IB Economics Higher Level Revision Notes

Graphs to Microeconomics

1. Microeconomics

- Market = an institution, which permits interaction between buyers & sellers.

- Demand Law = inverse relationship between P & QD, all other factors assumed constant. A change in price causes a movement along the curve. A change in income, price related goods, consumer preference and demographic changes causes a shift of the curve. QD = a-bP (a=shift, b=slope)

- Supply Law = positive casual relationship between P & QD, ceteris paribus. A Change in price causes a movement along the curve. A change in Factors of Production (FoP = land, labour, capital, entrepreneurship), in technology, tax, subsidies causes a shift of the curve.

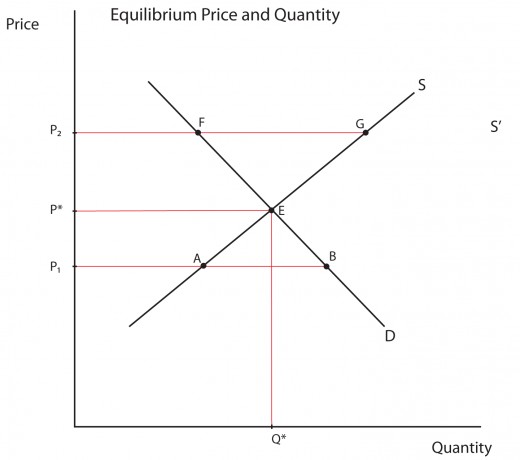

- Market Equilibrium = no excess supply or demand. – Price has a signaling and incentive function. Full efficiency achieved.

- Market Efficiency

- Consumer Surplus = The difference between how much a consumer is willing and able to pay and what the real price, which they pay is.

- Producer Surplus – the difference between what firms earn from selling goods and services and what they would have earned at P=minimum.

- Elasticity

- Price Elasticity of Demand = responsiveness of QD to change in P

- %changeQD/%changeP

- >1 elastic, <1 inelastic

- Used for prediction, comparison, price discrimination, tax.

- Low for primary goods

- High for manufactured goods

- Cross Elasticity of Demand = responsiveness of D for good X to a change in P of good Y

- %changeQDofX/%changePofY

- >0 substitute (X), <0 complimentary (X)

- Used to describe markets, determine types of goods

- Income Elasticity of Demand = responsiveness of D to a change in Income

- %changeQD/%changeY

- >0 normal goods, <0 inferior goods

-

Used for income determination, market understanding

- Price Elasticity of Supply = responsiveness of QS to change in P

- %changeQS/%changeP

- >1 elastic, <1 inelastic

- Determinants = time, FoPs, capacity, stocks

- Low for primary goods

- High for manufactured goods (many substitutes)

- Taxation

- Indirect Taxes = taxes on goods & services fixed or percentage value (specific or Ad Valorem)

- To Collect Revenue, pay for public goods, decrease consumption.

- Price Increases

- Equilibrium Q decreases

- Tax incidence = who pays what proportion of tax = PES/PED

- To Collect Revenue, pay for public goods, decrease consumption.

- Direct Taxes = taxes on income

- Subsidies

- Payment to firms by the government to lower price, increase production, consumption and revenue.

- Market Price decreases

- Equilibrium Q increases

- Producer revenue increases

- Government expenditure increase

- Price Controls

- Maximum prices = set if market prices is too high to protect buyers

- Outcomes – shortage, inefficient resource allocation, welfare impact, underground market, rationing.

- Effects – lower prices, more demand, less supply.

- Minimum prices = set if market price is too low to protect producers ( farmers)

- Outcomes – surplus, government buying surplus, taxpayers burdened, welfare impact, inefficient

- Effects – higher prices, less demand, more supply

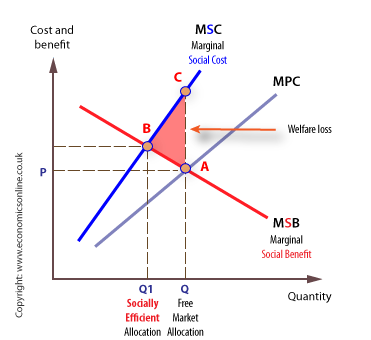

- Market Failure – Due to failure to achieve efficiency resulting in under/over allocation of resources. Failure to achieve social optimum of MSB=MSC.

