THINKING ALOUD (BusinessLaw) INTERNATIONAL TRADE: Letters of Credit

INTERNATIONAL TRADE FINANCE:

Letters of Credit:

promises & pitfalls

Writer: Chén Róng

You are a merchant and this year, 2013, is your twentieth year in business. With those hard-earned decades of experience, you now want to expand your product sales into budding new foreign marketplaces because your traditional markets, USA and Western Europe, are now shrinking fast. The emerging national economies of Vietnam, Myanmar, Brazil, India, Russia, South Africa and Latin America seem tantalising; and your government has just signed Free Trade Agreements with countries as far away as Costa Rica and Columbia.

As matter stands, you have been successful in getting buying orders from newly-introduced merchants from these emerging economies. With those written contracts at hand, you are confident that those promised Letters of Credit will soon arrive on your desk. It is time to set the production machinery running to churn out the contracted products. It is also about time to initiate talks with banks to finance your various trades.

-

Are things really looking up for you?

Unfortunately, international trades in emerging markets are no walk in the park. They are not fairy- tales that usually end happily for all. It is naïve to think that all is well because what you have in your pocket are not promises set-in-stone: contractual terms are changeable if people who promised to buy your products fall short on honour and integrity. Unforeseen economic forces may play a part if you recall the unpleasant events in the year 2008. There was a credit squeeze and many small trading houses were unable to get trade finance. The promised letters of credit were delayed and most never came. History is likely to repeat itself because the business community now has shorter memory for bad events. In the minds of some people, five years may be considered a long period. The common remark is: It was then. It is now.

Do you have an alternative?

It is true that at least 70% of world trades work on Open Account payment terms in place of documentary credit. Open Account has always been the way used by established bigger companies in Europe, North America and Asia-Pacific countries. They have the financial wherewithal and backings of banks. At times, their governments pave the way for them. Small private companies with limited finances just cannot afford to beat down this path. There are exceptions - those small U.S. importers who are able to use their shipments as collateral for loans – a trade finance service offered by major international freight forwarders. That is another story.

-

Things cannot go badly wrong with Letters of Credit?

Think again. The devil is in the detail.

It is equally true that the time-honoured letter of credit, as a trade finance instrument, is not dead. Its use is still growing but significantly slower than the growth of world trade. It is still a relevant instrument which most importers and exporters regard as trade-risk mitigation. But we need to put things in perspective. There are risks involved. A Letter of Credit requires documents to be matched manually and is prone to delays. Strict terms and conditions apply for the bank to make payment. Staff undertaking Letters of Credit need knowledge of both shipping and banking and requires meticulous care and attention to detail. In numerous cases, apparently trivial variations between the terms of the credit and the documents, can cause the credit instrument to be rejected and exporter getting no payment for goods shipped. Long negotiations and sometimes legal suites may ensue.

Yes, you have heard all these problems before. But what you may not realise is: your new-found buyers may not have intention in honouring the terms of the contract signed with you; or if they do, they intend to turn those terms around in their favour. Let us consider the following scenarios and see how they may affect your trades.

Scenario 1: The buyers have no intention to settle payment by Letters of Credit

An agreement on payment by Letter of Credit as a means for settling trade gives the illusion of safety it spawns complacency with merchants who think that all is well and dandy with a business contract safely in hand. It may be true in established markets where good relationships with counter-parties and banking staff will generally help with minor discrepancies and amendments to documentary credits. But this is not the case with emerging markets.

Your contract with the Buyers called for payment to be made by a confirmed irrevocable letter of credit opened in your favour through an account with your nominated Asian bank. Days later, the Buyers gave the green light for you to start producing goods as they approved of the proforma invoice you sent them. You started with production of the required goods. Days later, you sent another e-mail to the Buyers because the promised Letter of Credit was still not received. Finally a reply came. They informed you that a Letter of Credit made out in your favour was on its way. Three days later, you got a phone call from your bank telling you the long awaited Letter of Credit arrived. Unfortunately, you found lots of discrepancies and want them corrected. You again waited. A week ensued and the amendments came but this time a new condition required shipment to be transported in a 20-foot container consignment - no consolidation allowed. You had only 550 cubic feet and, therefore, your goods need to share space in a container with those of other shippers. There is little time left. You got on the phone with the Buyer insisting that the shipping term be changed to Less-than-container load. By this time, the goods were already stored in the warehouse awaiting shipment.

