Marginal Costing

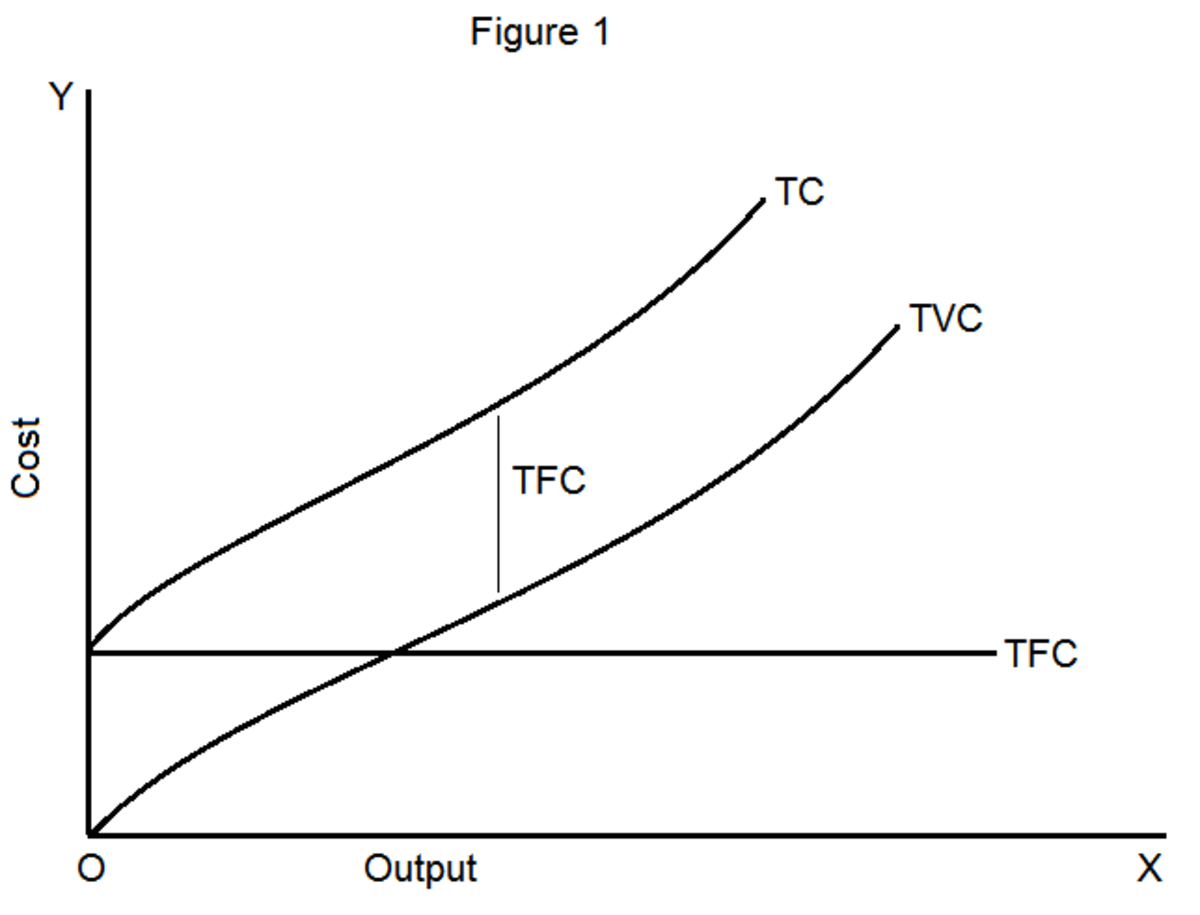

Introduction: Marginal Costing is a technique which also divides costs into two categories, but of somewhat different nature. In this case costs are identified as being either fixed or variable, relative to the quantity of output:

Total Cost = Variable Costs + Fixed Costs

Marginal Costing – Definition:

