When Colleges Don't Meet Your Financial Need

But How Will I Pay for It?

Congratulations. You've just been accepted to your dream school. You can't wait to get there, so you can start enjoying campus life.

But there's just one thing standing in your way. The cost of attendance is $55,000 a year. You worked hard in high school, so you've earned a nice merit scholarship of $10,000. In addition, the college is giving you a $3,000 grant.

Your financial aid package also includes $1,500 in work study and $5,500 in federal student loans, the maximum allowed for a freshman. With any luck, you'll be able to land a campus work study job. The federal loan can be repaid over time.

But you still need to come up with $35,000 out of pocket, this year, if you want to move into the dorm, eat in the dining hall and enroll in classes.

What About Your Parents?

Your parents say they'll help you out as much as possible. They both work, but, right now, they have two other children in college. Their estimated contribution, as calculated by the government college financing program known as the Free Application for Federal Student Aid, or FAFSA, has determined your parents can contribute about $3,500 a year toward your education, based on their income and assets.

They said they can probably come up with this, but it's going to be tough.

Unfortunately, even though you've been accepted to the school of your dreams, there is no realistic way you can attend. What this means, in the insider language of college admissions, is that you've been "gapped."

The Rising Tide of Admit/Denys

Countless students are accepted to highly selective top-flight schools. But that's only half the battle. Paying for the privilege of attending is another matter.

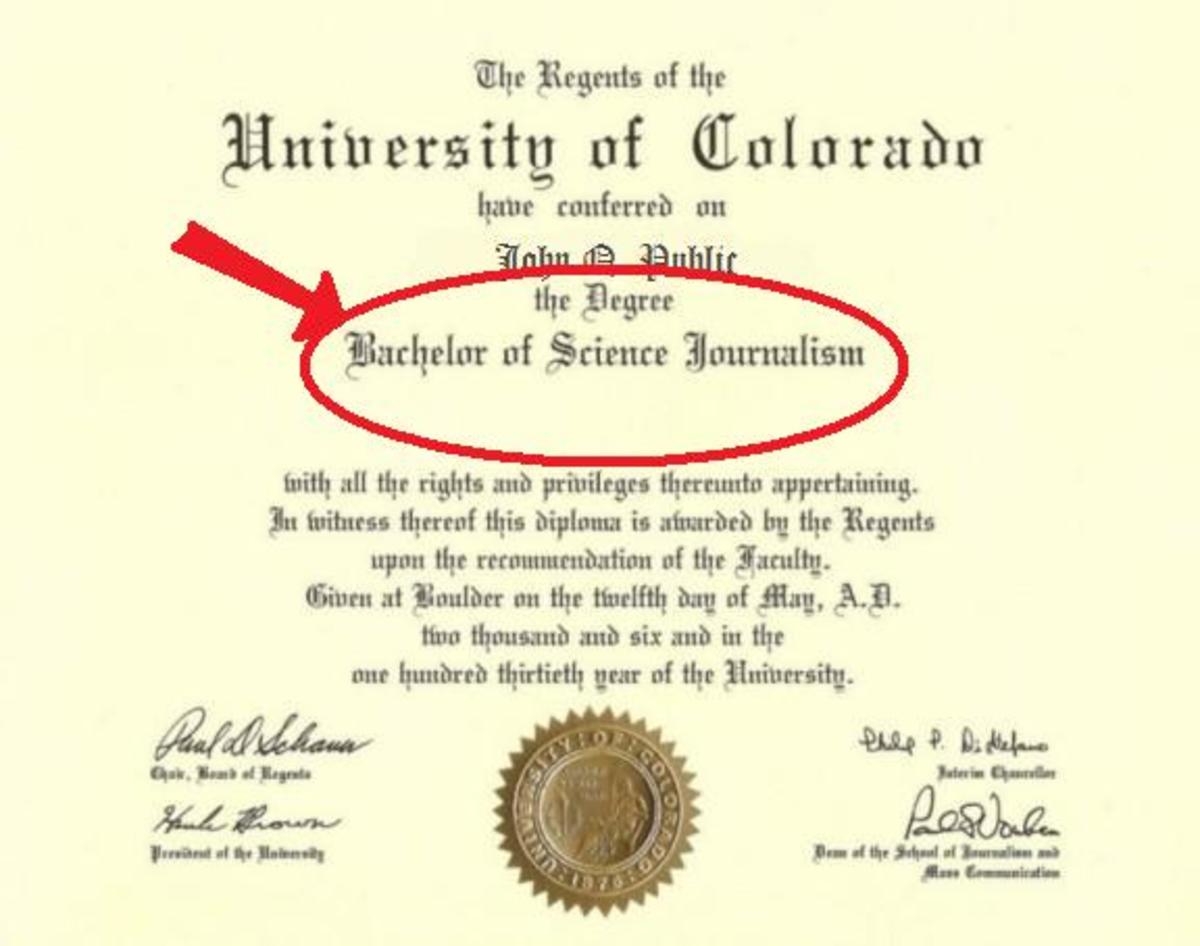

Unless the financial aid offer matches what a student, and his or her family can afford, the acceptance letter means very little.