The Letter of Credit was about to expire and the Buyer blatantly asked that you ship “Open Account”. You had little choice but to comply partly because you considered the Buyer a big trading house. Months went past and dozens of e-mails sent and phone calls made, you were yet to receive payment. It is just a made-up story? Sorry no, the writer was once a board member of a corporate group with a wholly-owned freight forwarding subsidiary that experienced similar sad stories of despaired shippers.

.

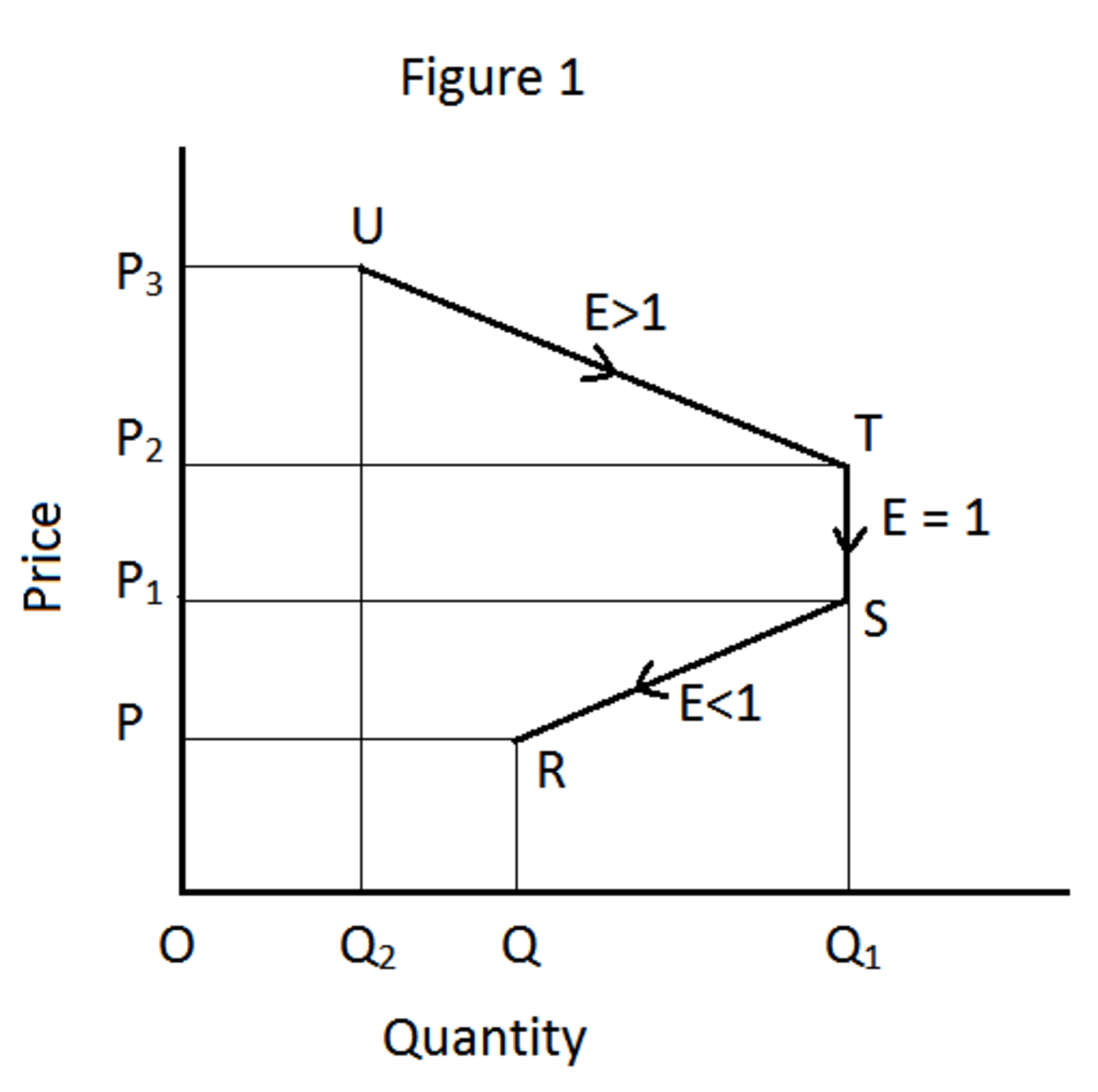

Scenario 2: The buyers will not pay agreed price if market falls

If you were to look at the website of Asean Rubber Business Council (ARBC) you will read about failed transactions members had with overseas merchants who defaulted on shipments. The ins and outs of the whole matter seemed complicated but simply put: the Buyers failed to honour contracts because of falling markets for their rubber products – the auto and related tyre industry. Owing to price falls, the Buyers have delayed the opening of Letters of Credit although prices were agreed upon in signed contracts. Buyers now want price reductions before agreeing to issuance of Letters of Credit. These outstanding cases are evidence to show that a signed contract is but the start of a business transaction. It is far from reaching a happy ending.

These rubber merchants are still lucky because they have the full backing of an Association and they were dealing with established players in the market-place.

The plight of a stand-alone merchant would be far greater. In a country where laws go flip-flop, well understood capitalist rule of law may be replaced by socialist type rules. Claimants cannot be sure of getting a fair hearing should they take up legal actions. It is a case of good money chasing after bad ones.

Scenario 3: The Buyer fails to secure Letters of Credit

Banks are major players in international trade financing. They are the biggest suppliers of Letters of Credit for international trades. But a bank’s capital will stay eroded when there is a huge write-down in value of government bonds it holds. Bonds serve as collateral for the money the bank raises for lending to customers. Another reason for the credit squeeze is the bouts of austerity measures now taking place in some parts of the world. Banks have trouble borrowing money themselves. If the money printing machines in USA, European Union and Japan were to shut down, all hot monies will flow back and there will be a short supply of funds in the emerging markets. We should not speculate when Fed Chairman Ben Bernanke and other central bankers would start the slowing down process and the extent of the devastation to world economies.

