Globalization of The World Economy is the root cause of The looming Global Economic Crisis

Global Economic Crisis

January 5 2016— There is a general atmosphere of a looming Economic crisis worldwide. The new economic theory comes at a particularly crucial moment in the evolution of the international economic and monetary situation and the decisions or lack thereof for advancing the new future economy will influence the course of events for years to come. It is one of the aims of the new idea MuRatopian Intersection Economics to define the areas of economic and technological solutions capable of resolving the crisis: (1) the international monetary crisis and its economic consequences, (2) the so-called economic recession, and (3) the military conflicts which are shaking numerous regions of the developing sector and an increasingly endangering world peace and stability.

Given the causal links which connect these three points it would be inappropriate to hesitate to introduce political considerations in analyzing them. We are presently confronted with a transitional phase in the evolution of the international monetary and economic situation. The exponential increases in the indebtedness of the developing sector nations since 1973 has forced a general recognition that a failure to find a rapid institutional solutions to Third World debt and correlated problems implies that the world would move inevitably towards a massive international monetary crisis, an illiquidity crisis followed by a general writing off of hundreds of billions of valueless paper assets, the classical road straight into the mouth of a world depression.

What the Economic Crisis Really Means - and what we can do about it

In pioneering the MuRatopian Intersection Economics the author of The New Future of Money not only acknowledged the irremediable failure of the postwar international Monetary System and its institutions, but at the same time the need to create the institutional forms for a global change in the monetary system. Those who have observed this evolution over time will know the importance of the open break with Keynesian theory which Schmidt announced in 1976. Keynes and equilibrium theoreticians of the International Monetary Fund had been proven wrong in practice-- the iron test of the failure of the theory.

We are thus confronted by the paradoxical situation that two fundamentally anatagonistic economic and monetary systems are simultaneously functioning in the Western World. The old monetary system and its institutions still largely rule over the behaviour of the international markets, yet the embroy of the new system is growing. Nonetheless, the new proposed economic concept will lead to the massive change of the rules of the game in international financial markets.

The MuRatopian Economy has set no small task for itself. We intend nothing less than to bring about a new worldwide equitable economic development and general peace. We want to orient ourselves to earlier high points of human culture, the true democratic processes and mankind periods, and study how mankind overcame the earlier dark ages which show close parallels with the present situation. We proceed with confidence that we, strengthened by the superior examples of great philosophers of the past, can again bring forth great nation-state economies, democracies, and thinkers.

And we are firmly convinced that man is endowed with reason, and it cannot be mankind’s purpose that only a few individuals reach the level of reason and thinking; on the contrary, we are convinced that through our efforts the Age of reason can be attained.

World Banker Makes Stunning Confession

The first major conference on the financial and economic crisis to involve all countries ended with rich countries blocking substantive reforms demanded by developing countries. The UN conference did however push key issues up the international agenda, such as the need for a better system of international reserves, and for genuine policy space for developing countries.

— — Economic crisis: rich countries block reform at UN summit, Bretton Woods Project, June 26, 2009

Two Kinds of "Economics"

Taking the two conflicting economic systems practiced during the nineteenth century capitalism until now, all principle species of economy today can be grouped chiefly in two principal types of today’s mutually opposing systems, herein defined as: on the one side, the traditional economic system; versus, on the opposing side, the science of economic foundation. That science of economic foundation is the foundation of new crafted intelligent economic theory MuRatopian Intersection Economics.

The MuRatopian Intersection Economics is derived, by way of the influence of Professor Kaoru Yamaguchi, with the combined effect of the founding of the Kelsonian binary model, the new structural law of supply and demand and the founding of Creativity Machine Paradigm.

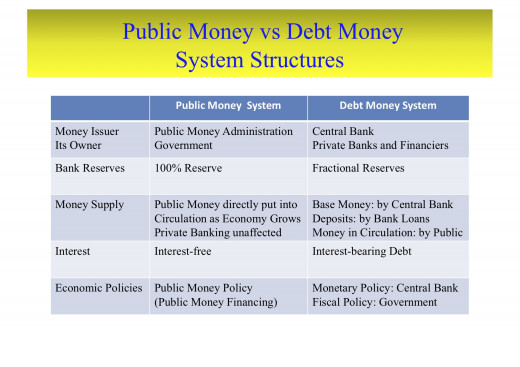

The ESSENCE of a new global economic evolution is tied to (1) design a Public Money system and (2) it points the way to scientific and technological revolution which will increase, by democratic capital acquisition, and ownership-broadening approach, both in production process on Earth, and with the earnings of capital to poor and middle class people, and thereby introduce a completely new phase in the evolution of the human species. (See Kelso and Adler, 1958, 1961; Kelso and Hetter, 1967; Kelso and Kelso, 1986, 1991).