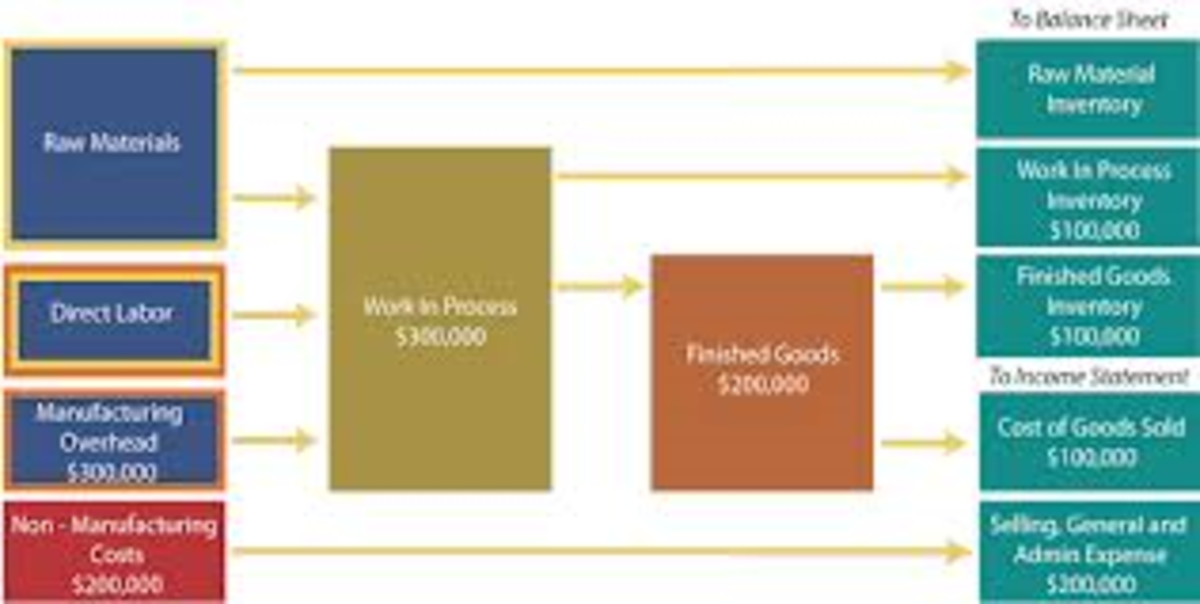

Marginal costing distinguishes between fixed and variable costs as conventionally classified. The marginal cost of a product is its variable cost. This is normally taken to be; direct labour, direct material, direct expenses and the variable part of overheads. Marginal costing is formally defined as:

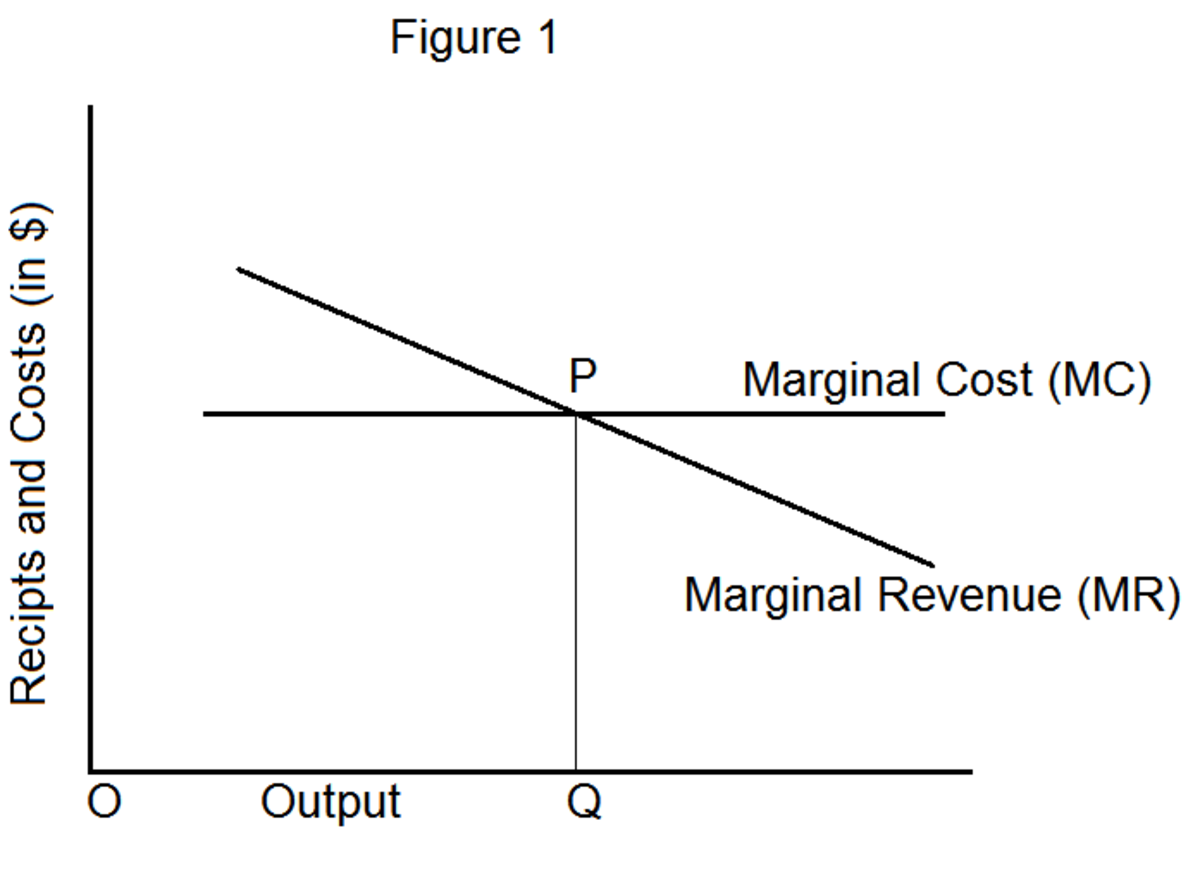

“ The accounting system in which variable cots are charged to cost units and fixed costs of period are written off in full against the aggregate contribution. Its special value is in recognizing cost behaviour and hence assisting in decision-making. “

