How did Indian corporate sector has risen stronger in the last 25 years of economic liberalization?

Introduction: What is this so called economic liberalization?

Economic liberalization means relieving the economy out of the clutches of the then government. One of the most significant areas to be benefited by this is the Indian banking sector. If there was a sector where no private players could be seen, it was the banking sector. In those days of 1991 who was exactly responsible for this radical change in the economic outlook in India?

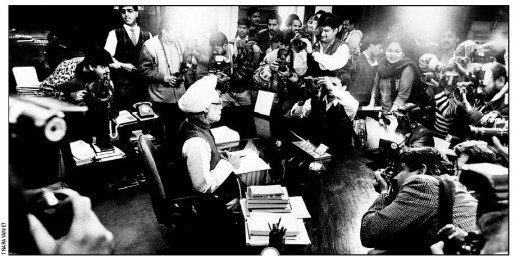

The answer to this question is the then finance minister Dr. Manmohan Singh, who’s budget of 1991 made all the changes in the economy. The year 2016 marks the 25th year of the changes that pushed India higher into the global market.

Dr. Manmohan Singh’s Budget: Sparing the poor of the nation

His budget represents a major effort at change and finer tuning, displaying at the same time an inclination towards national interests and social concerns.

On one hand, there was unsustainable fiscal imbalances and with foreign reserves facing crisis, drastic measures were closely monitored by the International Monetary Fund (IMF) and the World Bank. On the other hand, with the Government itself in a corner, every decision it took were closely scrutinized by their opposition, be it from mere political agendas to game changing reforms.

In the circumstances, the broad philosophy that Dr. Manmohan Singh outlined was that large scale fiscal adjustment was needed but the poor should be protected from any kind of burden. At the time when India was still a nation whose economy depended on agriculture to a large extent, this statement of giving no burden upon the poor only could have been made by a finance minister who had lots of guts. The very poor have been spared and even given marginal reliefs as in the case of the cut in the price of kerosene. The burden was primarily on the corporate sector and on the rich and the middle class.

The details and stats of that faithful budget

- Indirect Taxes:-

The net effect of the proposals by the Centre is negative, an additional ₹ 2,213 crores was to be raised from direct taxes. In the sphere of indirect taxes, the “luxury” items including cars, air-conditioners and consumer electronics are to bear a significantly heavier tax burden. Producers’ subsidies including export subsidies and fertilizer subsidies have been virtually done away with, the food subsidy which benefits the poorer consumers directly has been marginally increased thus relieving the poor a little.

In indirect taxes, cigarettes have, as always, bore the brunt of heavy taxation. So have motor cars with only two wheelers of 50 to 70 cc given a concession. Colour television sets, air-conditioners, video recorders and refrigerators have been hit harder and thus the full force of the taxation spree was burdened on the middle and rich people.

While previous budgets have talked of the need to rationalize the current high rates of customs duties, Dr. Singh finally took steps to visualize that fact. The cut in the highest rate of import duty was halved from 300 to 150% was long overdue and was fueled by the devaluation of the rupee and the rising premium on REPs which have pushed up import costs. The longstanding prevalent issue of industries having high capital costs had little relief provided to them by granting some tax relief.

- Direct Taxes:-

In the sphere of direct taxes, the personal income tax and the wealth tax rates have been left untouched, which could have increased. On the other hand, there is a minor concession on long term capital gains calculated to give a boost to the share markets and mutual funds.

Dealing with black money which could also have put the economy on a highway was thought of and the plan was to use it for slum clearance and low cost housing benefiting the ultra-poor.

In the area of corporate taxation, liberalization of trade would add to the GDP of the country by taxing the affluent people more. The increase of 5% points in the corporate tax rates even while retaining the surcharge at 15% is a major burden. The cut in the depreciation rate was from 33.3%, which is considered too liberal, to 25%.

On the expenditure side, there are two game changing elements. The first is the increase in defense expenditure of India by ₹ 600 crores over the level of 1990-91. With the security issues not showing up at that time, the decision to increase allotment of budget for defense expenses was not justified.The plus point in the scenario in the last two years before the budget, is that even with huge fiscal imbalances and severe foreign exchange crisis, the economy(GDP) has grown at the rate of about 5 per cent a year. Dr. Manmohan Singh’s claim that the fiscal adjustment would not affect the growth of the economy seemed valid for everything except the two scenarios:

- Increase in prices of fertilizers which might dampen agricultural production even with higher procurement prices of raw materials for the farmers.

- Substantial new burden in the form of taxes on the corporate sector bound to hit industrial growth that was growing vigorously at over 8 per cent per year at that time.

One would hope that the positive impulses from the Government’s initiatives would more than compensate for the negative effects. Only then would the effort put by the Finance ministry would be fruitful enough to support such a scheme on such a level.

Role of the then RBI governor in the same:-

The then RBI governor C. Rangaranjan who held that post from 1992-97. He oversaw the economic liberalization and its immediate effects on the Indian economy and the corporate sector. He literally changed the face of Indian banking sector.