- Marginal Private Benefits (MPB) = the benefits individuals enjoy from extra consumption.

- Marginal Private Costs (MPC) = costs of extra production (wages, FoP, etc.)

- Marginal Social Costs (MSC) = costs of extra production borne by society.

- Marginal Social Benefits (MSB) = benefits society enjoys from extra consumption.

- Externalities

- Negative of Production – MSC lies above MPC so there is an external costs, welfare loss, and overproduction. Demerit goods and their consumption create external costs (alcohol). Possible responses = taxation, government regulation.

- Negative of Consumption – MSB lies below MPB so there is an external loss, welfare loss, over consumption.

- Positive of Production – MSC lies below MPC so there is a external gain. Underproduction. Merit goods and their consumption create external benefits

- Positive of Consumption – MSB lies above MPB so there is an external benefit, under consumption. Possible responses are subsidies, legislation, education, advertisement, direct provision of goods & services.

- Public Goods

- Non-excludable & Non-rival consumption

- Common access resources & sustainability threat – fishing, pastures, forest, fossil fuels, etc.

- Difficult to exclude individuals

- Rivalry

- Sustainability

- Lack of pricing for CAR – goods are overruled, depleted.

- Government responses – legislation, taxation, trade schemes, funding.

- Asymmetric information – market failure may occur when either the buyer/seller possesses more info. Than the other party. Government response – legislation, regulation, provision of information

- Abuse of monopoly power – able to restrict output, charge higher prices leading to a welfare loss. Government response – legislation, regulation, nationalization, trade liberalization.

- Theory of Firms and Market structures

- Short run – time period during which at least one FoP is constant.

- Long run – no constant factor of production, all adjustments are possible.

- Total Product = Total output of a firm = Q

- Average Product = Q/L

- Marginal Product = changeQ/changeL

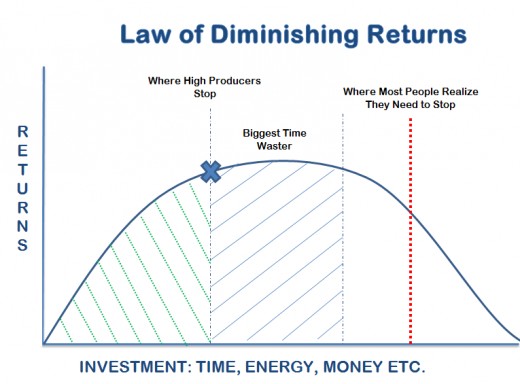

- The Law of Diminishing Returns – As more units of a variable factor (labour) are added to a fixed factor (capital) there is a point beyond which the total product will continue to rise, but at a diminishing rater, or the marginal product will decline.

- Economic Costs = the value of all resources that are sacrificed during the production process.

- Explicit = production costs (wages, resources)

- Implicit = minimum payment to secure entrepreneurship.

- Fixed = costs, which do no vary when the level of production varies (rent, insurance)

- Variable = vary with the level of output.

- Marginal = the additional cost of producing an extra unit of output.

- MC=changeTC/changeQ = changeVC/change Q

- Average Variable = variable costs over the level of output

- Average Total = total costs over the level of output

- ATC = AFC+AVC

- Average Fixed = Fixed costs over the level of output.

- Long run production costs

- Increasing returns to scale - %change increase in output > than %increase in all inputs

- Constant returns to scale - %increase in all inputs

- Decreasing returns to scale - %increase in output < than % increase in all inputs.

- Revenue

- Total Revenue = TR = P x Q

- Marginal Revenue = MR = changeTR/change

- Average Revenue = AR = P

- Economic Profits

- Abnormal = TR > economic costs

- Normal = TR=Economic Costs or when TR is just sufficient enough to keep the firm in business. Π = TR – TC

- Goals of Firm

- Profit Maximization = MR = MC

- Revenue maximization, growth maximization, satisficing & social responsibility.

- Perfect Competition – Large number of firms, homogeneous product, freedom of exit/entry, perfect information, and perfect resource mobility.

- Monopoly = a single dominant firm in the market, no close substitutes, barriers to entry – economies of scale, branding, copyright and legislation.

- Can set price.

