The Great Recession and The Economic Intangibles

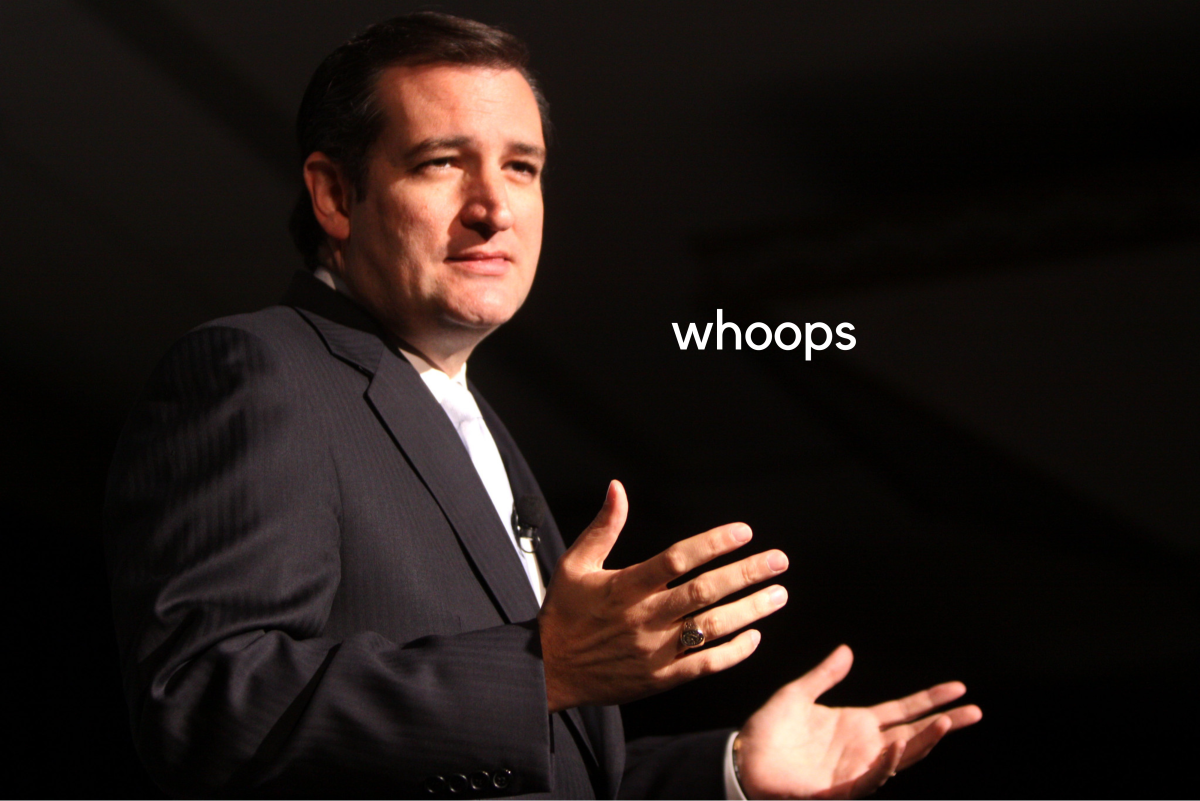

“Economic Intangibles”? What’s meant by “Economic Intangibles” are the little assets that can’t be seen with the naked economic eye. This said, what many have fail to recognize in this hostile economic environment, indeed, are the “Economic Intangibles”: the very idea that Ben Shalom Bernanke—aka, Ben Bernanke assumed the post of Chairman of the Federal Reserve at the height of the real estate bubble is an “Economic Intangibles” worth its weight in gold. Furthermore, the changing of the guards at the Federal Reserve occurred, in conjunction, with the beginning of one of the most callous economic downturns in the history of our modern economic society. And as much as what the Fed represents—in a pure capitalistic society doesn’t jazz well with rational economic theory—common logic says, “in a floating exchange/fiat based monetary system, what the Fed Chairman does and fail to do in times of monetary panic can make or break a macro-economy.”

Fact is many within economic academia perceived ‘Ole Ben to be a bit on the “green-side.” This “green-side” I’m referring to has nothing to do with his economic pedigree either: the former Princeton University tenured professor, indeed, does carry an impressive resume—i.e., economics summa cum laude Harvard University, Doctor of Philosophy economics Massachusetts Institute of Technology. On the contrary the “green-side” I’m referring to points to Bernanke’s penchant for printing “green-dollars.” In fact, Bernanke has been lambasted in media for his role in the 2008-2009 bank bail out boom. According to The New York Times, Bernanke “has been attacked for failing to foresee the financial crisis, for bailing out Wall Street, and, most recently, for injecting an additional $600 billion into the banking system to give the slow recovery a boost.”

In his 2009 book End The Fed, Congressman Ron Paul wrote, referring to Bernanke, "there is something fishy about the head of the world's most powerful government bureaucracy, one that is involved in a full-time counterfeiting operation to sustain monopolistic financial cartels, and the world’s most powerful central planner, who sets the price of money worldwide, proclaiming the glories of capitalism." Is what transpired during the late-2000s financial crisis Bernanke’s fault? Absolutely not! No ones insinuating that it was: fact is, current Fed Chairman, Ben Bernanke, had to get his feet wet in the worse kind of way. But to imply that the current Chairman didn’t have a hand in making matters worse would be a disserve to the hard working American people. Bernanke’s sophomoric response in regards to the whole ordeal breeds indignation: just like you can’t expect superior service at a brand new restaurant, you can’t expect a brand new Fed Chairman to reap superior economic policy. Amid its ability to act as lender of last resort, the Fed only has one other tool at its disposable, which is, of course, its illogical monetary policies.

What a recession of this magnitude needs is time to adjust to horrors of the financial aftershocks. This current recession’s recovery is proving that it’s suffering more from a situation of consumer confidence—the kind of macroeconomic distrust you would expect from a populace that feel its been fooled once: “fool me once, shame on you, fool me twice shame on me.” The American public isn’t gullible, with the advent of the internet, the American public is armed with information that’s causing them to be careful with spending and this carefulness could send our economic engine into a virtual liquidity trap. What are liquidity traps? A liquidity trap situation takes place when interest rates reach near zero (ZIRP) yet do not effectively stimulate the economy. This recession and many others are still based off of three economic fundamentals: 1) Avoiding liquidity traps; 2) Bolstering consumer confidence; and most importantly 3) Mitigating wide spread unemployment. A combination of all three of these will yield a standstill in economic activity.

This recession doesn’t feel good, people genuinely like to be financially fit. In an advanced economic system, like the one the U.S. has, people feel that economic prosperity is a kind of a birthright; they feel that living below the level of the subsistence isn’t acceptable. Just like chronic traffic congestion, a recession represents something very sinister in society: the idea that something has gone very wrong with our society. To make matters worse, all this recessionary mess could have been avoided. Now that our economic engine is in breakdown mode, the Fed doing its version of “shade tree economics” may end up doing more harm than help. Again, in a kamikaze economy, you just have to let the maniacal tendencies fade away. Theoretically, near-zero interest rates should encourage firms and consumers to borrow and spend, but this may not help. This Great Recession is testing the financial resolve of millions of Americans and for the first time, many are rethinking their way of lives—i.e., cutting down on consumption, saving every penny and even paying down their consumer debts.