led to runs on banks, and beliefs about imminent bank failures became self-fulfilling prophecies. Just as optimism had helped fuel the growth of the 1920s, pessimism played a prominent role in the downward spiral that became the Great Depression.

Once the downward spiral starts, it can be difficult to get things rolling in a positive direction again. Companies are unwilling to hire and invest until they see signs that people are spending again. Consumers are unwilling (or unable) to spend until they either get jobs or, if they are lucky enough to still be employed, feel secure enough about the financial future. Many Americans in the 1930s had also lost faith in the banking system and the stock market, fears that made it difficult for the banking system to stabilize and stock prices to rise. What, if anything, should be done to kick start an economy when it is in this kind of funk? What does it take to get businesses and individuals to get over their fears?

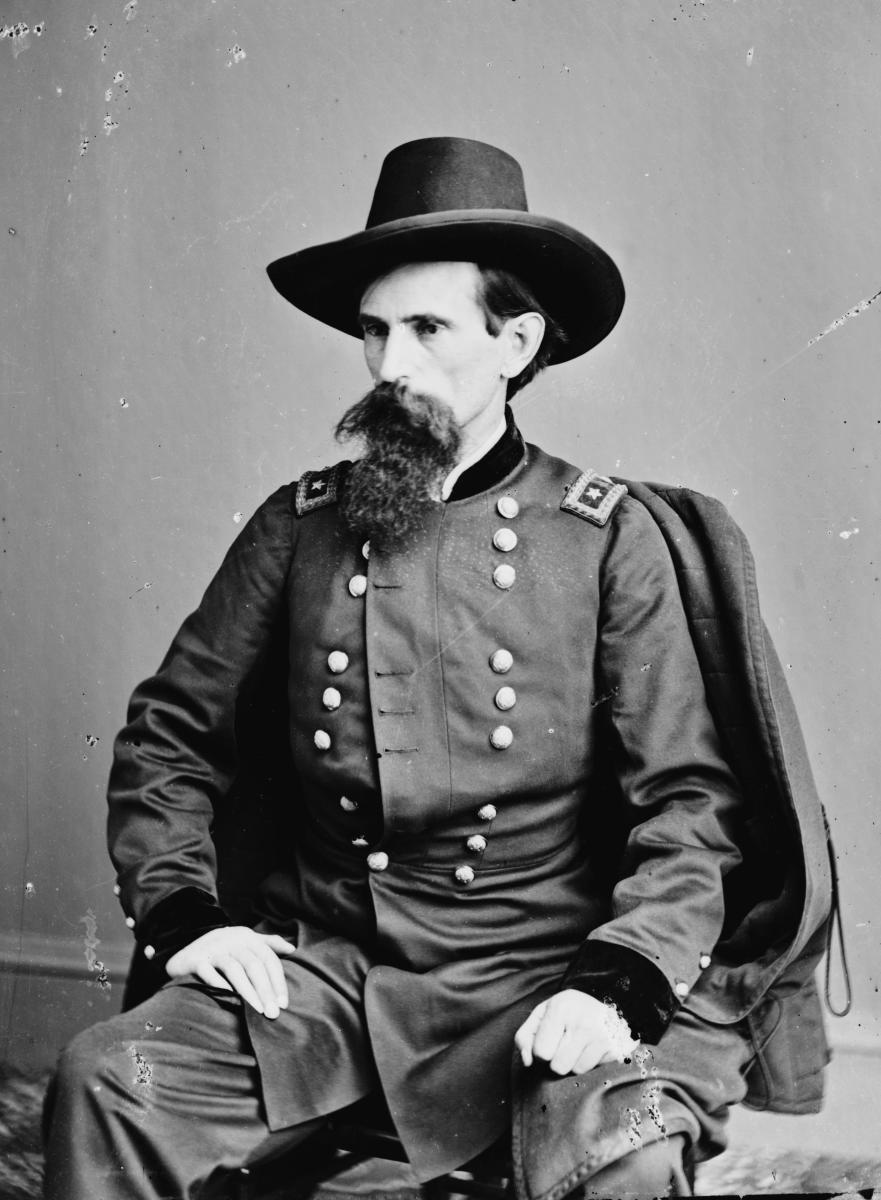

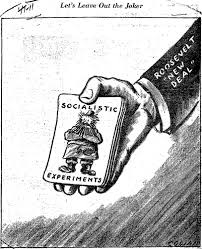

Franklin Roosevelt, regardless of what his admirers and critics might say, did not seem to have any coherent strategy. The ultimate pragmatist, he adopted the kind of trial and error approach that was appropriate for a disaster of this magnitude. And while many of his programs were designed to tackle specific problems both big and small, many of his efforts were designed largely to improve the public mood. His critics then (and now), however, often labeled him as some sort of a quasi-socialist (or outright socialist) who was instituting an unconstitutional federal takeover of the economy in which the national government would spend and regulate its way out of the crisis. By taking this misguided approach, he not only brought into being an unsustainable welfare state that has ultimately led us to our current condition of chronic budget deficits. This excessive taxing, regulating, and spending also slowed down and held back the recovery. New Deal supporters might point out that things began to improve gradually after Roosevelt came into office, but this happened more in spite of him than because of him.

It would have been better, some critics say, if Roosevelt would have allowed, as much as possible, the “market correction” to play itself out. Sure, there would have been some suffering in the short term. But in the long run, the economy would have been better off without the government trying to control it and prop it up with welfare spending. Some made the same types of complaints about President Obama’s response to the recent financial crisis. Instead of bailing out financial institutions and car companies, implementing an expensive stimulus package, and propping up housing prices through Fannie Mae and Freddie Mac, the government should have allowed some of these failed institutions to go under and housing prices to bottom out at their true market prices. Sure, it would have been painful in the short-term, but eventually, we would have a healthier, more sustainable economic and political system.

