How a Global Digital Currency Could Negatively Affect Poorer Nations

Timmy walks into the lunchroom; today is a special day. He’s brought with him a treat to share with everyone at his table: a box of 30 candy bars - twice as many as last week! Timmy sits down and proudly displays the carton. But there is no wave of excitement or surge of anticipation among his tablemates. Timmy soon gets the message: no one really wants his candy bars anymore. They're losing their taste for the usual chocolaty, sugary-goodness he delivers; his gifts are no good here. So, what to do?

A few tables over sits Robert, who always brings the latest health foods. What is it today? A vitamin, mineral, and protein-enhanced water-like beverage. He seems to have a few extra, so Timmy moseys on over.

‘Would you like to trade?’ he asks.

Robert doesn’t want the candy bars either, but he offers Timmy a deal: ‘I don’t want you to have wasted your money, so I’ll give you one drink for every five candy bars that you have.’

Why does he do this? For one, he thinks it would be better if more people ate healthily, so, out of a sense of altruism, he extends some of his surplus to Timmy. But, there’s more. From now on, Timmy and his table also have to bring healthy foods every Wednesday; then, the two tables will share with each other. The healthier snacks are at times more expensive; instead of 30 candy bars, Timmy may bring only three or four bags of baked naan chips and some hummus. The table may not ever have as much food as Robert's table, but they seem to be ok with this. For one, they can now exchange food with table 2 in case table 2 brings something in on a certain Wednesday that the people at table 1 would like to try. Further, although they may not have the same quantities of the healthier foods that they had of the junk food, they find it more filling, and therefore feel that they don’t need as much. They are content with the arrangement, and join table 2 in consuming organic, non-GMO, whole-grain, enhanced, all natural, and even vegan foods.

Three months have passed. Now, everyone has joined the health craze. Raw vegetables, Kashi, enriched homemade-smoothies, and legume protein wraps fill the lunchroom. But, just as at the outset, some tables can afford more than others. Susie from table 1 has brought four 12oz bags of fruit snacks today, but, unfortunately, she brought the same thing last week; no one seems interested. No problem, she’ll just try to switch her fruit snacks for something else. She walks to table 4.

‘Want to trade for my fruit snacks?’

‘No, we have some.’

She tries a few other tables, to no success. Finally, she makes her way to table 2 and lets Robert know she would like to swap her fruit snacks with of his table's goodies. Well, there’s a problem. Even though they’re both eating healthy foods now, table 2’s foods are still much higher quality than table 1’s. Robert doesn’t want to give up one of his bento boxes for a bag of fruit snacks. Switching to the healthy-food scheme expanded table 1’s possibilities for trade, but, as long as they’re purchasing items that no one else wants, they will remain in a relatively depressed state. Further, now that there is no other trading system to convert to, they’re somewhat stuck. But, even if there were a new system, it would probably be even more selective than the current (after all, what would be the appeal of the mass adoption of a new system if it were not more efficient or did not offer access to more desirable goods?) Three months prior, table 1 had 30 items to exchange for the enhanced beverages; now, they only have four bags - price level has risen while their purchasing power has remained the same. What would they exchange to acquire some of the newer goods? Table 1 seems to be left in a lurch. Susie sits back down and discusses with the group switching back to the old routine of bringing candy, chips, and the like on Wednesdays. That seemed to work better for them.

The Global Lunchroom

As humans have not as yet developed the skill of telepathy, a communicator must endeavor to ensure that the message of any parable used has reached the audience.

Consider the above example. Instead of a lunchroom, let’s call it, “the world economy”. Instead of candy bars, let’s say, “Currency A”; health foods, “Currency B”; tables, “nations”. When Currency A has devalued to the point of being useless, the less advantaged nation can seek to implement the more advantaged nation’s economic system within its own borders. In effect, its economy now begins to function based on how Currency B is doing, not on its own failing monetary system. While the nation itself is still poor, it is using a more secure currency, and will therefore not suffer such woes as spiraling inflation; creditors may also be more willing to accept payment in the new currency. Further, this change may allow for easier trade between the countries, and facilitate positive diplomatic relations.

A World-Wide Web

The global financial environment bears many similarities to an ecological food web. Unlike a food web, however, a higher trophic level in the "currency web" indicates a more integral role in the system's existence (not a lesser), and, therefore, a greater effect on the environment as a whole. Consequently, policies designed to aid the growth and development of the web as a whole may out of necessity need to show consideration to more influential countries.