The global financial system is a big wild wood. It is difficult to see the wood for the trees. The big multinational companies (MNCs) may not share your problem. Not lending out to smaller merchants mean banks are conserving cash to finance the MNCs otherwise they would be violating the terms of their financial obligations e.g. established lines of credit for big establishments.

Small private companies will have to watch all these economic booby traps and deadly financial minefields.

Scenario 4: Trusting your own bank to providing export finance

With the current economic climate, many exporters are turning to Letters of Credit as a way for guaranteeing payments from buyers in new and often difficult markets. You have to watch which bank you are dealing with as you may unexpectedly get a sudden hike in charges levied by your advising and confirming banks. You have to engage your bank in prior talks and factor in their charges in arriving at your final pricing. Letters of Credit are becoming more complex and expensive with the added charges, commissions and fees – more so, if your relationship with the Bank is about lukewarm. Size does matter with banks.

It also pays to read trade magazines to gain insights into the litany of complaints and legal cases. One prominent recycle-bin manufacturer said his business was placed in special measures by its lender and costing his business hundreds of thousands in fees, charges and interest while continuing to pay back his borrowings. Banks impose special measures on customers depending on how they assess their business risks. In the case of the recycle-bin manufacturer, his previous breach of a covenant term resulted in the bank imposing on him special measures as a kind of trade restraint. All merchants face difficulties at one time or another. For businesses regarded as big and strong, banks are more likely to view their faults lightly. In the case of this recycle-bin manufacture, the Bank sent accountants to seek out financial information on the company. Its cooperation landed the company with a huge bill and limitations on borrowing – such restrictions mean taking on fewer orders and high fees levied for Letters of Credit to allow trading to continue. This article is not part of a news providing service, so naming the bank and manufacturer is out of the question.

