13 Proven Tricks to Amass Abundant Money Easily

Avoid Using Plastic Money

Though we are going cashless, when it comes to saving, avoid using plastic money, i.e. usage of debit and credit cards. Why - When you leave your home without cash, but just a debit card, you tend to buy unwanted items that you really need. You end up spending more. If you have hard money with you, you know your budget and how much you should spend. The self-control factor comes naturally. You would end up saving a massive amount, if you follow one simple rule, next time you head on to the shopping mall.

Save on Electricity

I am going to demonstrate a simple calculation to make my point clear.

You need to know two things for electricity tariffs calculations. Watts which the device uses, and per unit rate. Assume that you used an appliance using 100 watts per hour daily, for a month (31 days). Suppose Per Unit Rate in your area is 8 (can be any currency). Lets turn on our logical mind:

1 unit = 1 kWh. Total kWh = 100 Watts x 24 Hrs x 31 Days = 74400 watts/hour. Total consumed units = 74400/1000 = 74.4 units. Cost per unit = 8. So (74.4 * 8 = 595 (can be any currency) per month. That is 7140 per year.

Bottom line - if you turn the appliance for 12 hours, the cost drops down to 297.6 units. Half the amount. That is 3571.2 per year.

You saved 3568.8. Do I need to explain more?

Invest in Mutual Funds, and not Fixed Deposits

Wen it comes to investment, only one medium pops up in your mind - Fixed Deposit. But Let me tell you that FD , although is a safe investing option, can be a bad option. Why ?

- Interest Rates are fixed, and do not change overtime.

- Fixed Tenure, low liquidity.

- Penalty for premature withdraws.

- Tax levied on current slab, irrespective of the tenure.

Lets talk about Mutual Funds:

- Rates vary according to market

- It bears high earning potential during good market conditions.

- Risk Exists, but as it is managed by professionals, risk can be mitigated.

- High liquidity for minimum holding period.

- Only charge exit load for premature withdrawal.

- Tax varies according to tenure. Hence, it is tax friendly.

If you ask any financial expert, he would recommend investing in Mutual Funds over Fixed Deposits. Look out for the best mutual fund providers in the market and sign up for one!

Go for Offers

Never take your eyes off the offers. Buy 2, get 1 free! Lets admit, not all offers bear advantages, some are meant to dupe people. But if you determine the actual cost of one item, double it, and find its difference with the offer, you will be in a better position to tell if the offer is valid or fake. If you love movies and can not do without them, use mobile applications offering 50% discounts. Pay bills via applications, I know a majority of the applications provide at least 10% discounts.

Take a stroll in various malls around your city and find out the best deals. Check whether you get more discount buying in bulk. I am referring to offers like - Get a pack of rice free on purchase of 2000/-. Look out for cashback options. For instance, ordering a pizza via apps has cashback options. The final sum that you'd have saved will be bigger than you thought.

Mobile Packages

Use prepaid instead of post paid. When you do that, you exactly know the amount that you've left in your balance, and will use wisely. When you have a post paid connection, you keep talking or texting with more liberty ending up with a long mobile bill.

If you don't want to go for prepaid, analyze your mobile post paid package. Chances are that you have activated a package for 1099/- or 2099/-. Out of which you utilize only 40% of its benefits i.e. you use only 100 free mins instead of 800 mins which is provided in the package. Carefully scrutinize the bill and then check what plan suits your needs. I had a plan of 2099/- per month. On utilizing this trick, I found that my usage was matching 499/- package. Now that's a handsome saving!

Budget is a Savior

Make a list of expenses that incur per month. For example

Milk - 1200/-

Electricity Bill - 500/-

Maid - 2000/-

and so on.

Make sure your expenses don't cross your fixed monthly budget. Tracking the money has been the best method to riches. Legends made sure to have an account of every single penny that debited or credited in their wallets. Now a days, there are app like Walnut, mTracker etc. that grab expenses from your SMSes. And then, it shows you a detailed chart or a report of where the money went, what bills are pending etc. Wow. Never thought such app would exist. In older days, people use to maintain a notebook(somehow, I still prefer that), or a customized excel file. None of those are needed any more. When you see the sneak peek of where the money went, you will be even more conscious about expenses.

