Is Inflation Always Bad?

Go Back to the Gold Standard

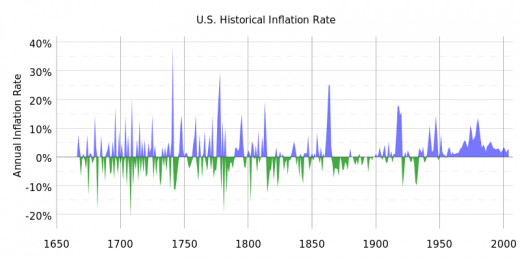

For much of American history, the value of a dollar has tended to stay fairly stable. The relative value of American money tended to go down because of inflation during war, and it would increase due to deflation during financial meltdowns.

This changed during the 1970s when the nation went off the gold standard. Since the 1970s, the value of a dollar has dropped considerably. One dollar in 1970 would be worth about six dollars today. Is this necessarily a bad thing though? Should we go back to the gold standard as some people are calling for? Inflation can be a very bad thing for some people, but some people will benefit quite a bit.

The 1896 Election

The gold standard and tight money has generally been popular among the banking classes. The gold standard and price deflation works quite well for those who are creditors. In 1896, many farmers had trouble with mortgages and tight money from the Panic of 1893. Many had to foreclose.

The Populists and the Democrats supported William Jennings Bryan for president that year. Bryan called for the "free and unlimited coinage of silver" to expand the money supply. It was thought that this move would help the farmers pay off their debt more easily. The bankers and other goldbugs supported the eventual winner William McKinley. It was thought by many that tight money was good. However, was this necessarily the correct opinion?

- Inflation Calculator | Find US Dollar's Value from 1913-2013

Easily calculate how the buying power of the US dollar has changed from 1913-2013; get inflation rates, and inflation news.

Why Does Deflation Hurt Most People?

Most people think that deflation would be a great thing. Who wouldn't want to pay $0.50 for a loaf of bread that now costs $1.50? This sounds like a great deal, doesn't it? Until the cost of debt is included in the equation.

Most people have to take out a mortgage to pay for their homes. To show how deflation of the money supply (and wages) hurts most people, let us keep the numbers quite simple.

Bob earns $1,000 per month. His monthly mortgage payment is $250. This 25 percent cost for housing is very reasonable.

Now let's say that there is cost deflation and wage deflation so that the income keeps in line with consumer costs by 25 percent. Bob now makes $750 per month. His food and discretionary costs might go down. However, his mortgage payment will still be $250. This will now make up 33 percent of his monthly budget. Therefore, his purchasing power has gone down from 75 percent of his monthly income to 66 percent of his monthly income. Only if costs go way down will Bob be in better shape.

Who benefits from this scenario? The bankers. Loans are getting paid back at the older rate in the current dollars that are suddenly more valuable. In other words, if wages deflate with the cost of living, those who already have plenty of money will be able to benefit in terms of higher payments in real terms and lower costs on real property. Those who are wealthy will frequently be able to gobble up property at low prices.

