Meaning of Market in Economics

What is Market in Economics?

Today in this globalized world we are hearing the word market, market…. Actually what is market? Is it a place? or a shop? Generally are people using the word ‘market’ to represent a particular place there trade occurs. There can be see separate market for vegetables, fish etc. Some other people are using market for representing stock exchanges. This hub is briefly discussing about the concept of market and different forms of market with special reference to Economics.

In economics market may not be a particular place or building, shop etc. By definition “market is one where the complex activities are occurring and where the buyers and sellers meet closely for buying and selling of commodities”. So, there is no condition that a market should be place or something like that. But a place or shop may be a market.

A distinctive example for market is online shopping. Where we cannot find any place to meet the buyer and seller. But they are interacting and transactions are delivering. Any way following are the important conditions for a market.

i) There should be a buyer and seller

In a market there should be the presence of buyer and seller. They interact oppositely to exchange their commodities.

ii) Commodities

The transaction should be in the form of goods and services for cash. In a market suppliers are selling their commodities to buyers.

iii) Freedom in interaction

In a market buyers and sellers have the freedom to interact between them without any barrier. That means there should be the freedom to enter and to exit from the market.

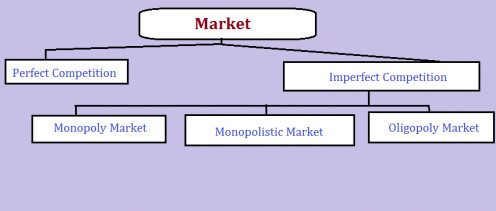

In almost all the economy we can see the high level of competition between suppliers. On the basis of competition there are two types of models in economics.

a) Perfect competition

b) Imperfect competition

Further imperfect market competition can be classified in to monopoly, oligopoly or duo poly. Each of the market forms are briefly described given below.

I – Perfect Competition Market

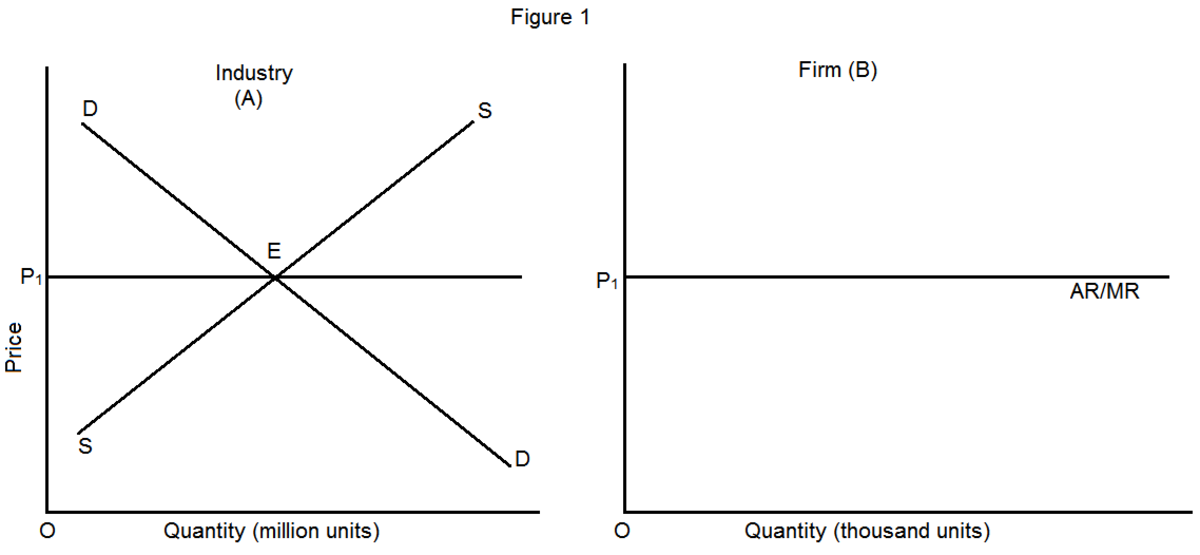

Perfect competition is actually an imaginary market situation. So it does not exist in the real world. By meaning perfect competition is the market situation in which large number of buyers and large number of sellers are interacting. The main reason for the non- existence of the perfect competition market is its unrealistic features or assumptions. Some of the most important assumptions of perfectly competitive market are briefly described below.

a) Large number of buyers and large number of sellers: In a perfectly competitive market there exist large quantity in the number of buyers and sellers.

b) Homogenous product: It is another assumption meaning that all the producers or sellers are supplying same product. There is no difference in quantity and quality.

c) Uniformity in price: Since commodities are homogeneous no firm can sell it at higher price. So the price in the industry will be same for all firms.