The sorry state of the banking sector can be reflected upon the facts that in the then banking system (prior to 1991), banks made no mention of profits and losses, nor did they fix deposit and lending rates. There were no capital adequacy rates nor any kind of rules for bad loans. RBI set the rates, which was again controlled by politicians as the RBI was just a wing of the politicians back then. Simply speaking bankers did not do the banking.

Mr. C. Rangaranjan took over and coming into office he made two ground breaking reforms:

- Rupee devaluation when he was still the deputy governor of RBI.

- Laying the foundation for the modern banking system without having to turn economy, markets and banks inside out.

Under Rangaranjan private banks like the HDFCs and ICICIs of the present day came into existence. He unleashed competition into the stagnant Indian banking sector. He was instrumental in ending the government’s control on the banking system and undermined RBI’s independence.

Significant changes over the 25 years of liberalization

- India’s economy which was 17th in 1991 now ranks 8th in the world.

- Poverty came down from 46.1% in 1991 to 21.3% in 2016.

- Forex reserves increased from 9.22 billion dollars in 1991 to 355.56 billion dollars.

- STD call rates which were Rs. 22 per minute in 1991 is now Re. 1 per minute.

- The length of National Highways lengthened from 33700 km to 1 lakh km.

- Number of computers in the country which were just 18,000 in 1991 has now reached to 220 million!

- Life expectancy has improved from 58.4 years to 67.7 years. thus decreasing mortality rate.

- The TV sets in the country which was 33.3 million in 1991 is now 168 million.

- Rural wages increased dramatically from Rs. 46/day to Rs. 277/day.

The effects of the game-changing budget on the Indian economy and corporate sector

The perceivable effects on the following sectors:

- Financial Sector.

- Fiscal Sector.

- Industrial Sector.

- Trade Sector.

Impact on various sectors across India

Impact on Small Scale in India:

In pre-colonization era, India’s textiles and handicraft were renowned worldwide and was the backbone of Indian economy. With the dawn of industrial revolution along with foreign rule in India, Indian economy suffered a major setback and much of its indigenous small scale cottage Industry went for a toss.

After independence, government attempted to revive small scale sector by reserving items exclusively to manufacture from India. With liberalization, list of reserved items were substantially decreased and many new sectors were thrown open to big players where they had the opportunity to do business.

Small scale industry however exists and still remains the backbone of Indian Economy. It contributes to major portion of exports and private sector employment. Results were mixed post liberalization, many Small scale industries did get bigger and better. But overall value addition, innovation and technological advancement was below par as the government help that this sector needed was not coming.Their products were contested by cheaper imports from China.

Impact on Agriculture:

Share of agriculture in domestic economy has declined to about 15%. However, people dependent upon agriculture were still around 55% which was huge considering the population of the then India. Cropping patterns has undergone a huge change, but impact of liberalization were still misty. Government control on production and distribution of crops were seen at that time.

Farming in a developing world supports large number of poor people by providing them with jobs. With globalization there has been high fluctuation in commodity prices which put them in massive risk. Now the number of people depending upon agriculture was huge with most of them being below poverty level.

Negative impact of the scheme was expecting more than a billion people living because of agriculture as a livelihood, to feed themselves if the free market becomes favorable.

On the positive note, India’s largely self-sufficient and high value products like Basmati Rice are in high demand all over the world. India is better placed to take up challenge of globalization in this case. If done in sustainable and inclusive manner, it will have a huge multiplier impact on the whole economy and help India establish itself on the global picture.

Now moving a step ahead, Information technology is being incorporated into agriculture to facilitate farming and pave the way for globalization

Impact on Services Sector:

In this case globalization has been a boon for developing countries and bane for developed ones. Due to historic economic disparity between two groups, human resources have been more affordable in developing economies. This was further facilitated by the IT revolution and this all culminated in exodus of numerous jobs from developed countries to developing countries. Thus a famous phrase is something like the US guarded its IT sector as India guarded its agriculture.

- IT industry:

Software, BPO, KPO, LPO industry boom in India has helped to absorb a big chunk of the people looking for jobs. Export of services result in export of high value and India became famous in that just over a span of 25 years. India is thus increasing its labor pool of Professionals with time and is better placed to become a truly Knowledge Economy keeping the IT industry as the leapfrog.

Exports of these services contribute big part to India’s foreign Exchange earnings. In fact, the only three years India had Current Account surplus, I.e. 2000-2002, was on back of this export only.

- Banking & Insurance:

Further, in banking too, India has gained a lot post liberalization. Private Banks such as ICICI, HDFC, Yes Bank and also foreign banks made their appearance, as a result destroying the stagnancy and raised standards of Indian Banking Industry. Now there is cut throat competition in the banking industry, and public sector banks are more responsive to customers.

Here too IT is on the path of bringing banking revolution. New government schemes like Pradhan Mantri Jan dhan Yojana aims to achieve their targets by using Adhaar Card. Public Sector Banks still remain major lender in the country but Private is fast catching up and bridging the gap.