The lesson a small trading company should learn is: if you are already financially stretched, you need to be careful not to be placed in special measures for covenant breach of your bank financing terms. If you are unfortunate to be in such a situation, perhaps you should think twice before signing buying contracts with importers of emerging markets.

-

There is light at the end of the tunnel

Letters of Credit established globally may be subject to regulations of the International Chamber of Commerce (ICC) - rules for documentary credits. The current version is Uniform Customs and Practice for Documentary Credits 600 (UCP600). These rules have introduced some measures of uniformity into a commercial field that was once fractured by conflicting laws of trading nations. The process is not complete and hence documentary commercial credit transactions may still differ from one country to another. So when merchants dealing with emerging economies and have to enforce the UCP rules in their respective courts, they may fare badly not counting the unquantified legal costs.

In the world of business, more often than not, your mind is not your own. Oftentimes, you may do things against your better judgement. Ship-owners too, when freight rates were riding high, flood the oceans with shiny new ships at a time when risk of excess capacity became apparent and restraints needed. They ignored those invisible but deadly hidden reefs when the world economy was sailing along under a clear blue sky. Similarly, property developers were often seen chasing up price of land to build new homes and commercial blocks only to see their ego bruised when markets came crashing down. So, we understand why merchants take extraordinary risks at times.

If you have to sell your merchandise in emerging markets, there are a few market pointers you might use, if you have not already acquainted yourself with such customary practices. Check them out as only outlines are provided here.

- Try obtaining part payment of your sales proceeds in cash. Ask the Buyer for 30% payment in cash at the time of contract signing, and the remainder 70% to be paid via documentary credit. This ratio may stay flexible as it depends on your ability to fix a better percentage in your favour. With the cash deposit, you can avoid payment delay by refusing to ship goods if the Letter of Credit does come in good time. You can now also count on the bank to discount the documentary credit to give you the necessary cash to buy components necessary for production.

- The credit-worthiness of the Issuing Bank is a significant one. Equally important are political events at the place of its domicile. You can control these risks by requesting a confirmed irrevocable Letter of Credit. With a confirmed Letter of Credit, a confirmation bank located in your country will assume payment risk by charging a fee. This has to be done before issuance of the Letter of Credit because your local bank needs time for investigative work, and before agreeing to act as the confirming bank.

- If there are discrepancies in the Letter of Credit, it is in your interests as exporter to advise the Buyer directly to ensure you get a quick response from him when contacted by the Advising Bank.

Running a business as a merchant can be a high-strung occupation with many different types of risk in the international marketplace. We have highlighted some potential hazards that can destroy your business, but there may still be other crouching tigers and hidden dragons – figuratively speaking, less obvious risks that can cause serious damage and time consuming to repair. Despite the risks implicit in doing business – regardless of its size - a well-prepared business can avoid or at least moderate the impact of such risks.

READ OTHER STORIES AT:

http://chenrong.hubpages.com

---- E N D -----

Hubpages do not support words written in the Chinese Language. Readers can get a free online English-Chinese translation from GOOGLE TRANSLATE OR TRANSLATED.net

I have also included ChénRóng’s Little English-Chinese Dictionary for a more precise translation of select English phrases from the article.

……………….

Chén Róng’s Little English-Chinese Dictionary

-

Beat down this path = yòng tóng yàng de fāng fǎ

- No walk in the park = bù róng yì de;dì;dí shì

- The devil is in the detail = xì jié hěn zhòng yào

- Proforma invoice = shāng yè fā piào

- ins and outs = lái lóng qù mài

- your mind is not your own = rén zài jiāng hú, shēn bù yóu jǐ

- crouching tigers and hidden dragons = wò hǔ cáng lóng

Disclaimer

The writer makes no warranty of any kind with respect to the subject matter included herein or the completeness or accuracy of this article which is merely an expression of his own opinion. The writer is not responsible for any actions (or lack thereof) taken as a result of relying on or in any way using information contained in this article and in no event shall be liable for any damages resulting from reliance on or use of this information. Without limiting the above the writer shall have no responsibility for any act or omission on his part. Readers should take specific advice from qualified professionals when dealing with specific situations.

