The Silent Knight of Singapore against COVID

Fiscal policy refers to the government expenditure and tax rates to influence as well as monitor a country’s economy. Unless you have been living under a rock, you would have heard about the fancy named budgets that the SG government, particularly Ministry of Finance has come up with this year – Unity, Resilience, Solidarity and Fortitude. DPM Heng, minister for finance, has presented these budgets and I do intend to explore measures implemented in each of those budgets and my thoughts about them but that would be for a different post. In today’s post I want to talk about the other type of policy that has been mentioned much lesser in the media – Monetary Policy!

Monetary policy refers to the actions taken by the central bank to control money supply in order to achieve sustainable economic growth. Now that we have gotten the terminologies sorted out, what is SG’s central bank? It is the Monetary Authority of Singapore (MAS). MAS uses the exchange-rate policy in order to maintain price stability. You may ask why not use interest rate policy like USA. Well the answer for that is the type of economy Singapore is. Singapore is a small and open economy where gross exports and imports of goods and services account for more than 300% of GDP and our domestic expenditure is mostly on imported content. As such, since domestic consumption is a low percentage of our GDP, interest rate policy would not be the most optimal. Hence, the exchange-rate has a much greater influence on inflation.

So how does MAS implement this Exchange-Rate Based Monetary Policy? MAS has several important features in this exchange-rate system. Firstly, the SGD is managed against a basket of currencies of our major trading partners and competitors. The currencies are given importance based on our trading relations with that country. Secondly, MAS operates on a managed-float system. This means that the exchange-rate is allowed to undergo small fluctuations within a fixed policy band. This allows flexibility in managing the exchange-rate. Lastly, this policy band is reviewed periodically to ensure that it is optimal and adheres to underlying fundamentals of the economy. As for interest rates, they are largely determined by foreign interest rates and investors confidence and expectations of future movements in SGD.

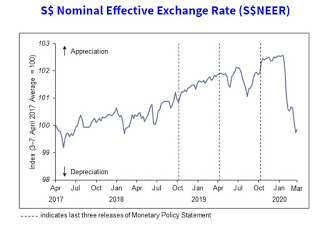

Singapore closed its borders to foreigners travelling from China around the end of January and this is when we started facing economic impacts of COVID due to Chinese tourists being a huge part of local tourism. On 5th February, MAS has stated that its monetary policies remained unchanged and the reason for that? Our policy band was reviewed back in October 2019 and the rate of appreciation was reduced back then. The Singapore Dollar Nominal Effective Exchange Rate (S$NEER) was fluctuating near the upper bound of this policy band and thus there was sufficient room for the S$NEER to ease with the incoming economic impacts. Fair enough because it actually makes sense. First week of February it was just the beginning stages and economic activity was normal except for the tourism industry which had just taken a hit. On 13th March, MAS released another statement where it said SGD market and FOREX market are functioning normally despite heightened volatility in global and domestic financial markets. They also mentioned that MAS has left a higher liquidity in the banking system and that SG’s interest rates have eased following suit global interest rates. The S$NEER also eased in its policy band. So from this it appears that all seems to be still working well and there is no need to touch our monetary policies at all since the S$NEER is within the band and the FOREX and SGD market is functioning normally. On 19th March, MAS announced that it will swap USD 60 billion with the Federal Reserve (US’s Central Bank). This move basically means that MAS will buy USD 60 billion with SGD using the exchange-rate at that time and will return it back at a later time for the same amount. This basically helps out to ensure that there are stable liquidity conditions in local USD funded markets. The only way I think this will backfire Singapore is if the USD depreciates then swapping it back for the same value will result in a loss for MAS. However, that is rather unlikely despite the Fed printing money as USD is the reserve currency of the world. Another cheeky thing MAS did is that it stated that the MAS Standing Facility is available for eligible banks to deposit or borrow SGD funds against specified collateral. I was curious on this Standing Facility (SF) and I went to check it out.

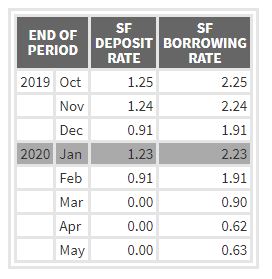

As you can see from this data present in their website, the interest for the deposit rate fell to 0% and the borrowing rate fell by around 1 percentage point comparing February 2020 and March 2020. This shows that borrowing has become cheaper while depositing has become less rewarding. This would obviously encourage banks to borrow rather than deposit in order to exploit the cheap borrowing rates. However, as I mentioned earlier, MAS does not use interest rate as its policy. Hence, these rates have been determined by global interest rates – my guess would be US of course!

Anyways on 30th March, MAS released its periodic report where it unveiled its policy band and level of S$NEER.