Every part of a computer has some importance but, unless the computer is a promotional model only meant for display, the entire machine will be ineffectual if there is an issue with the motherboard. Wealthier nations are the motherboards of the world economy.

Digital currencies have a slew of concerns unto themselves but, for the sake of simplifying the topic at hand, let’s posit that the entire world has adopted a single digital currency. When the disadvantaged nation needs help, where will it turn now? The IMF? The World Bank? Although exceptional institutions, their current deficiencies would be amplified under the hypothetical digital financial system being considered in this article. For example, the International Monetary Fund has been accused of continuing the hegemony of Western economic thought and practices, as the concentration of influence is held by the wealthier Western nations1. Similarly, the World Bank has been criticized for being unable to effectively adapt its programs to local concerns2. Some argue that the Bank puts too much of an emphasis on supplying money and not enough on how efficiently the money is being used or how well any loans or grants actually aid human development. Flooding smaller markets with too much money can counterproductively lead to inflation, the echoes of which are often felt internationally. But, such deleterious effects are understandably more probable when the decision-makers live a world away. If financial uniformity were to become institutionalized across the globe (greatly decreasing any advantages that regionalism could provide for smaller-scale issues, as similar guidelines would need to be followed everywhere), the problems caused by poorer countries' lack of representation would be exacerbated. Now, not only would it be difficult to apply policies in a way that suits their specific predicaments, these nations would also have nowhere else to turn, no other options. The digital currency's intangibility makes it that much more pliable, that much easier for those with greater authority and clout to manage (and, ergo, direct the flow of or keep a hold on).

The Chimera of Inflation

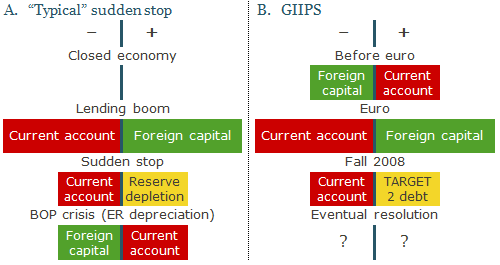

Consistent current account deficits and declining private capital investment are plaguing the nation. What to do? Logically, the country's currency would lose value (producing inflation), which, over time, allows domestic debts to be repaid in the cheaper currency. A weaker currency is also more attractive to foreign investors, who can in turn buy more for less. And, not to be forgotten is the appeal that lower prices have for tourists. So, inflation, when properly managed, can have an equalizing effect. But, when this struggling nation insists on maintaining a fixed exchange rate, instead of responding to the unfavorable market conditions, depreciation will not occur and debts will continue to rise unchecked. What does it do, then? Well, it can borrow. But, when consumption far exceeds capital inflow, borrowing can only go on for so long. Eventually, this nation will go bankrupt.

Let's say that this country is part of a larger unified economic system in which certain rates have been agreed upon, and thus the country is also pressured to maintain specific levels of activity, even when doing so would not be in its own best interest. Inflation may be desirable, but it is essentially unattainable.

For example, consider what has happened recently in the Eurozone surrounding Greece. Greece adopted the euro as its currency in 2001, two years after the currency’s inception. For the next several years leading up to the Global Recession, investment in Greece rose exponentially, as investors felt that its membership in the EU would lower the risk of investment3. In addition to (and not entirely exclusive of) this fact is that Greece’ trade deficit also skyrocketed during this time period. As the recession hit, investors began withdrawing funds, inflow of money slowed across the EU, and borrowing costs increased. When facing a sudden stop in investment, the response is typically to allow the nation’s currency to depreciate, thus stimulating exports and re-inciting investment. This was not possible, however, as Greece does not have its own currency. The next options are either to revert to using a national currency or accept a bailout (with strict conditions of austerity). The former would bring dire consequences to the struggling nation, while the latter drains the economic union’s resources and diverts them from other projects or areas that are arguably important in their own right. Further, member states may not appreciate the idea of having their funds rerouted by a central authority to another ailing nation. Some states are much more efficient economically relative to others. Cultures vary and schools of thought produce differing ideas on what constitutes prudent economic policy. Greece is not the only European nation that has needed assistance, but it stands as the ne plus ultra. In December 2009, the U.S. dollar was worth 0.685 euro4; they are now almost on par, with the euro having a net depreciation of nearly 33% to its current exchange rate of .91 USD5. Of course, some of this can be attributed to gains in the dollar’s value, but much of it is also related to the collective depreciation of the euro. As the Eurozone now plans to give Greece a third bailout, the euro will no doubt continue to depreciate. A Greek exit from the EU is becoming less speculative and more probable6.