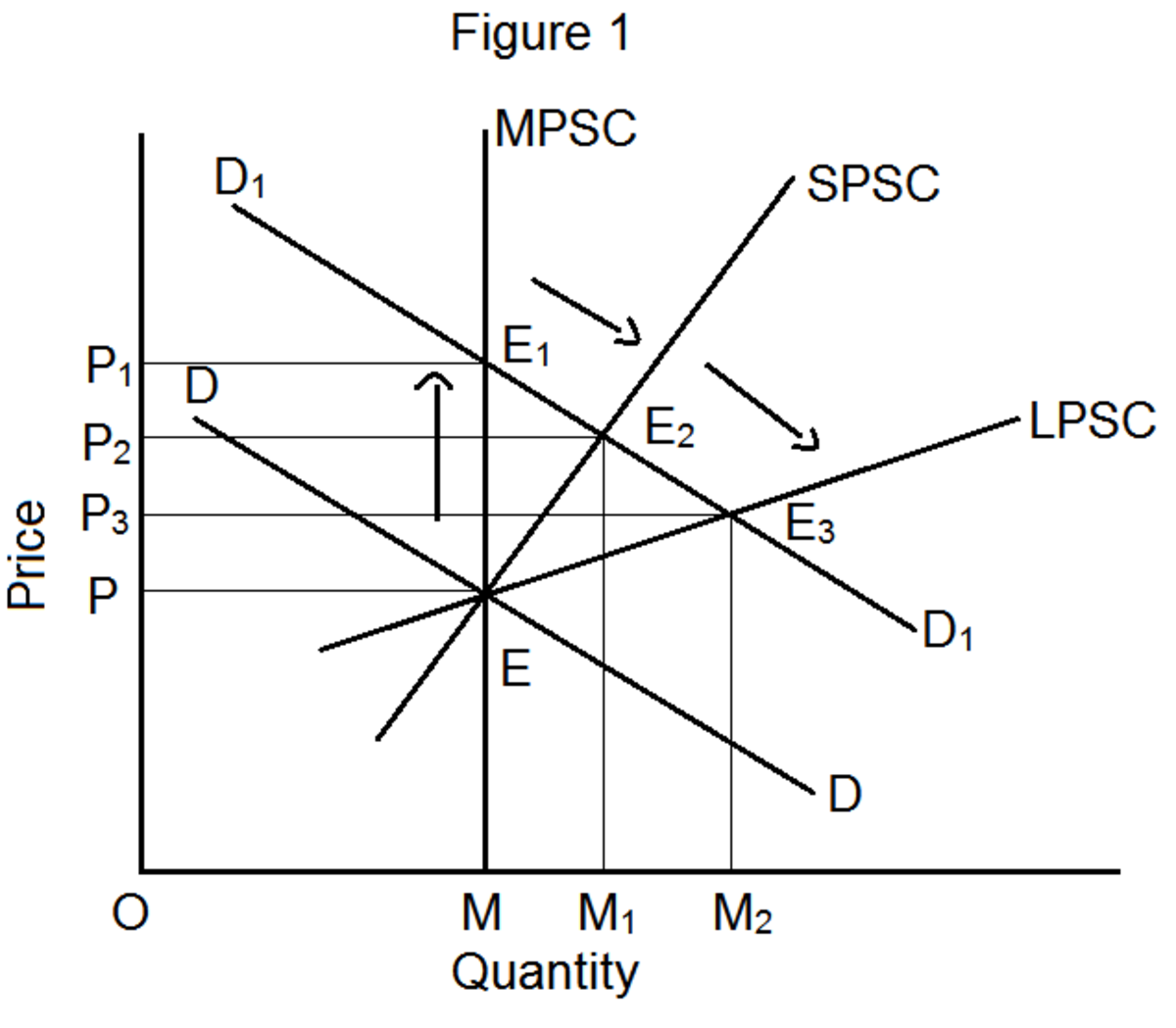

Is Inflation Good for Anyone?

If deflation impacts borrowers in a negative way and creditors in a positive way, inflation can have the opposite effect as long as wages keep up with the inflationary pressure. If there is economic (and usually wage) stagnation during an inflationary period (called stagflation), this can be bad on most people because discretionary income will go down.

To show that inflation can actually be a good thing for borrowers, please consider the following example in which inflation and wages are considered to keep up with each other.

Jerry makes $1,000 per month and has a monthly mortgage of $250. His mortgage, just like Bob's in the example above takes up 25 percent of his income.

Let's say that inflation over five years is 5 percent per year (25 percent total--this number will be slightly off because of compounding, but it will suffice because of the easy math).

Jerry now makes $1,250. Where he had discretionary income of $750 before, he now has $1,000. If his costs increased by 25 percent and he has not increased his standard of living, he should be spending about $937.50 per month ($750 + 25 percent). His mortgage would now by only 20 percent of his monthly income. Therefore, Jerry would actually be almost $50 ($63.50 in nominal terms) ahead in real terms after deducting the 25 percent decrease in the value of the dollar over this period.

If Jerry comes out ahead, bankers will come out behind because they will be getting paid at the devalued rate. From these examples, it is easy to see that the majority of people can actually benefit from inflation when their wages can keep up with the increased cost of living. It is easier to pay off debt, and there can actually be additional money available to drive the economy and jobs.