Civilization is born when people come together to form a society, they are agreeing on a shared economic future- a ways and means of doing things collectively. It then creates an atmosphere in which ideas flow with fair trade. That is vital to the evolutionary process within the economy.

Transition Process to the Public Money System

Critical Indicators Scream Global Crisis is Deepening

The Global Economic Crisis Is Getting Deeper

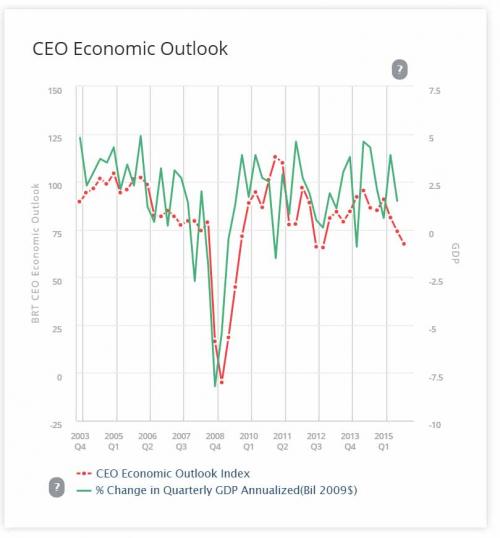

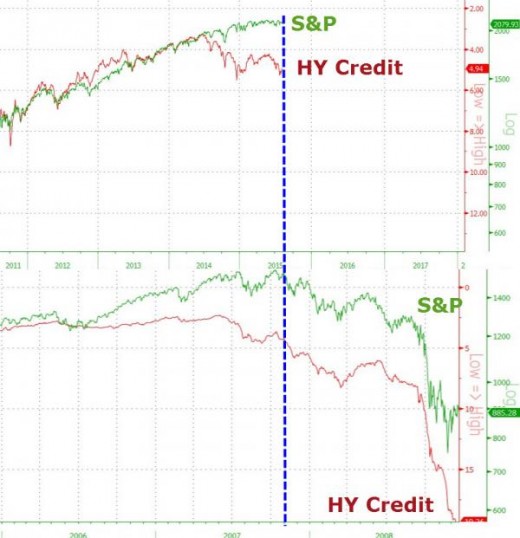

Economic activity is slowing down all over the planet, and a whole host of signs are indicating that we are essentially exactly where we were just prior to the great stock market crash of 2008.

#1 On Tuesday, the price of oil closed below 40 dollars a barrel. Back in 2008, the price of oil crashed below 40 dollars a barrel just before the stock market collapsed, and now it has happened again.

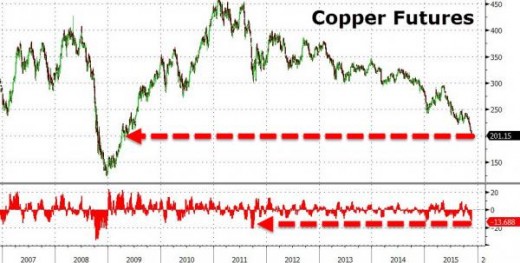

#2 The price of copper has plunged all the way down to $2.04. The last time it was this low was just before the stock market crash of 2008.

#3 The Business Roundtable’s forecast for business investment in 2016 has dropped to the lowest level that we have seen since the last recession.

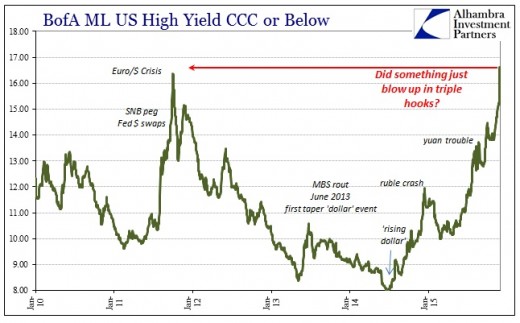

#4 Corporate debt defaults have risen to the highest level that we have seen since the last recession. This is a huge problem because corporate debt in the U.S. has approximately doubled since just before the last financial crisis.

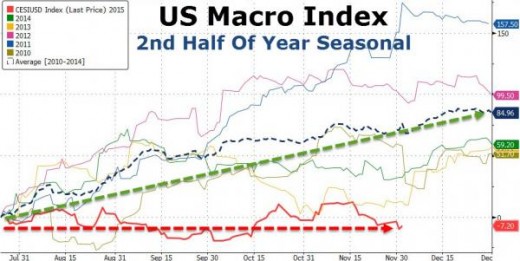

#5 The Bloomberg U.S. economic surprise index is more negative right now than it was at any point during the last recession.

