What is Inflation?

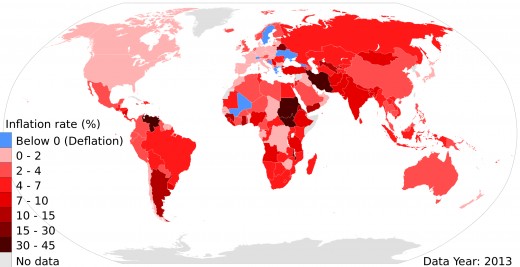

We have heard about inflation in many scenarios and know that it is very bad for the economy. But most of us do not know the real causes and consequences of high inflation rates on an economy. So what is inflation and why is it that countries are so afraid of getting caught in the inflation spiral?

What is Inflation:

Inflation is defined as a continuous increase in the cost of goods and services inside a country. This is generally measured as a yearly percentage growth in the cost. This means that the if you are able to buy 100 chocolates for $1 this today you will be able to buy only about 5 chocolates for the same amount the next year. Increase in price of goods is fine as long as everything else such as wages and productivity increase. But this seldom happens.

Consequences of Inflation:

At first glance, this doesn't sound that bad. The cost of goods and services rise but at times this is good for a growing economy. However, the percentage at which the cost rises needs to be under control always. If the rate of inflation gets too high it becomes almost impossible for an economy to bounce back.

In 1920, Germany, inflation struck the nation as it was forced to pay a huge sum of money to the allied nations as a fine for initiating WW1. The government could not afford to pay such a huge sum and thus resorted to printing more money. People began to lose trust in the value of the German Mark currency and thus its value plummeted. The exchange rate for a single dollar was 4.2 trillion German Marks by 1923.

In 1941, Hungary the inflation rate was 150,000% per day. This means that a chocolate which costs 10p today would now cost $150 the next day and $225,000 the day after. As the inflation rate increases, people fear that the value of the money they have will reduce more and more as the days go by. So they try to spend their money immediately to get maximum value out of it. But as people spend more and more the inflation rates rise even more leading to an endless spiral.

Causes of Inflation:

There are various causes of inflation. The Governments of countries keep a close eye on inflation rates to prevent it from getting out of control. The problem is that there are so many factors which affect the inflation rate and there is no reliable way to predict it. It is somewhat like the weather and always unpredictable. In the 17th century, the Spanish empire collapsed from inflation before it realized what had actually happened.