The term ‘contribution’ mentioned in the definition is the term given to the difference between Sales and Marginal Cost. Thus

Marginal Cost = Variable Cost = Direct Labour

+

Direct Material

+

Direct Expenses

+

Variable Overheads

Contribution = Sales - Marginal Cost

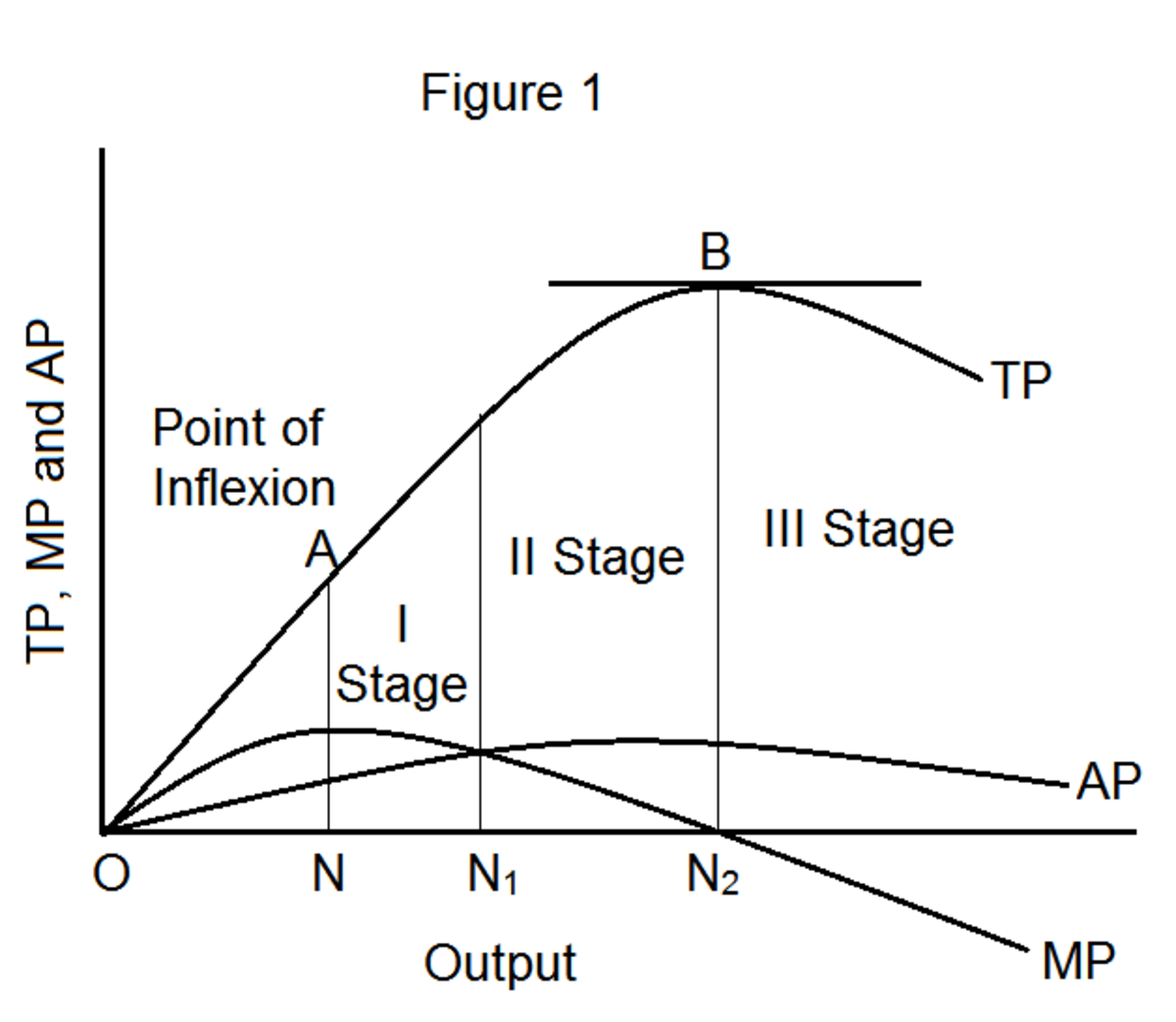

The term marginal cost sometimes refers to the marginal cost per unit and sometimes to the total marginal costs of a department or batch or operation. The meaning is usually clear from the context.

Ø Marginal costing involves ascertaining marginal costs. Since marginal costs are direct cost, this costing technique is also known as direct costing;

Ø In marginal costing, fixed costs are never charged to production. They are treated as period charge and is written off to the profit and loss account in the period incurred;

Ø Once marginal cost is ascertained contribution can be computed. Contribution is the excess of revenue over marginal costs.

Ø The marginal cost statement is the basic document/format to capture the marginal costs.

Note:

Alternative names for marginal costing are the contribution approach and direct costing.