- AR = D

- Profit Maximization – more units at a lower price

- Desirable monopolies

- Ability to finance research and development

- Need to innovate to maintain profit

- Possible economies of scale

- Monopolistic Competition – large number of firms, differentiated product, absence of barriers.

- Product differentiation – small degree of monopoly power

- Neither allocative or productive efficiency achieved.

- Oligopoly – dominance of industry by a small number of firms, important interdependence, differentiated or homogeneous products, high barriers to entry. – Joint profits.

- Perfect Competition – very many small firms, homogenous product, no barriers

Price discrimination – charging different prices to different consumer groups for the same producer, when the price difference is not justified by difference in cost.

- Price Elasticity of Supply = responsiveness of QS to change in P

Graphs to Macroeconomics

2. Macroeconomics

- Goals

- Satisfactory & Sustainable growth

- Low level of unemployment

- Price stability

- Long –run equilibrium

- Distribution of income

- Gross Domestic Product = GDP = C + I + G + (X-M)

- C = consumption

- I = investment

- G = government spending

- (X-M) = net exports

- Gross National Income (GNI)

- Business Cycle

- Recession

- Trough

- Recovery

- Boom

- Peak

- Line of Best-fit = Long-time average annual growth

- Aggregate Demand = AD = GDP

- Shifts due to individual components of GDP

- Aggregate Supply = AS = LRAS or SRAS

- LRAS = long run aggregate supply = new classical

- LRAS = long run aggregate supply = Keynesian

- SRAS = short run aggregate supply – wages assumed fixed

- Shifts due to change in FoPs, resource prices, taxes, subsidies, technology, unemployment reduction, institutional changes.

- Keynesian multiplier - effect on GDP of change in investment, gov. spending and exports. (Shifts)

- 1/(1-MPC)

- Macroeconomic Objectives

- Unemployment = actively searching for a job but cannot find one.

- Rate = number of unemployed/labour force x 100

- Consequences = loss of GDP, loss of Tax revenue, increased costs, loss of income, less equality, increased crime.

- Types

- Seasonal – predictable variation in D & S of labour

- Frictional – people in between jobs

- Structural – unemployment due to recovery, boom.

- Cyclical – due to business cycle

- Policies = training, subsidies, increase of AD

- Low & Stable inflation

- Inflation = sustained increase of the average price level.

- Deflation = sustained decrease in the average price level.

- Disinflation = a decrease in the rate of inflation.

- Inflation = %changeCPI

- Consequences = uncertainty, less savings, damage to exports, increase in cyclical unemployment, bankruptcies

- Stagflation = recession with rising inflation

- Economic Growth = Growth of (real) GDP over time

- Increase in Output

- Outward shift of PPC (Production Possibility Curve)

- Increase in potential output

- Income Distribution & low poverty

- Lorenz Curve/Gini coefficient

- Poverty & Taxation

- Marginal Tax Rate = extra tax on extra income

- Average Tax Rate = tax over income

- Progressive = more income, more tax

- Proportional = % of income

- Regressive = more income, less tax

- Fiscal Policy = Government Spending and Taxation

- Expansionary

- May close deflationary gap

- Increase AD & Growth

- Increase of Gov. Spending

- Decrease in Gov. Revenue

- Possible increase in inflation

- Contractionary

- May close inflationary gap

- Decreases AD & inflation & growth

- Government Spending Increases

- Government Revenue Decreases

- Unemployment increases

- Monetary Policy = Interest Rates / Exchange Rates = Central Banks

- Expansionary

- Increase in AD

- Close deflationary gap

- Lower interest rates

- Increase S of Money

- C, I, (X-M) increase

- Contractionary

- Decreases AD

- Close inflationary gap

- Increase S of Money

- C, I, (X-M) decrease

- High interest rates

- Supply-Side Policies

- Increased Production by: improving institutions, capacity,

- Market based or interventionist

- Interventionist = Investment in

- Human Capital - Training

- New Technology – Research and Development

- Infrastructure - Improvement

- Industry – Tax Cuts

- Market based

- Encourages competition – deregulation

- Reforms – less union power

- Policies – tax cuts, investment

- Effectiveness

- Time Lags

- Creates unemployment

- Greater choice

- Requires resources

- Efficient

- Source of foreign exchange

- Increased competition

- Producer benefits

- Interventionist = Investment in

Pictures to International Economics

3. International Economics

- Free Trade – lower prices for consumers, producer benefits, resources, competition, foreign exchange