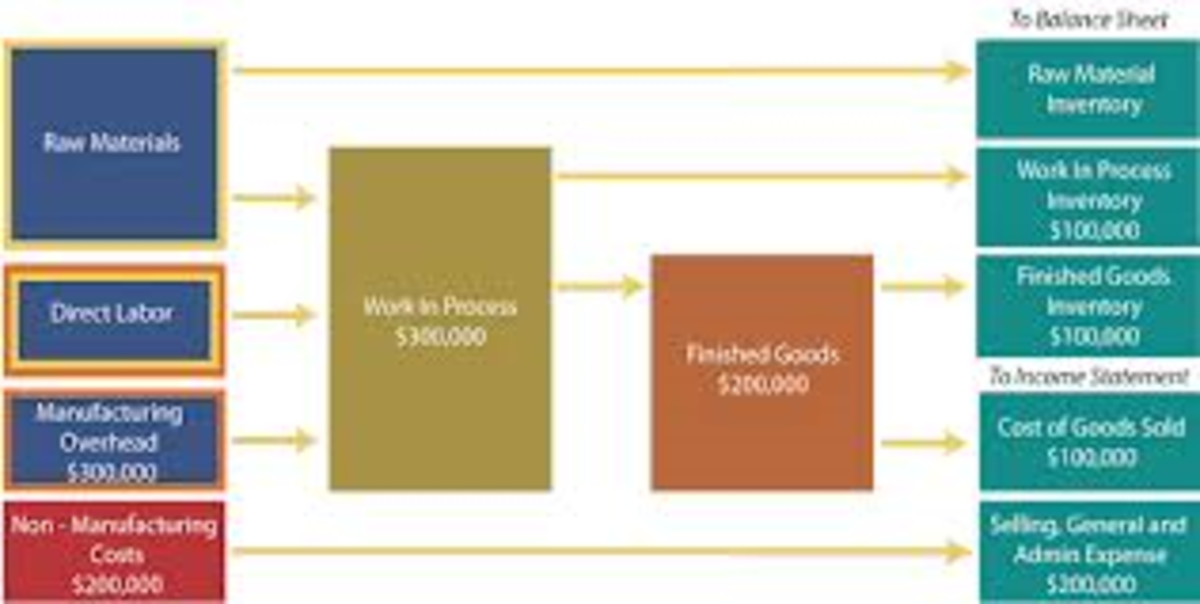

Cost Push Inflation:

This is when the cost of manufacturing goods rises. This can be either due to the rise in prices of raw materials or the increase in wages of employees working in the industry. This, in turn, forces the manufacturers to increase the cost of the goods which are being sold leading to inflation in prices. Although increasing the price of goods might affect the sales the companies have no other choice.