Skip Eating and Drinking Out

Restaurants that we savor meals every weekend, no doubt have tasty food, but did you realize that the same food, if cooked at home, will cost you less than half of the price you paid outside? For instance, I used to have Thali at a local restaurant, and it costed no less than 120/-. After marriage, my wife cooks even more delicious thali, and if I summed up the cost of items utilized in it, it sums up to 50/-. Drinking is another money snatcher. Not only they cost a lot, but are also not good for health. I do not drink so may not be able to advise you on cheap brands. I would straightaway advise you to stop drinking, not only for saving money, but also for health reasons. Drinking never did anyone good, except beer and red wine (Thanks, I have never tried those and will never try them, I just wrote what the newspaper/social media apps brag about every alternate day - may be the newspaper owner drinks!)

If you do not have cooking apparatus at home, you can head on for small and frequent meals. Ask any dietitian, they would insist on small, frequent and pretentious meals every 3 hours. For example - a bowl of oats, egg whites etc. This will make you fit along with bagging money!

Use Public Transport

Hiring a private taxi is 4 times more costlier than using a public transport like city buses or trains. You can always wait for few mins rather than booking a private cabs, which offer you royal and unwanted hospitality for a hell lot of money. Plus, travelling with a crowd gives you a feeling of being connected, rather than wandering alone like a lost soul. You would save on petrol as well. If you drive by your own vehicle, you would have a headache of taking care of it, while driving. You will have to drive carefully. All of those are banished, when you opt for public transport. Let the driver take all the burden. You sit back/read a book/listen to music and make your life easier.

I used my private vehicle which demanded maintenance+petrol money of around 2000/- every 15 days. So monthly expense is 3000/-. I started travelling by city bus transport which costs 40/- per day, so its 1200/- per month. A beautiful difference of 1800/- with relaxation as an added advantage!

Find out Cheap Sources of Pleasures

Who told you that you gain pleasure only by spending a hefty amount at public places? Believe me, for some people, that is the way of life. There are things that give you immense joy without even spending a penny. Take a walk in the garden, observe the sunset in the evening, go for long morning walks, have a conversation with a friend over a cup of strong coffee, watch yor favorite show at home and so much more!

I have been to costliest places searching for momentary pleasure, but came out frustrated. Take discotheques for instance. Entry fee is usually 2000/- or 3000/- per month for a couple or for a group of friends. They offer free drinks, which is usually a cheaper one, disco lights, high volume music, and you need to dance. You need to match up either with your partners steps or invent your own. You dance, you pay. A lot of people would oppose me for this concept, and tag me as boring or uninteresting, so be it. Sorry, but I would rather use 3000/- to pay off my travel expense and mobile bill for a month!

Gym is another ironic place where you pay for your own hard work. Trust me, you do not need any equipment to be fit. Nature has crafted us smartly. A long brisk walk can ward off all diseases. Yoga is another boon to fitness. You purchase branded stuff and head on to the gym, just to walk or jog on a trade mill. And most importantly, you pay a huge amount of money for it. So think logically about what actually gives you pleasure, without money being a part of the process. Have fun for free!