Based on this chart, the S$NEER was near the upper bound back in early February and took a large depreciation where it is now under the mid-point. In the report, it was stated that most segments have had a lacklustre performance except for biomedical and precision engineering industries. Decline in external demand and disruptions in supply-chains also will weigh down the growth of trade-related industries. Wage growth is also expected to slowdown and unemployment rate to increase despite the Jobs Support Scheme Fiscal Policy. MAS has stated that it obviously expects GDP growth to be negative this year -4% to -1%. The weak economic outlook and macroeconomic conditions have caused the S$NEER to depreciate. In response tot this, MAS has said that it will adopt a Zero Percent Per Annum rate of appreciation from the current level of S$NEER. However, it stays resolute in the fact that there is no need to adjust the policy band. The question here is – should MAS readjust the policy band due to the new fundamentals of current global economy? As for me, I feel that it is not necessary as there is still time. We are only beyond mid-point and not at the lower bound yet. Besides, by maintaining this, it will provide stability to the exchange-rate and current trades. Anyways back to the report, MAS has stated that it will complement the fiscal efforts by the government by ensuring that sufficient liquidity is provided to the financial systems and price stability is maintained. On 31st March, MAS released a statement saying that it will support individuals and SMEs through a package of measures. The three components of this package are - help individuals to meet their loan and insurance commitments, support SMEs with continued access to bank credit and insurance cover and lastly to ensure interbank funding markets remain liquid and well-functioning. For the first component, individuals with certain types of loans are able to basically defer the loans from 6 months up till the end of this year. This would generally help those who have faced a decrease in their monthly income. For the second component, SMEs may opt to defer principal payments on their secured term loans or pay in installments payment plans etc, somewhat similar to individuals as well. Bank and finance companies may apply for low-cost funding through a MAS SGD Facility till December 2020. As for the third component, MAS stated that it is providing sufficient liquidity to SGD and USD funding markets in Singapore. This will enable financial institutions to fund themselves as well as provide essential financial services. The 60 billion USD swap with the Fed has also enabled MAS to be able to increase its daily USD swap through Money Market Operations (MMO) to the banking system. On 8th April, MAS launched a 125$ million package (and a further 6$ million on 13th May) for financial institutions and fintech firms to strengthen their long-term capabilities. 90$ million will be spent on workforce training whereas 35$ million will be spent on strengthening digitalization and operations. This is quite a clever move in my opinion by MAS. By providing most of the fund into workforce support and training, these firms can continue to keep their employees as well continue to accept fresh graduates. Furthermore, these companies do not require to set up physical infrastructure and developments could be done remotely during the lockdown period. Hence, I feel that MAS has used the lockdown as an opportunity to help boost these companies’ growth through long-term productivity measures. On 16th April 2020, MAS announced measures to help REITs listed in the SGX to pay their taxable income such as by giving an extension. This will aid in managing their cashflow. On 20th April, MAS introduced another SGD Facility to help out SMEs indirectly, this time offering loans to banks and financial institutions at 0.1%. This will make loans provided to SMEs by financial institutions more affordable. On 30th April, MAS introduced further deferments plans for individuals on student loans, motor vehicle loans and so on. Furthermore, individuals who have missed GIRO deductions can have bank fee waived for those failed deductions up till the end of this year. On 3rd June, MAS introduced further loans and cashflow support for landlords – individuals, SMEs and large REITs. This will ensure that the landlord pass on their savings to their tenants which will ease the pressure caused by the fall in income for many. This concludes the general overview of measures meted out by the MAS in this COVID season.

Singapore is highly interconnected with other countries and the effects of COVID in those countries affect us in a large scale. Our open economy and firm hub for economic activities in South-east Asia has allowed us to advance really quickly in the past few years but this boon has become our bane now due to the massive disruptions of global supply chains which has caused a lower demand for the intermediate goods produced by firms in Singapore. Furthermore, collapse in foreign demand is also affecting our exports of goods and services. The lockdown has also slowed down our domestic sector which is less significant. We will be affected largely by external spillover effects from mainly China and USA as they are both our biggest trading partners. However, there is still some hope. Singapore boasts some of the most advanced research in the medical field and sectors such as medical technology and manufacturing as well as pharmaceuticals manufacturing will see positive growth. For example, Dyson has stated it will manufacture digital motors that would be assembled into ventilators and companies such as Razer and ST Engineering have set up production to produce medical products such as masks. Biolidics, a Singapore based medical tech firm has also produced rapid test kits. This means that Singaporean firm’s adaptability to the COVID situation could be of a great asset and when the vaccine is finally found, we could quickly switch production lines to mass produce it.

Moving forward, I feel that Singapore’s current short-term outlook is rather uncertain. The poor understanding of the COVID situation globally, which in turn implies that the extent and duration of the downturn in Singapore, as well as the strength of the eventual recovery, remain unknown. As of now, MAS has projected that our growth rate will be the worst in our history but I am confident that the current measures that MAS has implemented to ensure liquidity in Singapore’s financial institutions as well as measures to come will surely mitigate the impact of COVID on individuals, SMEs, large enterprises like the S-REITs and our economy…

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.