National Income and Its Determination

National Income:

1. Classical definition

2. Modern definition

Classical definitions:

A. National income is the total sum of goods physically produces in a country if measured in money. (G. Crowther)

B. the labor and capital of a country acting on its natural resources produce annually a certain net aggregate of commodities material and immaterial including services of all kinds. This the true net national income or revenue of the country or National dividend. (Marshall)

i) In this definition, NET refers to the residual amount after deducting depreciation from gross.

ii) Income received from abroad should also be included in it.

c. National income is the part of the objective income of the country, including of course income derived from abroad which can be measured in money. (Pigou)

Criticism:

1. In the modern times, a long range of goods and services are produced which can’t be known easily.

2. There is always a possibility of double counting.

3. Measurement of all goods produced in money is not possible.

4. The definitions can be made applicable in developed economies only where goods and services are purchased by money.

All of the above definitions made the production as the base for defining National income.

Modern definition:

The National income or dividend consists solely of services as received by ultimate consumers. Whether from their material or from the human environments. Thus piano or overcoat made for me this year is not the part of this year’s income but an addition to the capital. Only the services rendered to me during this year by these things are the income. (Regner Fisher)

This definition is better because of it:

a. Extends the concept of economic welfare.

b. make consumption as base

c. consumption determines the living standards.

Defects:

1. Estimation of net income is possible but not of net consumption.

2. It is not necessary that the durable goods like piano and coat are exhausted completely in a year.

3. Durable goods are bought and sold, therefore, their ownership and value is changed.

4. Goods are also sold in black market so differentiation between real value and value of the black market is very different.

“National Income is somewhere between GNP and NNP. GNP (user cost; reduction in the value of capital equipment’s actually used and not fully depreciated”) (L. J.M. Keynes)

Different Concepts of National income

Measurement of national income:

There are 3 methods used for computing the national income:

1- National income at Market Price Method:

- Division of economy into sectors (agricultural and industrial).

- Estimation of goods and services produced in both the sectors.

- Conversion of goods and services into value on the basis of market price.

- The value of the good is to be added with the goods and services with the services

- For estimation, the net value, investment of preceding year is to be deducted.

- When the goods and services produced and rendered is converted into value, it becomes income.

2. National Income at Factors cost Method:

- Find out the income of people working in different sectors of the economy.

- Every individual works and earns his/her income in the capacity of landlord or laborer or capitalist (investor) or entrepreneur.

- They earn as rent, wage, interest or profits.

- By adding all annual incomes together, we get GNI.

- For finding out the NNI, direct tax (non-disposable income) is to be deducted

3. National Income at National Consumption:

- Since the expenditure of one is the income of other, therefore, according to this method, national consumption is computed rather the national income.

- As no individual can consume more than his income, no nation can consume more than its income so national income should be equal to national consumption.

- By adding direct and indirect tax, we get gross national consumption or gross national income.

- For calculating NNI, depreciation cost is deducted from GNI.

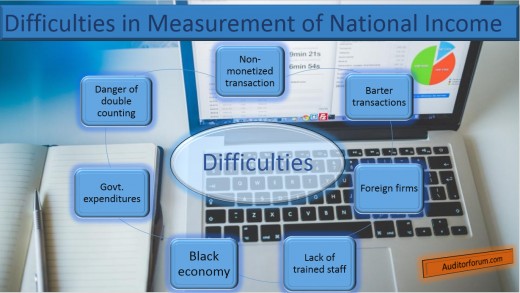

Difficulties in Measurement of National income:

- Lack of statistical information

- Untrained staff in the statistical office.

- Illiteracy of the masses.

- The existence of non-monetized sector.

- Unpaid services.

- Society of pomp and show.

- Non-documented transactions.

- The existence of foreign firms in the country.

- Double job (farmers and laborers, after their main job, also work part-time).

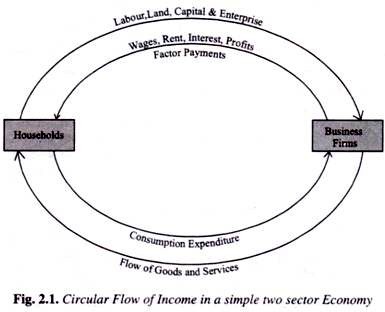

Circular flow Of Income:

- There are two sectors( household and firms)

- Firms are held responsible to produce goods and services.

- Factors of production are required for producing goods and services.

- Income of all these factors, in this manner, is created.

- The market value of net production should be equal to the payments pad to the factors as rent, wages, interest, and profits.

- These incomes are converted into the channels of consumption.

- The flow of income, in this manner, directs from firms towards households for purchasing goods and services.

- While the flow of production towards households takes place when they buy goods and services.

- This is the reason that National Income is computed in 3 methods.