The Subprime Mortgage Debacle: The Fraudsters Themselves!

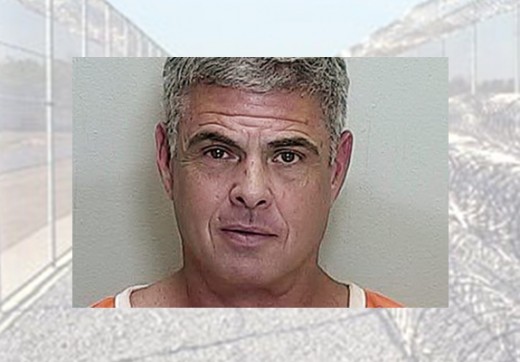

The rampart fraud and misrepresentation of the loan underwriting process would prove to be the final ingredient to the debacle’s demise. In fact, mortgage fraud became so widespread, you would have thought, the entire real estate industry was one big gigantic underground mafia organization. The epicenter of this mortgage fraud occurred in such beautiful sunny places as Fort Lauderdale, Florida. In fact, things got so out of control down in South Florida, that the city had to create an economic crime unit to combat these “fraudsters.” From 2007 up until today, there are literally thousands of such cases where mortgage brokers decided not only to circumvent the conventional mortgage process but deceptively “schemed and beamed” their way into misrepresenting the actual loan documentations.

This real estate debacle--along with its thousands of cases of mortgage fraud--has revealed major holes in the armor of our real estate sector. I think more than anything else, it showed how just easy and fast things can get “out of whack” when the government set bad precedent by shielding the risk of loans. It’s very easy to defend the principles of economics in the real estate debacle because what occurred during this brief period wasn’t associated with economic principles. Again, market economics isn’t a science of bad behavior, if someone or something doesn’t play by the rules, the market doesn’t care; but that doesn’t mean it won’t show. Also, markets don’t like it when the government becomes a bit too officious—to be exact, what caused this debacle weren’t the forces within the free market enterprise system, what caused this debacle was an unknown centrifugal force, created by kamikaze economics which then spiraled out of control and into the realm of the economic unknown.

Our entire mess had its humble beginnings when government created mini-agencies like FHA which began backing loans. Alas, when the government removed the risk of default on loans, commercial lenders could now make loans to people that probably shouldn't have had loans anyways. In addition, this became a justified practice—as now the profit incentive from banks became greater than the risk of loans being defaulted on. In theory, whenever the government created Fannie Mae and Freddie Mac, the risk of default wasn’t ever an issue; therefore, from the vantage point of the lenders, there was never anything to loose. To protect our engine from another debacle, what should happen, from now on, is that borrowers with sub-par credit standards should have no business applying for a mortgage.

This said, the government knew it screwed up with regards to the real estate debacle and in the process may have sullied a sector of the economy that has come to be a hallmark of sustain macroeconomic growth. Again, this wasn't a free market capitalist caused problem; this was a government insinuated debacle that suddenly caused “all economic hell broke loose.” Fed Chair Alan Greenspan—even by his own admissions—acknowledges this folly on the part of the Fed when he says the follows:

At the FOMC meeting in late June, where we voted to reduce interest rates still further, to 1 percent, deflation was Topic A. We agreed on the reduction despite our consensus that the economy probably did not need yet another rate cut. The stock market had finally begun to revive, and our forecasts called for much stronger GDP growth in the year’s second half. Yet we went ahead on the basis of a balancing of risk. We wanted to shut down the possibility of corrosive deflation; we were willing to chance that by cutting rates we might foster a bubble, an inflationary boom of some sort, which we would subsequently have to address. I was pleased at the way we’d weighed the contending factors. Time would tell if it was the right decision, but it was a decision done right.

--Fed Chairman Alan Greenspan

“Time has told,” in our recent economic engine’s breakdown that this decision was “bad economics” and whether you’re in the minority that give credence to the idea that, in the long-term, the Fed reducing the funds rate, doesn’t really have an affect on mortgages is left to individual conjecture. What’s not left to speculation is the fact that when mortgage rates began its inevitable descend, this declivity started to fuel a fire that was already burning out of control.