Similarly Insurance Industry now offers variety of products such as Unit Linked Insurance plans, Travel Insurance etc. But, in India life Insurance business is still decisively in the hands of Life Insurance Corporation of India (LIC) with ICICI prudential insurance being the largest private player.

- Stock Markets:

Another major development is in Stock Markets. Their Importance can be estimated from the fact that, behavior of stock markets of a country is one of the strongest indicators of health and future prospects of an economy. More the activity on the stock market, better is the financial health of the country.

Improvement of these markets has thrown open wide array of associated services such as Investment Banking, Asset Management, Underwriting services, Hedging advice etc. These collectively employ lakhs of people all over India.

Similarly there are commodities market which provides avenues for investment and sale of various eligible commodities were boosted by the liberalization.

- Telecom Sector:

Conventionally, Telecom sector was a government owned monopoly and consequently service was quite substandard. After reforms, private telecom sector came into the picture with a boom and reached pinnacle of success within a short span of time. And Indian telecom companies went global. However, corruption marred this sector especially when there are middle mans involved who eat into the profitability of these private firms.

Entry of modern Direct to Home(DTH) services saw improvements in quality of Television services on one hand and loss of livelihood for numerous local cable operators.The introduction of mobile phones and smartphones added to the boom of the telecom sector.

- Education & Health Sector:

Food, health and education and somewhat banking are among basic necessities, which every human being deserves and should receive. Unfortunately, in developing countries like India majority of people deemed financially below par can’t afford beyond a certain limit (or can’t afford at all). Concept of free markets, globalization, liberalization etc. fails here miserably. Free markets only provide goods and services to people who can afford to pay for them.

And thus to cater to the needs of the richer people, private institutions mushroomed all over the country from engineering to medical to even primary schooling. Every well off parent who could afford a better schooling for their child wanted institutions that can provide them with world class learning methods.

But these new colleges accommodate only a minuscule proportion of aspirants at very high costs. High fees of education forces many aspirants to take educational loans from banks. After qualifying, job market is unable to absorb majority of them. Practice turns out to be a scape-goat. Now to make a decent living and to pay back the loans a person is lured by corruption where I should not get into details myself. Consequently, when many similar cases are put together, we get a corrupt system, economy and society. And that's how corruption is getting fueled instead of getting curbed.

In case of education almost universal enrollments have been achieved upto primary level both by public and private players and now focus should be on improving the quality, so that student of public schools comes at par with atleast average private ones.

Conclusion: Has the Corporate Sector grown stronger in the last 25 years?

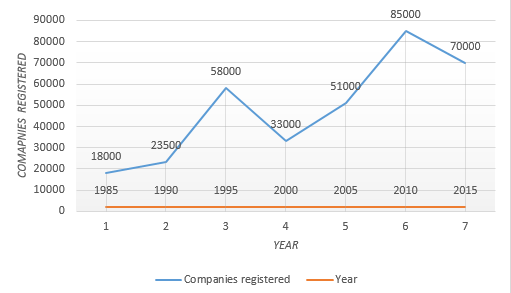

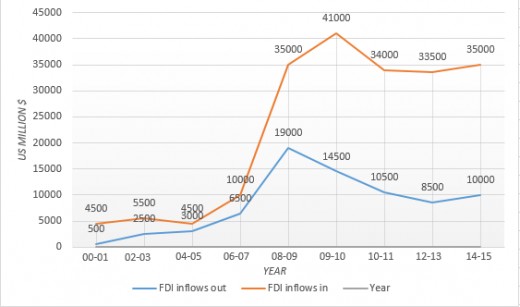

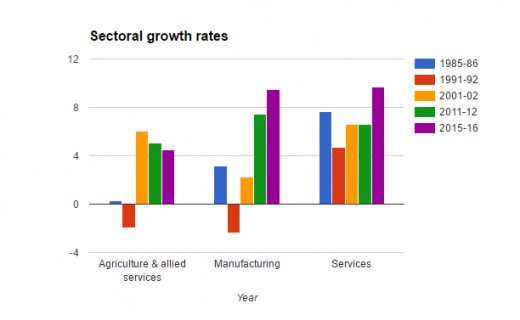

Let's have a look at the graphs below

The above charts speak for themselves. Let’s state some more facts about the Indian Corporate Sector:-

- The gradual increase of FDI in different sectors has ushered in greater competition.

- India's trade volumes has expanded dramatically and it has access to the best global services and brands because of globalization.

- India has become the global leader in IT/ ITES, hospitality (services sector) in terms of growth Y-o-Y.

Thus it can be concluded that the economic liberalization that started as the vision of the then finance minister Dr. Manmohan Singh needed to be steered through rough seas and 2016 being the 25th year of that game changing event sees India getting recognized as a nation that can support sustainable growth through the development of the Corporate sector.

Thus India became a "service economy" from an "agrarian economy".

What is your opinion?

Did the corporate sector of India really benefit from the economic liberalization?

© 2016 Ankush Mukherjee