Some students can foot the bill if their parents agree to take out loans and tap heavily into their home equity, if they have any. But a growing number of parents are running the numbers, or talking to their financial advisers, and then saying "no."

One very wise guidance counselor I know warns her high school seniors to never take on more than $20,000 in student loan debt, which is less than the maximum amount of $31,000 a year in federal loans for a dependent student. A full-time college student would have a difficult time securing additional private financing.

This counselor also advises against getting too excited over a $20,000 annual merit scholarship from a private school if tuition, room and board are pushing $60,000 a year.

Paying for College Without Going Broke

Which Students are Most Likely to Be Gapped

The students most likely to be "gapped" are those from middle-class families whose grades and test scores fall in the average or below average range for demographics at a particular college.

There are many variables, depending the school, its reputation and its profile. A selective East Coast college is in very high demand because students all over the country seem to have a desire to go "back East" for college. It doesn't need to award big aid packages.

However, a relatively unknown state college in the South or in the Midwest might be much more generous. That's because all schools are trying to raise their profile by trying to attract the best candidates.

If your GPA, SAT and ACT numbers are significantly higher than their average, then you might then get a lot of help. Conversely, you can expect relatively little aid if you want to attend a "reach" school, where your statistics are lower than its average. But there's still plenty of room for surprises, everywhere, either with much more aid than you'd expect or significantly less.

That's why, nowadays, it's very important to apply to a wide range of schools. This should include a school you can afford to attend, even without relying upon a lot of aid. Usually, the least expensive way to obtain a four-year degree is at a state college or university. Public flagships are also becoming increasingly expensive.

Ivy League schools are in a different category. They offer a lot in grants if a student comes from a needy family. Harvard University, however, doesn't give merit aid. That's because it's so selective that all of its students would be deserving.

How to Succeed in and After College

Run an Online Net Price Calculator Before Applying

By law, all colleges and universities must have a "Net Price Calculator' on their websites. This gives prospective students an idea of the actual cost of attendance, minus scholarships, grants and loans.

However, this is only an estimate. The actual financial aid package may be significantly higher or lower. A student with impressive achievements will probably get much more institutional help than someone whose credentials are average.

It's a good idea to run these numbers before applying to any school. If it's clear you won't be receiving much assistance, and you don't have the money to pay out of pocket, you may want to reconsider your decision to apply.

News Clip on Student Loan Debt

Is There Any Room for Negotiation?

I know of a single working mother who put three children through college, probably with very little help from their father. She encouraged them to apply to many colleges in order to compare financial aid packages. Sometimes the differences were very surprising. She would also get on the phone with the financial aid office and try to negotiate.

Most admissions experts recommend against doing this. Her children were all very smart, so she had a little bit of leverage. She would also compare packages, over the phone, and tell them another school was offering a lot more.

Although this seemed to work for her, her children went to college prior to 2008, when the recession caused endowments to tumble. Colleges, nowadays, don't seem to have as much aid to award.

I'm not sure if negotiation is a good idea. This woman is the only person I know of who's ever done it successfully. However, if your family circumstances change greatly, such as if one of your parents loses a job, it certainly can't hurt to bring this to the attention of financial aid office.

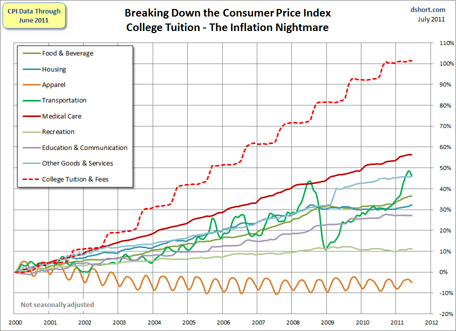

Chart Showing Tuition Increases

Tips on Maximizing Student Aid

Is Residential Living for Everyone?

It's long been the American Dream to attend the school of your choice and to live away from home while doing so. Just a short while ago, a high school student who earned good grades could expect a great deal of institutional to make this a reality.

All of this has changed, although many people are not yet aware of what's happened. So they're shocked when they realize the price of a four-year degree could run be as high as $240,000, if they attend a private expensive school and don't receive any discounts.

Unfortunately, the experience of "going away to school" and living in a dorm is no longer possible for everyone.

My personal moment of awakening came when I was walking with my daughter through the campus of a private college the about 2,000 undergraduates. The ivy-covered brick buildings looked especially lovely on a sunny fall morning. But something was missing.

The campus was not representative of the American population. Nearly everyone we saw was white. In the student dining hall was one Asian. We saw no one who looked Hispanic. There was one black family on our tour that day. And then it dawned on me. Even though I'm Caucasian, I started to feel out of place with my darker-than-average skin.

Then it hit me. Only the wealthy can afford this school, which, at that time, would cost have $53,000 a year in room, board and tuition.

The Complete Idiot's Guide to Paying for College

So What are Your Options?

If you can't afford the tuition, and you can't negotiate a better arrangement, the only logical solution is to go elsewhere. This might be a lower-priced state university or a community college, where you can live at home and save enough money to attend the last two years at another school, in order to earn your degree.

Although this is isn't what you expected, it's probably your best choice. In the end, it doesn't matter so much where you obtained your degree, but, rather, what you will do with it.

A Life Destroyed by Student Loans

Disclosure

I am a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.