What is Monetary Policy?

Introduction

Monetary policy is an important method to stabilize the economy. That is to avoid economic instabilities. Since, every economy is required to face many challenges to attain maximum economic benefits. Economists developed many tools like monetary policy, fiscal policy, income policy etc. So, monetary policy enables a country to eradicate economic bad conditions like inflation, deflation, price raising etc. Here this hub is aimed to explain monetary policy, its objectives, basic tools etc.

Monetary policy is considered as one of the macroeconomic policy. It is a system or practice where the central bank of the country formulates policies for the economy. Since the economy is under the control of central bank, they adjust the money supply to stabilize the economy. Here the central bank uses interest rate as a tool to adjust the money supply.

Main objectives of Monetary Policy

The implementation of monetary policy is aimed to attain the following objectives.

a) To help the economy to attain full-employment.

b) To produce maximum national output.

c) To ensure price stability from the trap of inflation and deflation.

d) To acquire economic growth.

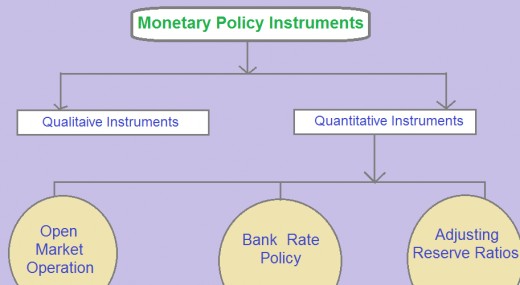

Instruments for Monetary Policy

Generally there are two types of monetary policy instruments using to control the economy. That is

i) Qualitative instruments and

ii) Quantitative instruments

Qualitative instruments are also known as selective policy. That is the central bank control an economy through policies for a specific part of the economy. For example, sometimes central bank controls a specific type of institutions through an independent policy. Such policies are implemented in those institutions which are challenging the economic system. If any institution is highly active in speculative business, then central bank may take a special control over them.

Quantitative instruments are imposed by central bank to control the economy as a whole. That is all the segments of the economy are come under the control of central bank. Commonly there are three instruments used as quantitative instruments. They are,

a) Bank rate or discount rate

b) Cash reserve ratio

c) Open market operation

These three instruments are briefly described below.

a) Bank rate or discount rate

Bank rate or discount rate is the rate of interest imposed by central bank on the borrowings taken by commercial banks. At a lower interest rate the commercial banks will borrow more from central bank. So, commercial banks must be able to provide more loans and advances to industrialists and business people. It will help the economy to increase the supply of money. On the opposite side at a higher rate of interest commercial banks will borrow less from central bank. So, the money supply will decline.

b) Cash reserve ratio

There are different forms of reserves imposed by different central banks in different countries. Anyway mainly there are two types of reserves. One is every bank must keep a portion of total deposits as a reserve with central bank. Further each bank is compelled to keep cash in liquid form within them to meet the urgent requirements of depositors. In short, central bank will fix a specific rate of reserve that must follow by every commercial bank. This will help the central bank to adjust the money supply in the economy. If the money supply is higher, then the central bank can increase the required reserve ratios to shrink the excess supply of money. This is because, at a higher reserve ratio, the amount for granting loans and advances will decline amount of money will be lower in the economy.

c) Open Market Operation

Open market operation is simply refers to the process of purchasing and sale of government securities and bonds. Open market operation is another widely using tool in the monetary policy. When supply of money in the economy is lesser, then government purchases the securities from public. That is money will be reach to the people and the money supply will increase. Similarly when money supply increased government will sell securities to re back the excess money in the economy. When people purchase securities the money will return to government tills and arrive to equilibrium.

How to Use Monetary Policy Instruments

Here it is aimed to learn how to use these monetary policy instruments to stabilize the economy. These instruments are implemented in two main economic unstable conditions, that is inflation and deflation. Each of them is explained below.

