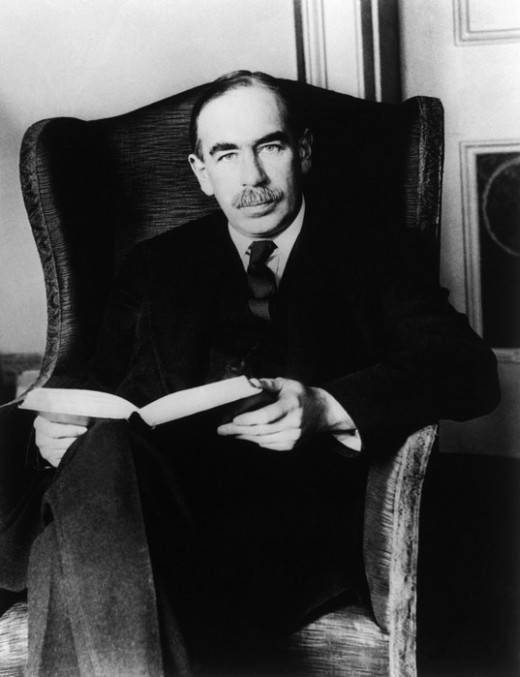

What is Keynesian Economics?

In Part I of his magnum opus published in 1936,The General Theory of Employment, Interest, and Money, John Maynard Keynes explained that his economic theory was based on the refutation of Say's Law; the doctrine that income is automatically spent. Applying Say's Law would mean that all the observable indicators, used by economists to understand the behaviour of an economy, would be irrelevant. Say's Law implies that all resources in an economy will be used, because all cash is used for consumption and capital investment to satisfy the consumption.

Keynes however, was able to demonstrate that there is a strong motivation by individuals and companies to accumulate cash as an objective; rather than to then use it to maximize consumption and investment. The tendency to accumulate cash occurs during good times and recessions. During recessions however, this tendency becomes extreme; so that aggregate demand for goods and services in an economy falls to a level at which the economy ceases to operate normally. Capital investment also stops, so that there is no consumption related to the purchase of capital goods; or from the wages paid to those involved in the manufacture and use of these capital goods. According to Keynes's analysis, economies have an inbuilt tendency to instability; because of this motivation to accumulate cash.

A year after publication of his General Theory, Keynes expanded his thesis to a scenario in which there is extreme economic uncertainty. Uncertainty brings risk aversion, so that the tendency to accumulate, rather than to spend or invest cash becomes dominant. Extreme uncertainty therefore also produces the same fall in aggregate demand and investment.

According to Keynes, when these extreme situations of uncertainty and recession occur, the Government should create aggregate demand in the absence of that created by the private sector. There are several ways to create aggregate demand. Keynesian Economics is the application of an economic theory; that seeks to correct the inherent instability in economies, through the creation of aggregate demand during times of uncertainty and recession.

Governments can use the taxation system to redistribute income, to leave different sections of the population with more disposable income; however this is still no guarantee that aggregate demand will be created. Beneficiaries of the redistribution of income will still have the tendency to save cash rather than to consume or invest.

It is therefore necessary for Government itself to create the aggregate demand; by the expenditure of revenues. These revenues can be spent on projects,that the Government believes will have the maximum effect in creating aggregate demand once they are executed. In times of recession, tax revenues will be small or non-existent; therefore Government expenditure will incur budget deficits. The economic growth and aggregate demand created by this deficit financed Government expenditure will then be recovered from future tax revenues.

![Economics 101 For the Political Junkie: Part 1 - Schools of Economic Thought [183a]](https://usercontent1.hubstatic.com/7463054_f120.jpg)

![Economics 101 For the Political Junkie: Part 4b - Understanding GDP - Government Spending [183e*2]](https://usercontent2.hubstatic.com/12216145_f120.jpg)