Are They Really Better Off?

Purchasing power may nominally improve; however, unless real income rises, actual purchasing power may decrease as the integration of poorer nations into wealthier economies inflates the price of goods.

Greece is a developed country; a poorer nation would have been ruined under these circumstances.

What would have happened to Myanmar had it been in Greece' place? Myanmar is a nation with a GDP per capita 5% that of Greece’ and in which purchasing power is 60.48% lower than in Greece7,8. In Myanmar’s case, the only option would have been a total bailout (or perhaps the complete dissolution of the nation), which it would never have been able to repay, and which would have destroyed growth for the rest of the country’s existence because of the associated conditionalities (creating a veritable slave-state or serfdom) and the resultant lack of interest by investors.

Expand the issues raised in this example to a worldwide scale. A lone country in need cannot leave the global economy, as doing so would isolate it, akin to leaving society and being left only with the options to subsistence hunt, fish, or farm. But, being destitute, the country also cannot easily repay the bailout loans and would be given stringent measures of austerity. Investment dries, and so there is little growth in the private sector, and government bonds are not worth investing in. What does the country do? If we also assume that the global economy’s currency is solely digital, leaving this economy and establishing a unique currency would create erratic, stochastic effects on the burgeoning financial system – not simply because it is new, but relatedly because digital currencies are inherently volatile9. The shocks would be felt regardless of whether or not the dissenting nation sets up its own currency digitally, with banknotes, or by some other means. Timmy’s table may be eating candy bars again, but they still have to function in a lunchroom dominated by the Whole Foods crowd.

Efforts to refine global trade and financial systems are noble (and vital). We will see what trends, innovations, and institutions the future brings us.

Ten Richest Cities in the World (In Ascending Order)

Notice that they are all located in the northern hemisphere.

Only two (#10, Shanghai and #9, Moscow) are not in westernized nations.

A Further Look: Cryptocurrency

REFERENCES

- Alexander, Titus (1996). Unravelling Global Apartheid: an overview of world politics. Polity press. p. 133.

- Stiglitz, Joseph E. (2003). Globalization and Its Discontents. New York, NY: W. W. Norton & Company. ISBN 978-0-39-332439-6.

- Klein, Ezra. "Greece's Debt Crisis Explained in Charts and Maps." Policy & Politics. Vox, 06 July 2015. Web.

- "Monthly Average Converter Euro per 1 US Dollar Monthly Average." Exchange Rate Average (US Dollar, Euro). X-Rates, n.d. Web.

- "EUR per 1 USD - Past 24 Hrs." (USD/EUR) US Dollar to Euro Rate. XE, n.d. Web.

- Torralba, Francisco. "Greek Bailout Won't Avoid Grexit." Greek Bailout Won't Avoid Grexit. Morningstar, 3 Aug. 2015. Web.

- "Myanmar." UN Data: A World of Information. N.p., n.d. Web. <https://data.un.org/CountryProfile.aspx?crName=MYANMAR>.

- "Cost of Living Comparison Between Greece and Myanmar ." Cost Of Living Comparison Between Greece And Myanmar. Numbeo, n.d. Web. 03 Aug. 2015.

- Frisby, Dominic. "Are Cryptocurrencies the New Dotcom Stocks? - MoneyWeek." MoneyWeek. N.p., 27 Nov. 2013. Web.

- Hale, Galina. "Balance of Payments in the European Periphery." Balance of Payments in the European Periphery. Federal Reserve Bank of San Francisco, 14 Jan. 2013. Web.

- "10 Wealthiest Cities in the World: It's Not New York or London at the Top." Finances Online. N.p., 18 Feb. 2014.

- Iza Terán, Carlos: Catálogo Museo Numismático Quito, Banco Central del Ecuador, Quito, 2000, ISBN 9978-72-336-6.

- Hungwe, Brian (6 February 2014) Zimbabwe’s multi-currency confusion BBC News Africa, retrieved 6 February 2014

- Krugman and Obstfeld (2009). International Economics. Pearson Education, Inc.

- http://i.ytimg.com/vi/A-OZK2I4CtQ/maxresdefault.jpg

- http://image1.masterfile.com/em_w/03/18/40/837-03184065em.jpg

- https://mi621.files.wordpress.com/2015/01/internet-2025.jpg