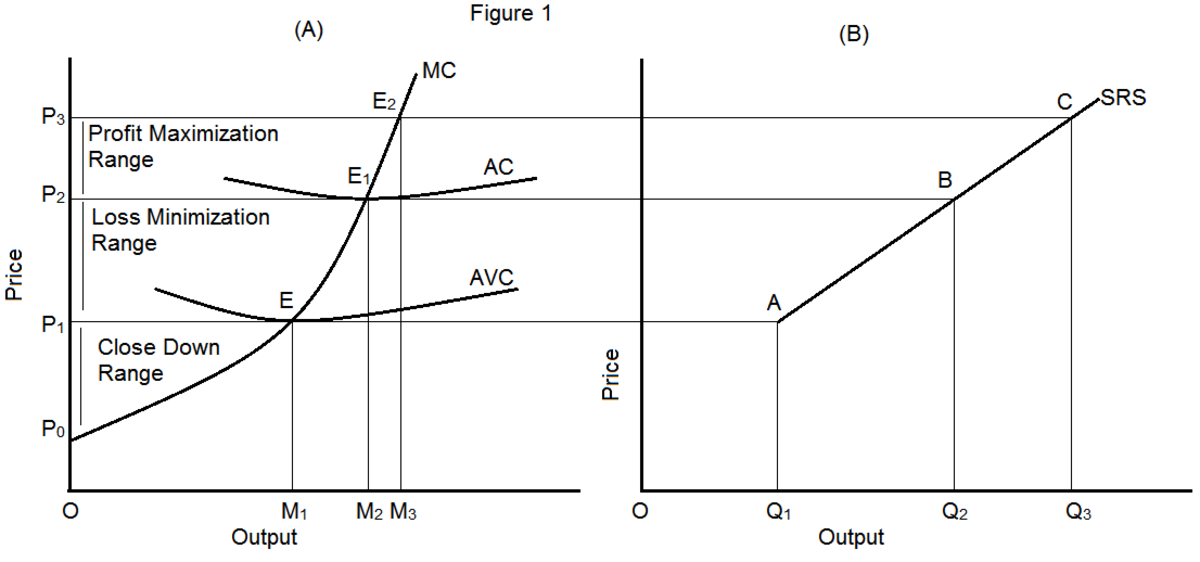

d) Firms are price takers: Since the products are homogenous, the price of the commodity will be determined by the market. Any single firm cannot set their own prices. So sellers are the price takers in a perfectly competitive market.

e) Perfect knowledge: Since the products are same, buyers and sellers will be having perfect knowledge about prices, products, other sellers etc.

f) Freedom to entry and exit: It means that a new firm or seller can enter into the market or an existing firm can exit from the market. There are no barriers or restrictions.

II – Monopoly Market

The word ‘mono’ means ‘single’ and ‘poly’ means ‘seller’. Monopoly market is a market condition where only a single seller and many buyers are interacting to fulfill transactions. Actually it is a very rare market form in the real world. The following are the assumptions or features that are required to be a monopoly market.

