Private Colleges that Aggressively Recruit Students

A Very Persistent Admissions Official

Each evening, as we were getting ready to eat dinner, the telephone would ring. It was a certain university calling me son. He'd been accepted and they wanted him to come.

This was a school he applied to almost on a whim. It is a respectable university, but a step or two down from the Ivy League.

Tuition at this institute is now around $40,000 a year. If you factor in room and board, that brings the tab well out the range of what most Americans can afford.

If our experience is any indication, this particular school is struggling to maintain its body count. The aggressive sales tactics were more of what you'd expect from a used car dealer than from an institute of higher education. But the game has changed a lot in recent years. The marketing tactics used by some campuses are now over the top.

The Postcard Campaign

I started to get suspicious when I checked our mailbox. Nearly every day, or so it seemed, a similar postcard arrived. They were from the school that was recruiting my son. A postcard or two after the acceptance letter would have been fine. But the daily deluge gave us pause.

If the school is really as terrific as it sounds, and a good value for the money, why did it need to advertise so much?

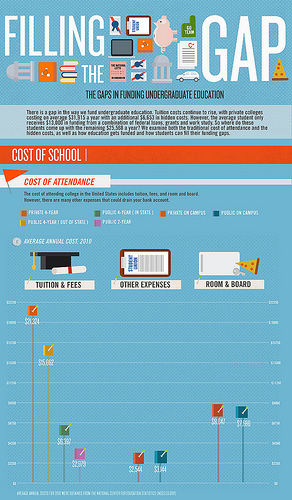

The True Costs of College

Increasing the Scholarship Offers

My son was offered a fairly generous scholarship. This arrived with his acceptance packet. However, a week or so later, he received the first of what were to be many phone calls. The admissions office had decided to give him another scholarship, nearly doubling what he was originally offered. So would he consider attending?

Knowing what I know about the growing desperation of some private institutes, I'm starting to wonder how many other students received similar phone calls.

It's becoming increasingly difficult for second and third-tier private colleges to survive. They have priced themselves so far out of reach that students are starting to stay away. The colleges have responded by offering deep discounts. But, oftentimes, these price cuts still aren't enough.

What's happening is that students from all socioeconomic backgrounds are gravitating toward the less expensive public universities, which have also become increasingly selective.

Next Came the Flowers

One afternoon our doorbell rang. A nice woman stood on my front steps holding a pretty bouquet of flowers. "These are for your son," she said.

At first I thought his girlfriend was behind this seemingly romantic gesture. Then I realized they came from the school that was making all the telephone calls and cutting him the scholarship deals.

Although I truly appreciate the beautiful flowers, which bloomed for two weeks on my dining room table, I started to get suspicious. At this point, we were getting a really good deal with the tuition, or so I thought. So, what was the catch?

The Average Student in America Now Graduates with More than $29,000 in Student Loans

Aggressive Recruiting Usually Means it's a Bad Deal

A hard-driving sales pitch usually means to close your wallet and run in the other direction. Overly aggressive recruitment by a college probably means the same thing. The institute could be struggling to attract students, because of the growing perception that it is a bad deal financially.

It's becoming increasingly difficult to justify the cost of attendance at most small and mid-size second and third-tier private colleges. Tuition, room and board at some now exceeds $60,000 a year.

Consequently, there is now a rush to apply to public flagships, and other public universities. In recent years, these institutes have seen record numbers of applicants.

Here's the Catch

A couple of days after the flowers were sent, my son received yet another telephone call from this college. His financial award letter would be arriving in a couple of days, he was told. By this time, we were expecting a very affordable package.

However, it turned out not to be. There was a sizable gulf between the cost of attendance, versus what we could afford.

Even with a very steep discount, and the full amount of Federal Student Loans, my husband and I would need to go deeply in debt, if our son chose to attend this school.

I will say the award letter was straightforward. It was also very candid in what we could expect to pay per year, including incidentals such as various living expenses. Since this was an out-of-state school, we'd also need to factor in travel costs.

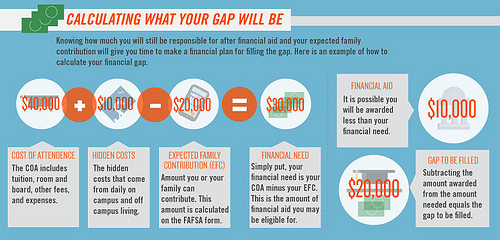

Despite the enticing offers, my son was essentially "gapped." This means the institutional aid was much less than what a student and his family can reasonably afford.

Some Common College Terms You Might Now Be Aware Of

Gapped

| Expected Family Contribution or EFC

| FAFSA

| Parent PLUS Loan

|

|---|---|---|---|

The vast majority of students now need financial aid to attend college. However, if a school awards you a package way out of line with your financial needs, it means you've been "gapped."

| This is the amount the federal government has determined a family is able to pay, based on a formula after the Free Application for Federal Student Aid is completed.

| This acronym stands for Free Application for Federal Student Aid, which is a prerequisite for obtaining institutional aid from the colleges that you apply to.

| These federal loans are available for parents if they are unable to pay the difference between the tuition and the amount of aid a college awards.

|

The Financial Aid Handbook - College at a Price You Can Afford

The Parent PLUS Trap

At the bottom of the award letter was the amount we'd need to pay, minus my son's student loans. The college offered several suggestions on how to make this work.

Topping the list was the Parent PLUS option. These are federal loans administered by the college. You can borrow up to the full amount you need to meet college expenses. These loans are very easy to obtain, which is why they are so problematic.

For my husband and I, the amount we'd have to borrow would likely ruin our financial future. If we were unable to pay, we'd potentially face having part of our wages, or our Social Security checks, garnished. It's also nearly impossible to have these loans forgiven if you declare bankruptcy.

Even in our current situation, with both of us generating income, we'd have trouble paying back what we owed. An unexpected job loss or a serious illness would surely push us over the edge.

However, these loans are a win-win situation for the institution. First, they guarantee tuition will be met. They also allow colleges throughout America to keep hiking their prices.

Parents willing to take on this debt also pay a 4.2 percent "origination fee." This is on top of the 6.91 percent interest rate that comes due later.

Millions of Parent PLUS loans are issued every year. Right now, 7 percent of them are in default. We can safely assume these loans have caused financial distress in mass proportions.

A Documentary on Student Loan Default

Gapping is When an Institution Doesn't Meet Your Financial Need

What Happens if You Can't Keep Your Merit Scholarships?

Doing a little research, I came across an online forum discussing this institute. As it turns out, the scholarships are fairly difficult to maintain. They require a 3.0 grade point average and the school in question is not known for giving easy grades.

Many students have been unable to achieve this benchmark, according to the forum posters. Just a fraction off, and the scholarships are pulled. Apparently, there was no room for negotiation.

Merit scholarships always come with a stipulation of good grades. However, typically, institutes will first put you on a probationary semester before taking your award away.

Because my son is not particularly attached to this school, deciding not to attend is the prudent thing to do.

This is part of the built-in problem of attending a school with a ridiculously high tuition. Even with deep discounts, you start at an untenable vantage point. If anything happens to your scholarships, you can't continue your education, unless you parents have very deep pockets, or they agree to take out a Parent PLUS loan.

Faced with a child having to leave school and return home, taking on a large debt may seem the lesser of two evils.

Parent PLUS Loans

- How a Parent PLUS Loan Can Destroy Your Life

College tuition has increased to where it's no longer affordable for the average family. Parent PLUS loans are part of the problem.

Disclosure

I am a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.