Are E-Commerce Grocery Businesses Sustainable in India in the Start-up Era?

Entrepreneurial reasons for putting a grocery business online:

An entrepreneur would always want to see his/her firm skyrocket with profits some years down the line. For a person who is thinking of the same, the internet is the answer for him/her. Putting the firm online is the best way of achieving profits these days. The sheer outreach of the world wide web (www) helps in making local businesses global. In such an age of 4G internet, starting an online grocery business is very much possible in India with the tax relaxations offered by the Indian government.

Let's have a look at some common issues that an online grocery store can solve:

- Indian laziness: We Indians don't believe in toiling to get food/groceries. We would rather prefer to order them online and get them delivered to our doorstep. With the huge number of online grocery firms that are coming up in every metropolitan city in the country, our laziness is even increasing.

- No need to maintain a store: When one is online, one does not need to maintain a store and bear the overheads involved in it. For an online store, a warehouse is enough for operations. Thus overheads are cut drastically.

- Low penetration of large online grocery stores: The big players might not be at smaller towns and cities, this gives the ideal ground for small grocery e-tailers to thrive and grow.

- Taming the local competition: Price is not the only factor to pull customers towards a particular online store though it is one of the decisive factors. After the cannibalization of the market by disruptive pricing and offers, local competition must be kept in check by providing superior service quality to the customers.

- Talking with customers: The internet makes it easy for communication to travel its way from the online service provider to the customer and from the customers back to the service provider. This closed feedback loop helps the providers to improve their service from their current state, upon listening to the voice of the customers.

The year of the e-tail grocery: 2018 seeing some game-changing developments online

When offering customers a superlative shopping experience, organizations also fight to fit into that little corner of the customer's mind which we term as brand loyalty and also fight to get a share of the customer's wallet. Every e-tailer's goal is to make consumers buy everything solely from their platform. The same reason why the Amazons and the Flipkarts are keeping grocery as one of their verticals. The push of the e-grocers towards a better service, is giving food manufacturers new channels to market their products apart from the conventional ones.

From an immersive retail experience to the shift to hyperlocal sourcing, let's have a look at some of the trends in grocery e-commerce in 2018:

Hyper-local: To reduce inventory and wastage many online grocers are applying this strategy to support their finances and help local SMEs. Big players often think about global expansions but hyperlocal strategies help them to reach out to the local market and match consumer demands. Thus the big boys in the grocery business are increasing their long-tail and giving consumers endless options to shop from.

Smart shopping: Technology forms the forefront of any e-commerce. Though big e-tailers with their deep pockets do not shy away from giving audacious discounts to customers, at the core, all of them know the fact that without a superlative shopping experience, no customer is going to be a loyal customer. This statement is justified by their technological superiority. From the advent of AI to the consumer choosing online and buying offline and vice-versa on the same platform, online grocers are leaving no stones unturned to woo their customers.

Innovation in last mile delivery: Online grocers also try to leave a lasting impression on the minds of their customers. Amazon is testing with unmanned aerial bots to deliver. Many firms hire third parties to supply electric bikes and scooters to promote their consciousness towards nature. Last mile delivery is the face of an online player, perfecting this aspect of the game is what they thrive for.

Transparency is the key: Without full transparency of what goes into the food, grocers may face consumer rights issues telling them to unravel the entire process of food preparation from farm to fork. An online grocer must spread consumer-awareness about the transparency and quality of their products for sale.

Worldwide e-commerce grocery market trends:

Worldwide FMCG sales growth stands at around 4% CAGR. Growing sluggishly, the entire FMCG industry (both offline and online) has a current valuation of 4 trillion $. In comparison, the total retail e-commerce industry is predicted to grow at 20% CAGR till 2020. The extrapolations cite a valuation of retail e-commerce to be around 4 trillion $ by 2020.

