How Can the Newly Introduced GST Revolutionize the Indian Economy?

What is GST and how does it work?

The Goods and Services tax (GST) is an indirect taxing scheme applicable throughout India replacing multiple cascading taxes that were levied previously one after the other by the central and state governments.

Under the GST, goods and services will be taxed at 0 per cent, 5 per cent, 12 per cent, 18 per cent, 28 per cent, .25 per cent on rough precious and semi precious stones and 3 per cent on Gold.

Nearly 60 per cent of all the goods and services coming under the GST will fall under the 18 per cent tax slab. Goods like unpacked grains, milk are untaxed, items like hair oil, shampoos, deodorants, chocolates are taxed at 28 per cent.

Working model of GST:-

The GST are of three types

CGST: Where revenue will be collected by the central government

SGST: Where revenue will be collected by the state government for intra-state sales

IGST: Where revenue will be collected by the central government for inter-state sales.

For sales within state the applied GST is CGST + SGST

For sales to another state the applied GST is IGST

Thus for India the GST stands as "One nation one tax"

Under the new tax structure, all different phases from production to warehousing to distribution are considered to mere "pass through" stages with focus being completely on the destination or final consumption of the goods. Logistics is the most key element benefited from the new tax structure as it plans to provide seamless transfer of goods from one state in the country to other.

Highlights of GST in other countries

The first country to implement Goods and Services tax (GST) was France way back in 1954. It paved the way for a new taxation system which was quickly adopted in many European countries in the 1970s and 1980s, all tweaked the GST in their own way differing from country to country.

The Asian powerhouse Japan launched GST in 1989 at a very modest rate of only 3%. This increased to 5% by 1997 and immediately Japan went into a recession. Later in 2010 the then Japan government increased the rate to 10%. Currently the Shinzo Abe government are formulating to increase the taxation further and the tax increasing deadline is set at October 2019.

In Singapore the GST was introduced in 1994 with immediate inflation as an after effect. After more than two decades the inflation has subsided and GST forms the second highest source of government revenue after corporate income tax.

Brazil saw VAT rates (VAT similar to GST there) vary from region to region and the inter state supplies pegged at tax rates between 4% to 25%.

Canada is the only country other than India which also adopts the dual GST model that is the Central GST (CGST) and the State GST (SGST) but it gives liberty to provinces to go for state or central GST taxation schemes with GST rates at 5%.

USA does not have GST as it ensures a high level of autonomy for it's states.

History behind the implementation of GST in India

India's most iconic tax reform since the independence in 1947 came into action from 1st July, 2017. After coming to power Prime minister Narendra Modi left no stone unturned to make the GST face the light of the day, but with strong resistance from the opposing Indian National Congress who ironically fought for the GST bill while they were in power form 2009 to 2014.

The GST was the brainchild of the then prime minister Atal Bihari Vajpayee in 2000. He set up a committee for the design and implementation of the GST model headed by the then Bengal finance minister Asim Dasgupta who headed the committee till 2011. He was given the responsibility of designing the entire implementation technology and logistics.

During the union budget presentation of 2007-08 the then finance minister P. Chidambaram expressed his satisfaction over the considerable progress that was made for the implementation of GST which was supposed to be into effect from on 1st April, 2010.

Anticipating the GST to come into action from 1st April, 2011 (because it got delayed one year due to unavoidable circumstances) the then Congress government allotted Rs 1133 crore for the computerization of the commercial taxes in states which was considered to be the foundation groundwork for the GST to be executed efficiently.

In March 2011, the INC introduced a constitutional amendment bill to implement the GST as per schedule on 1st April, 2011, only to be opposed by the other parties in the parliament and the stalling game started.

The then central finance minister Pranab Mukherjee appealed to the various state ministers about the seriousness of the INC to implement the GST and urged them for support in reforming the tax structure of the biggest democratic nation in the word. The INC also allotted Rs 9000 crore in 2013 for compensation to the various states that were just about to shift to GST in 2011.

Ironical chain of events followed when the then Gujrat government in 2013 under Narendra Modi opposed the implementation as the state would be bearing losses amounting to Rs 14000 crore per annum.

Ironical indeed as the new BJP government with the finance minister Arun Jaitley re-introduced the GST bill in the parliament in December 2014 after being in power for seven months. At that time the BJP had the Congress standing in between them implementing the GST.

In March 2016, Arun Jaitley agreed with the Congress's demand of not keeping the tax rates higher than 18% as no state government would agree to having higher rates as well. If any emergencies were to come the government would need the parliament's permission to raise the tax every single time.

Finally the tax slabs were fixed and there is a tax slab of 28% also but that would be applied on luxury goods only keeping the majority of goods taxable on and under the 18% tax slab and GST rolled out on 1st July, 2017.