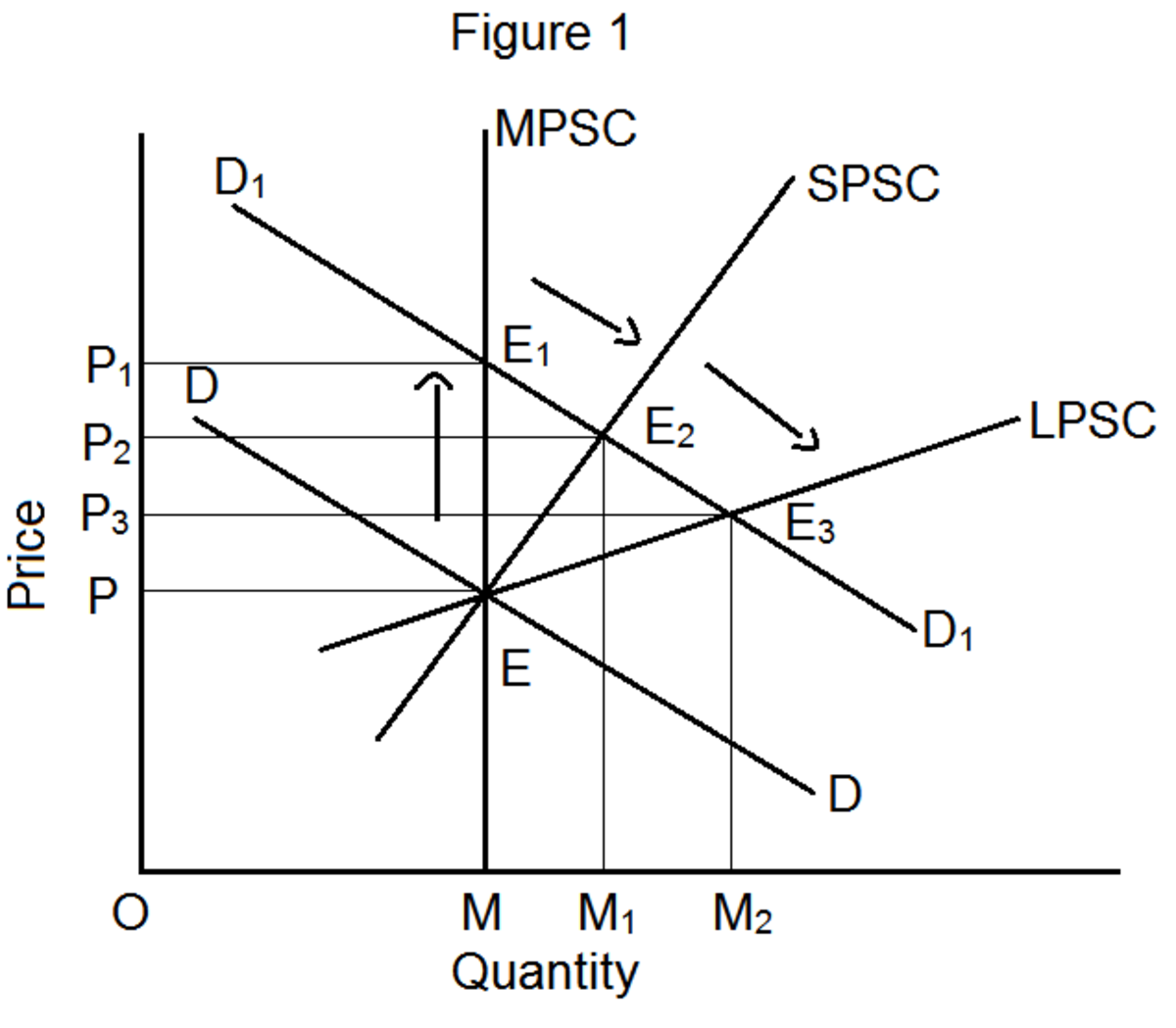

Demand Inflation:

This is the type of inflation where the number of people who are seeking a product increases whereas the supply remains the same. Since more and more people want the same product, the demand, and price of the product rise leading to inflation. This is not a necessarily bad thing as if more people want to buy a product it means that the people are getting richer and have more money to spend.

This would, in turn, lead to more economic growth as the cash flow within the economy increases. Countries sometimes try to create inflation by lowering the taxes. With lower taxes, the people have more disposable income which they can then spend on purchasing other goods which cause a small inflation but this will be negated by the reduction in tax rates.

There is also, however, a risk that this might permanently increase the price of goods. With an increase in demand, the price of the goods rises. Let us consider the demand for a car. But if the production of cars does not increase then a couple of years from now then there will be more people willing to purchase cars whereas the number of cars remains the same. This is the reason why the price of goods is a lot higher than it was years back.

Monetary Inflation:

Sometimes the governments try to stimulate the economy to create more job opportunities. This is done by printing more money. With more money in circulation, the people will be able to purchase more goods thereby promoting growth. However, after a short period, the value of the currency falls. This is because the production capacity doesn’t increase and now there is more money available to purchase the same amount of goods. In the end, the prices just go up and we end up back where we started.

There is, however, a minor chance that printing more money can improve the economy. This is because it takes a bit of time for the value of money to fall even though more are being printed. This is the time span which can be used to improve the productivity of companies by purchasing better equipment or raw materials to increase the output. By purchasing the means of production before the price rises production can be increased to meet the consumer needs and thus stabilizing the price rise.

Inflation and Savings:

A small amount of inflation is always good for the economy. It just means that the economy is growing. However, when the rate of inflation goes beyond a particular limit it is very harmful. In November, 2008, Zimbabwe had the second highest inflation rate ever recorded at 79,600,000,000%. This meant that the government had to print money with denominations like 100 trillion dollars!

Saving up money to buy something in the future is a noble act. But when inflation strikes, the value of money suddenly drops. This means that a fortune of savings could be worth nothing overnight. This is the scary part of hyperinflation. Keeping inflation low helps people in long-term planning.

Bonus - Deflation:

Deflation is the exact opposite of inflation. In economics, it is the general decrease in the price of goods and services. This happens when the inflation rate of an economy goes below 0%. This is not faced as often as inflation but is a consequence of the low demand for goods and services. With less amount of cash in circulation and unusually high prices, the purchasing power of the people is less. This results in unemployment and decreases in productivity as the demand for goods falls.

With the cost of goods reducing each day due to low productivity, the consumers are less likely to purchase goods immediately. Since the cost of a product is bound to drop substantially in the near future they tend to hold off making any purchases which once again reduces the demand. This increases the deflation percentage and creates an infinite loop.

© 2018 Myth and Memory