The figures speak that the online retail industry may equal the entire FMCG industry in the near future. This itself shows a trend that is shifting online-wards. The lifestyle of people, their choices are all influenced by online commerce. The manufacturers, wholesalers, and retailers have to keep up with this change in consumer behavior just to stay competitive let alone make profits.

If we look at the e-commerce grocery industry VS all other e-commerce industries, it can be cited as a nascent industry anywhere in the world. No-where in the world has any e-commerce company reached saturation in their respective market. This gives rise to tremendous growth opportunities to any player big or small that are in this sector.

To cite an example, the US being the most developed market in the world still holds a tremendous growth opportunity of online channels. With the online channel comes the e-commerce grocery sector. As of 2016, 23% of Americans buy groceries online. A survey conducted in late 2017, found that almost 49% of Americans bought groceries online at least once in the last three months. This figure is expected to triple in less than a decade.

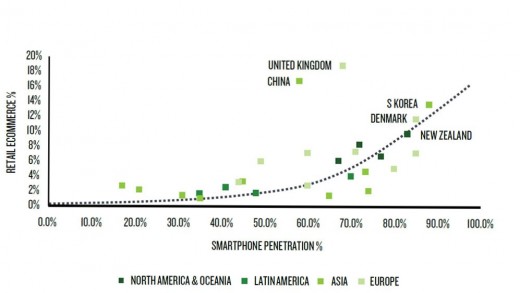

Retail e-commerce is penetrating deeper into the various markets with the increase in usage of smartphones. But the customer acquisition of the e-tailers with the smartphone penetration is not always directly proportional.

Graph showing retail e-commerce and smartphone penetration in various continents

The graph below shows the trends

The relationship between e-commerce grocery and smartphone penetration is not always linear. Some countries like U.K, China, South Korea, Denmark come up as anomalies to the trend. Further conclusion can be drawn like tremendous smartphone growth rate alone is not enough to fuel e-commerce growth. This means consumer's online behavior alone is not enough to decide the trends of online commerce and the pattern in which consumers are shifting from offline to online.

Cutting the long story short, people even in developed countries still want to experience the touch factor when it comes to buying groceries, irrelevant of how tech-savvy they are.

The best players of the Indian click and mortar grocery segment:

E-commerce is all based on technology and innovation. But is having a robust technology enough, to pull an online business skywards? No is the answer. With a success story of more than 8 years, this notion was once again strengthened by Bigbasket. The co-founder of the biggest e-commerce grocery firm in India (Bigbasket), cited that the understanding of the business and it's sector is more important than the technology itself. The correct path of business development yielded through that understanding, will guide the technological innovations towards operational excellence of that firm.

Strong connections between click and mortar, efficient supply chain, procurement and lean inventory management are key factors when it comes to making profits in the online grocery business.

Why does every big e-tailer want to enter the grocery business? The answer is simple, the stickiness of grocery. According to research data from Forrester, an average online app-familiar customer opens a grocery app thrice a month.

Alibaba recently invested 220 million $ in Bigbasket. Walmart owned Flipkart's plan to enter into groceries with tremendous discounts will soon be on the cards for some Tier I cities. Amazon also has it's grocery wing and is burning through truckloads of money every month to build the brand. Grofers and Paytm mall are the smaller players in the sector when compared to the sheer volume of sales the former three firms have or can garner in the near future.

Strategic alliances and acquisitions may also be on the cards as firms look for vertical integration and larger profit margins. The other reason for consolidation in the online grocery sector of India may be because of common investors like Alibaba and Softbank in multiple firms.

The Engine behind the growth of E-Grocery firms:

Grocery businesses in India are at 60% of the total value of retail businesses in India. There is a potential of the grocery industry in India to cross 700 Billion $ by 2022. The online grocery segment in India is currently valued at just over 1 Billion $, but the growth potential is tremendous.

Robust marketing, tremendous infrastructure improvements, technological improvements at the user end equipped with strong analytics are the drivers of growth of the e-tail especially the grocery industry. In a land where people spend more than 50% of their income on monthly groceries, this industry is perfect to thrive in India. Strong delivery system representing the best of services from e-tail firms and huge customer bases are the measurement parameters for an e-grocer's growth plans.

