How Some Colleges Front Load Financial Aid Offers

Congratulations on Your Financial Aid Package

Your son is a top student. His SAT scores are nearly perfect. He'd like to go away to an elite private college, and you're trying hard to make this work.

The total cost of attendance is $60,000 a year. But that's without discounts. You just received the good news he earned a $30,000 merit scholarship. Plus, his financial aid package includes generous grants, which don't have to be repaid.

It looks as if you can break out the champagne and celebrate. But not so fast.

A line, written in very small print, at the bottom of the award letter alludes to something you hadn't considered. The merit scholarship isn't automatically renewable from year to year. So this means your son must apply again, if he wants to continue receiving it. Unfortunately, there are no guarantees.

Call the Financial Aid Office

Before making any decisions, you'll need to assess whether your son has a realistic chance of receiving this scholarship going forward.

It's not alright for parents to contact an admissions office, which looks for signs of maturity in their incoming students. They expect students, now young adults, to negotiate the details of their education.

But it is perfectly acceptable for Mom or Dad to talk directly to a financial aid officer, who is used to receiving phone calls from parents.

Find out more about the particulars of this scholarship. What percentage of students receive it all four years?

Some financial aid officers will immediately reassure you. The figures you see now are indicative of what you can expect for the duration. (However, most schools do lower grant aid a bit in the sophomore year, as students are eligible for higher federal loans.)

Usually, the people you speak with in the financial aid office can honestly tell you if front loading is a common practice.

The intent of front loading is not always entirely nefarious. Colleges know a certain percentage of freshmen never return. In some institutes, that's as high as 30 percent. So not saddling students with heavy loans the first year is a kind thing to do.

Be very careful, though, if the answers you receive are vague. You don't want to get snagged by unexpected costs as your child progresses through his classes.

Why Front Loading is So Problematic

The danger of front loading is that it offers false hopes and may prevent someone from seizing a much better opportunity. It can also cause you to drop out of school. Financial stress is one of the leading reasons students leave college without earning a degree.

It can also catch families off guard, forcing them to choose between taking out heavy loans or asking a child to leave college. Neither of these choices are pleasant. This is one of the reasons families of college-age students decide to borrow heavily. Student loan debt in the United States has now reached $1 trillion dollars.

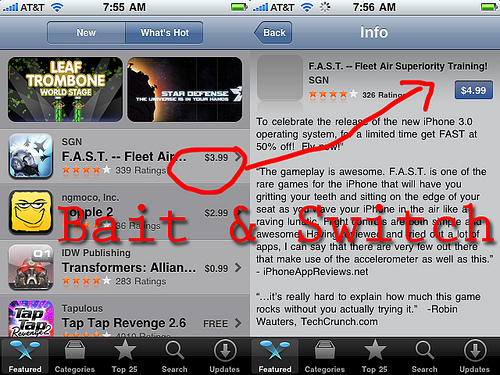

Bait and Switch?

Do You Think Financial Aid Front Loading is Classic Bait and Switch?

Now is the Time to Weigh Your Options

Front loading is one reason why it's so important to choose the right college from the outset. The most generous financial aid is always given to incoming freshmen. A transfer student can count on receiving much less. This is why picking the right college can avoid crushing debt down the road.

If you come from a family of moderate means, it might be possible to attend your dream school, at least during your freshman year. But, after that, you'll struggle if your aid drops significantly. You've also just lost your best chance for receiving maximum aid at a more affordable school.

Remember, the financial aid package can directly affect whether you graduate or not. A diploma from a slightly less prestigious school is worth a lot more than random credits from an elite institute.

Merit Scholarships With Very High GPA Requirements

Merit scholarships are given on the condition that a student maintain a minimum average GPA. This varies from college to college, and even from scholarship to scholarship. Sometimes automatic scholarships are given to all graduating high school seniors who score well on state-mandated tests. Institutional scholarships often require a 3.0 or higher GPA.

This, by itself, is a fair practice. These monies are given in recognition for academic achievement. The schools also use these awards to lure the brightest students to their campus. The expectation is that you'll continue to excel.

However, sometimes recipients of merit aid are assigned very difficult classes the first year, taught by professors notorious for giving nearly everyone low grades. Then it becomes very difficult for a student to remain eligible to continue receiving merit aid.

Why a Lower-Priced School May Be a Better Option

If you come from a family of moderate means, and depend heavily on financial aid, you might want to consider a college with a "sticker price" of $25,000 to $30,000 a year, instead of one that starts at $60,000. That's because you're entering at a high point and bargaining down. If something goes wrong, it's almost impossible to continue.

However, starting at a lower figure allows you to work from there. If something goes wrong, it's not as much of a disaster.

This I can speak about from first-hand experience. My own daughter received a merit scholarship at her public university. It was, however, contingent upon her grades. Her freshman year, she took an honors class with a professor who gave vague, nebulous assignments. Everyone struggled. Her grade in that class was so bad she won't tell me what it was.

Her GPA the first semester of her freshman year was very low. (How low I don't know.) But she pulled her grades up the second semester.

However, her scholarship was in jeopardy. Initially, she didn't receive it. She had to petition the financial aid office. Then her request was sent to the head of the honors program.

Luckily, she received the scholarship her second year. If she didn't, it would have made paying tuition a bit more difficult. But we would have found a way.

If this had happened at an elite private school, and things didn't work out, it would have probably meant leaving campus.

So choose your school wisely, to maximize your chances of obtaining a degree.

Disclosure

I am a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.