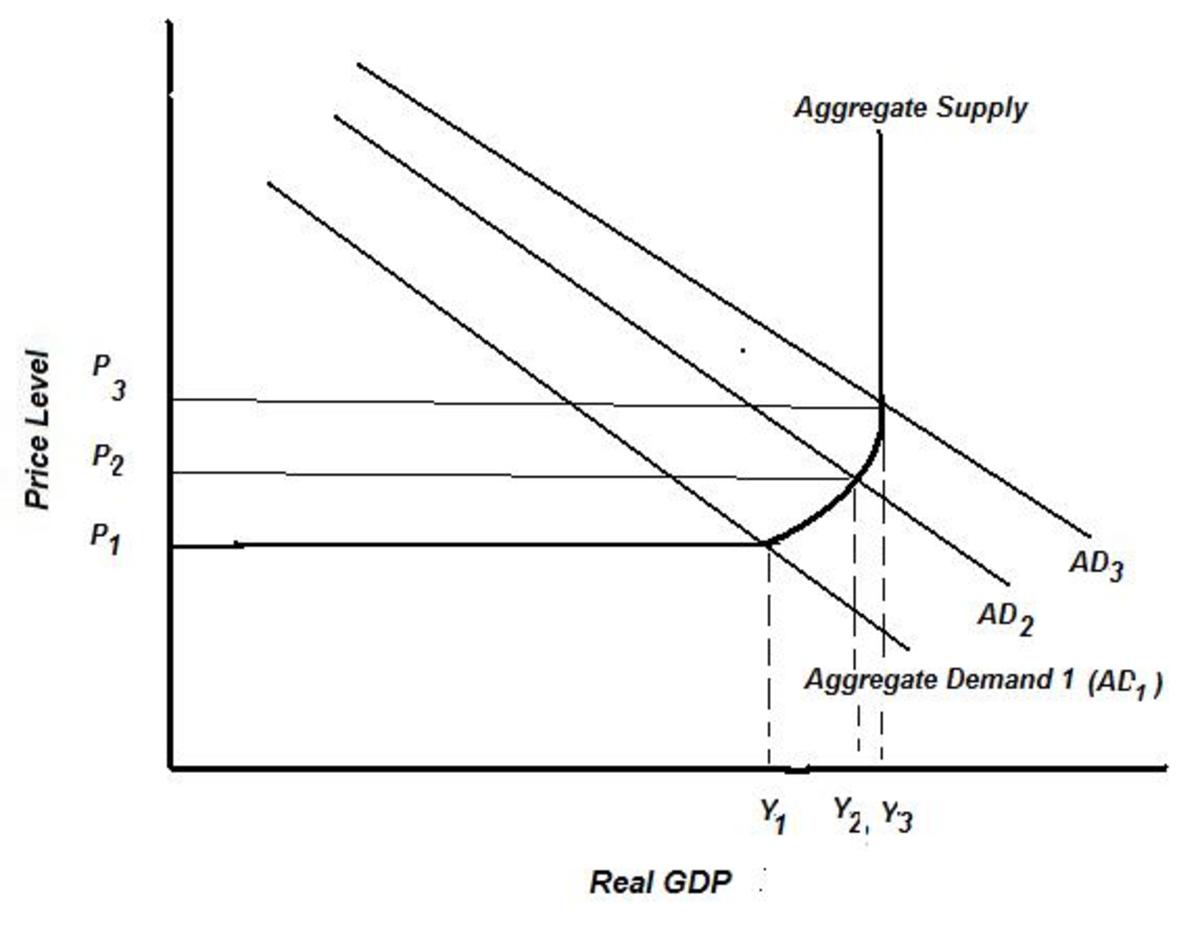

Monetary Policy during Inflation

Inflation is a phenomenon which consider as a burden to the economy. There are different views on inflation among economists. Simply inflation is an economic unstable condition where the prices and supply of money are arriving in its peak and the value of currency decreased. In such a dangerous condition monetary instruments are used to eliminate these problems. During inflation the money supply will be too large. So, the monetary policy is focused to reduce the excess supply of money. So, this monetary policy during inflation is popularly known as tight monetary policy. The following three actions will be taken as the cure for inflation.

i) Central bank will raise bank rate, which will reduce the amount of loans. That is commercial banks will borrow lesser amount from central bank and so the public also borrow less. In short it will reduce the money supply in the economy.

ii) Central bank will raise the required reserve ratios. When the reserve ratios are increased the commercial banks can only grant loans for smaller amount. So, the injection of money to the economy will decline.

iii) Government securities will sell to commercial banks and people. When people and commercial banks purchase securities the money in the economy will return to the monetary authority. So, supply of money will be lower.

Monetary Policy during Deflation

Deflation is also an economic phenomenon which is almost opposite to inflation. During deflation the money supply and the prices will be lower. Above all the unemployment will increase. In such a condition monetary instruments are used to eliminate this problem. Since, during deflation the money supply is very less the monetary policy will be focused to expand the money supply. So, it is also called as expansionary monetary policy. The following actions will be taken for meeting deflation.

i) Central bank will reduce bank rate. At a lower interest rate commercial banks will take more loans from central bank. And similarly people will also take loans. This will increase the money supply in the economy.

ii) Central bank will reduce the rate of required reserves. That is if the reserve amount is very smaller commercial banks can use major portion of the deposits to give loans. This will enhance the process of credit creation.

iii) Government will purchase securities. This means, when government purchases the securities invested by the public, it will inject more money to the economy. In short, money supply will increase in the economy.

Following picture is showing a very short pictorial representation of monetary policy.