GST rate in various countries

Country

| GST/ HST/ VAT rate

|

|---|---|

Canada

| 13 to 15%

|

France

| 20%, reduced to 5.5 to 10%

|

UK

| 20%

|

New Zealand

| Upto 15%

|

Malaysia

| 6%

|

Singapore

| 7%

|

India

| 5 to 28%, 28% + cess, .25% and 3%

|

Source: www.financialexpress.com

Highlights of previous Indian tax system (Central taxes)

Central taxes

| Rate

|

|---|---|

Central value added tax (CENVAT) which is levied on the production of manufactured goods

| 12.36%

|

Service tax which is levied on services provided

| 15%

|

Central sales tax levied on cross-state trade

| 2%

|

Countervailing duties (CVD) which are additional import duties on imported goods that are also produced in India

| 12.36%

|

Special additional duty of customs (SAD) which are additional import duty to counterbalance the sales or value added tax paid by local manufacturers

| 4%

|

Source: www.federalreserve.gov

Highlights of previous Indian tax system (State taxes)

State taxes

| Rate

|

|---|---|

Value added tax (VAT) which is levied on the production of manufactured goods

| 10-14.5%

|

Sales tax which is additionally levied on production of manufactured goods in some states

| 0-15%

|

Entry tax levied on entry of goods for consumption in that state

| 0-12.5%

|

Luxury tax levied on luxury goods and services

| 3-20%

|

Entertainment tax levied on film tickets and festivals

| 15-50%

|

Source:federalreserve.gov

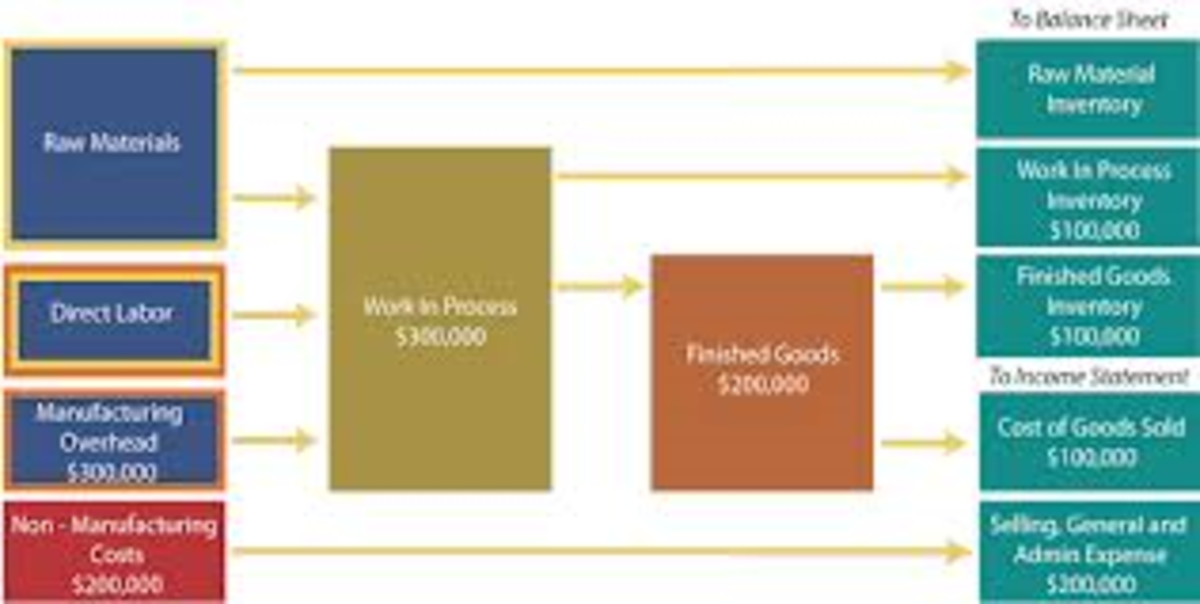

What are the replacements that will take place?

Central taxes replaced by GST are:-

- Central Excise Duty

- Duties of Excise (medicinal and toilet preparations)

- Additional Duties of Excise (goods of special importance)

- Additional Duties of Excise (textiles and textile products)

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Service Tax

- Cess and surcharges in so far as they relate to supply of goods or service

State taxes replaced by GST are:-

- State VAT

- Central Sales Tax

- Purchase Tax

- Luxury Tax

- Entry Tax (all forms)

- Entertainment Tax (not levied by local bodies)

- Taxes on advertisements

- Taxes on lotteries, betting and gambling

- State cess and surcharges

Examples to clarify the GST hurdle

Without GST:

Lets say a product at cost price Rs 1000 is made at Nagpur and then sold at Mumbai. Lets assume the VAT to be 10%. Then the subtotal becomes Rs (1000+100)= Rs 1100.