Now, how to support this growth of robust customer acquisition? Highly efficient supply chain with the use of proper technology to manage this supply chain, retaining customers with very low return rates, and phase-wise expansion. Grocery is a local business and has very low margins. The city by city expansion model is followed by e-tailers these days.

But the expansions come at a cost. Complex logistics issues and increasing reverse logistics costs eat into the pockets of investors. At the same time, grocery being a basic need, customers will never pay a premium for a great service. Complete visibility over the supply chain and continuous calculated investments are the key to succeed in this business.

The sustainability question still remains for various firms and they face a dilemma of choosing horizontal growth VS vertical integration. Players with deep-pockets can stress on vertical integration while the less fortunate firms can focus on horizontal growth to offset the losses.

Disruptive pricing is another aspect of this industry, which only firms with deep pockets can pull off. Its a normal trend of this industry, that the bigger players eat up the smaller ones for targeted expertise and customer base acquisition.

The sustainability question: When does the cash flow stop?

Taking the bigger picture into the mind and believing firmly in future returns, investors behind e-commerce firms keep the cash flow going. An example will clear the picture, Japanese investment firm Softbank has incurred losses of 555 million $ in November 2016 and comparatively lower 475 million $ in February 2017 over 24 firms in which they have invested. Some e-commerce even incurs losses up to 10 times its revenue.

In the grocery segment, Grofers closed down operations in several cities owing to tremendous losses in those geographical areas. But here we are, using e-commerce services almost daily. The underlying fundamentals of e-commerce businesses are way stronger than the dot-com boom in the late 90s and the early 2000s. That is why we see firms grow at CAGRs of over 200%.

The USPs of e-commerce firms lies in the ability to provide a large variety of products over a huge geographical span. This brings down overheads as compared to maintaining a physical store.

Now the question arrives, does the customer buy from you when you give discounts? In India, this question is becoming more of the norm. The customers flock on e-commerce sites citing discounts they won't get anywhere else. This will give a firm, exponential customer acquisition rate, huge topline growth but the bottomline figures will be very concerning.

Burning through cash is not the ultimate solution of an e-commerce, turning the business into a profit-making one, is. This is the real sustainability question, selling products of other brands will never give a firm the margins they want. That is why grocery e-tailers like Grofers are shifting towards the entire product portfolio onto their Private label.

Contract manufacturing with small firms and bringing their food products under a single umbrella is the norm nowadays for grocery e-tailers. This is how they increase their long-tail product portfolio and make products exclusively available on their web portal. This method can fetch an e-commerce firm 5-10 % more margin than selling other brand's products.

That is how e-grocers are increasing their Private label (PLB) portfolio, offsetting losses with each order that they deliver. But does that mean, they are heading towards profitability? No, by a long shot, the new services that they offer, attaining a better service quality level to deliver the same, as promised, makes a firm bear tremendous supply chain costs. So at the end of the day, it's a battle of the competitive supply chains and better technology of firms which will drive it towards profitability in the long run.

Finally, e-grocers need to stress upon promoting cashless transactions. Cash on delivery (COD) accounts for nearly 60% of the online sales in India. This comes with pain-points like coming up with additional working capital, cash pilferage etc. Slowly e-tailers especially grocers where daily cash flow management is very crucial, need to push customers towards paying online more.

With online grocery segment, being the fastest growing in retail space, this sector will see growth rates of 65-70 percent by the end of FY 2020. This gives a valuation of the sector big enough, to make all the big players like Big Basket, Grofers, Amazon, Paytm mall etc and other smaller players to co-exist. Deep discounting can never sustain a firm, how popular it is or how big a fan-following it has. Proper and prompt service, value-added features, convenience to the shoppers are the factors that will drive sustainable growth of e-grocery firms.

Do you shop groceries online or offline?

© 2018 Ankush Mukherjee