Letter of Credit fraud

Writer: Chén Róng

Small businesses often run into cash-flow problem and they require emergency loans to tide them over. Some such merchants may think of obtaining cash flow through the use of existing credit facility with their banks but without there being a genuine underlying transaction. Fake purchases of goods using documentary credit -- or letter of credit kiting as it is commonly known - are frauds against the bank and a serious crime even if such loans are paid back.

In one reported case of buyer and selling collaborating to cheat a bank -- the seller provided blank invoices to the buyer to create sham transactions. This was to enable the buyer to get his bank to pay the seller for fake purchases. The seller then returned the money to the buyer after pocketing his commission payment. The transaction provided the buyer with a fraudulent opportunity to use his credit facility with the bank. There were 82 fictitious transactions in all. Credit facility was finally expanded to US$10 million. At this point, the buyer defaulted on his loan agreement. This is fraud. It is not a case of business failure per se.

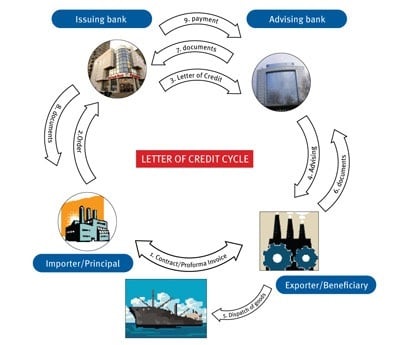

Although there are regulations governing documentary credit transactions, there is weakness in the system. In the letter of credit cycle, a bank promises to pay on behalf of the buyer which is independent of the underlying business transaction. The bank would honour the letter of credit as long as every document submitted, on the face of it, is correct. Since the bank only examines the documents but not the physical goods, such an oversight offers a loophole for fraud.

Small businesses must never fall prey to tempting offer of earning a quick commission; or using a fraudulent transaction as a way to ease short-term cash flow. Whether or not banks are getting wised up to such frauds is immaterial. Crime never pays. As mentioned, it matters not if the outstanding loan is finally repaid; the parties involved have committed the crime of fraud against the bank because the underlying transactions were false.

READ OTHER STORIES:

http://chenrong.hubpages.com

LETTER OF CREDIT:

Risk of non-payment

Writer: Chén Róng

Small international trading companies are now seen joining corporate giants in export drives to emerging regions such as the African continent, Middle East and Russia. Securing a buying contract is not an end-game. Watch it! If banks in the exporter's country are not willing to take on the risks of accepting letters of credit from issuing banks, trade transactions will fall through.

Risk of bank failure is real; bankruptcies in newly industrialised countries (NICs) of Africa, North and South America can take place suddenly. Smaller banks get most of the funding from inter-bank markets and deposits in savings, including wealth management products. These banks face risks of funding mismatch with their long-term loans to borrowers such as government-linked agencies. Banks in established markets find it difficult to assess risks of transacting with these small banks in NICs and hence it became a constraint on international trade.

Where buying companies are in lesser-known countries with smaller banks, a credit guarantee provided by the exporter's regulated export credit agency will be useful, provided such facility is available. Moreover, not every exporter can qualify for such insurance facility. An exporting company has to build strong business plans and demonstrate financial discipline. Its management has to continue presenting the business a better face than it has previously done, so to speak, before an established bank such as Standard Chartered would provide the company with services from letters of credit to financing receivable. Equally so, the exporter's better presentation will ensure that the export credit agency will provide the documentary credit guarantee to the local bank which assumes the credit risk on the buyer's bank. In other words, a guarantee from an export credit agency will enable the exporter to rely on the local bank for payment, rather than the buyer's bank.

One caveat: An export credit guarantee programme may extend to specific regions and may not cover an exporter's intended market. Even if it does, the scheme may guarantee just fifty percent of a letter of credit's value. Hence, before an exporter goes on an overseas export drive, it pays to talk things over with the confirming bank and the export credit agency in its own country. Do remember what has been said about the risk of local banks not accepting letters of credit from certain foreign banks.

READ OTHER STORIES AT:

Chenrong.hubpages.com