Then the product is sold from Mumbai to Chennai keeping a further profit of Rs 1000. Therefore the price at Chennai without tax becomes Rs (1100+1000)= Rs 2100.

Central sales tax (CST) will be applied on price at Chennai at 10% (assumption) i.e Rs 210. So the total price of the product at Chennai amounts to Rs (2100+210)= Rs 2310.

With GST:

Lets take the same example of a product being made at Nagpur and sold at Mumbai at a cost price of Rs 1000. Now on this there will be a 10% GST as was the case earlier with VAT. This 10% GST will be divided equally between Central GST (CGST) at 5% and State GST (SGST) at 5%. Both amounting to Rs 50 each. Thus the subtotal of the price of the product at Mumbai is Rs(1000+50+50)= Rs 1100.

Then the product is sold from Mumbai to Chennai keeping a further profit of Rs 1000. Therefore the price at Chennai without tax becomes Rs (1100+1000)= Rs 2100.

IGST at 10% will be applied on Rs 2100 at Chennai as the product crossed state borders. Thus the tax amount will be {(IGST at 10%= Rs 210) - (SGST at previous stage at 5%= Rs 50 + CGST at previous stage at 5%= Rs 50)}

Tax amount = Rs 210-100= Rs 110

So the final price of the product at Chennai will be Rs 2100+110= Rs 2210.

Thus one can save Rs 100 when buying this product when the GST gets applied against previous tax scenarios.

Highlights of impact of GST on different sectors

FMCG

FMCG sector will be benefited from the implementation of GST as lower logistics cost for transfer of goods between states will be a big boon. Overall any FMCG goods are taxed upto the 18% tax slab level.

Airlines

Travelling in economy class will be more affordable as GST will cut tax rates from 6% to 5%, whereas travelling in business class will be costlier as tax rates increased from 9% to 12% under the GST. But as the aviation turbine fuel has been kept out of the GST so aviation companies will face two different taxation schemes one being the GST and the other being indirect taxes.

Pharma & Healthcare

Pharma products will be taxed at 12% under the GST up from 10%. The healthcare sector is exempt from the GST but the inputs to the healthcare sector are taxed at 18% which will increase the operating costs significantly.

Consumer durables

These will be taxed at 28% as against the previous 27% signifying negligible changes.

Services

All bank, telecom, stock investment brokers etc services will be taxed at 18% up from 15% previously, the bleeding telecom sector faces a dismal situation with more taxes in stored for their customers.

Cement

Taxes were at 12.5% excise and 12.5 to 15.5% VAT earlier which are replaced by 28% GST implying no huge change here. Reduction in prices of coal and logistics cost will help the industry.

Automobiles

This sector will also remain neutral as various categories of cars will attract various GST rates from 18% on small to mid sized cars to 28% plus 15% cess on luxury cars.

Real estate

Taxes under the GST would be 12% for ongoing projects.

How can GST be a boon for business and economy in India?

First of all let's observe the logistics scenario in India post GST implementation. As there will be no inter state check points there will be no truck delays and cost escalations due to this.

Estimates by world bank suggest that India looses Rs 2300 crore on truck delays through inter state check points as on 2005. Several south Indian states have already done away with check points which will be followed by other states soon. The trucks earlier used to travel 280 kilometers in a day owing to stoppages at the check-posts, with the implementation of GST they are supposed to travel 460 kilometers on an average because they don't have to wait at check-posts.

Thus the logistics costs vis-a-vis GDP of India is supposed to lower from 14-15% earlier to 9-10 % after the implementation of GST. With that said the GST looks forward to convert the unorganized sectors in organized ones, thus reducing tax arbitrage in the unorganized sectors. Another one of its major goal is to facilitate "Make in India" campaign.

As the entire tax structure of India is consisting of 17 different taxes and 23 different taxes will be replaced by a single tax across the country it will become easier for the foreign investors to understand the tax structure and invest seamlessly in the country. Thus with greater transparency in taxes the foreign investments in the country are to increase, giving India breathing space to make itself a manufacturing hub to export goods and thus adding significantly to the GDP of the nation.

GST may slow down down growth for the next 3 to 6 months only to be beneficial in the long run helping "ease of doing business" in India and helping India climb the ranks of that index globally. Hopefully the once conceived GST model in 2000 will give rise to an economically stronger India with fresh foreign investments and strong manufacturing infrastructure.

Was GST beneficial for you?

Did you save or loose money because of the new GST implication?

© 2017 Ankush Mukherjee