- Absolute Advantage

- Comparative Advantage

- WTO – World Trade Organization

- 1995

- 153 countries

- Trade liberalization

- Arbitrator

- Biased for US & EU

- Economics only no human viewpoint

- Restrictions = Protectionism

- Tariffs

- Quotas

- Subsidies

- Administrative Barriers

- + Domestic jobs, national security, industries, health, environmental standards, anti-dumping measures, source of government revenue

- - Inefficient use of resources, retaliation, trade wars, political tensions, corruption, costs, less imports, less export competition.

- Exchange Rates

- Floating = free, no market, government or bank intervention

- Fixed = set and maintained by government or bank

- Managed = allowed to float within a certain range

- Change in D & S

- D for exports, D for imports, interest rates, inflation, oversea investment, speculation, and tourism.

- Effects of D & S

- Change in inflation rate, employment, growth, and balance of payments.

- Appreciation = increase of price in a floating rate.

- Depreciation = decrease of price in a floating rate.

- Revaluation = official price increase in a fixed rate.

- Devaluation = official price decrease in a fixed rate.

- Balance of Payments = a record of all transactions of a country with the rest of the world over a period of time.

- Current Account

- Goods & services = exports and imports

- Primary income = profits, interest, rent

- Secondary income = aid

- Capital Account

- Debt forgiveness

- Non-financial assets

- Financial Account

- Foreign Direct Investment

- Sale of bonds and stocks

- Reserve assets

- Current Account Balance = Capital + Financial

- Account Deficit – May results in downward pressure on the exchange rate

- Implication:

- Foreign ownership of domestic firms

- Exchange & interest rates

- Indebtedness

- International credit ratings

- Expenditure Switching - low imports, high domestic production, devaluation, depreciation of exchange rate

- Expenditure reducing – low AD, low spending on imports, contractionary fiscal and monetary policies.

- Increased competition – growth of domestic market.

- Marshal-Lerner condition = For devaluation/depreciation of a currency to improve a current account deficit the sum of the PED for imports and the PED for exports must be greater than 1. (J-Curve Effect)

- Economics Integration & Trade Liberalization

- Trade Agreement – bilateral/multilateral – reduction tariffs, etc.

- Trading Blocs

- Free Trade Area – no barrier of trade to members

- Customs Union – common external tariff

- Common Market – free flow of Factors of Production

- Economic Union – same macroeconomic policies

- Monetary Union – same macroeconomic policies & free flow of FoPs & a common currency with a common central bank. (Euro Zone)

- + Lower costs, greater transparency, no exchange rate, less uncertainty greater political and economic power.

- - no independent monetary policies, no exchange rate policy, limited fiscal policy, loss of economic and political sovereignty.

- Terms of Trade = Avr. P of exports as index/Avr. P of imports as index x 100

- Improvement = Increase in imports

- Deterioration = Decrease in Imports

- Short Term Changes = D for exports, imports, change in global supply of key inputs, changes in inflation rates and exchange rates.

- Long Term Changes = world income level change, change in productivity and technological development and a Global redistribution of income.

Pictures to Dev. Economics

4. Development Economics

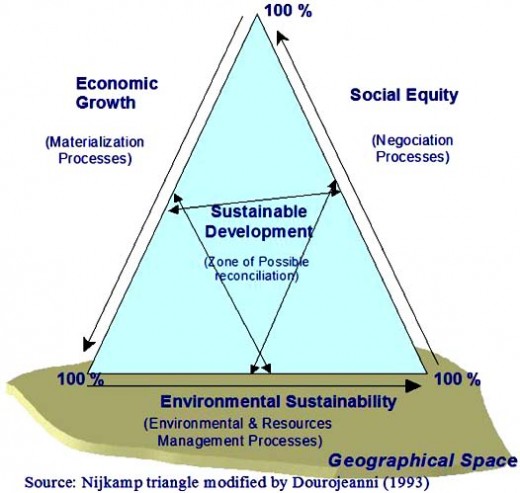

- Economic Growth = increase in (real) GDP over time.