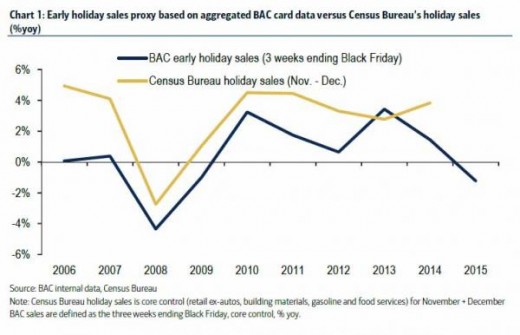

#6 Credit card data that was just released shows that holiday sales have gone negative for the first time since the last recession.

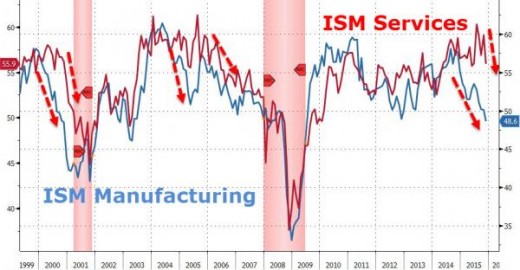

#7 As I mentioned yesterday, U.S. manufacturing is contracting at the fastest pace that we have seen since the last recession.

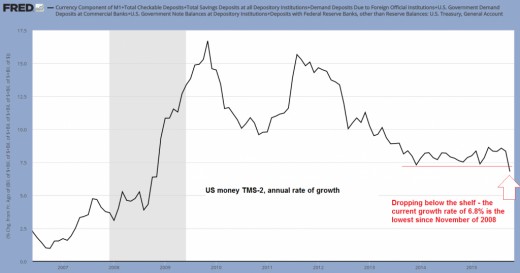

#8 The velocity of money in the United States has dropped to the lowest level ever recorded. Not even during the depths of the last recession was it ever this low.

#9 In 2008, commodity prices crashed just before the stock market did, and late last month the Bloomberg Commodity Index hit a 16 year low.

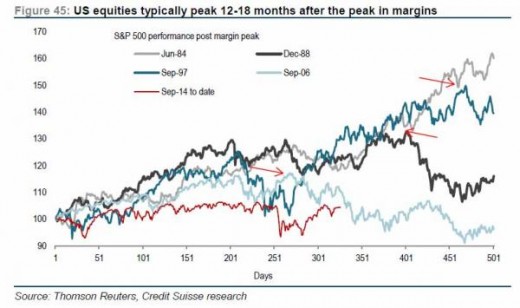

#10 In the past, stocks have tended to crash about 12-18 months after a peak in corporate profit margins. At this point, we are 15 months after the most recent peak.

#11 If you look back at 2008, you will see that junk bonds crashed horribly.

Why this is important is because junk bonds started crashing before stocks did, and right now they have dropped to the lowest point that they have been since the last financial crisis.

Bonus Alarm #12: The US Services economy is weakening in its usual lagged way to manufacturing. This is a problem as the narrative has been that Services will save the economy even as manufacturing collapses.

Why The Crash of 2016 Will Happen...

The Future Lies in MuRatopian Intersection Economics

Professor Kaoru Yamaguchi, the original founder of MuRatopian Economy concept and Louis Orth Kelso the founder of binary economics and others, exerted a powerful influence upon Ssemakula Peter Luyima's research work The New Future of Money that greatly enabled the author to craft a new economic theory known as MuRatopian Intersection Economy.

The new economic theory discovery, is necessary to define the future of the entire world, as an alternative that will bestow equitable and global sustainable progress of mankind for thousands of years into the future: the utilization of public money system on the basis of two factor economics and new structural laws of demand and supply, triumps over conventional economics.

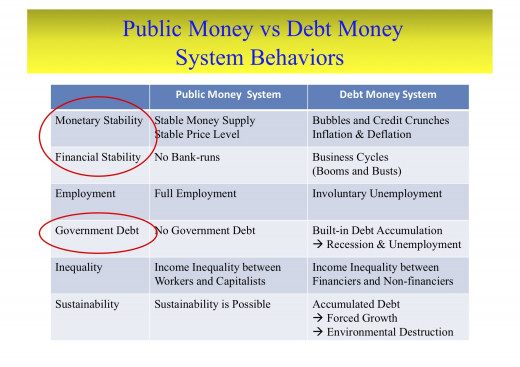

The mission of the new economic theory is to form scientific collaboration among all countries in the world to play a prominent role, because as an equitable approach for the World economy, it does not follow the debt economic system, but instead introduces public money system with new binary reform market system approach, which makes possible an economic revolution. Instead of the debt money system, in which there is a great human suffering, it will become possible to build a new economy to convert the debt money system into public money, and much higher efficient binary market economy system.

