When Going to a Community College Won't Save Money

Merit Scholarships for Top Students

College costs have soared to astronomical levels. So students who don't have a lot of money are typically advised to spend two years at a community college before transferring to a degree-granting university. This strategy can often save tens of thousands of dollars.

That's because community colleges charge only about $4,000 a year for tuition. By living at home and commuting to campus, you'll also save on room, board and other expenses.

Books may also be less pricey at a junior college, since professors are very aware many of their students have limited financial resources. So they are sensitive to the fact that paying $250 for just one textbook could cause some hardship.

However, for some students, going to a community college might be the more expensive route.

Someone who excels in high school can often land a better package by going directly to a four-year college, even if it means incurring the costs of living in a dorm.

That's because all institutes of higher education want to improve their standing. Attracting very bright students helps them do that. That's why they offer generous full tuition scholarships to incoming freshman who've distinguished themselves. If you get really lucky, or if your family can demonstrate financial need, you could even get help with housing.

Going to a Community College Will Foil These Merit Scholarships

Unfortunately, some high-achieving students may instead decide to spend their first two years at a community college. However, this can be an expensive mistake.

The most generous merit scholarships are always given to incoming freshmen, because colleges are eager to attract the brightest students. Priority is given each year to building the best possible freshmen class. This is when the bulk of institutional aid in the form of scholarships and grants, which don't have to be repaid, is allocated.

By comparison, there are relatively few scholarships for transfer students. The financial aid packages they receive will be generally be weighted with loans. A top student may not be able to recoup this potential loss of aid. In this case, starting your education at a community college may not be such a good idea.

Paying for College Without Going Broke

Giving Up the Full Ride

Stellar students who don't apply to a four-year college in their senior year of high school will be missing out on the best institutional scholarships, which can mean half off of tuition or even a full-tuition ride. At a private school, this could total about $160,000 for four years. At public universities, tuition ranges from $10,000 to $15,000 a year.

Not taking advantage of these deep discounts could end up costing you a lot more in the long run, especially if you plan to transfer to a private school once you earn your two-year associate's degree.

The cost of attendance at many of the nation's private colleges now hovers around $60,000 a year. You could still be looking at a price tag of about $120,000 to finish your degree, in addition to the money you've already spent going to a community college.

You may also lose time if you attend a community college, and then decide to attend a private school. These institutes are notoriously picky about accepting community college credits. Public universities, on the other hand, are often required by law to accept these credits.

If graduating from a private university is your ultimate goal, you'll want to make sure the target institute will take your credits. Some community colleges do have agreements with select private schools, to assure that this happens.

Maximize Student Aid

Scholarships for Transfer Students

There are some scholarships specifically for transfer students, but they are severely limited compared to what incoming freshman can apply for. There are a few national foundations, such as the Jack Kent Cooke Scholarship, which is the country's largest source of private scholarship money for community college students.

Each year, 75 students throughout the United States are given $30,000 to complete their education at a four-year institute. However, as you can imagine, the application process is very competitive, and the reality of landing one of these scholarships is a long shot.

Many colleges and universities do have scholarship funds earmarked especially for transfer students. However, these are generally in smaller amounts of $1,000 to $2,000. Although this will help, it still represents only a fraction of your overall tuition.

Tips to Maximize Your Merit Aid

Students who apply to a college where most of the other applicants have grades and test scores a little above theirs, or similar to their stats, probably won't receive a full-ride scholarship, or even a half-tuition scholarship.

However, if you apply to a less elite school, and your application stands out, you have a much better chance of receiving the best financial aid package.

It's believed that applying to a college as early as possible, though early action, will maximize your chances of landing a full ride. Just make sure not to confuse this with early decision, in which you are committed to attend the school if you are accepted.

How Much Can You Borrow?

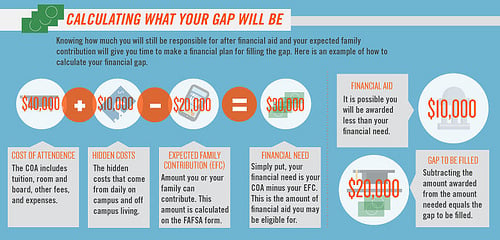

Most students today fund their education partially through Federal Student Loans. But there are limits on what you can borrow. (Trust me, this is a good thing.)

A freshman can borrow up to $5,500 and a sophomore can borrow another $6,500 and juniors and seniors can borrow as much as $7,500 for each year. There is also a certain formula that determines what percentage starts to accrue interest immediately. If your parent's income falls under a certain threshold, interest on some of this debt does not accumulate until after you graduate.

Unless you have a lot of money saved to pay for your last two years of college, or your parents are willing to cover the cost of tuition, this is the full amount you are probably allowed to borrow.

One exception is if your parents apply for a Parent Plus loan and are turned down. Under federal guidelines, you can then take on additional education loans.

How to Potentially Go to College for Free

The Complete Idiot's Guide to Paying for College

When Community College is the Right Choice

However, there are still some stellar students for whom community college makes more sense. Unfortunately, the system is geared toward students who have families willing to help with college costs.

But not everyone has that kind of family. Some parents are not willing to help pay for an education. They may also refuse to share financial advice so a student can complete the Free Application for Federal Student Aid, also known as the FAFSA.

If that's the case, the average high school graduate will have a very hard time funding college on their own. They are ineligible for any need-based grants and Federal Student Loans. Depending upon the institute, students without a FAFSA may not be eligible for merit scholarships either.

Community college is probably the right choice for these students, even if they're at the top of their class.

One of my son's friends, right now, falls into this category. He's living on his own, because his mother moved far away, and his father is deceased. But he's having a difficult time being categorized as an independent student. (Colleges are very reluctant to do this, as they don't want students from wealthier families to attempt the same thing.)

However, the deadline for financial aid information has passed, and his mother still hasn't filed her tax returns. Even though he's an excellent student, and has received offers of merit aid, it's still not enough. Also, depending upon the school, he may not be able to receive any scholarship without a completed FAFSA.

In his case, starting at a community college is probably his best option and his only option.

When Not to Attend Community College

If You're a Stellar Student

| You Live Near a University

| Desiring the "College Experience"

|

|---|---|---|

You'll potentially miss out on tens of thousands of dollars in merit scholarships, typically only awarded to incoming freshman. These are generally renewable for four years, if you maintain a certain GPA.

| If you live within driving distance of a university, it might make more sense to enroll there and commute. If you're a full-time student, and receive a good aid package, tuition may be less than at your local community college.

| Finances or grades prevent you from attending a four-year school. However, you can still enroll in individual classes. If you do well, future acceptance should be easy.

|

Use Your Senior Year Wisely

Knowing all your options and planning accordingly gives you the best chance of earning your degree. The number one reasons students leave college is because they are no longer able to afford to stay.

Learning all you can about the college admissions process can save you a lot of time, trouble and money. Work closely with your guidance counselor, who will be your best advocate during the college admissions process.

Disclosure

I am a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

For Additional Reading

- What Happens if You Don't Pay Your Student Loans

This article describes what happens when you default on a student loan.