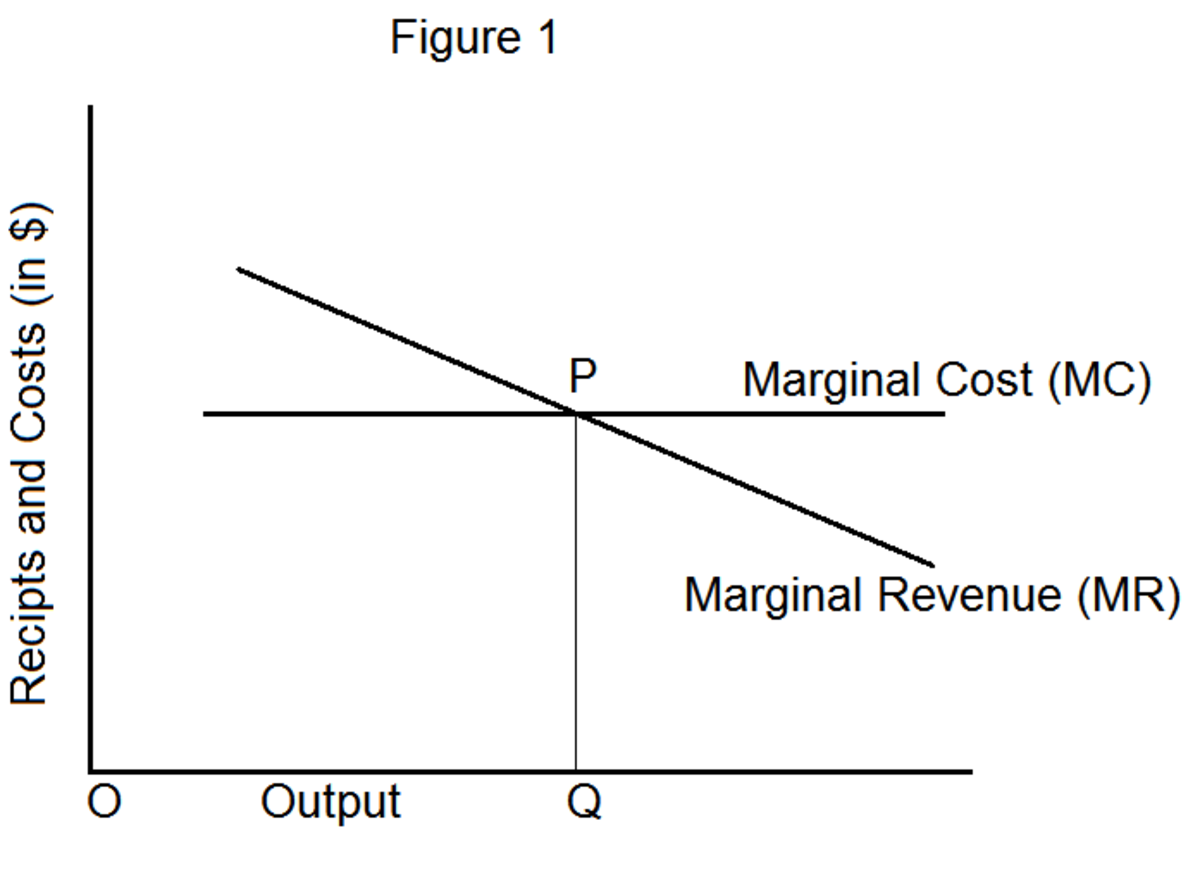

a) Single seller: The word monopoly shows the domination of a single one. In a monopoly market only a single firm supplies the commodities to many buyers.

b) No competition: Since a monopoly market consist a single firm, there is no scope for competition.

c) Price discrimination and price maker: In a monopoly market a single firm can penetrate more profits, because there are no substitute suppliers. So a monopolist can impose different prices to the different groups of the consumers and so, the firm is the price maker.

d) No freedom to entry: It is very difficult for a new firm to enter in to the market because of many barriers. When a firm enters in to the market it will become another form of market due to the lack of monopoly power. So, there is no freedom to entry in to a monopoly market.

III – Monopolistic Market

It is a market condition where large number of buyers and sellers interact. They are supplying different substitutable products but may not be perfectly substitutable. Following are the major features of a monopolistic market.

a) Large number of sellers and buyers: It is the vital feature that there interact large number of buyers and sellers in a monopolistic market

b) Differentiated commodities: In a monopolistic market, each firm will supply differentiated commodities but it can be used as an (not perfectly substitute)

c) Differentiated prices: Since the firms supplying differentiated products they impose a flexible price from one to another.

d) Competition other than price: Since firms are supplying substitutable products they will compete each other in factors other than price. Especially by doing advertisements and changing quality, size, color etc.

e) Freedom to entry and exit: A new firm can enter in to the market and an existing firm can exit from the market. There are no hindrances.

IV - Oligopoly and Duopoly

Oligopoly is the most real market form existing in the world. Almost all the markets are examples for oligopoly market. By meaning in an oligopoly market few sellers and large number of buyers are interacting to satisfy their demands and supplies. Different forms of oligopoly markets are there.

Duopoly is similar to the oligopoly market. A two firm industry can be regarded as the Duopoly market.

Major features of an oligopoly market are listed below.

a) Few sellers and large number of buyers

b) Interdependency: Each of the firms in an oligopoly market is interdependent. So, any action by a single firm could influence other firms.

c) Price rigidity: Any single firm cannot fix the price of the commodities, it is rigid. When a single firm reduces the price of commodity others will do the same.

d) Selling cost: Since sellers are few, they compete with each other. So, there required selling cost. Many firms would spend huge amount for advertisements.

e) Difficulty to entry and exit: It is not easy for a new firm to enter or exit of an existing firm. It required huge investment or capital. So, it is very risky to exit from the industry.