Professor Kaoru Yamaguchi, Ph.D. (UC Berkeley)

We are currenlty living under the Debt Money System, which has been, for centuries, the root cause of many socio-economic instabilities and disersters such as Booms and Depressions, Inflation and Deflation, Unemployment, Inequality, Wars, and Environmental Destruction. In addition, it has served less than 1% of humanity. To be freed from these calamities, we have to establish the Public Money System for the welfare of 120% (including future humanity)

— Professor Kaoru YamaguchiThe collaboration among the world nations is paradigmatic for the new era of mankind, in which we-instead of plunging ourselves into geopolitical wars-will concentrate on the common aims of mankind. This new economic platform begins a new age of mankind. The utilization of MuRatopian Economy will be the game-changer which will revolutionize all relationships in science, economy, and politics on the Earth and Climate justice.

Philosopher Louis Orth Kelso

The low credibility of government and of all lesser institutions in America today is a consequence of our own increasingly hollow democracy. It is reflected in the rising domestic crime rate and the social and political alienation of people in all walks of life, except for the rich and their sycophants. The real collapse of American ideological leadership in the world can best be seen in the feebleness and confusion that characterizes American foreign policy. The handwriting on the wall is clear

— (Louis O. Kelso, 1984)A new strategy for mankind means the ability, from now on, to see human species as a unity, and to see that unity in the process of mutual development. Thus, along with Louis Orth Kelso, we see no contradiction whatsoever between the inviolability of national sovereignty, which is guaranteed by the law of nations and by the United Nations Charter, and the rationality of the world citizen who has in view the interests of mankind as a whole. For this unity lies in the higher development of all; the concordance of the macrocosm requires the maximal development of all microcosms to their reciprocal benefit, as Professor Kaoru Yamaguchi.

This also signifies a new model of cooperation among the nations of the world. It means that all potential treaty organizations and alliances must be inclusive, that they cannot be for the security and economic interests of some nations, while excluding others. While the support of mutual development is the premise, they must nonetheless respect the different levels of development, history, culture, and social systems, above all, respect national sovereignty. That is Professor Yamaguchi’s idea of unity in multiplicity, and it must be inspired by a tender love for the idea of the community of nations, for the idea of mankind as the creative species.

Toward a New MuRatopian Intersection Economics -- Issues & Questions

Theory of Conventional Finance System & MuRatopian Economy

Notes And Sources

(1) US Congressional Briefing 2011, July 26, 2011 by Prof. Kaoru Yamaguchi: TRANSCRIPT (This is a transcript of my US congressional briefing on the workings of the public money system)

* (1-Page Briefing Note for Media) (One page briefing note distributed to the Media)

(2) HR 2990 (NEED Act, National Emergency Employment Defense Act)

Congressman Dennis Kuchinich's Bill based on the American Monetary Act,

which is submitted to the US House Committee on Financial Services on Setp. 21, 2011.

(3) Workings of A Public Money System of Open Macroeconomies;

(Paper, Slides and YouTube) at the 7th Annual AMI Monetary Reform Conf.

University Center, Downtown Chicago, Sept. 30, 2011.

(4) A Program for Monetary Reform by Irving Fisher, etc., July 1939.

(Reformatted by the Kettle Pond Institute)

(This document is an extended version of the original "The Chicago Plan for Banking Reform" by Henry Simons, etc., March 16, 1933).

(5) On the Monetary and Financial Stability under A Public Money System;

( Paper, Slides and YouTube ) at the 8th Annual AMI Monetary Reform Conference, University Center, Downtown Chicago, Sept. 20 - 23, 2012.

(6) Public vs Debt Money Systems - the American Monetary Act in a Nutshell;

(Paper, Slides and YouTube) at the 9th Annual AMI Monetary Reform Conference,

University Center, Downtown Chicago, Sept. 19 - 22, 2013.

(7) From Debt Money to Public Money System - Modeling A Transition Process Simplified;

(Paper, Slides) at the 10th Annual AMI Monetary Reform Conference, University Center,

Downtown Chicago, Oct. 2 -5, 2014.