Forget 10% of Your Salary

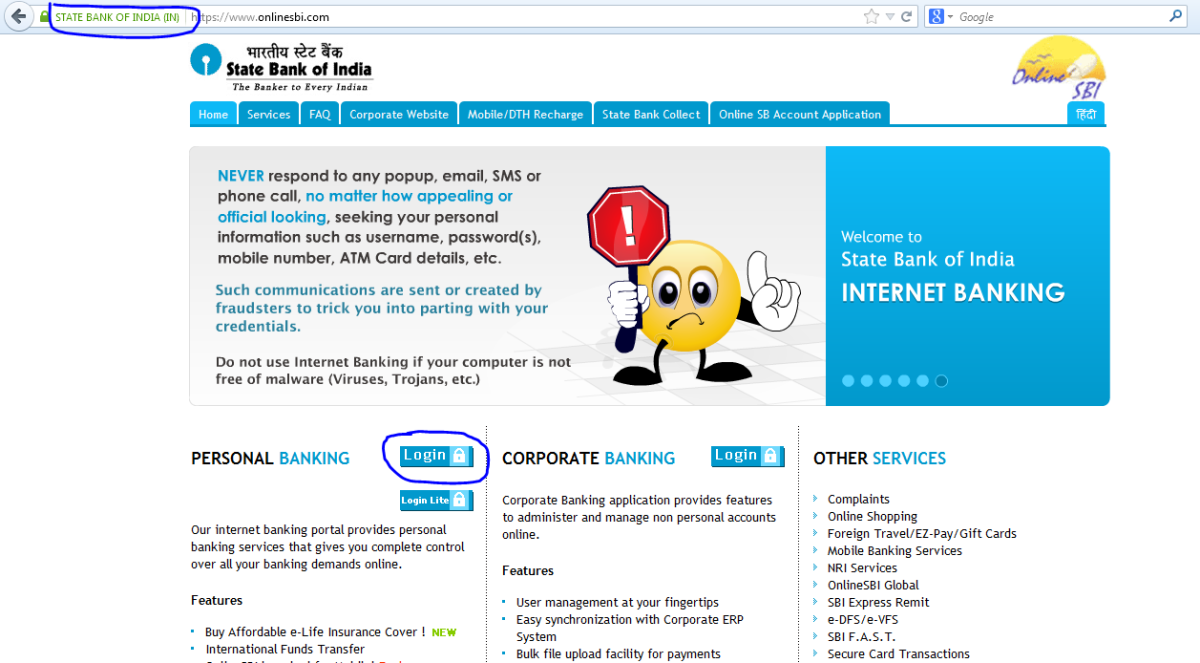

If you earn 10000/-, forget 1000/- rupees i.e. put it away in a separate bank account as saving. Assume that you never had earned that money. Once you accumulate a handsome amount, invest it in Short term Investment plan (SIP) or mutual funds or fixed deposits. Then, let it grow. As stated earlier, you need funds for lot of other purposes like medical emergency, repairs etc. If you have an online bank account, you can schedule it to debit automatically on 10th of every month, so that you do not have to remember to keep that money aside. Trust me, when money accumulates overtime, and when you see the amount, it really feels good.

Forget the Change

Our ancient system of lending and borrowing things i.e. barter system came to a complete halt, because of its discrepancies. But thank God, we have something called currency, which is available in two physical forms - coins and notes. I guess I went too far.The point I am trying to make here is - after all your purchases, dump all the coins, which you received in the form of change in your piggy bank. Just forget that you ever had a change. Let it accumulate overtime. I remember when I had no cash in the form of notes, and when I was stuck in an emergency, I broke my piggy bank which rewarded me with a spectacular 1050/- coins, which I had it converted into cash. From that day on wards, I always have a backup account, which I call a Piggy account, that saves me during the test of time. Smart tricks, aren't they?

Skip the Second Tea and Dinner

After a long and refreshing 8 hour sleep, you only need a strong cup of tea or coffee, first thing inthe morning. I am a tea addict and can tell you that my mind is still sleeping even when my body is up without a cup of strong ginger tea. That is the only time you need to stimulate your brain. You are mostly up and awake during the rest of the day. Why have tea or coffee unnecessarily? When you have committed yourself to save as much as you can, you can use this simple trick, to save abundant money. One tea in India costs 10/-. If you have an habit of having tea thrice a day, skip having tea twice - that is your afternoon and evening tea/coffee. You save 20/- per day. You save 140/- per week. You save 560/- per month. You save 6720/- per year!

Lets talk about dinner. No. I do not want to starve you to death for savings. I am only suggesting you to skip dinner is because dinner accumulates as fat in your body, once you sleep. You can have a glass of milk before sleeping. You can have breakfast, lunch and a light evening snack. That would cost you 40 + 100 + 40 (rates are assumed for simplicity) = 140/-. Dinner would be another 100/-. So, here you've saved 100/- per day. 700 per week and 8400/- per year.

Lets sum it up! - 6720 + 8400 = 15120/- per year. Not bad.

Fire Your Maid

In olden times, women were strong and never needed to go to the gymnasiums or hospitals. Now a days, there is a maid to cook, maid for doing the dishes, maid for cleaning the house, for ironing clothes, for gardening and what not. Merely cleaning the home would burn 150 calories, which is equivalent to jogging on a trade mill for 20 mins. Like wise, if you take up all the house hold tasks, each day, you end up burning nearly 600 calories per day. No need for any special yoga, zumba, or aerobics classes. Rich people often tend to get fat, as money makes their life very comfortable and lazy. Money works for them. They risk their health, to earn money and then spend the same money in hospital beds paying off bills. So, assume that you are a house keeping guy for the first half of the day, everyday (You can have Sunday as a holiday!). Indian maid typically costs 400/- for one task. If you make her/him accomplish, say, 5 tasks, it costs you 2000/- per month. You've got the same hands and legs (plus a lot smarter brains) than the maid has. Why not do your tasks yourself? - You can reward yourself 2000/- per month, if you are successful at that! At the end of the year, you will accumulate 24000/-. Amazing.