Science of Economic Forecast and Climate Change

Introduction

It came to me recently how economics and climate change are very similar in nature. They are both very complex issues and more importantly they share some common attributes. This is a new perspective that may change the way we look at these problems and how to deal with them going forward. Science has many classifications. I believe both economics and climate studies belongs in the same class. I will explain my hypothesis. By the way, remember Al Gore saying the Science of Climate Change is settled. I believe it can never be settled.

-June 2015

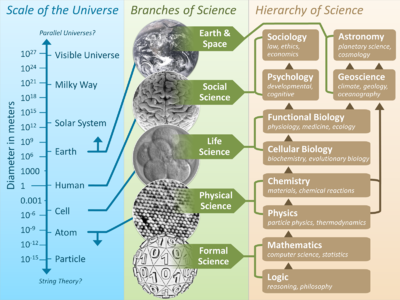

Classifications of Science

My Hypothesis

Economics, unlike hard sciences such as mathematics or physics or chemistry, is not contained in a closed system. By closed system I mean a set of finite rules that can be tested and replicated and not influenced by outside factors. For example (1+1=2) is an exact equation. Nothing can change the outcome. Economic forecast, is very different. There are two attributes that makes it different. One, there are input variables that are random or unpredictable. Two, there is a feedback mechanism that can affect the outcome. One example of this is the price of stock of a company. The price will change from day to day depending on market conditions and on buyers and sellers of that stock on the open market. One can study the company and learn about it's balance sheet and P/E ratios and performance and all kind of metrics and then come up with an educated guess on the target price. However, there is no guarantee that the price will be what is projected. And in fact, it has to be that way. If it isn't, then the whole system will breakdown.

Prove: Suppose hypothetically, a hedge fund has come up with a super algorithm that can predict the direction of any given stock from one day to the next. It is sort of like "a sure thing" in betting circles. Given that scenario, anyone can go out and buy that stock if the prediction is up and will be guaranteed a profit or alternatively, if the prediction is down, one can short that stock and again make a profit. Is this viable? The answer is obviously no. No algorithm can make that claim. The two factors being, some random event can affect the price of the stock and once a prediction is public knowledge, no one in their right mind would buy/sell and thereby making the information useless. It is this random nature of the market that keeps it working - sometimes known as the butterfly effect.

Science of Climate Change

Here is my leap of faith. I recognized a parallel between the science of economics and the science of climate change. Both are working in a non-closed system. First, there are random events that can influence the outcome. Second, there are feedback mechanisms that are very complex. The earth is a small part of our solar system.

The claim of climate scientist is that CO2 is the primary driver behind the global warming theory. Increases in CO2 emissions creates a green house effect that traps the sun's radiation and heats up our planet.

What are some of the random events that can occur? and have occurred in the past.

- Major earthquakes

- Volcano eruptions

- Asteroid strike

- Sun spot cycles

- Polar shifts

- Magnetic Pole reversal

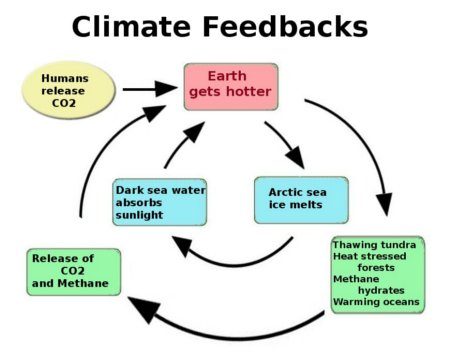

What are some feedback mechanism?

- Carbon cycle

- Methane release

- Forest fires

- Desertification

- Black Body radiation

All these natural events can have a dramatic effect on our climate.

One Climate Feedback Loop

Conclusion

The science of economic forecast and climate change are subject to the black swan effect. One glaring example recently is the price of crude oil in the world market. If you were to ask experts their projection on the price of oil futures a few years ago, the concensus were they would go up due to the theory of peak oil. Our oil reserve is limited and we will be dealing with a shortage of supply and increasing demand. However, last year, the price of oil dropped dramatically and unexpectedly down to $40 per barrel. How can that be? The answers are due to many factors. Fracking in the US became more viable and added to the supply side. A slowing world economy created a drop on the demand side. OPEC also got into the mix and made a strategic decision to keep the oil production stable instead of lower production to counter the drop in demand. The point is, no one predicted this. It was a black swan event and we the consumer reap the benefit of cheap gas.

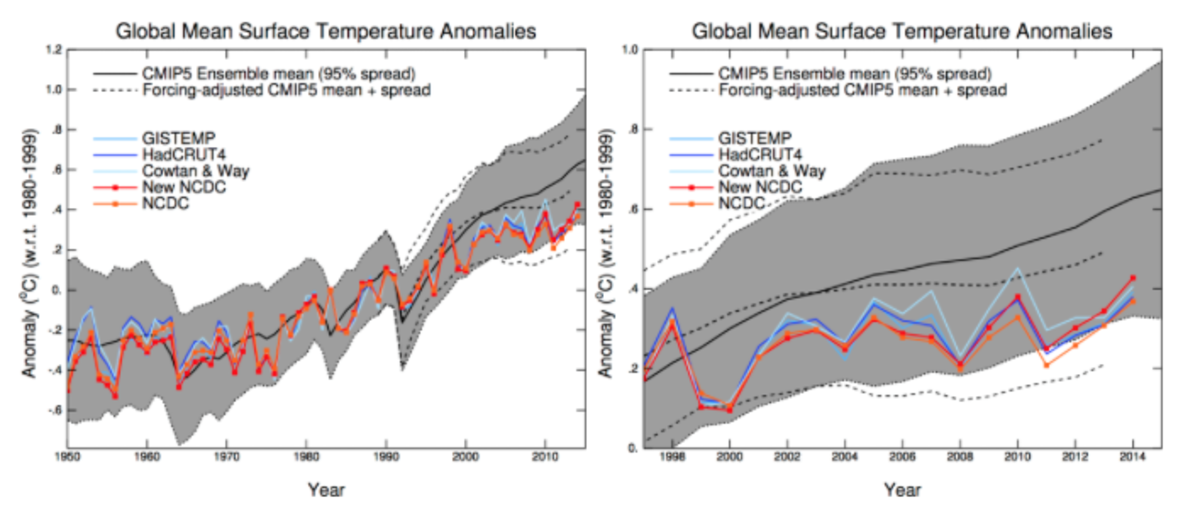

The science of Climate Change is not settled and for that matter, may never be settled. This is due to the fact that some of the drivers are totally out of our control. Current Climate scientists have focused on one aspect of human contribution - that of fossil fuel emissions. They have minimized the other drivers due to random or natural events. I am not saying they are wrong but just that they are incomplete in their analysis. They don't have a good handle on black swans and rightly so.

Any long term projections by climate scientists usually starts out with "if current trend continues..." The problem is, current trends do not continue in a straight line. In the case of climate change, the sun can go quiet for the next 100 years and cause a mini ice age and our contribution will be negligible. We have no fore knowledge or control on the activity or inactivity of the sun. That is the crux of the problem. Thanks for checking in. Please give me feedback in the comment section.

- Climate change feedback - Wikipedia, the free encyclopedia

Some cimate change feedback loops. - Butterfly effect - Wikipedia, the free encyclopedia

Butterfly effect. - Black swan theory - Wikipedia, the free encyclopedia

Black swan theory.