- Economic Development = A multidimensional concept including the following:

- Reducing poverty

- Raising living standards

- Reducing income inequalities

- Increasing employment opportunities.

- Economic Development needs growth with few exceptions and growth does not lead to development without additional action!

- Common Characteristics of LEDCs

- Low GDP per Capita

- High Poverty

- Large agricultural sector

- Large urban informal sector

- High birth rate

- Diversity among LEDCs

- Variety of factors

- Resources

- Climate

- History

- Stability of the political system

- Poverty Trap/Cycle

- No investment in human capital due to low savings

- Transmission of poverty from generation to generation

- Intervention needed to break

- Aid often useless

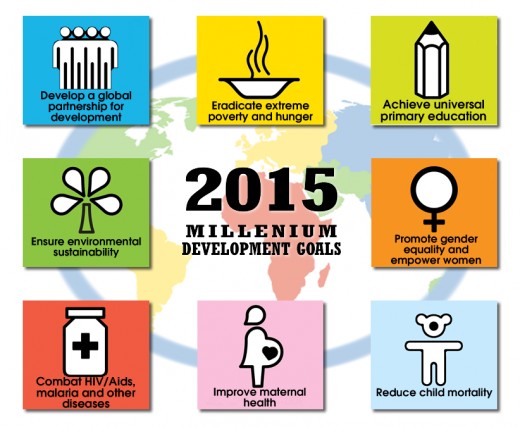

- Millennium Development Goals until 2015

- Eradicate Poverty/Hunger

- Achieve universal primary educaton

- Promote gender equality

- Reduce child mortality

- Improve maternal health

- Combat HIV/Malaria

- Ensure Environmental stability

- Global partnership for development

- Measuring Development

- GDP & GNI per Capita

- No income distribution

- No environmental degradation

- No living standards

- Human Development Index

- Life Expectancy

- Literacy Rate

- GDP

- No human freedom measure

- No Gender equality

- No environmental measure

- No political measure

- National average only.

- Domestic Factors & Economic Development

- Education & Health

- Higher labour productivity

- Faster long-term growth

- Improved living standards

- Larger workforce

- Credit & Microcredits

- More investment

- More business

- More employment

- More human capital

- Break of poverty cycle

- Appropriate Technology

- Capital – physical capital, jobless growth

- Labour – use of labour, less unemployment

- Empowerment of Women

- More employment

- More family security

- Lower mortality rate

- Increaser health

- Political involvement.

- Distribution of Income - Leads to all factors

- Poverty reduction

- Less corruption

- Increased trust

- Increased health and education

- Lower civil unrest

- More investment

- More demand

- Cyclical nature of increase

- International Trade & Economic Development

- Barriers to Development

- Over-specialization – inelastic demand

- Price volatility

- No access to markets - protectionism

- Long-Term changes

- Trade Strategies for Economic Growth & Development

- Import substitution

- Export promotion

- Trade agreements

- Trade liberalization

- Diversification

- WTO

- Foreign Direct investment FDI = long-term investment where a firm based in one nation establishes pressure in another country.

- Multinational cooperation = a firm within more that one nations.

- In LEDCs – new resources, markets, lower costs, less rules.

- Stable environment

- Public policy

- Weak regulation

- Secure legal framework

- High human capital

- Large market

- Free trade areas

- For:

- Investment

- Gov. revenue

- Less unemployment

- Training

- Management

- Technology

- Against:

- Hurts domestic firms

- Inappropriate technology

- Unskilled labour

- Inequality of income

- Political & economic power

- Profits may go abroad

- Foreign Aid (Official Development Aid & Non-governmental Orgs.)

- Humanitarian Aid = Food, medical supplies, relief aid

- Development Aid = loans, project aid, programme aid

- NGOs – small scale aid to achieve development objectives

- Bilateral, Multilateral, Tied Aid

- IMF, UN, UNDP, World Bank.

- Effective or Ineffective

- Foreign Debt = owed to non-residents of a nation. Money owed to foreign entities.

- High levels lead to:

- Foreign exchange earning depleted

- No gov. funds

- Political tensions

- Investment decreases

- Opportunity costs

- Balance of payments problems

- Development to be achieved by:

- Good governance

- A balance of Market-based and interventionist politics

Governmental cooperation