The Making of the American National Debt

I have been hearing much lately about the U.S. debt ceiling crisis and how it relates to the annual budget deficit and the national debt. I will confess immediately that I am not an economist and I don't claim to have any in-depth knowledge of how our national finances work. With that said, I would still like to share some of my personal observations! This is a very simplistic analysis, so please bear with me.

My perception is that, no matter how you look at it, the basic economic rules which apply to an individual or corporation must also apply to a government. In order to function on a daily basis, each must have income, each must pay for expenses, and each must manage debt, if money has been borrowed.

For the U.S. government, it is now common to pass a budget which includes plans to borrow money. This seems like an oxymoron and it is. For most of us, the term budget implies some sort of spending restraint. Specifically, it is a plan to spend within our means without resorting to borrowing! In theory, when a government borrows money to cover expenses, it is no different than an individual borrowing money from a bank - both are obligated to pay back the amount with interest in a certain amount of time. The amount borrowed is added to the national debt and, unless paid down, the national debt will increase every year.

Now we have something called the debt ceiling which specifies the maximum national debt allowed by law. If planned spending exceeds this ceiling, then the government must make cuts somewhere. This might be Social Security payments or welfare payments, or veterans benefits. This is considered a default and is a bad thing because a default tarnishes the reputation of the U.S. economic system and will also cause the interest rate paid on the national debt to go up. I compare this to what happens if I miss a credit card payment -- my credit score could be damaged and my interest rate will probably go up as a penalty.

In order to avoid a default, the U.S. Treasury can request that the debt ceiling be increased to a new maximum. This is what Congress traditionally does because Congress itself approved the budget which already included a plan to borrow in a manner which would cause the debt ceiling to be exceeded! Clever, isn't it? The problem is that now it is assumed that the debt ceiling is an artificial limit and that it will be raised whenever a raise is requested. A hard limit would be an incentive for the President and Congress to formulate a budget which did not require more borrowing. But a soft limit offers no incentive.

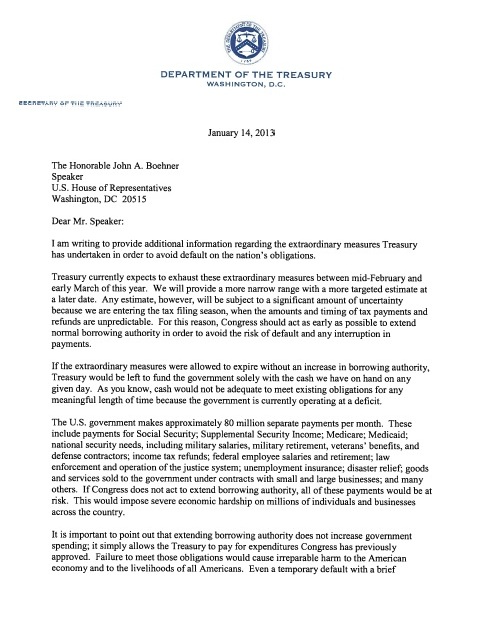

In what has now become a common ritual, the Secretary of the Treasury writes a letter to the Speaker of the House formally requesting that the debt limit be increased in order to avoid defaulting on our financial obligations. On January 14, 2013, Treasury Secretary Geithner wrote such a letter to House Speaker John A. Boehner requesting that, once again, the debt limit be increased. You can view the letter here:

http://www.treasury.gov/connect/blog/Documents/1-14-13%20Debt%20Limit%20FINAL%20LETTER%20Boehner.pdf

It is interesting to note how the Treasury Secretary explains basic economics to the Speaker of the House! I assume that this is the traditional format because the Secretary knows that this will be a public document and therefore takes the opportunity to share the details of the process with the average citizen.

But here is the irony: The reason the Treasury Secretary has to ask Congress to raise the debt ceiling is because Congress, itself, approved a budget that calls for spending beyond what resources are available! Now, if they came up with a true budget (one which did not require borrowing), then an increase in the debt ceiling could possibly be avoided. Let us examine the dictionary definition of the word budget:

The definition at www.thefreedictionary.com defines budget as:

a. An itemized summary of estimated or intended expenditures for a given period along with proposals for financing them: submitted the annual budget to Congress.

Notice the usage example that the dictionary gave: "submitted the annual budget to Congress". WAIT JUST A MINUTE! The definition said "along with proposals for financing them". When Congress submits a budget, its proposal for financing it is to increase the debt limit and borrow more money? So how is that a "proposal for financing"? Wouldn't Congress then need another budget to propose a method for repaying the additional money it just borrowed? What if the proposal to finance that was also just another increase in the debt limit? I think we can clearly see now how the government operates. Obviously, without a serious increase in tax revenues or some spending cuts, this is a formula for a runaway national debt. There is, in effect, no upper limit. Currently, the U.S government borrows over $1 trillion per year. At this rate, it is quite possible that the national debt will be over $20 trillion by the end of President Obama's second term.

The dilemma then, is that we must choose either a default, which would seriously damage the U.S. economy, or an ever increasing national debt, which merely postpones the pain of paying back borrowed money. As a citizen-consumer, the easiest way for me to relate to this is to consider the obligation of credit card debt. In a bad month, I could just not send a payment. The bank would see that as a potential default and I would have to suffer the consequences. Or, if I had the same magical powers that Congress has, whenever my credit limit was reached I could simply have the bank raise my credit limit. Then I could go on spending indefinitely, making only the minimum monthly payment. Perhaps someday the bank would ask me to pay back all of the debt. But why worry about the future?

At the time of this writing (January 21, 2013) the total U.S. public debt outstanding is: $16,432,631,489,854.70.

The Last Word...

But perhaps this is all much ado about nothing. Allan Greenspan once said, ”[A] government cannot become insolvent with respect to obligations in its own currency. A fiat money system, like the ones we have today, can produce such claims without limit.”

Economic Alchemy: Eliminating the national debt with a $1 trillion dollar coin: