The New Needed World Monetary System

America is drowning in debt. The government’s liabilities are now growing at an exponential rate. The national debt is on a vicious downward spiral.

Understanding The New Economy

An actually competent science of the new MuRatopian economy, is essentially a matter of ending, and replacing the priority which has been wrongly placed on what had been, hitherto, an axiomatically incompetent system, a debt monetary system. This has been a conventional, specifically 19th century capitalism system which had been rooted in the basis provided by those traditional monetarist conceptions of one factor market system.

More broadly, the fault of that system has lain in the system’s adopted notion of the function of one factor market economy, a notion which has been a vicious, conventional expression of what has been, essentially, the same incompetence built up from both those ancient and, then, the nineteenth century capitalism of conventional roots traditionally underlying the prevalent dogmas of economic practice during the medieval and modern times, still, presently in the 21st century.

The presently onrushing plunge of our entire planet is into what, unless stopped, will be a prolonged, global new collapse of all mankind. This contingency requires that we free ourselves from the grip of those conceptions and practices of the debt monetarists traditions, traditions which must now be thoroughly superseded, that systematically, by a science of a new economic foundation: by the adoption of a notion of MuRatopian Economy, rather than debt economy value. This replacement must be in the form of MuRatopian Intersection Economics, rather than a monetarist system.

This new conception will be a notion of equitable value which must be premised, on all most essential points, on the superseding authority of that revolution in modern democratic capital science, the authority which will have been based on the retrospective implications of the unique features of the discoveries of universal binary principles by Louis .O. Kelso, and, also based upon the relevant conception which was derived from Professor Kaoru Yamaguchi’s discovery of MuRatopian Economy and by a leading pioneer follower of his, Ssemakula Peter Luyima, who has incorporated the discoveries done by Egmont Kakarot-Handtke regarding the new structural law of supply and demand as well as Dr Stephen Thaler for his revolutionary invention of Creativity Machine all are considered in that order, for our purposes here.

The MuRatopian economy combines three disciplines of economics in uniformity with creativity machine paradigm that can lead the transformation of the semiarid, starving region of the Sub-Saharan Africa into the breadbasket of the African continent.

Each decade, governments, financial institutions, engineering firms, and other complete studies of new projects. To date, for Africa alone, Creativity Machine Paradigm can generate subsequent potential projects for development which are not only technologically feasible beyond doubt, but which would produce a substantial contribution to the national surplus of each African nation and the regions in which they are intended to be placed.

Indeed, with the new economy we can have substantial sound projects to launch than the combined forces of the industrialized and developing nations have the present economic means to launch simultaneously.

Our practical task for development is that of selecting a combination from among the proven economic disciplines which now form the New MuRatopian Economy. Under the new MuRatopian economy, public money system and binary financing resources will be allocated for development to a combination of selected projects which, taken together, will have the optimal effect in raising per capita output in the African continent.

Up to that point, the policymaking and the administrative problem are well defined and easily understood among the relevant professionals. Limiting our attention to those governments, parties, and financial institutions which are opposed nineteenth century capitalism, International Monetary Fund policy, World Bank, debt money system, the problem occurs the instant those groups’ sound packages are turned over to the economic specialists. With some few exceptions, the economic specialists respond with elaborate explanations showing the high-technology development of continents such as Africa is more or less impossible.

The Religion of Usury

Equilibrium Economics

In point of fact, the arguments of such economic specialists are questionable. The variety of economic theory they are employing is no longer suitable for the 21st century socio-economic problems. Unfortunately, graduates coming from learning institutions most of them are employed in the administrative infrastructure of governments, parties, banks, firms, and trade-union organizations even in the best of nations. Governments and others set forth to undertake an eminently sound program for economic development of the so-called developing nations. The western learning institutions are the root of such programs. As a result of this questionable post-colonial approach at the roots, sound programs wither, and the abused and neglected developing nations slip closer to the abyss of biological catastrophes of famine and epidemic, combined with the effects of poverty and inequalities fostered through such economic impoverishment.

The True Story of The Bretton Woods

The Bretton woods monetary system has been a cancerous revival of what Roosevelt rightly denounced as “nineteenth century methods”. This Bretton Woods system has meant leaving formal colonial nations to carry independently their accumulated debts-independent of significant assistance from the industrialized nations. This is the phenomenon which developing nations often describe as “neo-colonialism”. On balance, since the death of President Roosevelt, the United States government has worked to perpetuate the old nineteenth century capitalism in thin disguises, and has done so by embracing what Roosevelt denounced as “Capitalist 19th-century methods”.

The conventional school of economics, is the formalization of precisely those “capitalism 19th-century methods”. Without rejecting those methods, without replacing those miserable varieties of political economy, the New MuRatopian Economy may not be brought into being.

For such reasons, it is a wishful delusion to speak of the developments of regions such as Africa without committing ourselves to the replacement and eradication of those kinds of economic doctrine associated with current school of Economics.

The author of The New Future of Money, proposes the immediate reconstruction of the world economy’s monetary structure into the form of what we termed now a “MuRatopian Intersection Economics”. The new economy demands a debt free economy and a technological two factor structural market economy, not debt money system one factor market system used under Bretton Woods. We propose that a MuRatopian Intersection based monetary system would be made economically feasible through economic cooperation agreements with the global nations.

The proposed establishment of the MuRatopian Monetary System, combined with the new world equitable accords among nation-state economies, will establish the indispensable cornerstone for the new, needed world monetary system.

If the new members of the proposed MuRatopian Monetary System place common reserves in a public money-binary financing based pool system, that pool is readily converted into a new democratic self-finance facility. Churning liquidities held by central banks and other major institutions can be exchanged for purchases of low-interest, democratic capital acquisition, long-term future savings. The liquidity so concentrated in the new public banking facility can aggregate to a level of hundreds of billions of dollars. This provides the basis for issuing low-interest, long-term democratic capital acquisition for export of high technology capital goods from the industrialized to developing nations.

If we assume that the MuRatopian Monetary Fund will be put into operation quickly now, this step is excellent. It is an indispensable step if we are to avoid an otherwise certain world depression and almost certain global war catastrophe.

However, this step by itself is not adequate. One more ingredient must be added. We must rid global government(s) and financial institutions of the pernicious influence of “Capitalism 19th-century methods”. Without that additional measure, the MuRatopian Monetary System must tend to fail—and the condition for Africa, among other developing regions, will then become hopeless.

This last problem I have detailed in a publication entitled The New Creative Economic Theory. As part of the same effort, the Agenda 2063 on the development of Africa is a most appropriate platform for discussing some of the leading, indispensable functions the “MuRatopian Economic Model” will have in ensuring competent equitable and productive process of economic development. This model enables us to replace the “Capitalism 19th century methods” introduced in the new economic theory and other economic-system procedures to be implemented in the new world economy.

Examine the evidence outlined below, connect the dots and think for yourself.

All truth passes through three stages. First, its ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident.

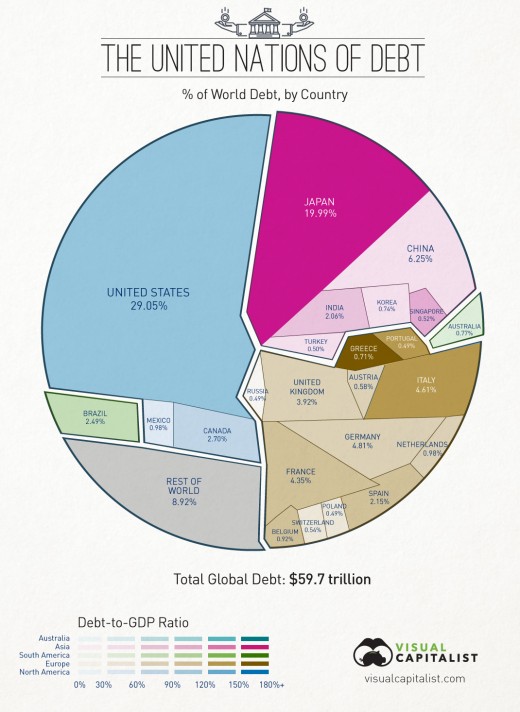

— – Arthur Schopenhauer$60 Trillion of World Debt in One Visualization

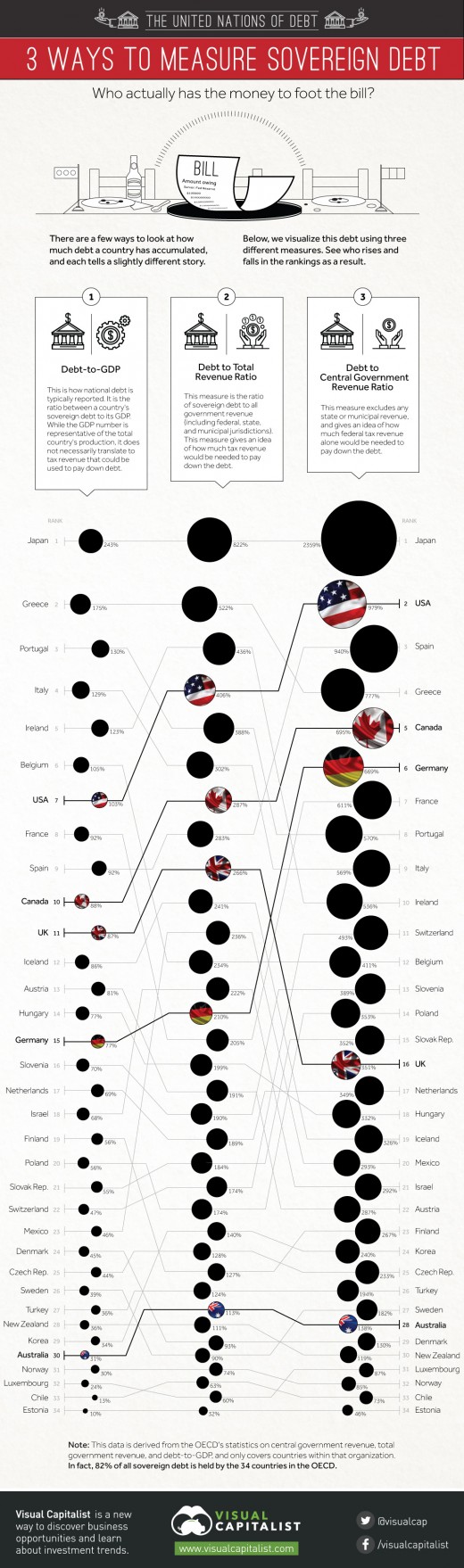

The above visualization breaks down $59.7 trillion of world debt by country, as well as highlighting each country’s debt-to-GDP ratio using colour. The data comes from the IMF and only covers public government debt. It excludes the debt of country’s citizens and businesses, as well as unfunded liabilities which are not yet technically incurred yet. All figures are based on USD.

The numbers that stand out the most, especially when comparing to the previous world economy graphic:

- The United States constitutes 23.3% of the world economy but 29.1% of world debt. It’s debt-to-GDP ratio is 103.4% using IMF figures.

- The United States constitutes 23.3% of the world economy but 29.1% of world debt. It’s debt-to-GDP ratio is 103.4% using IMF figures.

- China, the world’s second largest economy (and largest by other measures), accounts for 13.9% of production. They only have 6.25% of world debt and a debt-to-GDP ratio of 39.4%.

- 7 of the 15 countries with the most total debt are European. Together, excluding Russia, the European continent holds over 26% of total world debt.

Combining the debt of the United States, Japan, and Europe together accounts for 75% of total global debt.

To that purpose, Let us now summarize for you the following key points.

First, the author of The New Future of Money is a pioneer economist directly in the tradition of what Professor Kaoru Yamaguchi defines as the “MuRatopian Democratic Economy”. Followed with integration work of the best known economists of the “Binary Financing System” Louis Orth Kelso, Patricia Hetter Kelso, Professor Robert Ashford, and other important concepts advanced by Egmont Kakarot-Handtke developing the new structural laws of demand and supply and Dr Stephen Thaler leading inventor of the Creativity Machine Paradigm.

Second, The New Future of Money identifies the gross incompetence of the system of debt money system in official use globally today. By means of this illustration that leaves no doubt in your minds of the rightness of the theory of Professor Kaoru Yamaguchi, Louis Orth Kelso and Professor Robert Ashford, Egmont Kakarot-Handtke and Dr Stephen Thaler, or of the gross incompetence of the sort of economics advocated by mainstream economist’s society today.

Third, The New Future of Money book turns your attention to the flaw of omission in the economic theories of current conventional financial system. In this connection, the author shows why no competent administration of development of the developing nations is possible without the replacement of nineteenth century Capitalism methods of political economy by the MuRatopian Intersection Economic System.

The detailed explanation in The New Future of Money brings into focus the point emphasized in the title of this article. In the conclusion, the author turns your attention again to the special characteristics of the “MuRatopian Economic Model”, to show why any mathematical model or accounting system reducible to simultaneous linear equations is axiomatically incompetent to represent a developing economy. As a corollary point, he shows you that the effort to administer an economy or world monetary system according to the doctrines derived from globalization policies, must direct economies into relative stagnation and ultimate collapse.

MuRatopian Intersection Economics

Thought-Provoking Questions

Select Bibliography

[aristotle] Aristotle. The Politics of Aristotle. Translated by Ernest Baker. Oxford: Clarendon Press, 1946.

[ashford] Ashford, Robert H.A. The Binary Economics of Louis Kelso: The Promise of Universal Capitalism. Rutgers Law Journal. 22(1990): 3-120.

[berle1] Berle, Adolf A., Jr. New Directions in the New World. New York: Harper and Brothers Publishers, 1940.

[berle2] Berle, Adolf A., Jr. Power Without Property. New York: Harcourt, Brace and Company, 1959.

[buss] Buss, James A. and William E. Buss. A note on the Economic Impact from the Financed Capitalist Plan. Research in Law and Economics. 3(1981): 227-239.

[kelso1] Kelso, Louis O. Karl Marx: The Almost Capitalist. American Bar Association Journal. 43(1957): 235-279.

[kelso2] _. Labor’s Great Mistake: The Struggle for the Toil State. American Bar Association Journal. (1960).

[kelso3] _. Poverty’s Other Exit. North Dakota Law Review. 41(1965):147-155.

[kelsoadler1] Kelso, Louis O. and Mortimer J. Adler. The Capitalist Manifesto. Westport, Connecticut. Greenwood Press, 1958.

[kelsoadler2] and _. The New Capitalists. Westport, Connecticut: Greenwood Press, 1961.

[kelsokelso1] Kelso, Louis O. and Patricia Hetter Kelso. Democracy and Economic Power. Lanham, Maryland: University Press of America, 1986, 1991.

[kelsokelso2] and _. The Great Savings Snafu. Business and Society Review. Winter(64)(1988): 42-47.

[kelsokelso3] and _. The Right to be Productive. The Financial Planner. 11(8)(1982), 51-61; 11(9)(1982), 87-110.

[moulton1] Moulton, Harold G. The Dynamic Economy. Washington, D.C.: The Brookings Institution, 1950.

[moulton2] Moulton, Harold G. The Formation of Capital. New York: Arno Press, 1975.

[say1] Say, Jean-Baptiste. Letters to Mr. Malthus. New York: Agustus M. Kelley Publishers, 1967.

[say2] Say, Jean-Baptiste. A Treatise on Political Economy. Edited by Clement C. Biddle. Philadelphia: Lippincott, Grambo and Co., 1853.

[speiser] Speiser, Stuart M. A Piece of the Action. New York: Van Nostrand Reinhold Company, 1977.

Thaler, S. L. (1995). Death of a gedanken creature, Journal of Near-Death Studies, 13(3), Spring 1995.

Thaler, S. L. (1996a) Creativity via network cavitation – an architecture, implementation, and results, Adaptive Distributive Parallel Computing Symposium, Dayton, Ohio, 8-9 August, 1996.

Thaler, S.L. (1996b). The death dream and near-death darwinism, Journal of Near-Death Studies, 15(1), Fall 1996.

Thaler, S. L. (1997). "The Fragmentation of the Universe and the Devolution of Consciousness," U.S. Library of Congress, Registration No. TXU00775586, 1997.

Thaler, S. L. (1998). Predicting ultra-hard binary compounds via cascaded auto- and hetero-associative neural newtorks, Journal of Alloys and Compounds, 279(1998), 47-59.

Thaler, S. L. (1999a). No mystery intended. Neural Networks, Volume 12, Issue 1, January 1999, Pages 193-194.

Thaler, S. L. (1999b), AFRL-ML-WP-TR-1999-4033, Integrated Substrate and Thin Film Design Methods, Materials and Manufacturing Directorate, Air Force Research Laboratory, Air Force Materiel Command, Wright-Patterson Air Force Base, OH 45433-7750

(1) US Congressional Briefing 2011, July 26, 2011 by Prof. Kaoru Yamaguchi: TRANSCRIPT (This is a transcript of my US congressional briefing on the workings of the public money system)

* (1-Page Briefing Note for Media) (One page briefing note distributed to the Media)

(2) HR 2990 (NEED Act, National Emergency Employment Defense Act)

Congressman Dennis Kuchinich's Bill based on the American Monetary Act,

which is submitted to the US House Committee on Financial Services on Setp. 21, 2011.

(3) Workings of A Public Money System of Open Macroeconomies;

(Paper, Slides and YouTube) at the 7th Annual AMI Monetary Reform Conf.

University Center, Downtown Chicago, Sept. 30, 2011.

(4) A Program for Monetary Reform by Irving Fisher, etc., July 1939.

(Reformatted by the Kettle Pond Institute)

(This document is an extended version of the original "The Chicago Plan for Banking Reform" by Henry Simons, etc., March 16, 1933).

(5) On the Monetary and Financial Stability under A Public Money System;

( Paper, Slides and YouTube ) at the 8th Annual AMI Monetary Reform Conference, University Center, Downtown Chicago, Sept. 20 - 23, 2012.

(6) Public vs Debt Money Systems - the American Monetary Act in a Nutshell;

(Paper, Slides and YouTube) at the 9th Annual AMI Monetary Reform Conference,

University Center, Downtown Chicago, Sept. 19 - 22, 2013.

(7) From Debt Money to Public Money System - Modeling A Transition Process Simplified;

(Paper, Slides) at the 10th Annual AMI Monetary Reform Conference, University Center,

Downtown Chicago, Oct. 2 -5, 2014