It is difficult to know if these critics of Roosevelt and Obama were correct. We can only know the results of the paths that were actually taken. But when it comes to conservative Republican critics who favored a less interventionist approach, I would ask one simple question: if President Obama (and Roosevelt) for some reason had taken this conservative approach, would you have supported him through the inevitable short-term suffering that would follow? Or would you lay the blame for this suffering at his feet, ignoring the fact that he had actually followed your advice? It is so much easier, after all, to propose theoretical economic ideas than to face the American people and tell them that the short-term suffering is for their own good.

Given the current political climate in Washington DC and throughout the nation, I think we all know the answers to my questions in the preceding paragraph. In these highly partisan times, the ideas are not the important things. What matters is the identity of the person who proposed the ideas. Anything that the opposing party might do or support is therefore inherently wrong. And even if a person deep down inside agrees with some of the policies enacted by the opposing party, the temptation to use any bad news to attack your opponents can be too strong to resist.

In this highly partisan time of gerrymandered districts and unlimited campaign contributions, officials in Congress often come across as mindless ideologues that toe the party line even when the party seems to contradict its own supposed principles. I suspect, however, that many of these members of Congress, deep in their heart of hearts, are not as stupid as they sound when they are playing their partisan games. Instead, many of these people, if they lived in a different political environment, might be pragmatists in the spirit of Roosevelt. And if their party was in charge, few on either side of the aisle would stand idly by as an economy went down the toilet. Sometimes, in fact, it can take a crisis to spur them to action, just as we saw in 2008-2009 when both the Bush and Obama administrations took drastic steps in response to a looming catastrophe.

There is definitely something to be said for “laissez faire” capitalism. There is no doubt that markets have done a lot to create the climates necessary for innovation and economic growth. We humans tend to work harder to make money for ourselves than when we are working for the theoretical betterment of humankind. But history has also shown that government can have a role to play in helping to prevent financial catastrophes, mitigating the effects of economic downturns, and relieving some of the human suffering of people down on their luck. It is a difficult juggling act, a fact that thinking people recognize. But if a person claims that they will stick with their ideological principles no matter what, then they should at least be consistent. They should face up to the consequences of their ideas for better or for worse, and support those who agree with them regardless of their party affiliation. If you believe in ideas over partisanship, then put your money where your mouth is.